PM Images

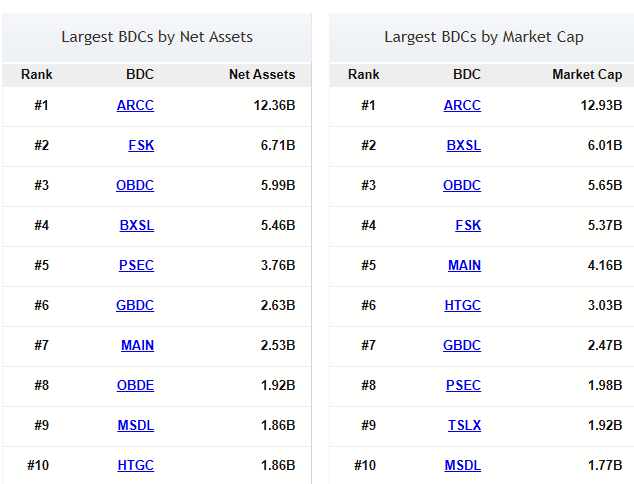

I love investing for income on one side of my portfolio, and business development corporations (BDC) are similar to REITs as they are designed to distribute at least 90% of their taxable income through dividends or distributions. BDCs are essential to business entities looking for capital as they provide an alternative route for funding to many small and medium-sized businesses that cannot meet their needs through the traditional banking system. I am invested in many BDC’s. Some have a stretched valuation, in my opinion, some are trading around fair value, and there are others that look undervalued. FS KKR Capital (NYSE:FSK) just reported Q2 earnings where their total investment income of $439 million beat analyst estimates by $13 million, and their non-GAAP EPS of $0.75 beast estimates by $0.04. FSK is the 2nd largest BDC by net assets, the 4th largest by market cap, and trades at a discount to their net asset value (NAV) per share. FSK just announced another supplemental distribution in addition to the normalized quarterly distribution of $0.64. As we work our way through earnings season, I believe that FSK is still significantly undervalued, and it’s still my top value pick in the BDC sector.

Following up on my previous article about FSK

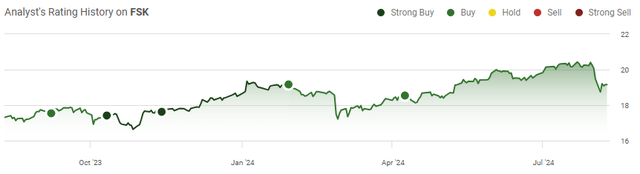

Since my last article about FSK was published on April 8th (can be read here), shares have been relatively flat, declining by -0.18%. The S&P 500 has appreciated by 2.44%, which has outpaced the rate of return from FSK, but when the distributions are factored in, FSK’s total return over this period was 2.44%. I had discussed what had happened in Q4 2023 to cause FSK to drop, and why I was bullish for the remainder of 2024. After going through the Q2 earnings report, I am following up with a new article to discuss why FSK is my top value pick in the BDC space.

Risks to investing in FSK

BDCs invest in private companies by either purchasing an equity stake or issuing debt, as many small or middle market companies are unable to access capital from traditional lending methods such as large money centers or regional banks. By doing so, BDCs are investing in much smaller companies that don’t have the balance sheet strength, or the earnings power of larger companies. FSK is subject to many types of risk, including credit, interest rate, and macroeconomic risk. If the companies that FSK is doing business with through equity of debt financing default on their loans, FSK would be negatively impacted as their profitability would be lower, and the distribution size would be at risk. If interest rates stay higher for longer or increase, it could squeeze FSK’s margins as they are borrowing to lend and make investments. If the macroeconomic environment gets tighter and commodity prices increase, and we head into a recession, FSK could face tremendous headwinds as the smaller companies they invest in could have trouble competing in the free markets. As unemployment creeps higher, we are seeing slow economic activity, which could negatively impact goods and services. If you’re investing in BDCs, don’t invest because of the high yield, as the distributions come with significant risk factors. While I am bullish on FSK, I can’t predict what will happen throughout the macroeconomic environment, and there are many risk factors that could impact an investment in FSK that investors should consider and conduct due diligence on.

FSK continues to generate large dividends for shareholders as operations continue to flourish

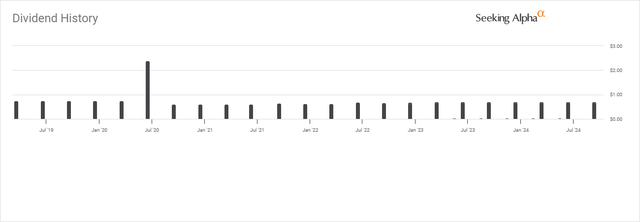

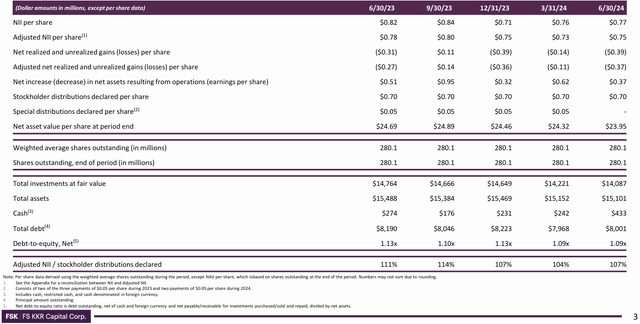

Like many other investors, I invest in BDCs primarily for the large amounts of income they generate. We’re heading into a lower rate environment, and CME Group is split down the middle as they are projecting there is a 51% probability that the Fed cuts by 25 bps in September while there is a 49% chance that the cut will extend to 50 bps. We have lived through a restrictive environment for some time, and unless something unforeseen occurs, rates are likely to decline over the next several years. This should cause investors to consider deploying cash from the sidelines back into the capital markets to recreate the yields they have been accustomed to receiving. In Q2, FSK rewarded shareholders after generating $215 million of net investment income (NII), which correlated to $0.77 per share. FSK paid out $0.75 per share in distributions, which consisted of $0.64 from the base quarterly distribution, a $0.06 supplemental distribution, and a $0.05 special distribution. Heading into Q3, FSK has declared a $0.70 distribution, which consists of a $0.06 supplemental distribution on top of the $0.64 base distribution.

FSK has been a cash-generating machine for shareholders over the years as 13 supplemental and special distributions have been paid since Q3 of 2022. FSK closed 2021 trading at $20.17 and has paid $6.37 in quarterly distributions since Q1 of 2022. The base distributions that have been paid since the close of 2021 have generated a 31.58% yield, and when the additional $0.74 of additional distributions are factored in, the yield increases to 35.25%. The $0.70 of distributions declared for Q3 will bring the amount of income FSK has paid to $7.81, which is 38.72% of the share price FSK closed 2021 at. If the share price remains stagnant through Q3, in less than 3-years, investors will have incurred a -5.01% price decline (-$1.01) but picked up 38.72% in distributed income, which is a net ROI of $6.80 or 33.71% on $20.17 per share. If FSK continues to trade range-bound while generating a double-digit yield, I think it will look attractive to many investors who are looking for income opportunities as we enter a cutting environment and eventually work our way toward a landscape where investing in money markets and bonds aren’t nearly as attractive as equities for income.

The real question is can FSK maintain its financial profitability and continue paying its shareholders large quarterly distributions. I believe they can and they will. More than half of FSK’s debt investments (58.1%) are made up of Senior Secured First Lien Loans, while 6.6% is made up of Second Lien Senior Secured Loans. I love seeing this because Senior Secured Debt has first claim on a company’s assets in bankruptcy or liquidation, so when I am investing in BDCs I tend to gravitate more towards the ones with larger amounts of Senior Secured Debt in the books. FSK finished Q2 with $14.09 billion in total investments, with 89.8% of the debt investments tied to floating rate debt while the remaining 10.2% tied to fixed rates. The actual weighted average annual yield on FSK’s debt investments was 12%, while the effective interest rate on borrowings was 5.3%. We could see the margin between FSK’s average annual yields and the interest on borrowings expand during a lower rate environment, which would be bullish for their total and net investment income. FSK has $4.7 billion of liquidity in undrawn debt, cash, and unsettled trades, while 83% of its debt liabilities mature in 2026 and beyond. FSK has been deploying new capital at staggering amounts in 2024 as they followed the $1.44 billion allocated in Q1 with $1.26 billion in Q2. The asset mix in Q2 included 81% of First Lien Senior Secured Loans. FSK is coming to terms with a large number of new originations before rate cuts, and I think this will help maximize gains in the future and keep the spread between borrowing costs and interest on lending to the point where the distribution is secured at these levels.

I think FSK is the best value opportunity in the BDC space

I compared FSK to 11 other BDCs, and based on several metrics, I believe it’s the best value proposition in the BDC sector at the moment. While I go through the metrics that I base my investment decisions on, keep in mind that FSK is the 2nd largest BDC by net assets and the 4th largest by market cap. The companies I compared FSK to are:

- Ares Capital (ARCC)

- Main Street Capital (MAIN)

- Prospect Capital Corp. (PSEC)

- Barings BDC (BBDC)

- Blue Owl Capital Corporation (OBDC)

- MidCap Financial Investment Corporation (MFIC)

- Goldman Sachs BDC (GSBD)

- Oaktree Specialty Lending Corporation (OCSL)

- Golub Capital BDC (GBDC)

- Gladstone Capital (GLAD)

- Sixth Street Specialty Lending (TSLX)

BDC Investor

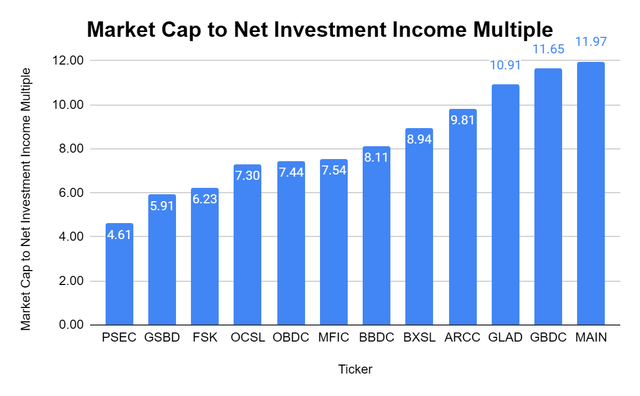

I want to pay the lowest multiple for a company, whether it’s a REIT, BDC, MLP, or traditional equity. The metric I care about with BDCs is NII because this is the capital left after all of the expenses a BDC incurs and where distributions are paid from. FSK has generated $861 million in NII over the trailing twelve months (TTM) which is the 2nd largest amount of NII behind ARCC in all the BDCs in my peer group. The next largest amount of NII generated came from OBDC with $760.97 million. FSK is trading at 6.23 times its NII, while the peer group average across 12 of the largest BDCs is 8.37x. I think some of the multiples on the higher end have become extremely stretched, and for a BDC such as FSK, trading below the midpoint of the market cap to NII multiples is an opportunity.

Steven Fiorillo, Seeking Alpha

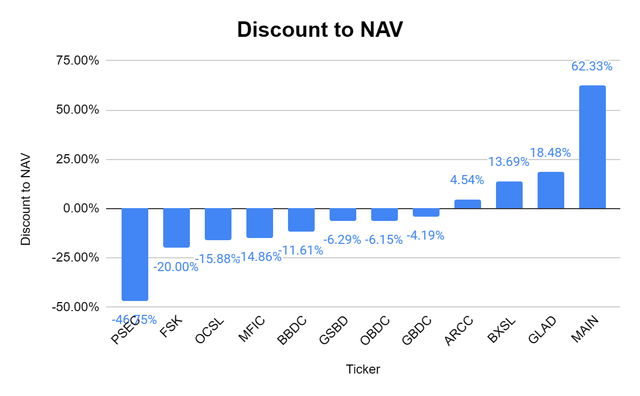

FSK is also trading at a steep discount to its NAV. Shares of FSK are trading for $19.16 while its NAV is $23.95. FSK is trading at the 2nd largest discount to NAV of -20%, with only PSEC trading at a deeper discount. When I look at companies such as MAIN, which I am a shareholder of the premium on its NAV and NII look excessive compared to many others in the sector. MAIN is a well-run BDC, but its valuation seems out of sync with that of the BDC sector. FSK trades at a 20% discount to NAV, and you’re getting a strong book of assets with more than $14 billion in investments. 65.6% of the book is tied to a form of Senior Secured Debt. On a valuation basis it’s hard to overlook FSK as the 2nd largest BDC by NII generated, and Net Assets is trading at a deep discount.

Steven Fiorillo, Seeking Alpha

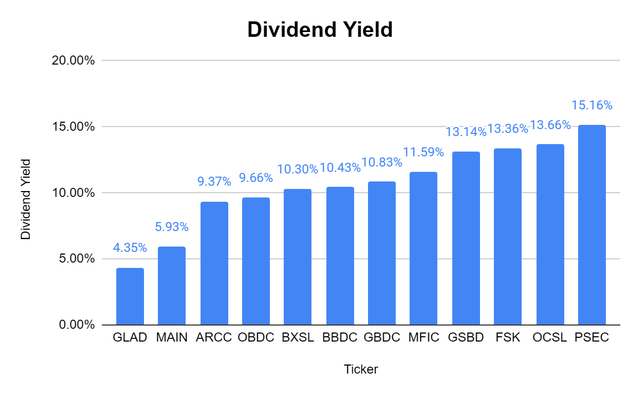

Excluding the supplemental distributions, FSK has a 13.36% yield, which is the 3rd highest in the peer group. FSK is well above the peer group average yield of 10.65%, which makes the investment case even more enticing. Investors are getting a well-run BDC at a discount on its assets, and it comes with a double-digit yield before the additional distributions are accounted for. As the Fed starts cutting, I think these yields will look very enticing, and it’s hard to overlook FSK with a 13.36% yield trading at a discount.

Steven Fiorillo, Seeking Alpha

Conclusion

I am very bullish on FSK under $20 as I think we will see BDCs in general, start to trade at a stronger multiple as rate cuts occur. FSK has a strong loan book which is backed by more than 60% Senior Secured Loans, and 89.8% of their originations are floating rate. FSK’s debt investments have an average yield of 12%, and FSK continues to generate enough NII to support the normalized quarterly distribution in addition to their supplemental distribution. I think that shares of FSK are trading in deep value territory at 6.23 times NII and at a -20% discount to NAV. Of all the BDCs I am invested in, I think FSK trades at the largest value proposition. I plan on adding more capital to my investment while FSK trades for under $20, as I believe FSK will close the gap on its NAV throughout the rest of 2024.