Laxman Narasimhan attends the 2023 TAAF Annual AAPI CEO Dinner at The Pool on September 26, 2023 in New York City. (Photo by JP Yim/Getty Images for The Asian American Foundation (TAAF).

Jp Yim | Getty Images

Activist Elliott Management and Starbucks‘ board of directors are in settlement talks, according to people familiar with the matter.

Elliott and Starbucks’ directors met last week to discuss the activist’s settlement offer, said the people, who requested anonymity to discuss private matters freely. A decision has not yet been reached, and it wasn’t clear what concerns the board had about the deal.

CNBC’s David Faber reported Monday that settlement talks, if successful, could result in Elliott managing partner Jesse Cohn becoming a Starbucks director. Cohn has been an integral Elliott’s activism practice for years, including pushes at AT&T and Salesforce.

CNBC previously reported on some details of the settlement, which most significantly would allow CEO Laxman Narasimhan to keep his job and remain on the board. The deal, as proposed, would also include governance improvements in addition to the board expansion. An agreement is complicated by the influence of Starbucks chairman emeritus Howard Schultz, who has expressed his opposition privately to a settlement with Elliott.

Starboard Value has also built a position in Starbucks, the Wall Street Journal reported Friday. But it isn’t clear yet if the activist investor will actually mount a campaign at the coffee chain. Representatives for Elliott and Starbucks declined to comment. A representative for Starboard did not respond to a request for comment.

Elliott has amassed a Starbucks stake valued at up to $2 billion, CNBC previously reported. The $69.7 billion hedge fund is known for its activism in the technology sector, mounting campaigns at companies like AT&T, Crown Castle, Salesforce and Texas Instruments. But it has also embarked on a push at another consumer name, Southwest Airlines, where it is seeking to unseat both the CEO and chairman of the struggling carrier.

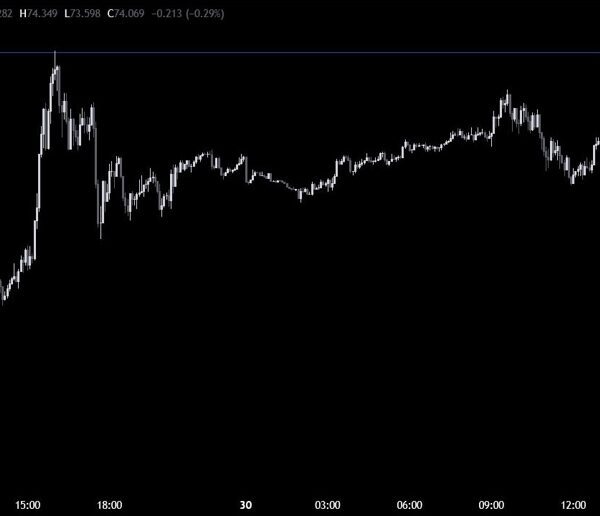

Starbucks has faced successive quarters of falling sales, with steep declines in China and weakness in the core U.S. business. Starbucks’ stock price is down 19% this year.