designer491/iStock via Getty Images

Investment Thesis

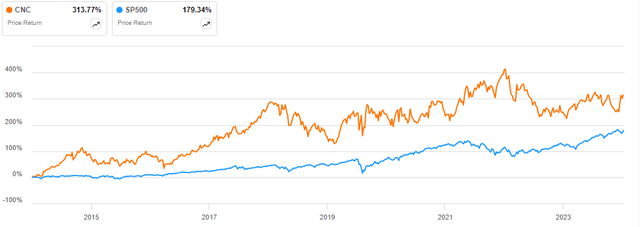

I am bullish on Centene Corporation (NYSE:CNC) due to its market position and competitive advantage. I have a buy rating for this stock owing to its robust financials, favorable industry trends, and growth levers. Centene has positioned itself as a managed care market leader, focusing on the underinsured and uninsured. Furthermore, with a market capitalization of $41.09 billion and a revenue stream of $144.06 billion over the previous twelve months, its financial health is strong, with revenue expanding steadily throughout the past decade. Over the last 10, it has had a price return of 313.77% almost double the 179.34% price return of the S&P 500 making this stock a compelling investment.

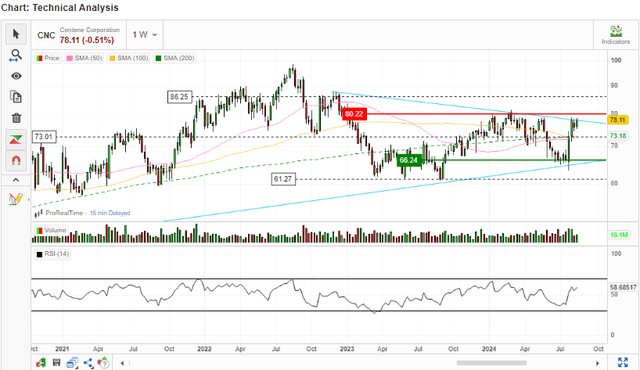

Above all, this stock is undervalued, which makes it a decent entry point for potential investors. In addition, from a technical point of view, the stock has moved above the 50-day and 100-day moving average, an indication of a bullish momentum. Notably, the 50-day MA has crossed above the 100-dy MA from the golden cross, which is a solid bullish trajectory signal. The RSI is also at 58.6 implying that the stock has ample space before hitting the overbought region of 70 where the upside will be limited.

Brief Company Overview

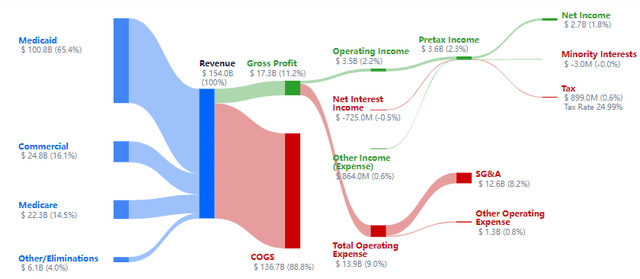

Centene, founded in 1984, has experienced considerable development through strategic acquisitions and organic expansion. Managed Care and Specialty Services are the company’s two primary business segments. Individuals in the Managed Care segment receive health plan coverage through government-subsidized programs such as Medicaid, Medicare, and the Health Insurance Marketplace. The Specialty Services business provides a wide range of healthcare solutions, including behavioral health, pharmaceutical benefit management, and telehealth services.

Financials

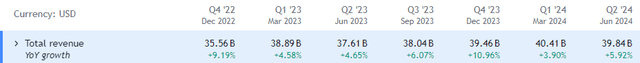

While financial health is an important aspect when making investment decisions, CNC has maintained a steady and strong financial position. To begin with, over the last decade, the company’s revenue has grown significantly. Its revenue grew from $15.69 billion in 2014 to more than $141 billion in 2023, showing a CAGR of about 20%. This solid growth appears to continue even in the MRQ, with revenue growing by 5.92% in Q2 2024 to $39.84 billion.

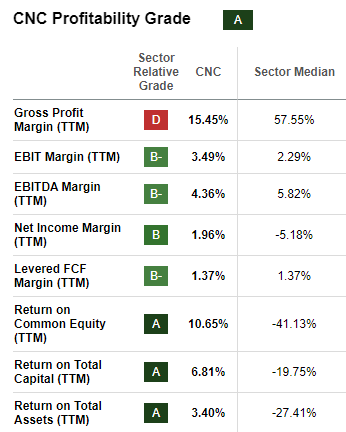

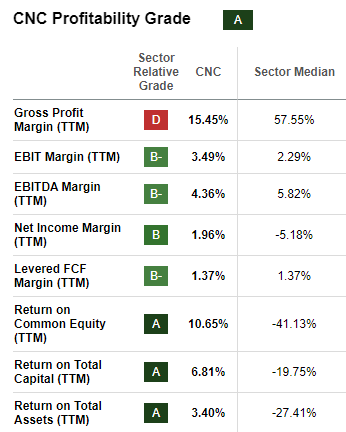

Its profitability indicators are very appealing, particularly when compared to other companies. Although the margins are primarily one-digit percentages, I believe they are respectable given the managed care market’s low margins and the fact that the majority of them are significantly higher than the industry median, resulting in a profitability grade of “A” for the company. Furthermore, Centene has continuously produced positive free cash flow, which is critical for funding future growth initiatives and returning value to shareholders.

Seeking Alpha

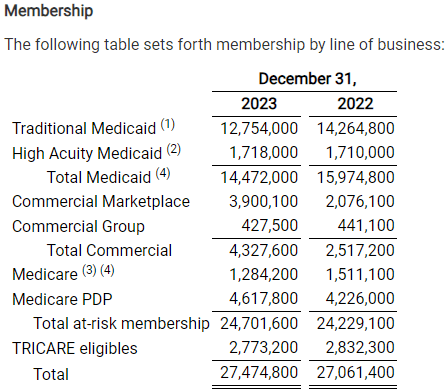

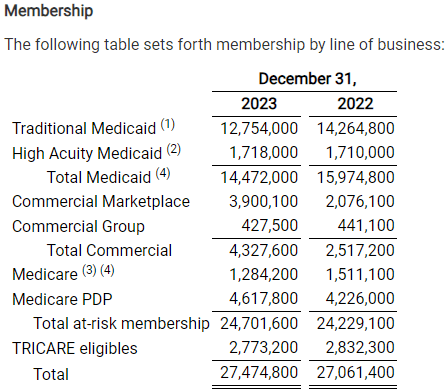

The reason behind the company’s strong financial performance is majorly its membership growth and acquisitions. For instance, its total membership increased from 27.06 million in 2022 to 27.47 million in 2023.

CNC 10-Q

Most recently, their consolidated HBR was 87.6% for the second quarter and 87.3% year to date. This puts them on track to meet the high end of their previous full-year forecast range of around 87.9%.

Moving to the balance sheet, CNC has a very solid financial footing. With a total debt of $17.63 billion and total cash of $20.21 billion, the company has net cash of $2.58 billion, which not only shows its impressive liquidity but a much deleveraged balance sheet. Most interestingly, with a total equity of $27.46 billion, the debt-to-equity ratio stands at 0.64 which is very low, signifying a very low debt risk. Above all, its interest coverage stands at a whopping 8.8x, demonstrating the company’s ability to meet its debt obligations.

This strong balance sheet not only boosts investor trust, but also gives the company operational freedom to make strategic investments, explore growth opportunities, and weather economic downturns. Its substantial liquidity is very reassuring because it indicates that the company will easily meet its short-term obligations and continue to operate smoothly. Most importantly, I believe a healthy balance sheet fosters trust among stakeholders such as customers, employees, supporters, and suppliers, which is critical for long-term success.

Overall, the company has a strong financial position and effective management techniques, as evidenced by its expanding client base, and the health benefits ratio has stayed stable at 87.7%. A constant health benefits ratio suggests that medical costs are under control relative to premiums, which could lead to long-term growth and stability. These aspects, in my opinion, provide grounds to be optimistic about the company’s current prospects.

Market Position And Growth Drivers

Centene’s strategy focus on managed care makes it a countercyclical investment. It profits from economic downturns by increasing enrollment in Medicaid and individual exchange products. Its unique positioning enables it to expand its customer base across economic cycles. It is the largest Medicaid-managed care organization in the United States, with more than 27 million members. Its wide network and considerable experience executing government-sponsored projects provide it with a significant competitive advantage. Its portfolio’s diversity of services helps to reduce the risks that come with depending just on one source of income.

Given this strategic market positioning, the company has several growth levers that, I believe, will keep fueling its long-term growth. To begin with, is the aging population. The aging population in the United States is a key growth driver for Centene. As the baby boomer population ages, demand for Medicare and other healthcare services is likely to increase, resulting in a continual inflow of potential new members for its plans. It is anticipated that there will be 47% more Americans aged 65 and over by 2050-from 58 million in 2022 to 82 million-and that their proportion of the overall population will climb from 17% to 23%. This explains why the US managed care market is expected to increase at a CAGR of 6.09% from 2024 to 2028 when it is projected to reach $4.37 trillion.

The second lever is government healthcare programs. Policy changes and rising enrollment are driving the expansion of programs like Medicaid and Medicare Advantage. Due to its experience running these initiatives, Centene is well-positioned to profit from this trend. Three examples of these policy changes are;

- Accessibility and Behavioral Health: The Centers for Medicare & Medicaid Services [CMS] under the Biden-Harris Administration has established plans to increase access to behavioral health care and improve healthcare coverage for millions of Americans by 2024. One aspect of this is streamlining the selection and enrollment procedures for health plans.

- Special Enrollment Periods: For those who are no longer eligible for Medicaid or the Children’s Health Insurance Plan [CHIP], a new special enrollment period [SEP] was established. This gives customers the option to choose a Marketplace plan 60 days in advance or 90 days following the loss of Medicaid or CHIP coverage.

- Medicare Advantage and Part D Protections: Policies have been finalized to strengthen protections for Medicare Advantage and Medicare Part D beneficiaries. These policies encourage healthy competition while protecting enrollees from inappropriate marketing and prior authorization activities.

With these developments, it appears that this is a significant tailwind. For fiscal year 2023, the corporation reported $140 billion in premium and service income, indicating that government contracts are a key source of revenue for them.

Besides its diversified portfolio and acquisitions, CNC is better positioned to leverage these tailwinds. I think so because of several reasons. For example, its ability to attract and retain new members. The company’s membership has grown significantly, particularly in the Marketplace, with a 34% rise in Q2 2024 over the second quarter of 2023. This expansion demonstrates its capacity to attract and retain members, which is critical for capitalizing on industry trends.

Secondly is enhanced reputation. Centene has garnered several accolades, including rankings on the Fortune 500 and Forbes Global 2000 lists, which boosts its reputation and positions it positively in the sector.

These aspects, together with the company’s expertise in administering government-sponsored programs and specialty services, allow it to effectively capitalize on market trends and government healthcare initiatives for future growth and success.

Bright Outlook

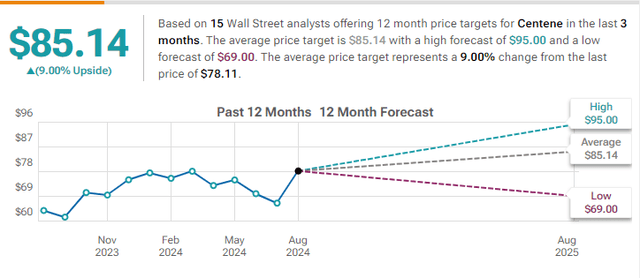

Centene is still seen favorably by 15 Wall Street analysts, who have a consensus price target of $85.14, which would mean a possible gain of 9% over the stock’s current value in the next 12 months.

To further strengthen its position in the market, the company has surpassed earnings projections and raised forecasts on rising premiums and memberships.

To solidify its bright outlook are its 11 upward revenue revisions with zero downward revisions.

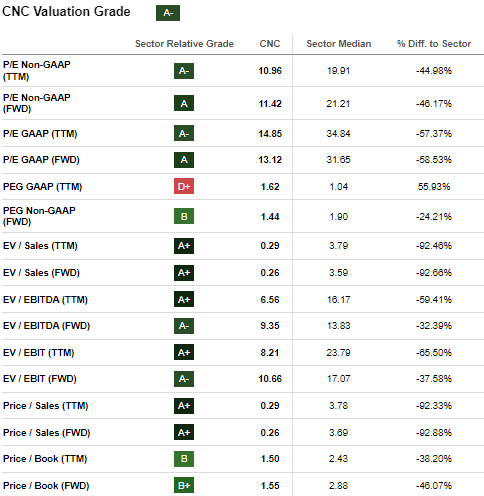

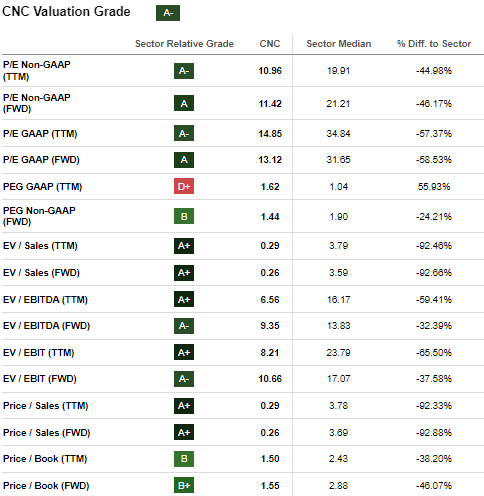

Valuation

From a relative valuation metrics, CNC is undervalued, offering a decent entry point. To begin with, its trailing PE is 14.85 which is a 57.37% discount to the sector median of 34.84. Further, its trailing PS of 0.29 is 92.33% lower than the sector median of 3.78. This implies that this stock is undervalued based on its earnings and sales. This is the phenomenon with nearly all other relative metrics, implying that this stock is indeed undervalued from all spheres.

Seeking Alpha

With this apparent undervaluation, I projected the price target for this stock over the next 5 years which will be the basis of my investment decision. Using the forward PE of $13.12 and the projected EPS of $10.42 by 2028, I arrived at a price target of $136.7 by 2028. This translates to an upside potential of about 75% over the next 5 years, which, I believe, are good returns.

Risks

Investing in this stock has its share of risks, just like any other investment. The primary risk of investing in Centene is its reliance on government-sponsored initiatives. Its business strategy is heavily reliant on contracts with Medicaid, Medicare, and other healthcare programs. This reliance exposes the company to regulatory and political changes that could affect finance and profitability.

Conclusion

CNC has a solid financial foundation, a strategic market position, and a promising growth trajectory. Its recent performance and analyst consensus indicate that it is an attractive investment choice for those wishing to diversify into the healthcare sector.