Art Wager

Summary

Despite early signs of an inflection in supply and recovery in market rents in Houston, we still believe it is too early to change our tone on BSR. While we continue to believe in the management team and long-term fundamentals of its sunbelt markets, we see the significant headwinds to rent growth persisting for the balance of the year. The margin of safety has deteriorated since our last report, and we maintain the units at Hold.

Earnings Update

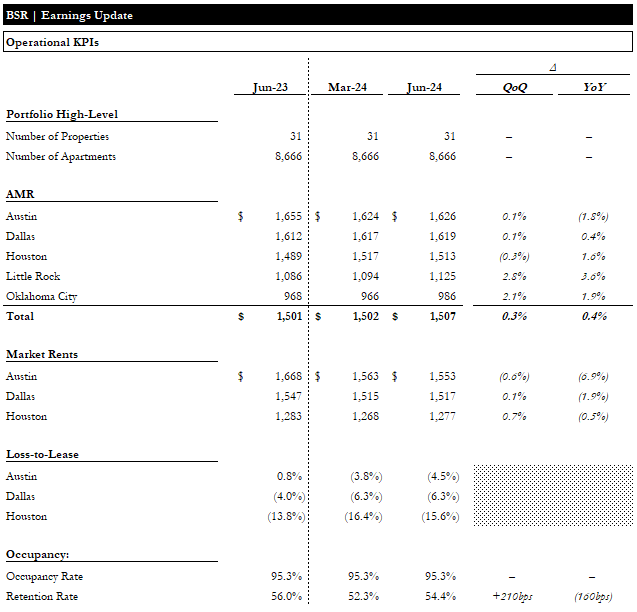

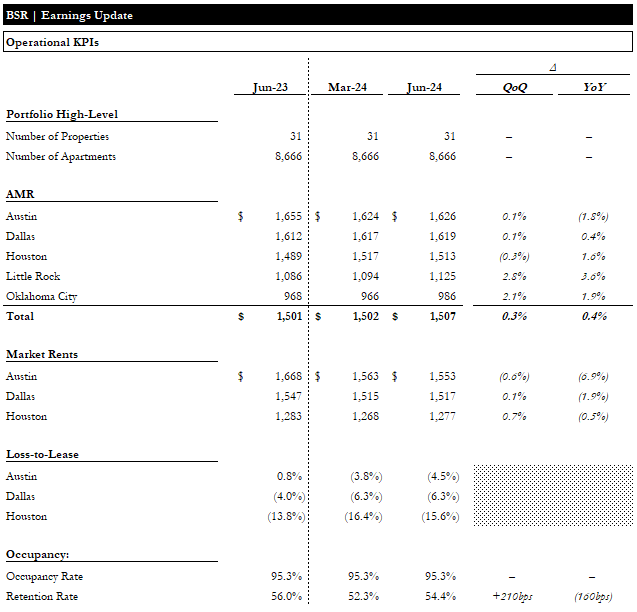

The portfolio composition did not change over the quarter as the REIT remains in a defensive investment posture. As expected, AMR growth in BSR’s critical Texas markets was extremely muted, essentially flat QoQ. Considering the continued supply pressures, we were pleasantly surprised to see positive growth, albeit minor, in 2 of the 3 markets. Little Rock and Oklahoma City saw strong QoQ AMR growth, with +2.8% and +2.1%, respectively.

The supply picture for BSR’s key Texas markets remains unfavorable. Colliers’ Q2 reports describe the issues well:

Houston

Bolstered by strong seasonal demand, overall net absorption jumped to 7,880 units, a significant increase from both the prior quarter and year over year. Absorption was positive across all property classes, with Class A units accounting for 72.3% of the total absorption. The construction pipeline slowed to 18,775 units in the second quarter, 10.3% fewer than the previous quarter and 20.1% less year over year, even though the number of proposed units increased to the current 35,988 units. Occupancy rose 40 basis points in the second quarter but is down 50 basis points year over year. New supply rose 30.0% to 5,727 units but is down 11.1% year over year. Average monthly effective rent increased marginally to $1,277 per unit but was down year over year. Class A rents at $1,749 have reported marginal increases in 2024 but were down 2.5% from the same time last year. (Colliers)

DFW

The Dallas/Fort Worth apartment market faces ongoing supply issues, with 39,140 units completed in the year ending Q2 2024, the most since the 1980s. Despite strong demand from employment growth and population increases, supply surpassed absorption, with net demand at 28,696 units. Consequently, vacancy rates remained at 92.6%, and rent growth fell by 2.6%. At the end of Q2 2024, over 64,000 units were under construction, with 41,185 expected next year, particularly in northern suburbs and urban areas like Uptown Dallas and South Fort Worth. This surplus has softened occupancy and rent growth, with Class A properties faring better than Class B and C. Effective asking rents decreased 2.6% annually, with notable declines in Allen/McKinney and Northeast Dallas. (Colliers)

Austin

The Austin-Round Rock apartment market is facing a critical challenge in absorbing a substantial influx of new supply. With over 31,000 units expected to be delivered within the next year, an all-time high, the market’s performance is likely to soften despite strong economic and demographic drivers. Occupancy rates are anticipated to continue declining as the market adjusts to the increased supply, though demand should remain robust due to ongoing population and employment growth in the area. In the short term, Austin’s apartment market will struggle with the high volume of completions, but over time, the market is expected to recover and potentially move into the upper quartile of performance levels nationally. In the second quarter of 2024, the market recorded stable occupancy rates quarter-over-quarter but saw a slight decline year-over-year, with rents also decreasing. The local economy has shown resilience, with notable job growth and a reduction in the unemployment rate. (Colliers)

The ongoing supply pressures showed up in BSR’s implied loss-to-lease, which continue to be negative, ranging from -4.5% to -15.6%. As we have been reporting, the supply narrative was widely expected to inflect in the second half of this year. In light of the new data from Colliers, we think the recovery timeline may be at risk of being delayed. The saving grace may be the unabated strength of demand in these markets; however, the risk of a US recession may further delay the timeline.

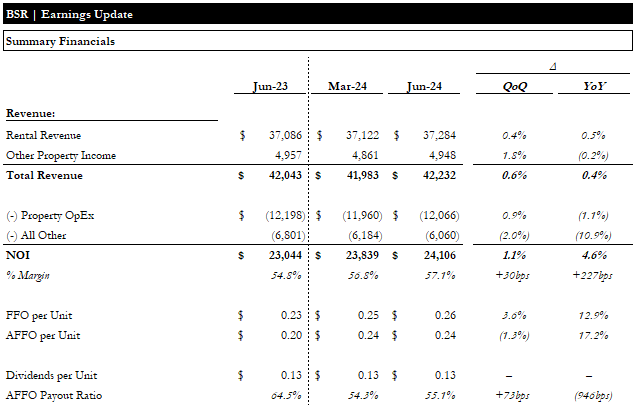

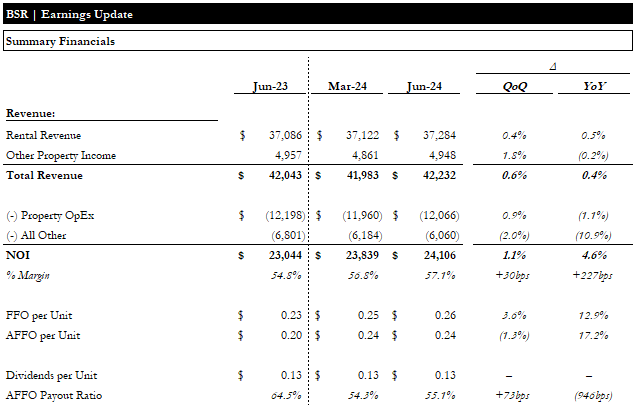

Earnings Update | Operations (Empyrean; BSR)

Revenue grew a modest 0.6% QoQ, and NOI grew ~1% (n.b., +30bps margin expansion). FFO per unit was up 3.6%, while AFFO was down ~1% on higher maintenance capex. The payout ratio remained a healthy ~55%.

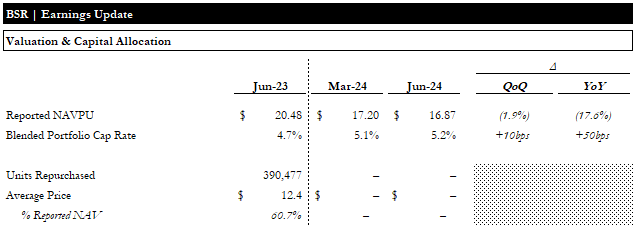

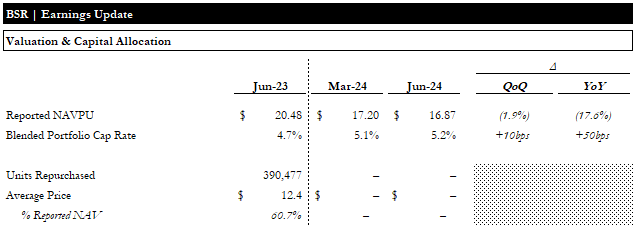

Earnings Update | Financial (Empyrean; BSR)

The IFRS NAVPU declined ~2%, driven by 10bps of cap rate expansion. There was no share repurchase activity in the quarter. On the earnings call, management reiterated its belief that unit repurchases are an attractive use of capital in the current environment. However, it has nearly reached the capacity of its current NCIB. When the NCIB expires on October 5, we expect BSR to initiate another and resume repurchases.

Earnings Update | Valuation & Capital Allocation (Empyrean; BSR)

Considering the tough supply dynamics in Texas, we see this as a relatively positive quarter. While we continue to like the strong demand drivers in BSR’s 3 key Texas markets, we are not yet seeing the slowdown in new supply that we had expected.

Valuation

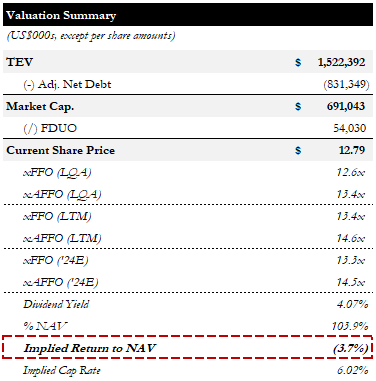

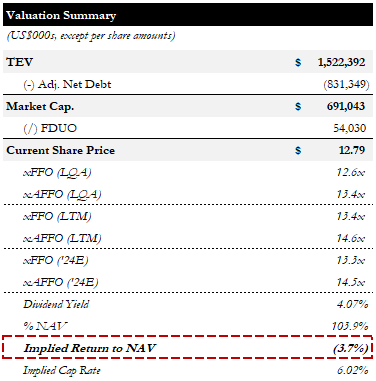

Since our last report, BSR is up ~5%. It trades for ~13x and ~14x midpoint 2024E guidance FFO and AFFO, respectively, and ~104% of our revised NAVPU estimate. It yields ~4% with an implied cap rate of ~6%.

Valuation Summary (Empyrean)

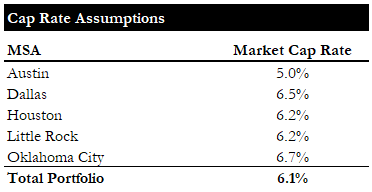

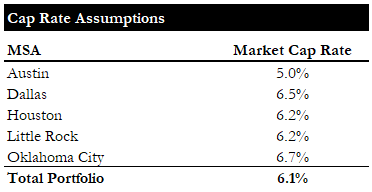

Our cap rate assumptions for Texas were updated per the Colliers reports linked above and were unchanged for Little Rock and Oklahoma City.

Cap Rate Assumptions (Empyrean; Colliers)

In our opinion, the recent rally and reduced NAVPU estimate have eliminated the margin of safety. We are maintaining our Hold rating, as we see the potential for sentiment to shift more positively if we get some favorable data points on supply, or if the Fed moves to cut rates. We remain cautious due to the lack of a significant margin of safety and ongoing supply pressures.

Conclusion

BSR’s Q2 earnings showed essentially flat rent growth in Texas despite continued pressure from falling market rents, a symptom of highly elevated supply. We are less bullish, with the units up ~5% from our last report, and our NAVPU revised lower to ~$12.3 (n.b., ~4% implied downside). We are not downgrading to Sell, as we see potential for upside to the shares and our target price when/if we see positive data points on Texas supply or rate cuts.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.