Robert Way

I first wrote about my initial thesis on Vipshop Holdings (NYSE:VIPS) in December of last year. Then in July of this year, I warned in my follow-up article that “VIPS has faced both expected and unexpected challenges in 2024. It is predictable that VIPS’s Q2 results will be under tremendous pressure.” Unfortunately, my warnings for VIPS has proven to be prescient, as VIPS reported horrendous Q2 2024 results on August 20th before the bell. Revenue, active customers and orders were all down during the quarter. To make things worse, management guided an even weaker Q3. It looks like that VIPS will continue to struggle in the second half of 2024. However, the market prices have immediately discounted most, if not all of the pessimistic news after the almost 18% dive. Therefore, I am maintaining my long-term “buy” rating for VIPS.

Q2 results highlights

According to VIPS’ Q2 results earnings press release, highlights of the quarter include:

- Total net revenues for the second quarter of 2024 were down 3.6% year-over-year.

- GMV for the second quarter of 2024 was RMB50.6 billion, almost flat year-over-year.

- Non-GAAP net income was down 8.3% year-over-year.

- The number of active customer for the second quarter of 2024 was 44.3 million, down 2.85% year –over-year.

- Total orders for the second quarter of 2024 were 197.8 million, down about 7.5% year-over-year from 213.8 million in Q2 of 2023.

Obviously, Q2 of 2024 was a really tough quarter. This is expected as VIPS faced increased competition during a period of very weak demand of China’s domestic consumption. However, things were not all bad for VIPS during the quarter. The positive development were:

- Gross margin for the second quarter of 2024 increased to 23.6% from 22.2% in the prior year period.

- Total operating expenses for the second quarter of 2024 decreased by 4.2% year over year.

- Operating margin for the second quarter of 2024 increased to 8.3% from 6.9% in the prior year period.

- The number of Super VIP members increased by 11%.

From a detailed look of the line items, the decline in operating expense is mostly led by the 17% decrease of marketing expense and 6.5% decrease of SG&A expense.

During the earnings call, management called out the following reasons for the weak results of Q2.

First of all, “consumption continues to be quite muted due to macro uncertainty, and consumers are being quite cautious, discerning and selective.” This is in-line with China’s extremely weak consumption trend.

Secondly, management pointed out that “heightened industry competition with everybody is looking at price comparison and offering subsidies, which VIPS don’t actually follow.” The heightened competition resulted in the decline of VIPS’ active members. It looks like VIPS has lost some market share, as both JD and BABA reported positive order growth. While PDD has not reported earnings for the quarter, it is widely expected that PDD’s revenue growth will outpace the industry growth again.

Thirdly, while the number of Super VIP members grew 11% during the quarter, management noted that “their stocking frequency has been slightly less than before, roughly about 2% to 3% as compared to the time they reach to shop on VIPS’ platform”. The slight decline in frequency is consistent with the weak consumer sentiment that management noted.

Overall, VIPS’ Q2 2024 results were in-line with my expectations. Considering the weak macroeconomic condition and increased competition, management’s guided that revenue for Q3 of 2024 to decline between 5-10%. I think most investors were expecting a 0-5% decline in Q3. Therefore, the magnitude of revenue decline was larger than expected. This is probably why VIPS’ stock sold off after the earnings release.

However, as I have explained in my initial write-up for VIPS. VIPS has three unique competitive advantages which make the business very resilient. As a recap, the three competitive advantages are a vast professional buyer network, long-term relationship with many brands, and a very loyal Super VIP customer base. All of them still hold true for VIPS as evidenced by VIPS’ stable gross margin and operating margin even though orders and revenue dropped. This is why I believe VIPS still has long-term potential.

Shareholder-friendly capital allocation policy

I’ve mentioned in my past articles that “VIPS’ capital allocation has been very shareholder-friendly, as it is very balanced with both dividends and share buybacks”. VIPS’ management has again shown investors that they are committed to return values to shareholders. Along with the earnings release, management announced a “new share repurchase program of up to US$1 billion after the full utilization of the remaining amount under the existing program”. And VIPS “plans to commit no less than 75% of full year non-GAAP net income attributable to Vipshop’s shareholders through discretionary share repurchase and dividend distributions”. At the current share price, there’s no doubt the share repurchase program will create enormous value for shareholders.

Financial projections and valuation

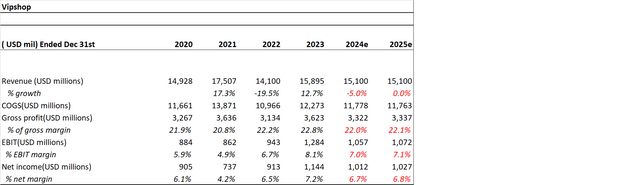

I have lowered my financial projections for 2024 and 2025 again to account for the weak Q3 2024 guidance. I’m assuming revenue for 2024 will decline 5% and revenue for 2025 will be flat. While management has guided stable gross margin, I am assuming gross margin will decline a little bit to be conservative.

author’s estimate

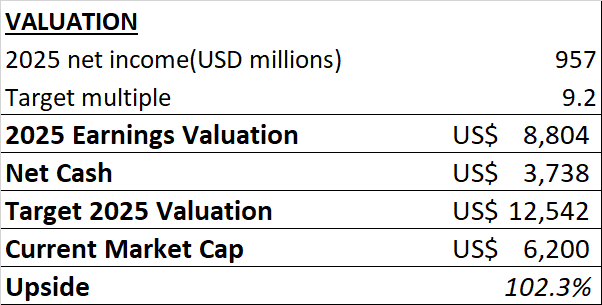

In terms of valuation, I am still applying 9 times P/E multiple, which is a discount of more than 50% of the sector median to account for the China risk and near-term fundamental challenges.

author’s estimate

Based on my financial projections and valuation estimate, VIPS is obviously cheap.

Risk discussions

I’ve discussed risks related to VIPS’ business in my previous articles, namely the competitive risks and management team risk. Based on Q2 results, I will add two other short-term risks.

The first short-term risk the weaker-than-expected Q3 because it was reported that many regions in China, including Shanghai, have experienced the hottest summer on record. The extreme weather may adverse impact VIPS’ business because VIPS tend to do well in spring and fall. An extended summer means less promotion for brands.

The second risk the potential acceleration of the decline of shopping frequency by VIPS’ Super VIP members. As noted in the above section, management noted that VIPS’ Super VIP members “stocking frequency has been slightly less than before by 2-3%”. It’s not clear whether the decline is temporary or structural. Investors will need to keep a close eye on the shopping frequency trend for SVIP members for Q3 and Q4.

Conclusion

VIPS’ Q2 2024 results are largely in-line with expectations. However, the weaker-than-expected Q3 guidance has caused heavy selling of the stock. As VIPS will continue to face multiple challenges, I think the fundamentals of VIPS probably won’t bottom until the first half of 2025. Meanwhile, VIPS’ super-friendly shareholder return policy will continue to create value for shareholders. At the current price, VIPS has almost 100% upside from my 2025 fair value estimate. Therefore, I am maintaining my “buy” rating for VIPS.