Monty Rakusen/DigitalVision via Getty Images

In my August 1 Seeking Alpha article on uranium and the Global X Uranium ETF (URA), I concluded:

Climate change initiatives, worldwide militarization, the widening supply-demand deficit, and the long-term bullish trend are compelling reasons for higher uranium prices over the coming years.

Uranium (UXA:COM) is an energy commodity with significant military applications in a volatile and dangerous world. The VanEck Uranium and Nuclear ETF (NYSEARCA:NLR) product has fewer assets under management than URA, which could make it more flexible in capturing opportunities in the uranium and nuclear sector.

The election may set the course for energy stocks

On November 5, the U.S. electorate will decide whether Vice President Harris and Minnesota Governor Tim Walz or former President Trump and Senator J.D. Vance will lead the United States over the coming years. While the many issues separate and define the candidates, energy policy is on the ballot. Another term for the former President will be a return to the “drill-baby-drill” and “frack-baby-frack” policies of energy independence and exports. A win by the Democrats will mean continuing energy policies combating climate change. Energy is on the ballot, but the potential for higher uranium prices remains compelling, as the commodity is a critical input for nuclear power and atomic weaponry.

Regardless of the election outcome, uranium prices will likely remain on an upward trajectory.

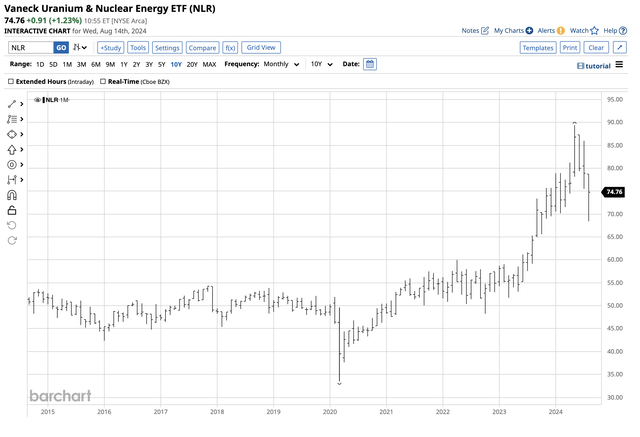

NLR tracks the MVIS Global Uranium & Nuclear Energy Index – Fewer assets than URA and outperformance since the 2024 high

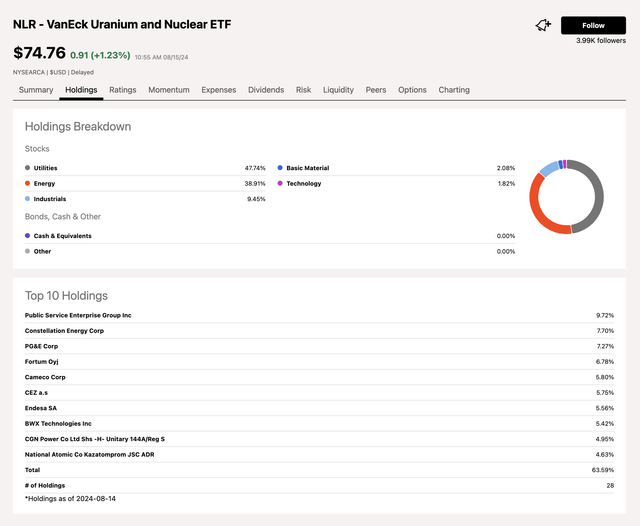

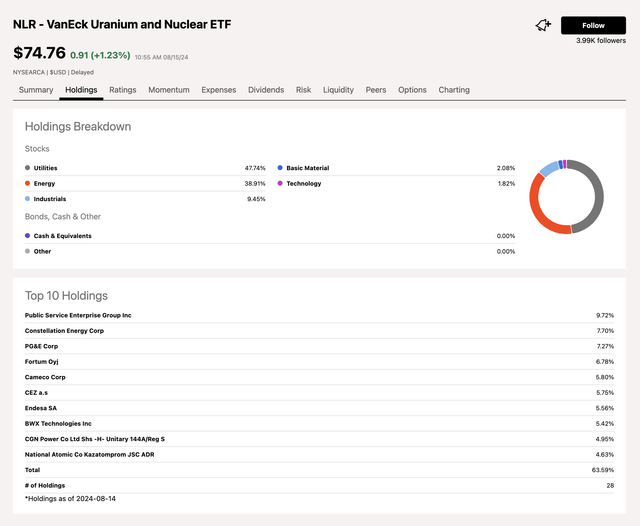

The top holdings of the VanEck Uranium and Nuclear ETF include:

Top Holdings of the NLR ETF Product (Seeking Alpha)

As the current portfolio construction illustrates, NLR has over 10% exposure to Kazakhstan’s and Canada’s leading uranium mining companies. At $74.76 per share, NLR had over $215.4 million in assets under management. NLR trades an average of 53,729 shares daily and charges a 0.61% management fee. The $3.26 annual dividend translates to an above-market 4.36% yield.

At $25.70 per share on August 15, the URA ETF was 23.65% lower than the May 2024 high.

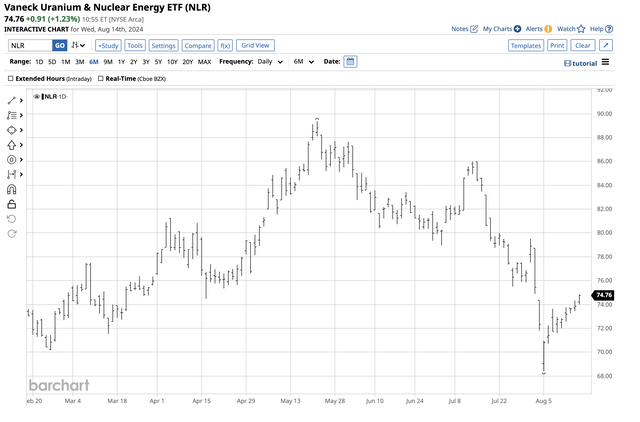

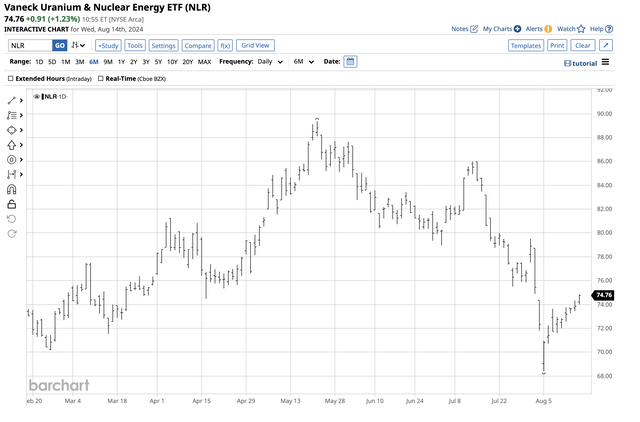

Six-Month Chart of the NLR ETF Product (Barchart)

Over the same period, the NLR ETF has outperformed URA, dropping 16.34% from $89.36 in May 2024 to $74.76 per share.

URA’s assets are over thirteen times higher at over $2.84 billion. At just over $215.4 million, NLR managers could have more flexibility in changing the portfolio’s composition, reducing some commodity risk and accounting for the outperformance since the May 2024 high.

NLR’s top holdings are diversified

URA has a 27.24% exposure to Cameco (CCJ) and Kazatomprom, the world’s leading uranium mining companies. NLR’s top three holdings are:

- Public Service Enterprise Group Inc. (PEG) at 9.72% of assets – PEG is a U.S. electric and gas utility.

- Constellation Energy Corp. (CEG) at 7.70% of assets – a third U.S. electric and gas utility.

- PG&E Corporation (PCG) at 7.27% of assets – another U.S. electric and gas utility.

NLR has nearly 24% of its assets invested in U.S. utilities spread across the country.

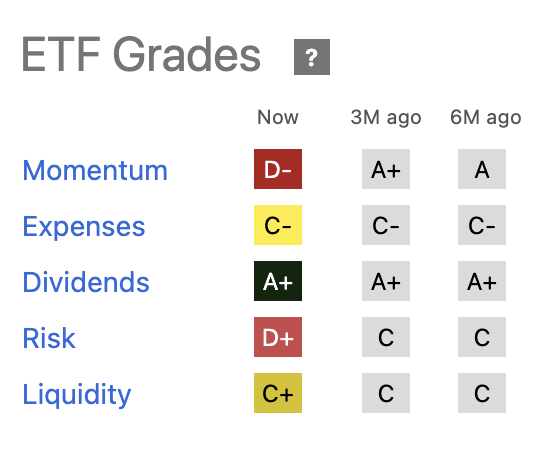

ETF Grades are mostly passing – Dividends are the standout

NLR’s Seeking Alpha ETF Grades are:

NLR Seeking Alpha ETF Grades (Seeking Alpha)

NLR gets a lower grade than URA in liquidity, a C+ compared to an A, because of its fewer assets under management. However, NLR beats URA in most other categories, receiving a D- in momentum compared to an F for URA, a C- in expenses compared to a D+, and a D+ in risk compared to a D-. Both ETFs receive an A+ in dividends.

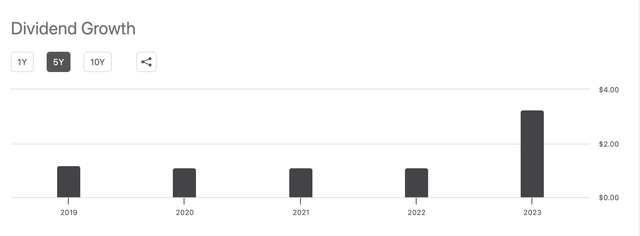

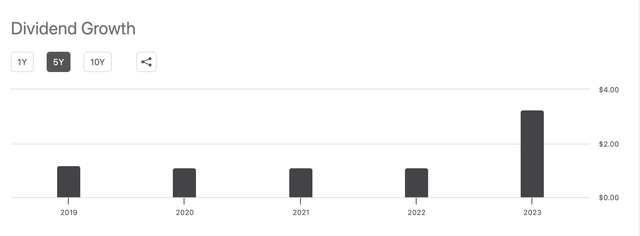

NLR Dividend Growth (Seeking Alpha)

NLR’s dividend levels were steady from 2019 through 2022 and experienced a jump in 2023. Dividends remain at the same level in 2024.

A correction could be a buying opportunity

NLR is a more diversified energy ETF product, as it is not concentrated on uranium production and has significant exposure to utilities.

The chart shows NRL’s nearly 20% correction from the May 2024 high, with the most recent low at $68.42 per share. Technical support is at the April 2022 high of $59.97.

Uranium and utility exposure through the NLR ETF could be the correct diversified exposure in the current environment. Meanwhile, the smaller ETF, with just over $200 million in assets, allows risk managers more flexibility to change the asset mix as market conditions evolve over the coming weeks and months. Moreover, when it comes to utilities, the rising prospects for lower interest rates over the coming months support the leading utilities as they traditionally offer substantial dividends.