Pgiam/iStock via Getty Images

Investment update

Following my last publication on Chemed Corporation (NYSE:CHE) the stock is flat, and I am reiterating my buy rating on the stock after its Q2 FY’24 earnings.

The last publication, titled “Continues to compound shareholder value at double-digit returns” advocated to size into CHE based on a number of factors, all of which are still relevant today, namely:

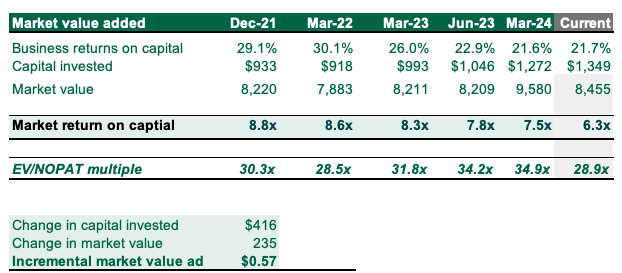

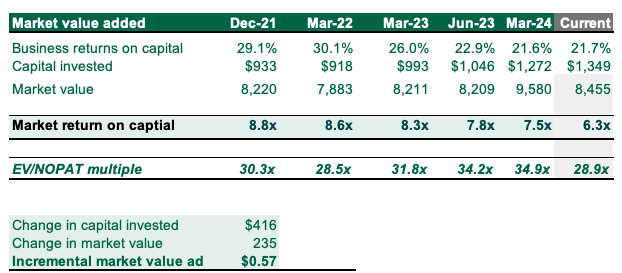

CHE is a long-term compounder with a cycle of producing high returns on the capital invested in its operations, recycling a decent portion of these back into its asset base, then repeating the process. It attracts high valuation multiples on capital as a result (currently ~6x, but historically up to ~8x), which provides exceptional compounding ability with each $1 of freely available cash management puts back to work in the business. If it is valued ~$6 on the dollar (justifiably so, given the persistence in its ROICs), then any surplus investment management can make should immediately be awarded high marks.

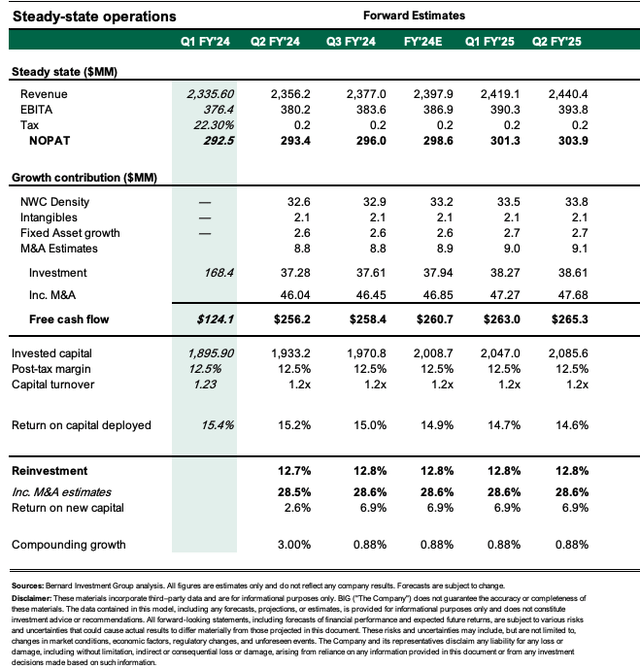

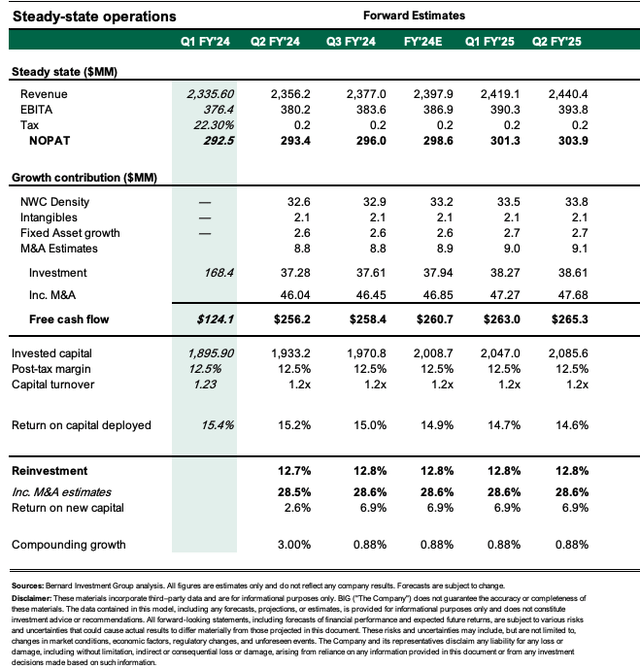

- Arguably, paying this high of a multiple reduces the investor return tremendously in the very short-term:

- Book capital = ~$1.9Bn (as of Q2 FY’24)

- Earnings on book capital = $292mm = ~22% return

- We pay = 6 x book capital = $8.4Bn

- Investor return = $292mm / $8.4Bn = ~3.4%.

- Alas, the view must be long-term for this high-quality compounder to enjoy the effects of this equally high-quality management’s performance.

To illustrate, using a hypothetical example (I’ll discuss my scenarios later):

- Pay 6x book capital = $8.4 Bn – assume 25% ROIC

- Total cumulative NOPAT produced, 5yrs = $1.22Bn ($407mm/yr)

- Management reinvest ~33% NOPAT to capital base = $403mm

- New capital base = $1.75Bn

- At 6x = $10.5Bn = 24.3% growth in business worth.

- Comparedm to 50% reinvestment = $611.5 = $1.96Bn(vii) At 6x = $11.7Bn = 39% growth.

These same economic principles explicitly apply to CHE in my firm estimation, which I’ll discuss briefly here. I have a long-term objective of $700/share on CHE (>5yrs) but in the meantime see the next price objective to $580-$600/share which I’ll run through here today.

Based on my appraisal of the latest updates and recent developments, I continue to rate CHE a buy, next price objective $580/share, then $600.

Q2 FY’24 earnings breakdown

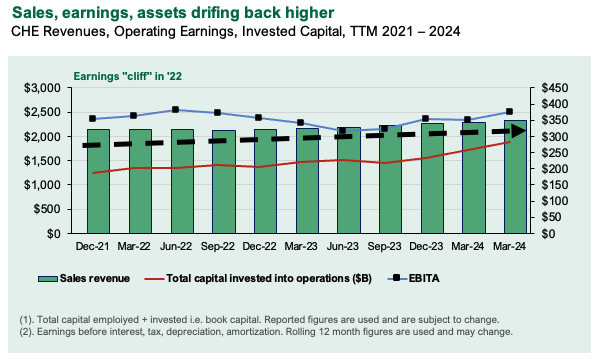

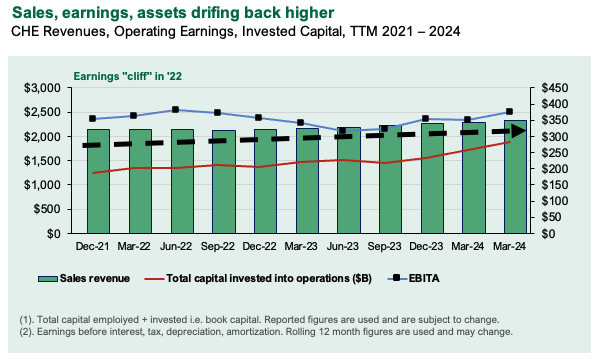

CHE did ~$596mm of business during the quarter, growing the top line ~760bps YoY on earnings of $5.47/share. Each of the company’s portfolio businesses continues to grow, and it grew headcount this quarter, which may be beneficial seeing it is 7th in the healthcare services industry for net profit/employee at ~$20K/employee (First 4 are (CI), (ASTH), (OPCH), and (PINC), respectively). The trend on sales ramp is now well in situ, and I see further growth in operating earnings from here (see: Figure 1, Appendix 1). Management’s comments on the average daily census (“AVD”) on the call also stood out to me:

In the second quarter of 2024, our average daily census was 21,036 patients, an increase of 14.4%. VITAS has generated quarterly sequential ADC growth over the last seven quarters. In the second quarter of 2024, total VITAS admissions were 17,334. This is an 11% increase when compared to the second quarter of 2023.

Management revised guidance to the upside, now calling for 16.3% to 17.3% growth in VITAS (before any Medicare Cap, with 13.3% to 14.4% growth forecast in AVD. It projects Roto-Rooter to contract 4-5%. It eyes adj. EBITDA margin of ~19% and earnings of ~$23.80/share on this at the upper range.

Regarding the divisional highlights, the following were my takeouts:

-

VITAS reported 17,344 admissions in Q2, +11% YoY. ADC was +2,644 otherwise _+14.4% YoY. VITAS put up sales of $374mm (~+17% YoY). Growth was underlined by +14.4% increase in days-of-care, coupled with a +2.5% change in Medicare reimbursement. Notably, the Covenant Health acquisition (discussed below) contributed ~$8.5mm to the top line.

-

Average revenue per patient a day was $200.03 (153bps YoY). Reimbursement for routine home care avg. $176.73/day, while high-acuity care averaged $1,071.65/day. Despite a slight decline in high-acuity days-of-care as a percentage of total days (it was -21bps YoY), the overall revenue per patient days is the number to go by in my view.

- Meanwhile, its Roto-Rooter business faced challenges in Q2, with revenue downsides across both residential and commercial segments. Sales were -500bps YoY to $221.3mm, underscored by residential revenue (-160bps YoY) and commercial revenues (-820bps YoY). The overall call volume was down 6.1%, reflecting softer demand in the market.

Covenant Health acquisition impact

-

The acquisition of Covenant Health added ~$8.5mm to the quarterly top-line, as mentioned, tallying ~+$1.7mm in earnings.

-

For the FY24, Covenant Health is expected to contribute ~$30mm in sales on adj. EBITDA of ~$8.5mm and ~$5-6mm in earnings.

My view of the company’s quarter is that it was tremendously strong, with continued growth in unit economics of both operating businesses. CHEs’s management is a good steward of capital and exhibits many shareholder-friendly moves designed to treat investors like partners rather than names on the share register. It views the business’s cash + capital as shareholders’ cash + capital, and has deployed it wisely over the years (I discussed this at lengths in my last CHE analysis). I’ve updated my modelling accordingly (see: Appendix 1).

Figure 1.

Company filings, author

Valuation upsides remain in situ

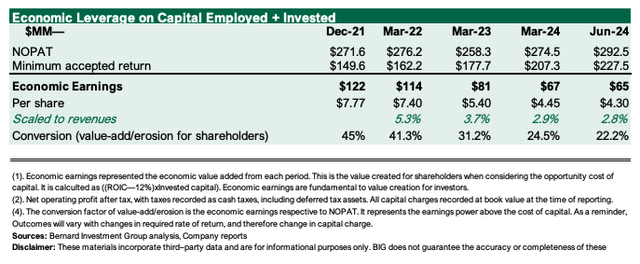

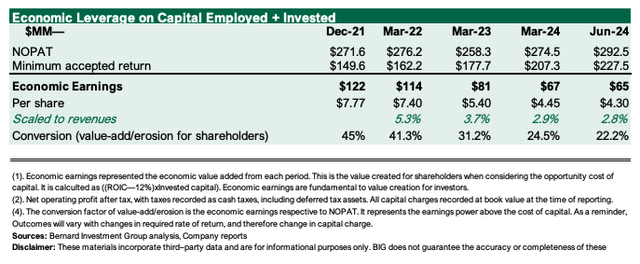

The business trades at a compressed valuation of ~6x EV/IC, but I’m happy to carry this forward as 1) it leaves headroom for expansion and 2) tremendously poor business efforts would be needed to see it trade below this range. Even 6x is pessimistic in my view – this is a business 1) earning >20% on all the capital that’s been put into it, 2) has a lengthy reinvestment runway to deploy capital over [my numbers suggest avg. ~11% of NOPAT to FY’28], and 3) where >2% of sales at minimum pull through to economic profit (excess returns above our 12% hurdle rate) .

Figure 2.

Company filings, author

Figure 3.

Company filings

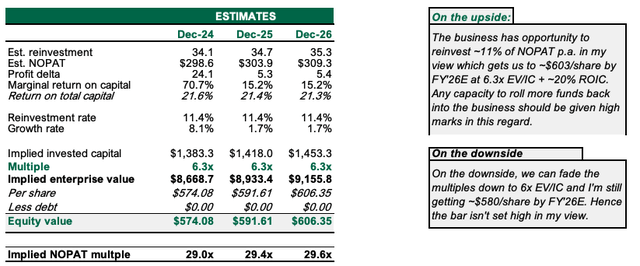

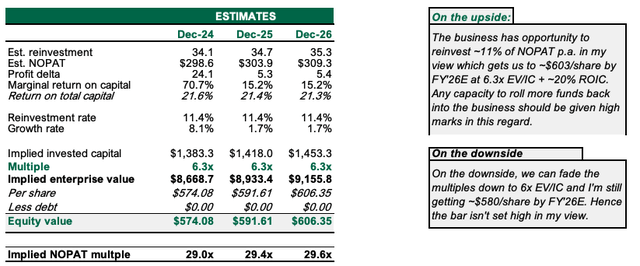

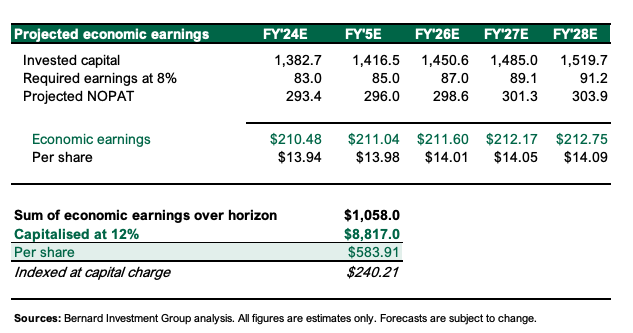

Valuation insights

- The business has opportunity to reinvest ~11% of NOPAT p.a. out to FY’26E in my view, which gets us to ~$603/share by FY’26E at 6.3x EV/IC + ~20% ROIC. Any capacity to roll more funds back into the business should be given high marks in this regard. On the downside, we can fade the multiples down to 6x EV/IC, and I’m still getting ~$580/share by FY’26E under these assumptions. Consequently, the bar isn’t high in my view.

Figure 4.

Author’s estimates

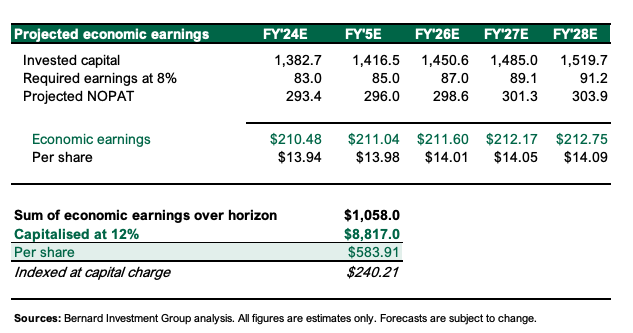

- My estimates of the freely available cash that could be produced for a 100% owner of the business produced in excess of a comparable rate of risk (~6% here, starting yields on many investment grade corporates) and discounted at 12% are ~$585/share. My view is there is upside risk on this as CHE’s ROICs are 1) cyclical, 2) currently at the low point of the cycle, and 3) starting to curl higher. Surplus ROIC and economic profits are accretive to the valuation, with 25% ROIC by FY’26E getting me to $600/share discounted value of cash – but I’ll remain conservative not to induce forecasting errors.

Figure 5.

Author

Risks to investment thesis

Downside risks to the thesis include 1) ROICs <20% as this compresses the intrinsic value, 2) management reinvesting <5% of NOPAT to grow, and 3) the broader set of macroeconomic risks that cannot be overlooked in all equity evaluations right now. These include 1) the inflation/rates axis, 2) geopolitical risks, and 3) the impact of central bank policies on point (1).

Investors must recognize these risks in full.

In short

CHE remains a buy in my view given 1) its high-quality business economics that throw off high earnings for reinvestment, 2) Attractive starting multiples underpinned by these economics, and 3) valuations supportive to $580–$600/share under various scenarios. Net-net, reiterate buy.

Appendix 1.

Author