International students — long the golden goose for universities and colleges in advanced economies — face an increasingly uncertain future as governments seek easy targets to rein in surging immigration.

In the UK, one of the world’s biggest destinations for foreign students, the Labour party while in opposition vowed to retain a ban on international students bringing dependents to Britain — the largest source of migration since 2019. In the Netherlands, the government has proposed restricting foreign students’ access to Dutch universities.

In Canada, where one in 40 people is an international student, a government clampdown is forcing “puppy mill” colleges to shut down programs. And in Australia, where that ratio is even greater at one in 33, the government has proposed caps on foreign enrollments in universities and is targeting “dodgy providers.”

The impact is already being felt — aggregate visa data for the first quarter of 2024 showed volumes to the UK, Canada and Australia down between 20% and 30% from a year earlier, according to Sydney-listed student placement services and testing company IDP Education Ltd., which operates in all three markets.

“Students are the easiest group to control in terms of numbers, that’s why they’re No.1 on the chopping list and universities aren’t particularly powerful constituencies so they’re probably also a reasonable political target,” said Andrew Norton, Professor in the Practice of Higher Education Policy at the Australian National University in Canberra.

Keir Starmer’s Labour party last month ended 14 years of Conservative rule in the UK and hasn’t settled on its immigration policy since the July election landslide. Canada and Australia have elections due in the coming 14 months.

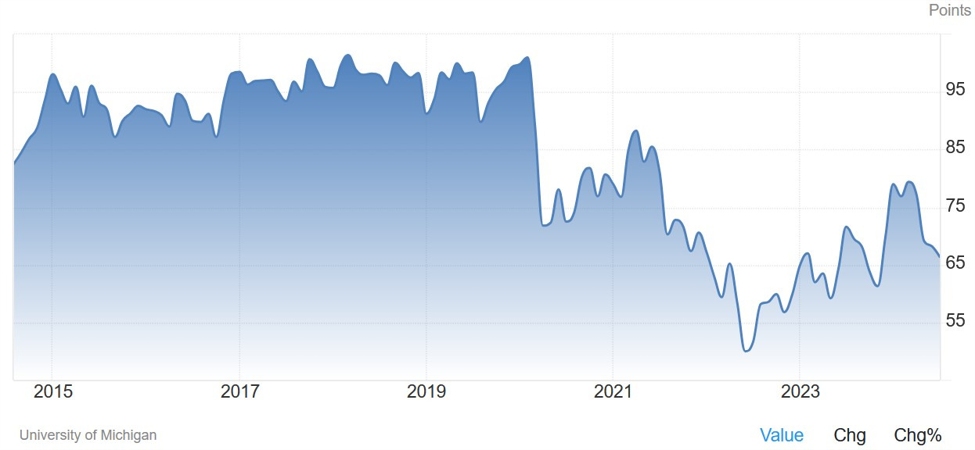

Governments are framing the moves as a way to improve the quality of education and stamp out rorting. But critics of the measures say they’re also politically motivated as a cost-of-living squeeze and housing shortages since the Covid pandemic sparks a backlash against rapid immigration rates.

International education is a roughly $200 billion global business, according to data company Holon IQ, with the UK, Canada and Australia three of its biggest players. The industry is considered a services export and generates economic benefits beyond tuition fees as students fork out for accommodation and living expenses and often go on to work and pay taxes in the countries they studied.

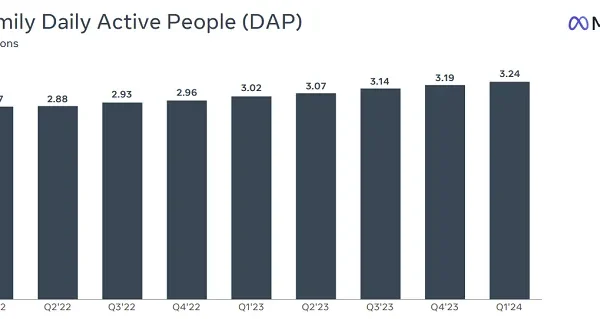

The US is shaping up as winner from the crackdown in other markets. It surpassed Australia to become the preferred study destination for international students, according to an IDP survey of more than 11,500 prospective and current international students.

International student enrollments in the US rose 11.5% in 2022/23 from the year prior, taking the total to more than one million for the first time since the pandemic. Vying to return to the presidency, Donald Trump has said he supports giving a green card to every non-citizen graduate of a US college, though his campaign later said the program would include a strict vetting process.

But elsewhere, economic arguments about the benefits of a booming international education sector are taking a back seat to political ones as the electoral tide swings against immigration.

UK Closes a ‘Gateway’

Measures by the former government to ensure the sector is used for education and “not as a gateway to immigration” are being reviewed by the new Labour government.

During the campaign, Labour shadow minister Chris Bryant assured that the party – if elected – wouldn’t reverse a ban on foreign students bringing dependents to the country. But more recently, UK Secretary of State for Education Bridget Phillipson asserted that “for too long international students have been treated as political footballs, not valued guests,” and that this will stop. “Be in no doubt: international students are welcome in the UK,” she declared.

The UK has seen a growing number of foreign students in the past decade, especially from China and India, with the academic year of 2021-2022 showing a record 679,970 overseas students.

That’s contributed significantly to universities’ funding, making them increasingly reliant on Chinese-British diplomatic relations and on Indian economic growth. The total economic benefit of the 2021-22 cohort was estimated to be £41.9 billion ($53.5 billion), according to an independent study.

The Office for Students, the sector’s independent regulator, said even a small reduction in student numbers could push 202 institutions, or 74% of the total, into deficit. A review was commissioned by the former government to study visa abuse by foreign students, but found little evidence of it.

Companies have also stressed the need for foreign talent. Executives at Anglo American Plc, Rio Tinto Plc and Siemens AG were among signatories to a letter warning the previous prime minister Rishi Sunak that Britain’s migration policies may weaken the university sector. UK universities have stressed that international enrollment doesn’t come at the expense of domestic students.

Dutch Restrictions

While across Europe anti-foreign sentiment keeps rising, limitations on foreign students are perhaps nowhere more striking than in the Netherlands, where a coalition supported by the far right has pushed a policy to restrict foreign students’ access to Dutch universities.

Dutch universities were famously favorable to foreign students, with most classes offered in English and foreign students making up a quarter of the higher education student body. But a lack of new housing and the tripling of foreign student numbers in the past decade have contributed to a serious shortfall in student accommodation.

Universities facing overcapacity decided in February to limit the number of English-taught degrees and reduce international enrollment.

The universities’ decision is supported by a bill, yet to be voted on in parliament, to cap the number of foreign students in the country, restrict non-European students from certain programs and forbid active international recruitment at student fairs except for sectors with significant labor shortages.

Large Dutch companies, which rely heavily on skilled foreign talent, have raised alarm bells about these restrictions, saying they might move their offices out of the country if a number of these anti-migrant policies pass. This comes as a top Dutch technical university is also facing pressure from the US about its Chinese students, as the university is a key feeder of one of the world’s leading chip equipment companies, ASML Holding NV.

The nation’s central bank chief also warned that foreign students contribute significantly to the Dutch economy. Non-EU students, for example, contribute up to 96,000 euros ($105,000) each to the Dutch economy over the course of their studies, according to the Netherlands Bureau for Economic Policy Analysis.

Canada’s Crackdown

In Canada, foreign students contribute more than C$22 billion ($16 billion) to the economy and support some 218,000 jobs.

New regulations — including a 35% reduction in student visa issuance this year and removal of incentives like the post-graduation work permit eligibility — are targeted at the subsector predominantly occupied by lesser-known, smaller colleges.

Munira Mistry, 43, fears losing her teaching job at a college in Toronto by December as the government clampdown prompts a cost-cutting drive.

“It feels like all the doors are closing,” said Mistry, a project management instructor who arrived as an international student from India in 2020 and is still struggling to gain permanent residency. “I’m back to square one.”

At the end of last year and before the crackdown took effect, ten small institutions had more international study permit holders than the University of Toronto, the country’s highest ranking institution.

Like in Australia and the UK, rents surged and reports of students cramming into apartments or using food banks to get by became commonplace. Opposition leader Pierre Poilievre has said that he would tie the pace of population growth to home construction, which could result in an even larger drop in international student entries and overall immigration levels.

Colleges Ontario, an association representing the province’s 24 public colleges, said it experienced a “collapse” of the spring cohort, which represents a quarter of total college enrollment. It expects a “severe impact” on the fall term, with revenue losses in the hundreds of millions of dollars.

“No organization can absorb such losses without significant cuts to operations,” it said in a statement in March, adding that the consequences include “immediate program suspensions and a pause on capital investments.”

Australia Acts

The stakes are even higher for Australia, where international students contributed A$48 billion ($31.6 billion) to the economy in 2023, becoming the country’s top services export. Roughly 55% of that amount is spent on goods and services outside universities – with significant benefits for local small businesses, according to policy think tank Committee for Sydney.

Australia’s universities rely on international students for more than a quarter of overall operating revenue, according to S&P Global Ratings, making them among the most dependent in the world.

The government’s plans — which include enrollment limits for individual universities and housing construction requirements — haven’t been through parliament yet. But international students are already facing tougher English language standards, visa rejections are becoming more common and some private colleges are being told to stop recruiting fake overseas students within six months or they’ll lose their licenses.

International student visa application fees in July more than doubled to A$1,600, the most expensive in the world, according to Group of Eight Universities, which represents the country’s leading research universities.

Australia’s plan risks crimping universities’ revenues, curbing funding for research and potentially hurting their international QS World University Rankings. Business lobbies say the move will leave a shortfall of workers in key industries.

Insolvencies in Australia’s education and training sector have already responded, jumping nearly 90% in June from a year earlier — the highest for any sector — according to data from Creditorwatch Pty Ltd., with the rate expected to increase in the next 12 months.

Australia’s opposition has promised even stricter limits, without specifying its policy proposals. Australian voters are due to go to the polls by May 2025 with sentiment swinging against rapid immigration — a survey in May showed 66% of respondents said 2023’s migrant intake “was too high” with 50% wanting the government to make deeper cuts to immigration.

A parliamentary inquiry into the proposed legislation is due to report back by Thursday. Given the proposed legislation has bipartisan support, analysts expect it to pass parliament this year, though universities might yet be able to persuade the government to water down some proposals.

“Migration is shaping up as a key battlefront in the lead-up to the federal election and the university sector is shaping up to be the fall guy,” Vicki Thomson, chief executive of the Group of Eight, said in her opening statement to a parliamentary hearing reviewing the proposed legislation on Aug. 6. “This rushed and poorly framed legislation is a classic example of retrofitting policy to suit dubious politics.”