bjdlzx

Ring Energy (NYSE:REI) is one of many producers not making any money at all producing natural gas. In fact, right now, the net price received is negative. Therefore, increasing the mix of oil produced is going to have some dramatic effects on the profitability of the company. Now, the wells that this company drills are relatively small wells. It therefore takes a lot of these wells to make a difference. However, with cheap wells like these, that “lot of wells” could prove to be a fast fix.

More Oil Became Really Important

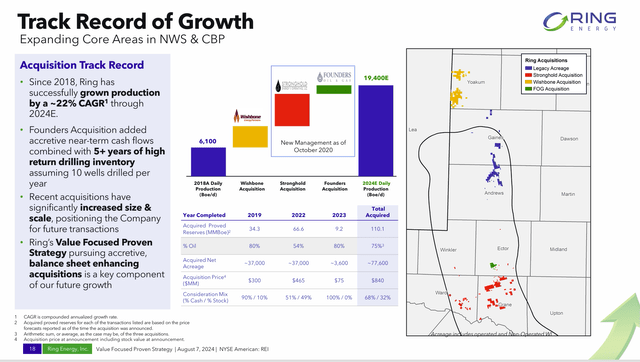

The last article noted how the Founders acquisition was a high oil acquisition. Therefore, this acquisition could have a surprisingly large impact (considering its relatively small size compared to the company size) fast.

Ring Energy Acquisition History (Ring Energy Second Quarterr 2024, Earnings Conference Call Slides)

All of a sudden, the ability to produce more oil rather than pay for natural gas production to be taken away makes for a very fast move to the higher oil producing parts of these leases. Management has had this slide out there for some time. But with negative natural gas prices, it becomes far more important.

As a result, readers can guess where the “high grading” process is heading. It should be no surprise that the goal to increase free cash flow and profitability is very easy right now.

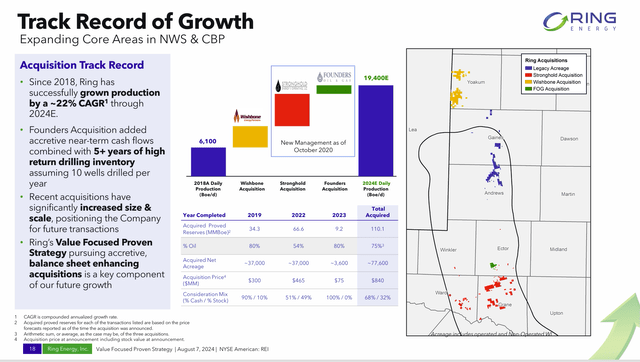

Ring Energy Recent Results (Ring Energy Second Quarter 2024, Earnings Conference Call Slides)

Even in the Central Basin, where the wells tend to be gassier, this management has been able to drill wells that at least initially produce considerably above the company oil production mix.

Obviously, it’s going to take some time. But the increase in free cash flow indicates that management is probably on its way to a permanent solution concerning the debt.

Free Cash Flow

Stronger second quarter oil prices definitely helped this company out. Now a better production mix appears to be a reasonable goal to further increase free cash flow.

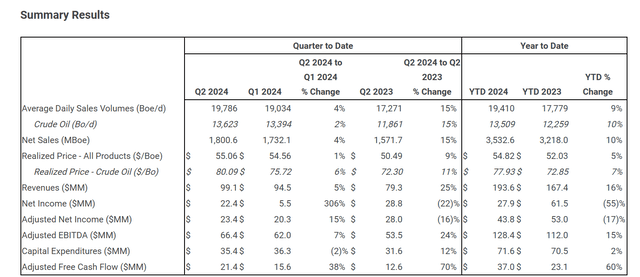

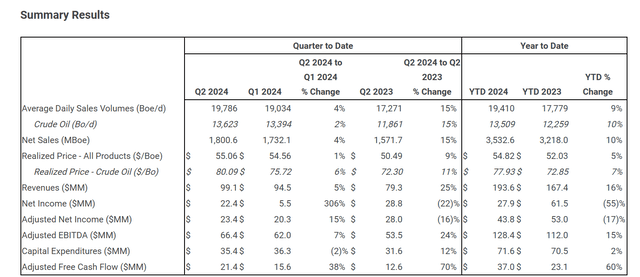

Ring Energy Summary Of Second Quarter 2024, Results (Ring Energy Second Quarter 2024, Earnings Press Release)

Free cash flow is up from the last quarter. Now some of that is due to the reduced optimizing activities that go on after any acquisition. But also, free cash flow is up compared to fiscal year 2023 even though this latest acquisition was made using debt for the whole transaction.

Not only that, but management has paid much of that additional debt back. That means that management will have the additional higher oil production of this acquisition to help manage the debt that was there before the acquisition in short order.

Also notice that capital expenditures are beginning to decline even though the company reported slightly higher production. The key is not that production itself increased, although that can be a positive sign. The key is that the very valuable oil production increased (initially thanks to the Founders acquisition) and that management has a way to keep that percentage climbing.

While more acquisition would definitely help this company. There is a very good chance that the climbing percentage of oil production will bring the debt ratio down at a pace satisfactory to Mr. Market and the debt market. That would be a relief for a company that was caught in a changing lending market, and it is now trying to meet the tougher requirements.

Debt Market Indicators

The history here has been pretty good. It just needs to keep going.

Ring Energy Free Cash Flow And Debt Ratio Progress (Ring Energy Second Quarter Corporate Presentation August 2024)

As shown above, the debt ratio may be in the process of crossing the line into barely acceptable territory. It probably needs to come down some more, although management performed a minor miracle when the first acquisition kept the debt ratio relatively low despite a significant drop in oil prices from 2022 into 2023.

Of course, now the debt market has the “what have you done lately?” attitude. The stock market is not a whole lot more patient either.

Management is likely looking for yet another acquisition that will boost progress. But that climbing free cash flow shown above likely means that they can afford to take their time making the next acquisition.

Debt Recap

As long-time readers remember, the Northwest Shelf acquisition was done under very different debt conditions. It was considered a conservative deal at the time. Management intended to then grow production by borrowing (which was common at the time) until there was enough production to handle the debt comfortably and management could take advantage of savings of optimum production levels.

However, covid during fiscal year 2020 changed all that as the debt market no longer allowed that strategy. The company came out of 2020 with inadequate production levels for the debt.

This meant a change in strategy. The new strategy started with:

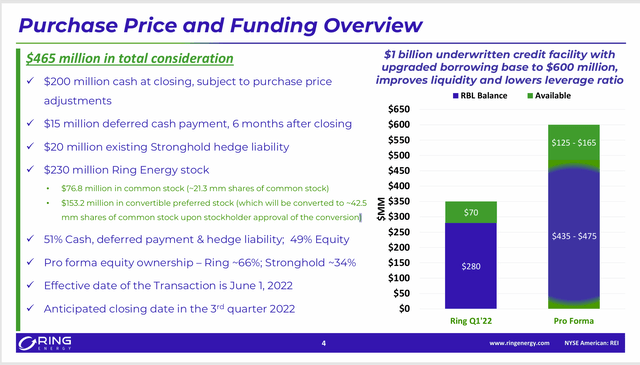

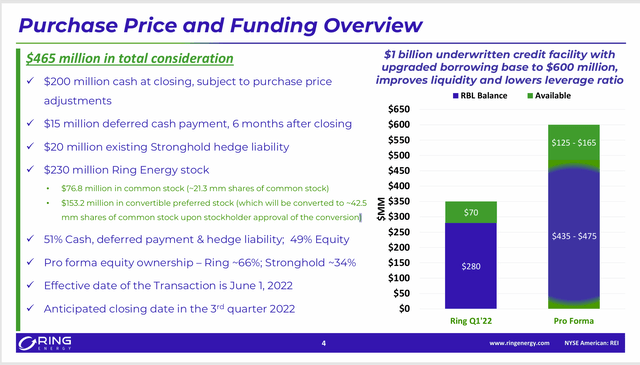

Ring Energy Stronghold Acquisition Proposal (Ring Energy Stronghold Presentation)

The Stronghold acquisition, shown above, was the first attempt at getting production where it needed to be to handle the debt load. At the end of the third quarter of 2022, long-term debt was $435 million and there was a deferred cash payment (and note payable) totaling $15 million.

The big deal here was that when oil prices declined, the debt ratio remained in the 1.60 area. This was a huge improvement over what it was before the acquisition was made. What helped was that the relatively high oil prices allowed for some debt repayments. As a side note, common stock outstanding was about to double.

By the second quarter of 2023, the debt was $397 million and there was about $1.5 million of notes payable.

The Founders acquisition sent the debt back up to $428 million, with a deferred and note payable of roughly $15 million. Management reported at the same time that the company paid $50 million net of adjustments and would pay roughly $12 million in deferred payments.

In the latest earnings press release, it was reported that:

“Ended the period with $407.0 million in outstanding borrowings on the Company’s credit facility, reflecting a paydown of $15.0 million during the quarter and $48.0 million since closing the Founders Acquisition in August 2023”

Most of the additional borrowing from the Founders acquisition has been repaid, while management retains a lot of upside potential from the acquisition. Already, capital costs are beginning to decline.

The key idea here is that EBITDA and free cash flow are growing faster than debt to improve the debt situation. Management is further improving the situation by increasing the percentage of oil produced in the production mix.

All In Cash Costs

As management notes, these wells have a very low per unit all in cash cost. Therefore, the wells breakeven at a very low price and are extremely profitable in the current environment. That means that production itself is not the issue.

The issue was that the debt requirements changed “overnight” to disallow borrowing to get the production level up to a minimum amount that would allow for economies of scale.

Another company that I follow, HighPeak Energy (HPK) tried that “borrowing to increase production” strategy and lost its bank line.

As a result, the company is now following debt market and stock market guidelines to regain banking relations and get away from expensive private money. Frankly, the company was lucky to get production as high as it did before the debt market “clamped down” on the company. This company can take advantage of economies of scale, whereas Ring Energy needs to make acquisitions to get there.

Hopefully, one of these days, the debt market will become reasonable again. But right now, both companies are dealing with reality.

Summary

Ring Energy made the largest debt repayment since the covid shutdown without selling some assets. It is very likely that management can now grow free cash flow while waiting for another suitable deal to appear.

This has been one of the more painful transitions from the old way to the new way of both the debt market and the stock market. But, so far, the company is succeeding.

Obviously, risk levels are elevated due to the financial situation of the company. But the stock is still a speculative strong buy that is likely best as part of a basket of similar choices.

The declining well costs and capital budget combined with the climbing oil percentage of production argue very well for the future.

Risks

Any upstream company is subject to the volatility and low visibility of future commodity prices. A severe and sustained downturn could cause a complete re-evaluation of the future, or even prove fatal.

The capital budget and well costs are declining. That could reverse and head upwards in the future to squeeze the company’s future prospects. Borrowing to drill these very low breakeven wells is out of the question. Basically, what happens is a race against time to get that debt ratio down and free cash flow up before there is a cyclical recovery in well costs.

The loss of key personnel could prove material to the company’s future prospects.