Key Points

- Republican candidate for US Senate, Curtis Bashaw, started accepting Bitcoin donations for his campaign.

- His stance on crypto aligns with other prominent political figures seeing digital assets as innovation and progress.

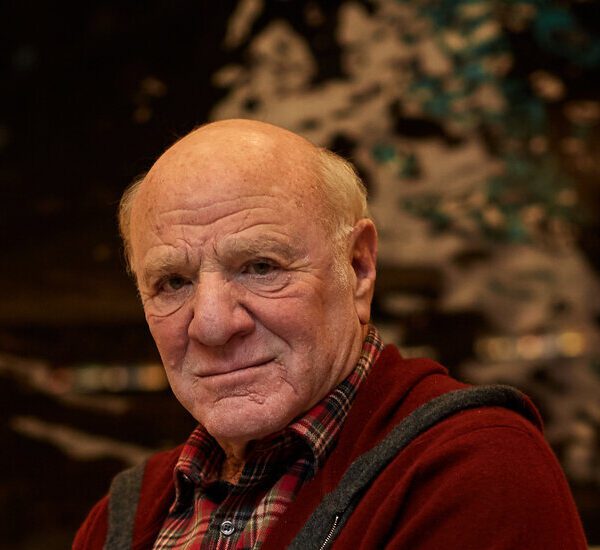

Curtis Bashaw, a Republican candidate for the US Senate, started accepting Bitcoin donations for his campaign. Bashaw is running for the US Senate in New Jersey to “provide freedom, security and opportunity to every New Jerseyan”, according to his X account.

The Republican candidate positions himself as a supporter of innovation and progress by integrating Bitcoin into his campaign. The move appeals to the growing number of American voters supporting blockchain technology and digital assets.

He recently stated that by embracing crypto, he is aligning his campaign with the future of finance. Bashaw’s campaign website is now featuring Bitcoin as a payment option via Anedot.

New Jersey Ranks 2nd in Terms of Crypto Owners

New Jersey is currently ranked second in the nation for the percentage of residents who own crypto, according to data from Coinbase.

Such high level of crypto adoption would benefit from a leader who understands and supports the industry and its potential.

It’s also worth noting that Bashaw’s pro-crypto position in NJ is important, especially during times in which the US is competing with China and other important global powers for dominance in blockchain technology and crypto.

US Political Bitcoin and Crypto Support

Bashaw’s campaign is aligned with the broader political trend which involves important political figures showing support for crypto and the blockchain.

For instance, important figures such as Miami’s Mayor Francis Suarez and Wyoming Senator Cynthia Lummis have been also showing strong support for the industry, bringing it into political discourses.

Lummis has been addressing FIT21 fighting to help the industry flourish in the US making regulating crypto in the country clearer for everyone who is working in the industry.

In June, it was reported that ‘Stand With Crypto’, a nonprofit group that has been created to keep the crypto industry in the US is fighting for “common-sense” regulations for digital assets

Also, former US President Donald Trump has been showing increased crypto support in 2024, with his own presidential campaign accepting Bitcoin as well.

The Republican Presidential candidate has been addressing his support for crypto on various occasions, highlighting that the US government should not sell its Bitcoin reserves.

In 2024 political support for Bitcoin and crypto has been on the rise, along with the growing crypto awareness in the US.

Crypto Awareness is Surging in the US

According to June data from Security.org, their 2024 Crypto Adoption and Sentiment Report, highlights that crypto awareness and ownership rates have increased to record levels.

Now, 40% of American adults own crypto, up from 30% in 2023, which translates to about 93 million people.

According to their data, among current crypto owners around 63% hope to obtain more crypto over the next year, with Bitcoin being the most desired digital asset in their top.

Other important data from Security.org’s report includes the following:

- The rate of crypto ownership by women surged from 18% in 2023 to 29% at the start of 2024.

- 21% of non-owners said that the Bitcoin ETFs in the US bring more openness to crypto investments.

- BTC ETFs could bring as many as 29 million American investors to the market.

Institutional Investment in Crypto on the Rise

It’s also worth noting that institutional investment in crypto is on the rise in the US. The trend has been especially accelerating in 2024 following the approval of Bitcoin ETFs at the beginning of the year.

As of June 30, important financial entities such as Morgan Stanley and Goldman Sachs disclosed owning shares in Bitcoin ETFs.

Morgan Stanley revealed significant positions in BlackRock’s Bitcoin ETF, IBIT – over 5.5 million shares worth about $188 million. They also disclosed shares in ARK 21Shares Bitcoin ETF, ARKB, and Grayscale Bitcoin Trust, GBTC as well.

Goldman Sachs also reported having fund shares in the US-based Bitcoin ETFs worth over $418 million as of June 30.

As Bitcoin valuation scenarios reach staggering predictions, such as VanEck’s $2.9 billion for BTC by 2050, the adoption of Bitcoin and crypto in the US continues to advance at a rapid pace.