Luis Alvarez

Introduction

Universal Health Realty Income Trust (NYSE:UHT) owns healthcare related facilities like medical offices and hospitals. Over the years, the company has had an exceptional record of paying a growing dividend to shareholders. With the company having just reported its second quarter results for the year, while rental revenues and FFO grew, I have concerns about dividend growth going forward given a higher payout ratio and interest rate swaps set to expire later this year. In this article, I’ll unpack the latest results, provide my thoughts on the outlook, and discuss the risks I see along with how investors should think about valuation going forward.

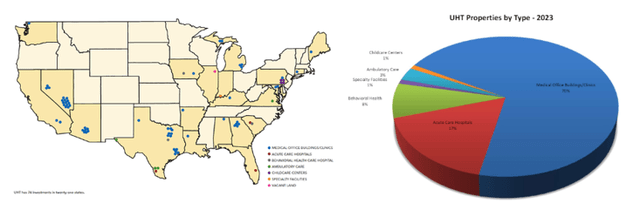

Universal Health Realty Overview

Universal Health Realty Income Trust is a real estate investment trust (REIT) that has a niche focus in specializing in healthcare related facilities. Founded nearly 40 years ago, the company has grown to own 76 facilities across 21 states. This includes properties like acute and sub-acute care hospitals, medical office buildings, rehabilitation hospitals, freestanding emergency departments, as well as childcare centers.

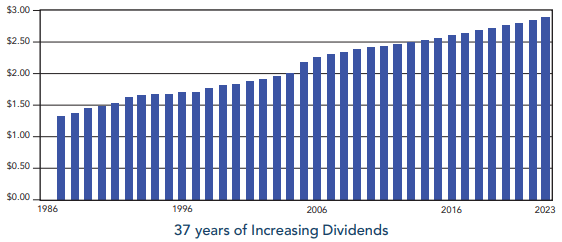

One of the reasons to like Universal Health Realty is that it has an exceptional track record of paying regular dividends to shareholders. Perhaps even more impressive is that the company has paid an increasing dividend for the last 37 years, and is on track to make that 38 years in 2024. With a record of paying growing distributions even during turbulent times like the Great Financial Crisis of 2009 and the COVID-19 crash, Universal Health Realty stands out as a REIT investors can trust in good times and bad.

Annual Report

Another reason I like the Universal Health Realty model is for its tenant profile. Because many of its tenants are medical offices and hospitals, they typically are involved in long-term leases. This provides the company with certainty and stability of cash flows. After all, you don’t see your local hospital moving across the street just to save a few bucks on rent. As a result, the company can generally get away with modest rent increases, which helps grow its NOI over time, funding those attractive dividend increases.

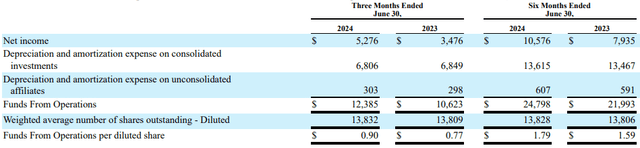

Growing Rental Revenues And FFO

When looking at the latest results from Universal Health Realty, the company reported rental revenues of $24.7 million, an increase of 3.9% compared to last year. While some of this was related to rent increases, the company also benefited from a contribution from a medical office building located in McAllen, Texas, that was acquired in Q3’23.

On net income, the company reported net income of $5.3 million, which was a strong increase from the $3.5 million in Q2’23. This increase was primarily attributable to lower expenses at a property located in Chicago, Illinois, and a property tax reduction there ($1.5 million impact). Net increase from various properties totalled $0.7 million was partially offset by an increase in borrowing costs (as interest rates rose).

Overall, I’d say that this was a good quarter for Universal Health Realty. As is typical for the company, a large fraction of its expenses at its medical office buildings get passed on either directly or indirectly to the end tenant, so rental revenue increases usually have an increase on the bottom line as well. When we look at funds from operations this quarter, the company’s FFO increased 16.6% year over year, clocking in at $0.90, despite a small increase in share count.

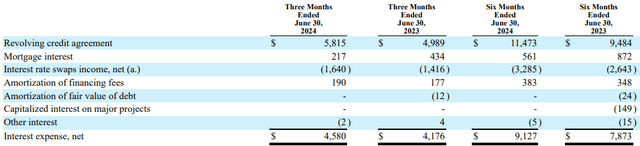

Interest Expense Concerns

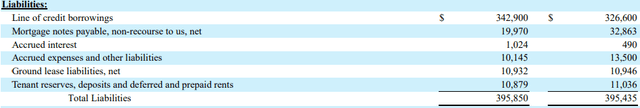

While the company did see FFO per share grow nicely (good results on both the top and bottom line), one area that did concern me was on the company’s rising interest expense during the quarter. As shown below, net interest expense climbed 9.7% to $4.58 million this quarter.

It’s not unusual to see REITs take on substantial leverage compared to your average company. Like utilities, REITs generally operate a low return on asset business and can get away with higher levels of debt and leverage because of the predictability and stability of (often growing) cash flows.

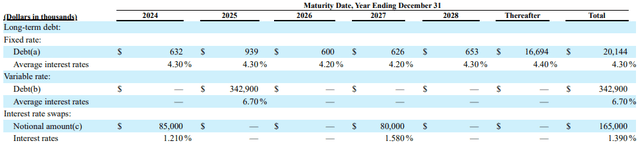

However, when looking at Universal Health Realty in particular, one area of concern that I have here is regarding the company’s interest rate swaps. Without this hedge, the company would have experienced an 11.2% increase (compared to 9.7% with the hedge on). That might not sound like a lot, but this would have offset nearly all of the gains in FFO this quarter had that hedge not been in place.

With two of four of the company’s interest rate swaps set to expire in September of this year ($85 million out of $165 million in total notional amount), the company is going to be more susceptible to interest rate risk once those swaps expire. While the company could take on new swaps post-expiry, they’re unlikely to get favoruable terms and sustain their current FFO, all things being equal.

Why this is significant in my view is because it puts pressure on the company’s dividend increases going forward. With FFO and cash payout ratios close to 90%, my expectation is for dividend increases to slow down in the near-term. As a positive, most of the company’s debt is fixed-rate debt in the 4% range, so the company’s cost of debt is not too large. However, it’s unclear that the company will be able to refinance at similar levels once those maturities come due, with U.S. ten-year government bond yields sitting at 3.9% for now in spite of yields moving lower in the last few weeks.

Company Filings Company Filings

Fully Valued At Current Levels

Compared to your average REIT, medical facilities generally trade at multiples above average, likely due to their higher rental revenue growth rates. At present, the company trades at a P/FFO multiple of 14x, which is higher than the group average of 9x.

In determining a comparable group average, I compared the P/FFO multiples of other healthcare REITs like Global Medical REIT (GMRE), Healthcare Realty Trust (HR), and Medical Properties Trust, which trade at multiples of 11x, 11x, and 5x, respectively (source: S&P Capital IQ).

Given that I don’t believe Universal Health Realty to be too significantly different from the other three (perhaps having more modest leverage and a better track record of growing value for shareholders), I don’t think such a wild disconnect between the company and its peers is warranted.

In terms of the risks to the investment thesis, higher interest rates are still a big concern and when those hedges expire, investors are sure to see the impact on dividend growth. In addition, with expanding cap rates recently, the company’s NAV could continue to drop. My expectation that these two risks will be somewhat offset by lower interest rates, which appears to be more priced in overtime.

Conclusion

In my view, the latest quarter showed that Universal Health Realty continues to demonstrate its resilience as a healthcare-focused REIT, underpinned by its strong track record of dividend growth and stable tenant base. The recent quarter’s performance showed the company’s ability to achieve higher rental revenues and FFO, despite mounting interest expenses and the upcoming expiration of key interest rate swaps. However, I think these factors introduce potential risks to future dividend increases and overall valuation. To me, while the company’s current P/FFO multiple suggests a premium valuation relative to its peers, this may be justified by its consistent dividend history and niche market focus. But going forward, investors should be mindful of the impact of rising interest rates and the potential pressure on dividend growth. Balancing these considerations with Universal Health Realty’s long-term growth potential and stable cash flows, I rate shares of the company as a ‘hold’ for now.