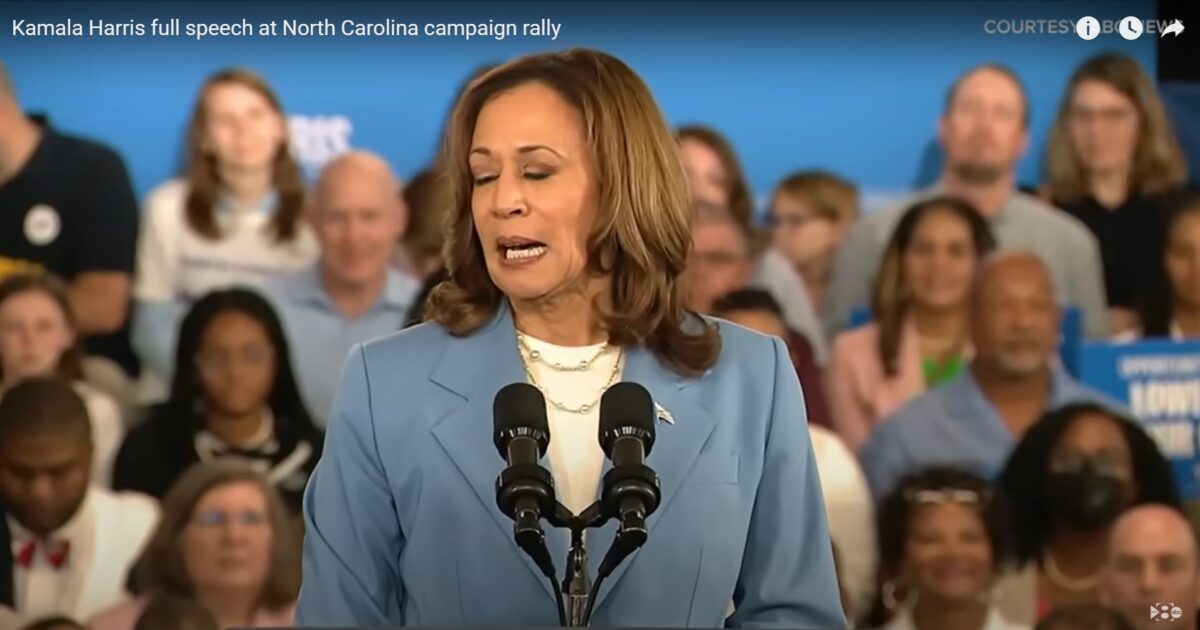

Kamala Harris promises to reduce the price of food, which is now 20-40% higher than before she became VP. If she and Joe hadn’t created so much inflation, food would be cheaper. Now, any government efforts to lower prices, whether through caps or subsidies, will harm the economy, leading to shortages, even higher prices, and increased taxes. The rest of her economic policies seem equally disastrous.

Harris’s economic agenda is socialist, ignores economic realities, and overlooks the damage these policies could cause. Like other socialist platforms, it would increase dependency on the government, reduce work incentives, and lower the standard of living. Her plan includes creating an “opportunity economy,” tax cuts, affordable housing, combating price gouging, and lowering costs for families. While these may sound noble, government intervention will only make things worse.

Creating an “Opportunity Economy” Kamal says will allow everyone to increase their wealth, regardless of where they start. However, building a new economy isn’t necessary because the U.S. system already provides this opportunity. Low-wage earners aren’t poor because they were denied jobs they were qualified for. Those in low-level jobs have limited skills and qualifications, or they are university graduates who studied impractical subjects like DEI or gender issues.

And of course, the “opportunity economy” includes tens of billions in loans for minority entrepreneurs. Giving out loans based on race or gender goes against the principles of the Civil Rights movement. Moreover, if entrepreneurs have a solid business plan, they can secure loans from banks or attract private investors, who base their decisions on the potential profitability of a business. These government programs, however, would result in companies and projects receiving funding despite failing the profitability assessments of banks and investors.

This “opportunity economy” plan also includes government-sponsored training in critical skills. The problem is that the government is incapable of determining which skills are needed, where, in what quantities, and who should obtain them. The market already handles this efficiently, which is why many gender studies majors are unemployed while plumbers are in high demand. The private sector is better equipped to identify and respond to labor market needs without government interference, which can distort the natural supply and demand dynamics.

Although Kamala’s program involves giving away more government money, she also wants to cut taxes. She has proposed making the expanded Child Tax Credit permanent, which was temporarily increased during the COVID-19 pandemic. This is exactly what conservatives warned about during COVID—that temporary measures would become permanent.

She also supports expanding the Earned Income Tax Credit (EITC), which creates disincentives to work and increases dependency on government assistance. Instead of handing out more free money, the government should focus on reducing its size and spending to create a truly free market where individuals can keep more of their earnings without relying on selective government intervention.

Affordable housing is one of the most damaging aspects of Harris’s plan. She has proposed increasing federal funding for affordable housing programs, expanding the Low-Income Housing Tax Credit (LIHTC), and creating new incentives for developers to build affordable units. She also supports boosting funding for the Housing Choice Voucher Program to help low-income families access housing. The problem with these programs is that private, for-profit developers will build housing that will be rented to people selected by the government at below-market prices. This will incentivize overproduction of subsidized housing, driving up housing prices for everyone else.

Her Rent Relief Initiatives are also a throwback to the toxic economic policies implemented during COVID, making it harder for landlords to evict tenants who don’t pay their rent. As a result, landlords will need to protect themselves by more closely scrutinizing potential renters, charging higher rents, and demanding higher security deposits.

If she imposes caps on the price of rent, there will be shortages of apartments because the demand for cheaper apartments increases while the supply decreases. Developers stop building new units, and landlords take their properties off the market.

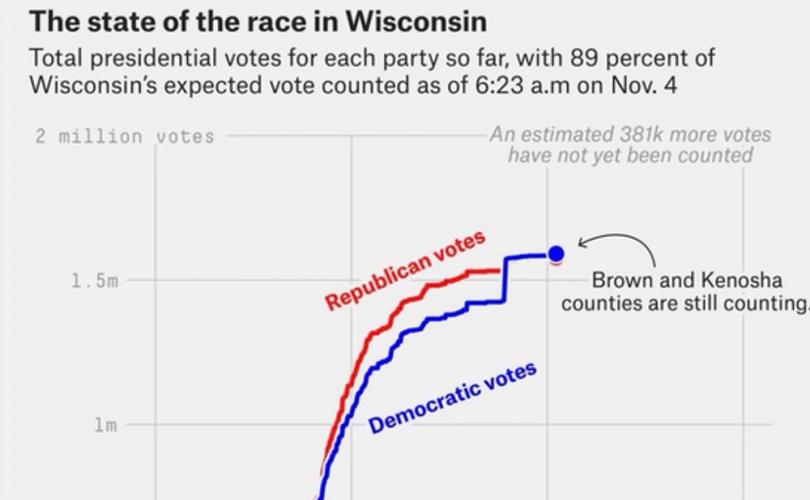

Combating price gouging is a fabricated concept. Sellers charge the market price for goods—if no one buys, the price goes down. Since Joe Biden took office, cumulative inflation has exceeded 20%, and gas prices have doubled. Additionally, many states and jurisdictions significantly increased the minimum wage, adding costs to the production of goods and resulting in higher prices.

Kamala has proposed empowering the Federal Trade Commission (FTC) to take more aggressive action against companies that allegedly exploit consumers, especially during crises. Ostensibly, this would involve government inspectors checking prices and determining if they qualify as gouging, after which companies would be required to lower their prices. This approach can only result in shortages, as companies cannot afford to sell products below cost or at an arbitrary government-mandated maximum.

Lowering Costs for Families includes healthcare cost reductions, which involve government subsidies that don’t actually lower prices—they just reduce the out-of-pocket expenses for the buyer. However, this means every taxpayer will end up paying more. And, since the government isn’t price-sensitive, healthcare providers will be able to raise their prices for all Americans.

With Kamala at the helm, working people will pay more taxes, prices will rise, and government assistance will become more attractive than working for a large portion of the population.