Reserve Bank of Australia August meeting minutes

- The Reserve Bank of Australia considered a case to raise rates but decided that a steady outcome better balanced the risks.

- The RBA mentioned that the cash rate might have to stay steady for an “extended period.”

- The RBA members agreed it is unlikely that rates would be cut in the short term.

- The RBA emphasized the need to be vigilant to upside risks to inflation, and that policy would need to remain restrictive.

- The RBA noted that an immediate hike in rates could be justified if risks to inflation had increased “materially.”

- The RBA suggested that keeping rates steady for a longer period than implied by markets could help restrain inflation.

- The RBA board stated that they would need to reassess this possibility at future meetings.

- The RBA board judged that the risks had increased that inflation would not return to target in a reasonable time frame.

- The RBA board indicated that they had limited tolerance for inflation remaining outside of the target band.

The minutes lean hawkish:

- considered a case to raise rates

- unlikely that rates would be cut in the short term

but there is wiggle room, this, for example:

- would need to reassess … at future meetings

But, if you want a one-word summary I think ‘hawkish’ would best fit. Agree/disagree – let me know in the comments.

AUD/USD is circa 0.6731 and not a lot changed.

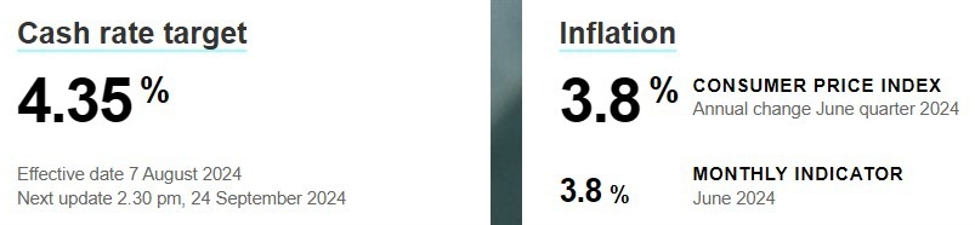

The most recent update on the Reserve Bank of Australia website re the cash and inflation rates