CHUNYIP WONG

Introduction

It’s time to discuss one of America’s largest energy companies. A company that has become the backbone of America’s position as a leading energy exporter. Interestingly, that company does not produce a drop of oil or any natural gas.

Cheniere Energy (NYSE:LNG) buys natural gas. It then turns it into liquified natural gas (“LNG”), which is then exported to nations all around the globe.

As it is impossible to build pipelines between the U.S. and export markets in Asia and Europe, LNG is the only way for the U.S. to ship its natural gas to these markets.

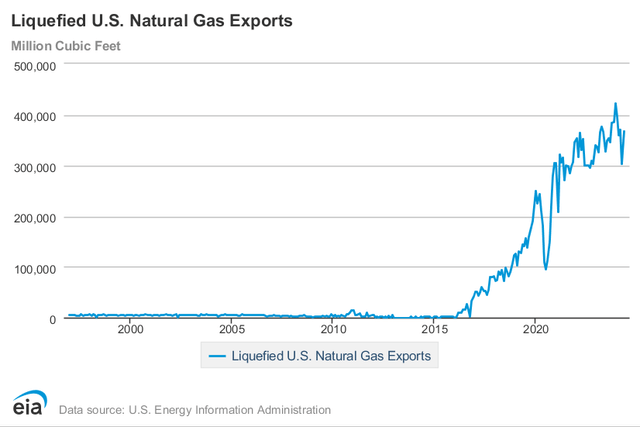

Before 2016, the United States did not export any meaningful natural gas volumes. That changed in 2016. Since then, it has turned into the world’s biggest LNG producer, beating both Australia and Qatar, two nations that had infrastructure in place before the U.S. did.

Energy Information Administration

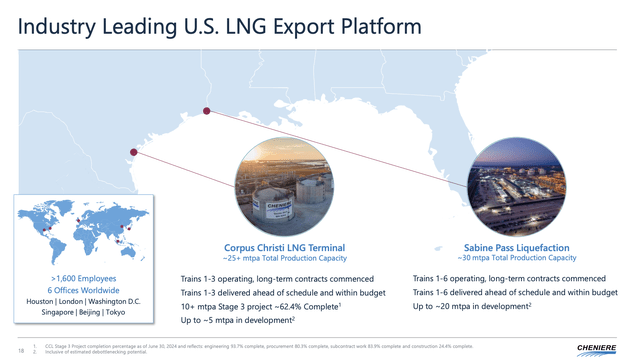

As the chart from 2022 below shows, the Sabine Pass LNG facility was the first major facility that allowed the U.S. to become a bigger player in the global LNG market. Corpus Christi was the second facility.

Cheniere Energy owns both, including through Cheniere Energy Partners (CQP), which partially owns and operates Sabine Pass.

Energy Information Administration

These two assets are located on the Gulf Coast, capable of exporting close to 60 million tons of LNG per year – with major upgrades being in progress.

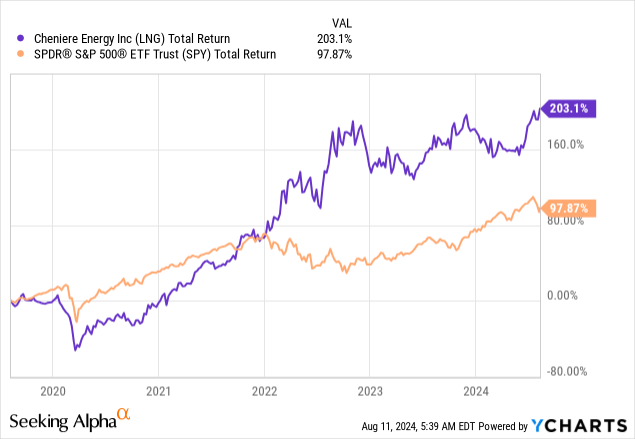

With that said, I have been bullish on the company since 2022. On May 8, I wrote the first article with a Strong Buy rating, titled “Cheniere Energy Is About To Become A Wide-Moat Dividend Growth Powerhouse.”

Since then, shares have returned 17%, beating the 3% return of the S&P 500 by a satisfying margin. Over the past five years, the company’s stock price has tripled.

In this article, I’ll update my thesis, including its just-released earnings.

So, let’s get right to it!

A Wide-Moat Business

Cheniere Energy has a wide-moat business model. For starters, this is based on the complexities of building LNG infrastructure. Cheniere is one of the few players in North America with profitable operations. In 2022, when it broke ground on its Corpus Christi expansion, costs were estimated to be $8 billion. Its existing infrastructure cost $17 billion. It’s very hard to build this kind of infrastructure without funding and expertise.

Moreover, the company has a fantastic contract structure, reducing pricing risks. After all, it needs to buy natural gas to serve LNG contracts.

Going into this year, 95% of the company’s production until mid-2030 was under contract. This includes Sales and Purchase Agreements (“SPAs”) and Integrated Production Marketing agreements (“IPM”). These deals hedge costs and allow the company to benefit from potential rises in LNG prices.

I added emphasis to the quote below.

We have contracted substantially all of our anticipated production capacity under SPAs, in which our customers are generally required to pay a fixed fee with respect to the contracted volumes irrespective of their election to cancel or suspend deliveries of LNG cargoes, and under IPM agreements, in which the gas producer sells natural gas to us on a global LNG or natural gas index price, less a fixed liquefaction fee, shipping and other costs. The SPAs also have a variable fee component, which is generally structured to cover the cost of natural gas purchases, transportation and liquefaction fuel consumed to produce LNG. – Cheniere 2023 10-K

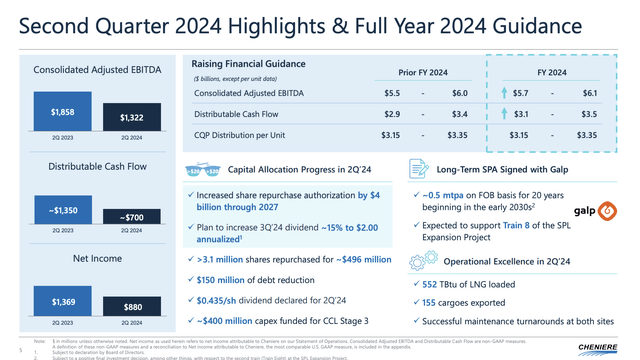

During its 2Q24 earnings call, the company mentioned a new long-term SPA with Galp, a Portuguese multinational energy company, for roughly 0.5 million tonnes for 20 years. This is one of the contracts that shows the increasing importance of U.S. LNG to supply Europe with natural gas – especially in light of the war in Ukraine.

Before Russia invaded Ukraine a few years ago, Russia was a reliable supplier of natural gas through pipelines like its Nordstream network.

Cheniere Continues To Shine

One of the most important things to mention is the progress of the company’s expansion. Multi-billion dollar expansions are risky, and delays often result in disappointed shareholders.

The good news is that Cheniere Energy has a track record of excellence when it comes to finishing mega projects within budget and on time. Right now, that is not likely to change.

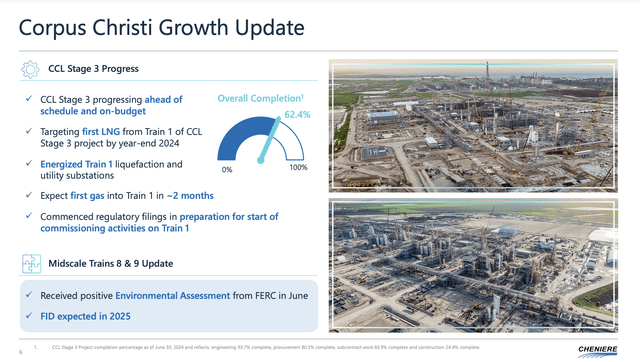

According to Cheniere, its Stage 3 project at Corpus Christi is progressing on budget and ahead of schedule, with construction over 62% complete as of June 2024. The first LNG from Train 1 is expected by the end of the year, with the first three trains expected to be online by the end of next year.

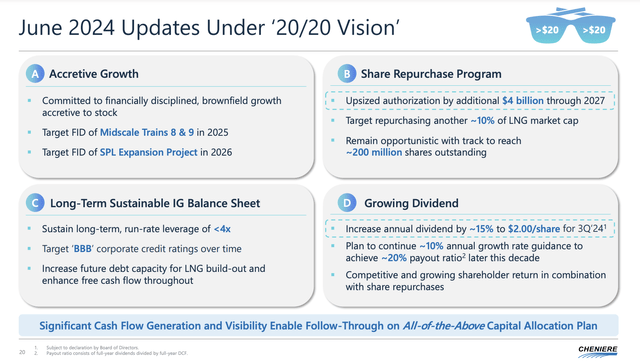

Additionally, according to the company, it has successfully navigated regulatory requirements, as it received a positive environmental assessment for Corpus Christi Trains 8 and 9.

With that said, as we can see below, the company’s adjusted EBITDA, distributable cash flow, and net income were all down in the first half of this year.

Net income, for example, fell by 36% to $880 million. Nonetheless, the company still raised its full-year guidance. It now expects consolidated adjusted EBITDA between $5.7 billion and $6.1 billion and distributable cash flow between $3.1 billion and $3.5 billion.

The reason why its 1H24 financials were “poor” is because of pricing.

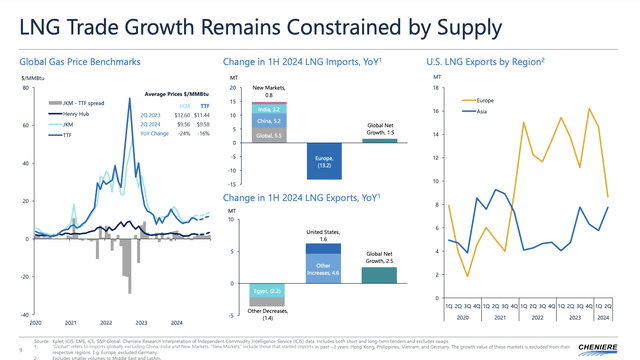

Asian JKM and European TTF benchmark prices were down 24% and 16%, respectively, which explained the drop in earnings.

Although Cheniere has to accept these pricing headwinds, it is still effectively managing changing global demand. For example, LNG exports from the U.S. shifted from Europe to Asia during the second quarter of this year. This was driven by strong demand from Asia due to extreme temperatures and restocking efforts, both of which are highly bullish for demand.

Because Cheniere is so flexible, it can quickly adapt to these changes, supplying the market with the most favorable fundamentals.

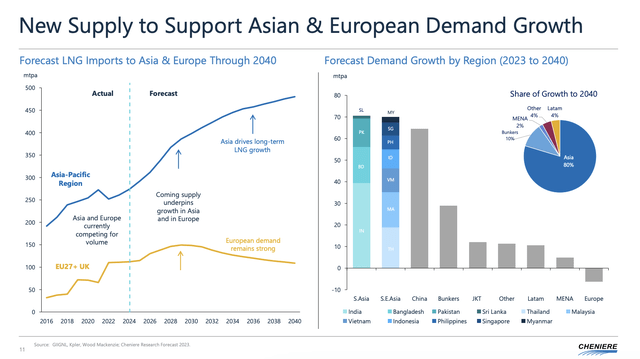

Right now, Asia is a fantastic market, as China alone saw 16% higher LNG imports in the first half of this year. According to Cheniere, demand is expected to keep growing, with Asian demand expected to almost double by 2040!

On top of that, Cheniere is expanding its reach, including new markets like the Philippines, to capture more emerging market demand growth.

Needless to say, supply is also growing. Nonetheless, Cheniere is very upbeat about the future.

Looking ahead, the company believes it is well-positioned to benefit from the expected increase in LNG supply in 2026. This expected supply boost will likely reduce current market constraints and enable further demand growth in Europe and Asia.

Essentially, as moderate LNG and gas prices prevail, Cheniere is poised to support Europe in meeting its energy security needs and Asia in its efforts to transition from coal and offset regional production declines.

After all, Cheniere does not need sky-high LNG prices. While it would certainly be a benefit, it makes most sense to benefit from a healthy mix of moderate prices and elevated volume growth. Sky-high natural gas prices are very bearish for economic growth.

There’s A Lot Of Shareholder Value In Cheniere

One major benefit of having a mature infrastructure base is strong free cash flow – despite investments in expansion projects like CCL Stage 3.

In the first half of this year, the company has deployed $3 billion. This includes $1.2 billion on share repurchases, dividends, and debt reduction in the second quarter.

The company also hiked its authorized buyback program by $4 billion through 2027, expecting to buy back another 10% of its market cap! This is fantastic news for the per-share value of its business.

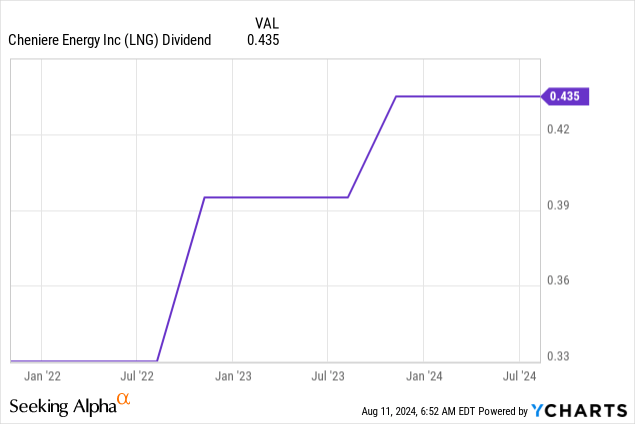

The company will also raise its dividend by roughly 15% to $2.00 (per year) for the third quarter. This implies a 1.1% yield.

This dividend is protected by a payout ratio in the low 10% range.

Going forward, the company will target a 20% payout ratio, which is roughly twice its current payout ratio. This bodes very well for future dividend growth and should come with elevated dividend growth in the second half of the 2020s.

It also has an investment-grade credit rating of BBB and $6 billion in liquidity, including $3 billion in cash on hand.

Valuation

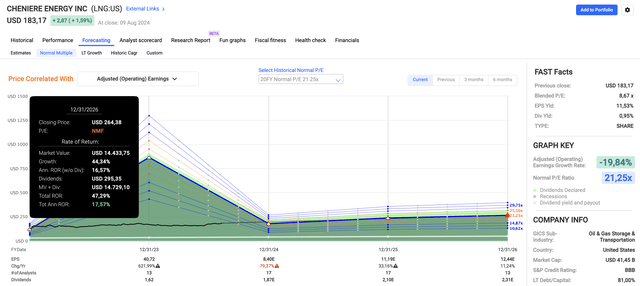

I have to admit, the chart below looks a bit “messed up.” That’s because 2023 saw 623% EPS growth, followed by an expected EPS decline of 79% in 2024.

Again, that’s nothing to worry about, just a mix of falling global LNG prices and tough comparisons after an outlier year.

What matters is that analysts expect 33% EPS growth in 2025 to be followed by 11% growth in 2026, potentially resulting in $12.44 in 2026 EPS. If we apply the company’s conservative long-term P/E ratio of 21.3x, we get a fair stock price target of $260-$270, roughly 45% above the current price.

In light of long-term tailwinds, successful expansion projects, a healthy balance sheet, and the company’s bigger focus on dividend growth, I stick to a Strong Buy rating.

The only reason why I do not own Cheniere is that I bought a lot of LandBridge (LB), a company I did not have on my radar before the end of June.

I now have so much energy in my portfolio that I need to be a bit more careful.

Takeaway

Cheniere Energy is a prime example of how strategic infrastructure and smart contracts can create a wide-moat business.

By converting natural gas into LNG for global export, Cheniere has positioned itself as a key player in the global energy market, delivering impressive returns for shareholders along the way.

Despite recent pricing challenges, the company continues to thrive, supported by successful expansion projects and a healthy financial position.

Looking ahead, Cheniere’s focus on dividend growth, share buybacks, and continued growth in emerging markets makes it a compelling investment with significant upside potential.

Pros & Cons

Pros:

- Wide-Moat Business: Cheniere Energy dominates the LNG market with significant infrastructure that’s very hard to replicate. This provides it with a wide-moat advantage.

- Strong Cash Flow: With major expansion projects and a solid track record, the company generates impressive free cash flow, fueling shareholder returns through dividends and buybacks.

- Global Demand Growth: LNG demand, especially in Asia, is expected to rise significantly, positioning Cheniere to capitalize on long-term growth tailwinds.

Cons:

- Pricing Volatility: LNG prices can be volatile, impacting short-term revenues and earnings.

- Potential Oversupply: Despite strong demand projections, upcoming LNG projects may lead to (temporary) oversupply in the market, potentially impacting pricing.

- Capital Intensive: Ongoing/future expansions require massive capital, which could strain resources if global demand doesn’t meet expectations.

- Geopolitical Risks: The LNG industry is subject to geopolitical uncertainties, which could negatively impact operations and market dynamics (i.e., demand).