Fundamental

Overview

Yesterday, the US PPI report missed expectations by a big margin

triggering a selloff in the US Dollar as the market started to position into a

potentially soft US CPI release today.

That led to a key breakout

in the NZDUSD pair which didn’t last as the RBNZ

tonight cut rates by 25 bps. While analysts and economist were expecting the

OCR to remain unchanged, the market was pricing more than a 70% probability of

a rate cut nonetheless.

What weighed on the Kiwi were

more dovish than expected central bank’s forecasts for future interest rates

settings.

For the Fed, the market is

split between a 25 and 50 bps cut in September and a total of 107 bps of easing

by year-end. On the RBNZ side, the market is expecting a 25 bps cut in October

and a total of 71 bps of easing by year-end.

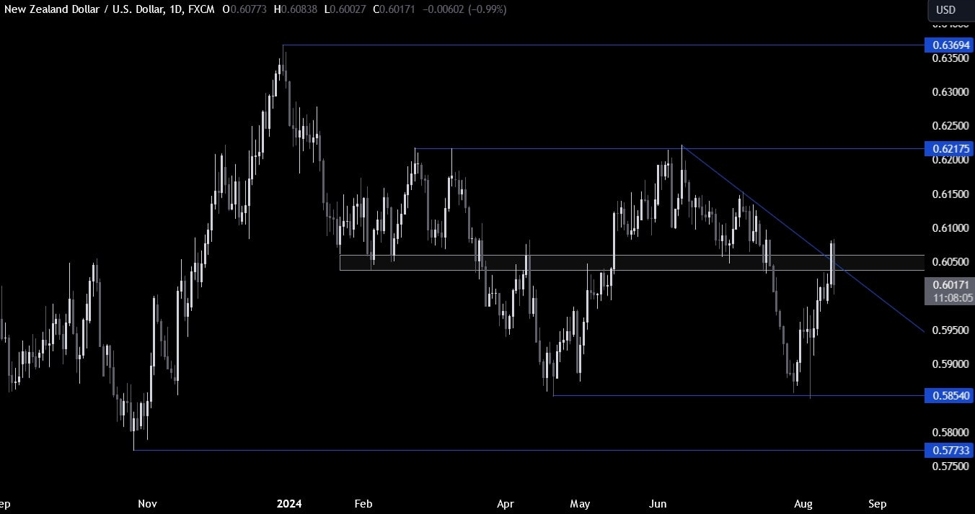

NZDUSD

Technical Analysis – Daily Timeframe

NZDUSD Daily

On the daily chart, we can

see that NZDUSD probed above the key resistance

zone around the 0.6050 level yesterday after the soft US PPI report but got

smacked back down tonight following the rate cut from the RBNZ.

The sellers piled in with a

defined risk above the resistance to position for a drop back into the lows

around the 0.5850 level. The buyers will want to see the price rising back

above the resistance to increase the bullish bets and position for a rally into

the 0.6217 level next.

NZDUSD Technical

Analysis – 4 hour Timeframe

NZDUSD 4 hour

On the 4 hour chart, we can

see that we have a minor support zone around the 0.5980 level where the price

got rejected from several times in the past weeks. If we get a pullback all the

way down to the support, the buyers will likely step in with a defined risk

below the support to position for a break above the major resistance with a

better risk to reward setup. The sellers, on the other hand, will want to see

the price breaking lower to increase the bearish bets into the 0.5850 level.

NZDUSD Technical

Analysis – 1 hour Timeframe

NZDUSD 1 hour

On the 1 hour chart, we can

see that the price dropped all the way to the lower bound of the average daily range for today. The price generally

doesn’t extend much beyond the range unless there’s a strong catalyst.

That catalyst could be a

hot US CPI report today, which might push the price into the 0.5980 support

zone. For now, the buyers are leaning on the minor upward trendline to position

for a rally into new highs.

Upcoming

Catalysts

Today we have the US CPI report. Tomorrow, we get the US Retail Sales and

Jobless Claims figures. Finally, on Friday, we conclude the week with the New

Zealand Manufacturing PMI and the University of Michigan Consumer Sentiment

survey.