The European session is empty today. We will get lots of data in the American session beginning with the US Jobless Claims and Retail Sales and then concluding with the US Industrial Production and the NAHB Housing Market Index a bit later. The focus will likely be on the US Jobless Claims.

12:30 GMT/08:30 ET – US July Retail Sales

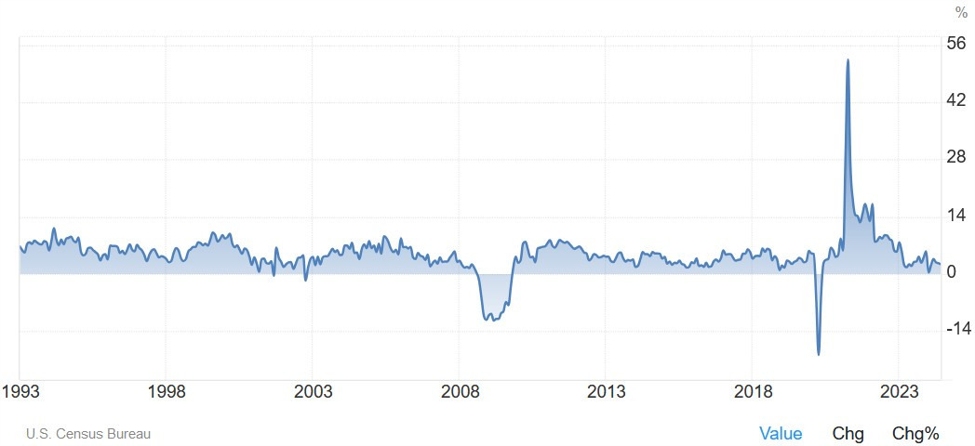

The US Retail

Sales M/M is expected at 0.3% vs. 0.0% prior, while the Ex-Autos M/M measure is

seen at 0.1% vs. 0.4% prior. The Control Group M/M is seen at 0.1% vs. 0.9%

prior. Although we’ve been seeing some softening, overall consumer spending

remains stable.

Retail sales data is generally a market moving release but it’s pretty volatile and most of the time the initial moves are faded. The Y/Y figure smooths the noise but in recent recessions, retail sales hasn’t been a leading indicator, on the contrary, retail sales showed weakness when the recessions were well underway.

12:30 GMT/08:30 ET – US Jobless Claims

The US Jobless

Claims continue to be one of the most important releases to follow every week

as it’s a timelier indicator on the state of the labour market. This release is more important than retail sales.

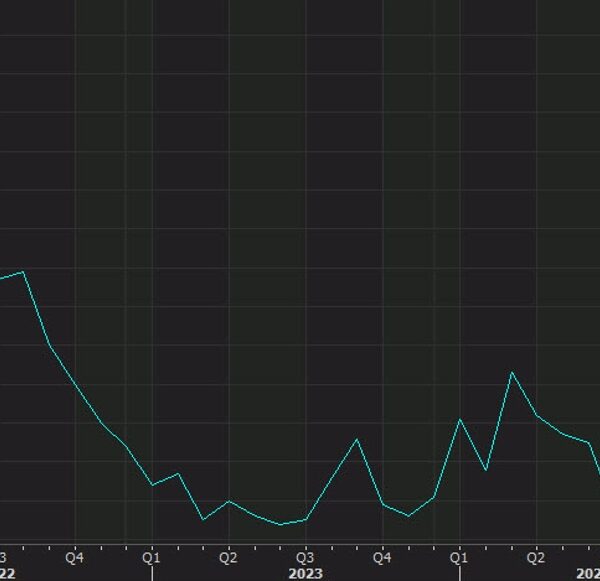

Initial Claims

remain inside the 200K-260K range created since 2022, while Continuing Claims have

been on a sustained rise showing that layoffs are not accelerating and remain

at low levels while hiring is more subdued.

This week Initial

Claims are expected at 235K vs. 233K prior, while Continuing Claims are seen at

1880K vs. 1875K prior.

Central bank speakers:

- 13:10 GMT/09:10 ET – Fed’s Musalem (slightly hawkish – non voter)

- 17:10 GMT/13:10 ET – Fed’s Harker (neutral – non voter)

This article was written by Giuseppe Dellamotta at www.forexlive.com.