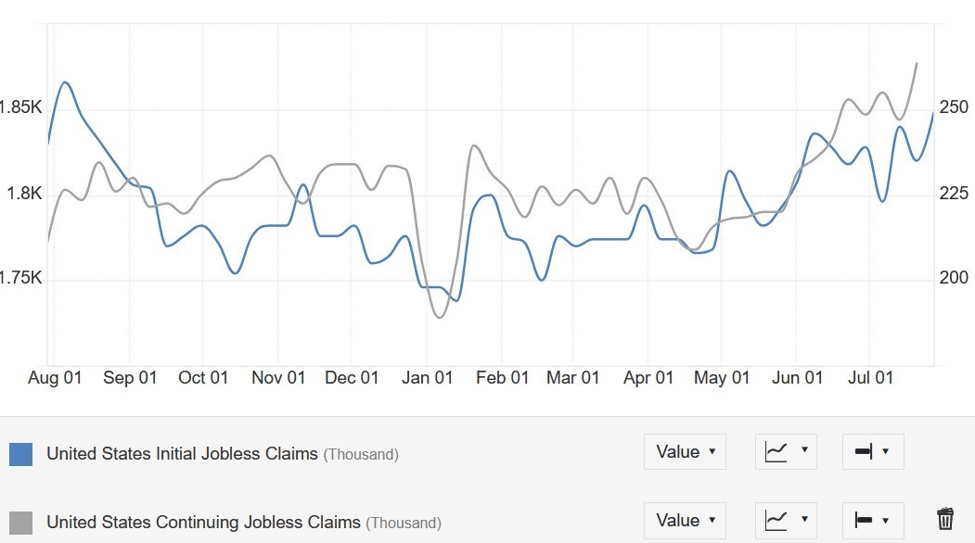

Once again, the European session is going to be empty on the data front and the focus will be on the American session when we will get the latest US jobless claims figures. We will also hear from Fed’s Barkin late in the day and the market will likely be attentive to comments regarding the recent volatility and economic data.

12:30 GMT/08:30 ET – US Jobless Claims

The US Jobless

Claims continue to be one of the most important releases to follow every week

as it’s a timelier indicator on the state of the labour market. This

particular release will likely be crucial as it lands in a very worried market after

the Friday’s soft US jobs data.

Initial Claims

remain inside the 200K-260K range created since 2022, although they’ve been

climbing towards the upper bound lately. Continuing Claims, on the other hand,

have been on a sustained rise and we saw another cycle high last week.

This week Initial

Claims are expected at 240K vs. 249K prior, while Continuing Claims are seen at 1870K vs. 1877K prior.

Central bank speakers:

- 19:00 GMT/15:00 ET – Fed’s Barkin (neutral – voter)

This article was written by Giuseppe Dellamotta at www.forexlive.com.