We Are

The AI boom is real. Any company with a business remotely related to artificial intelligence seem to be surging, and for good or ill, the multiples of many of those companies seem to be extreme. Some of these companies may make out big, but it reminds me of the 1990s bubble, when many companies rose on what would be known as irrational exuberance.

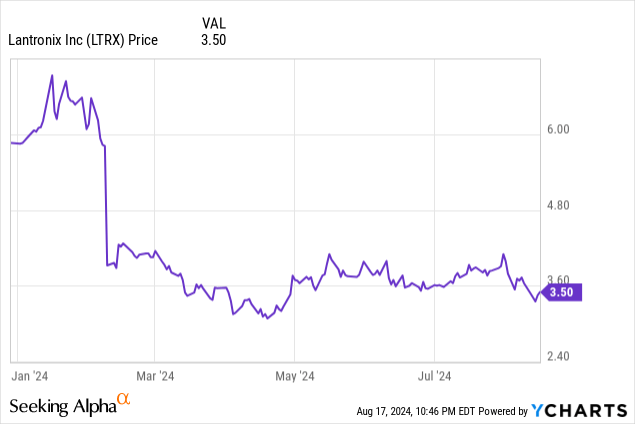

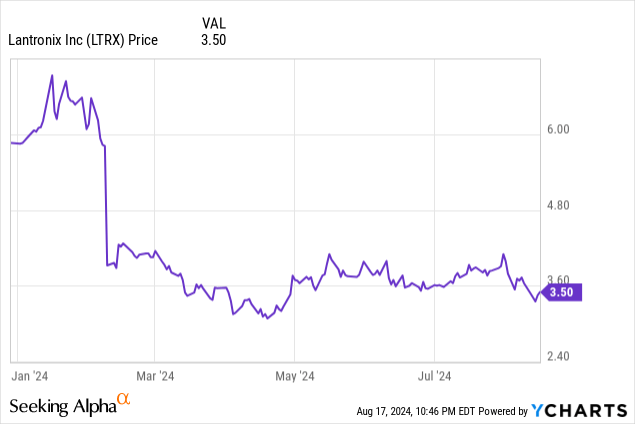

Today, we’re going to be looking at a small company that seems to have been overlooked in all the excitement. That company, Lantronix, Inc. (NASDAQ:LTRX) is trading well on the lower side of its 52-week range. We’ll be looking at it as a possible contrarian play, with a focus on underlying value and the prospect for growth.

Understanding Lantronix

California-based Lantronix is a provider of solutions for the internet of things, focusing on applications like smart grid, intelligent transportation, and AI data centers.

The company also offers out of band management products for cloud and fringe computing. The goal is to help companies with remote management and to reduce overall costs.

The company reports that its design cycles range generally from nine to 24 months.

Consolidated Balance Sheet

|

Cash and Equivalents |

$25 million |

|

Total Current Assets |

$98 million |

|

Total Assets |

$147 million |

|

Total Current Liabilities |

$43 million |

|

Long-Term Debt |

$14 million |

|

Total Liabilities |

$69 million |

|

Total Shareholder Equity |

$78 million |

(source: most recent 10-Q from SEC)

Lantronix has a very straightforward balance sheet, with plenty of cash on hand to manage their continued growth. The company last limited debt, which it is paying a very reasonable rate of interest on. The hope is that the company will continue to grow, and the debt will become even less relevant.

Lantronix is currently trading at a price/book ratio of around 1.69. That’s quite low for a tech company, especially a presently profitable one.

There are no perfect apples-to-apples comparisons to be made with other companies, but some similarly sized companies in similar industries, like Genasys (GNSS) and Inseego (INSG) are trading at price/book values of 4.29 and 47.72, respectively.

The Risks

A fledgling company in many ways, Lantronix has its share of risks to be aware of going forward, not the least of which is that the on-again, off-again chip shortage has threatened at times to impact their ability to produce products in a timely fashion.

Lantronix also outsources substantially all of its manufacturing to contract services in Asia, which gives them potential risks for delays, and currency risks on potential contracts.

The company is meant to be growing, and it is, at least somewhat. The ability to continue to grow will depend on Lantronix developing and selling new products, which need to be timely and find an appropriate market.

The company also depends on a limited number of distributors, meaning that getting the product into the hands of end users is largely out of their hands.

Statement of Operations

|

2021 |

2022 |

2023 |

2024 (9 months) |

|

|

Net Revenue |

$71 million |

$129 million |

$131 million |

$111 million |

|

Gross Profit |

$33 million |

$55 million |

$56 million |

$46 million |

|

Operating Income |

($3.3 million) |

($5.0 million) |

($6.7 million) |

($3.4 million) |

|

Net Income |

($4.0 million) |

($5.4 million) |

($9.0 million) |

($4.9 million) |

|

GAAP Diluted EPS |

(14¢) |

(16¢) |

(25¢) |

(13¢) |

|

Non-GAAP dil. EPS |

19¢ |

34¢ |

23¢ |

26¢ |

(source 2022 and 2023 10-Ks, and most recent 10-Q from SEC)

Understanding Lantronix statements of operations means understanding their non-GAAP earnings per share, which excludes certain restructuring figures, which the company argues is a better metric for their overall performance. The non-GAAP performance, among other things, removes amortization of intangibles, severance and restructuring charges, impairment of long-lived assets, litigation settlements and income tax provisions.

Ultimately, using non-GAAP makes a big difference, as you can see. Lantronix goes from being another unprofitable but growing company to one which has been profitable for years, and it is worth noting that analyst estimates are also using the non-GAAP figures for future earnings.

Estimates are that the company will be making $160 million this fiscal year, with a profit of 41¢. That gives them a P/E ratio of 8.53. That’s a pretty nice value proposition, but the estimate gets better for fiscal year 2025, when revenue will be $170 million and the profit is estimated at 47¢, giving them a forward P/E of 7.44.

Again we don’t have perfect companies to compare Lantronix to, but using the standby of Genasys and Inseego, we see a company that isn’t profitable at all, and a company that expects to go from unprofitable this year to Inseego with a P/E of around 60, respectively.

Generating Cash

|

2021 |

2022 |

2023 |

2024 (9 mo.) |

|

|

Operating FCF |

$4.3 million |

($9.4 million) |

$237 thousand |

$16.3 million |

|

Investing FCF |

(783 thousand) |

($25.7 million) |

($7.3 million) |

($1.3 million) |

|

Financing FCF |

($1.5 million) |

$42.6 million |

$3.3 million |

($3.8 million) |

|

Overall FCF |

$2.0 million |

$7.5 million |

($3.7 million) |

$11.2 million |

(source 2022 and 2023 10-Ks, and most recent 10-Q from SEC)

As you can see, the company is generally cash-flow positive. That’s good news for a smallish company that doesn’t necessarily have access to enormous potential avenues to borrow money. The operating free cash flow for 2024 is substantial, and reflective of the company not having to write down much inventory value. Fiscal year 2022 stands out because the company has an acquisition of a $25 million in investing FCF for Transition Networks and Net2Edge. This is more than offset by the financing FCF from the issuance of new shares, which were issued at an average price of $4.62, well above where the company is currently trading.

Conclusion

In my view, Lantronix has been unfairly beat down and as a small company, it is taking a while for investors to appreciate what is being offered. With a price/book that is better than other information tech companies of similar size, and a single digit P/E ratio, I’m viewing this as a buy.

Lantronix is a small company, but it has definite possibilities, assuming it can overcome the risks associated with having to outsource manufacturing and limited distributors, there is a path for the company to find its way to continue its success.

Anyone looking to buy should be sure they understand the non-GAAP earnings differences, and be comfortable with the use of such metrics to describe Lantronix growth.