As its corporate name suggests, Seaport Entertainment Group’s (SEG) main asset is its collection of properties located at New York’s South Street Seaport. groveb/E+ via Getty Images

Spun-off from Howard Hughes Holdings (HHH) at the start of this month, Seaport Entertainment Group (NYSE:SEG) consists of a grab-bag of non-core assets formerly held by the real estate development company.

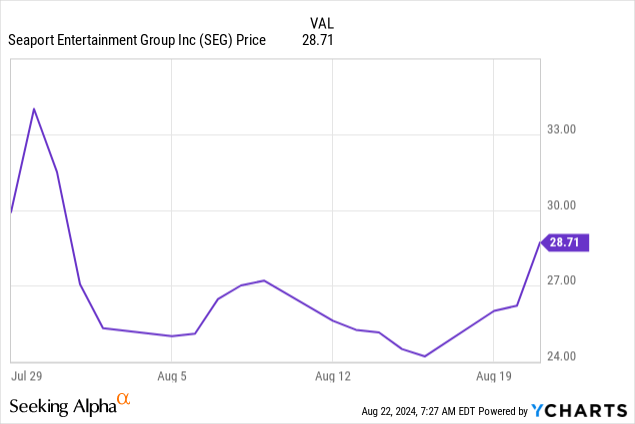

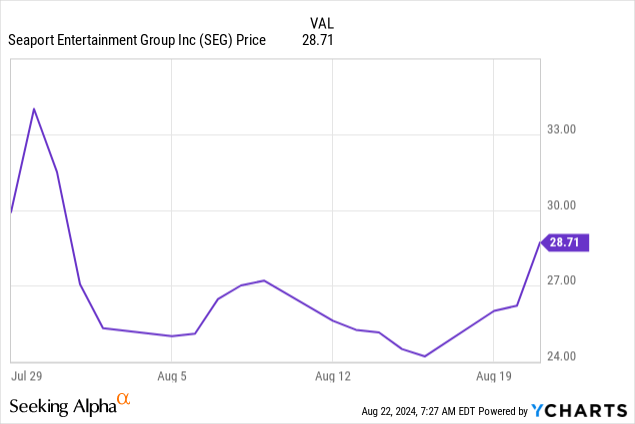

After initially sinking following its trading debut, increased attention to the potential long-term upside value with SEG stock is sending shares soaring. Trading for as low as $22.51 per share earlier this month, as of this writing shares are back up above $30 per share.

Yet while the bull case (detailed below) appears to be cut-and-dry, for investors just discovering this stock today, there are two questions.

First, is it too late to lock down this stock at a favorable long-term entry point?

Second, despite looking like a great long-term story on paper, could SEG end up being another real estate-focused value play that fails to pan out, producing big losses?

Taking a closer look at SEG, it’s clear that, while there may be more potential here than with similar situations, sitting on the sidelines is for now the best course of action.

SEG Stock: Background and Recent Performance

In an investor presentation released on Aug. 12, SEG provided a rundown of what the company calls its “unique collection of assets.”

As those familiar with Howard Hughes Holdings know full well, the “Seaport” in SEG’s corporate name references the company’s collection of properties located in New York’s South Street Seaport.

Alongside this, Seaport Entertainment Group also owns a nearby development parcel (250 Water Street), as well as a 25% interest in the restaurant management company that operates the Seaport’s Tin Building Food Hall.

Howard Hughes Holdings, by virtue of its development of the Summerlin, NV master planned community, remains heavily invested in the Las Vegas metro area. Interestingly enough, however, HHH decided to include two Vegas-based assets alongside the Seaport assets with this spin-off.

These assets are full ownership of the Las Vegas Aviators minor league baseball team and ballpark, as well as an 80% stake in the air rights to the Fashion Show Mall, which is located on the northern end of the Las Vegas strip, nearby the Wynn (WYNN), the Venetian, Resorts World and Treasure Island casino resort properties.

Like I mentioned above, SEG stock sank like a stone immediately following its separation from HHH, but in recent trading days, the market has become increasingly aware of its potential underlying value.

Largely, thanks to detailed analysis provided by commentators like X.com’s @marginofdanger, who on August 20 published a thread detailing the situation. This thread included sum-of-the-parts analysis that suggests that SEG could eventually be worth as much as $100 per share.

This has kicked off a serious rally for shares, but again, much suggests that there’s little need to chase this stock.

A Dollar for 30 Cents? Not Quite, but Upside Potential Still Substantial

The aforementioned pitch suggests that SEG stock presents the opportunity to buy a dollar for 30 cents, but generating our own rundown of Seaport’s value, it may be more accurate to say that with SEG, you’re getting a dollar for a little under 50 cents.

South Street Seaport Assets

The core South Street Seaport assets, consisting of Pier 17, the Fulton Market and Tin buildings, along with other properties, encompass around 478,000 square feet. About a third of the space is vacant, and the properties currently operate in the red.

Per @marginofdanger’s valuation assessment, these properties are worth between $500 and $1000 per square foot, or between $239 million and $478 million.

Substack publisher Antarctic Circle Capital, who has also written-up a valuation breakdown of SEG, uses a valuation of $676 per square foot to value these properties, but with a discount applied to account for vacancies at Pier 17. Antarctic’s calculation comes out to around $243.5 million.

As for my own estimate, I’ll use median square foot transaction values for Manhattan commercial real estate sales during Q2 2024. According to PropertyShark, the median commercial sale price per square foot for Manhattan real estate came out to $573 last quarter. At $573 per square foot, the South Street Seaport assets are worth around $273.9 million.

250 Water Street consists of one acre of land. The company is currently developing a $850 million, 550,000 square foot mixed-use development on the site. The project is expected to be completed by Spring 2026.

Coming up with a valuation for this parcel is tricky. Seaport’s predecessor bought the site, previously home to a parking lot, for $180 million in 2018. While that was six years ago, it may be best to disregard any potential price appreciation for the raw land, given the redevelopment is already underway.

The upside potential from Seaport’s development of 250 Water Street is unclear. While Seaport now owns the site, Howard Hughes Holdings is listed as the buyer of air rights needed to develop the site. This could mean HHH is still going to financially participate in the development.

Finally, the 25% stake in the Jean-Georges, the restaurant group managing the eateries located at the seaport. In 2022, HHH paid $45 million for the 25% stake, and an additional $10 million for the right to buy another 20%.

Just prior to the spin-off, the Jean-Georges’ stake was carried on the books at $14.26 million. This reduced valuation is due to equity method of accounting write-downs. I believe this figure to be a reasonable estimate for how much Seaport could get for this asset (perhaps through a sale of the stake back to Jean-Georges).

Adding it all up, we get around $468.1 million for the NYC assets.

Las Vegas Assets

Back in 2017, HHH became the full owner of the Las Vegas Aviators baseball team (then known as the 51s), paying $16.4 million for the 50% of the team held at that time by outside investors. This implies a valuation of at least $32.8 million.

The Aviators’ stadium is on the books for $132 million. In their respective valuation rundowns, the aforementioned commentators valued this asset at between 50% and 100% of book value.

I agree with this assessment, and would argue further that, if the team and stadium were to be sold, it would likely be a package deal.

Recent minor league baseball team sales, such as the just-announced sale of the Charlotte Knights to Silver Lake-backed Diamond Baseball Holdings, have entailed the purchase of both a team and its home stadium.

Although the transaction price has not been disclosed, when the Knights were first put up for sale earlier this year, forecasts called for the team and its stadium to fetch a price of up to $100 million.

Diamond Baseball, which isn’t slowing down in its hoovering-up of minor league teams, may be willing to pay a similar price for Seaport’s MiLB assets.

Finally, the Fashion Show Mall air rights. Among the SEG assets, this may be the trickiest to value; @marginofdanger forecasts these rights to be worth between $5 and $20 million per acre. That’s between $175 million and $400 million for the 35 acre site, in theory, making SEG’s stake worth between $140 million and $560 million.

Antarctic Capital, however, didn’t even take them into account. Although there have been hints that a casino will eventually be developed on the site, saying that’s a given is very speculative at this point.

After all, the Fashion Show Mall is not owned by Seaport, or by HHH for that matter. Rather, Brookfield Properties owns it, and the real estate giant has made zero commentary about redevelopment plans. That said, these rights are worth something, and $5 million per acre may be reasonable, considering raw strip-facing land itself has sold in recent years for prices north of $40 million per acre.

So, at $100 million for the Minor League team and stadium plus another $140 million for the air rights interest, we get $240 million for the Las Vegas-area assets.

Putting it All Together: Debt, Near-Term Losses, and the ‘Ackman Backstop’

Adding up both the South Street Seaport and Las Vegas assets, SEG’s current portfolio has a gross value of around $708.1 million.

Now, time for the adjustments. Per the investor presentation, Seaport Entertainment has outstanding debt and preferred equity totaling $113 million. However, this debt will be far outweighed by the impact of a post-spin off rights offering.

As also discussed in the investor presentation, Seaport is raising $175 million, through the sale of newly-issued stock. Full subscription is guaranteed, thanks to a $25 per share backstop provided by Bill Ackman’s Pershing Square Capital Management.

While this rights offering means dilution for those buying in today, the “Ackman Backstop” is of course another strong sign in the potential long-term value of this company.

So, putting it all together, what’s a fair estimate for SEG stock’s underlying value? Let’s add it all up:

- $708.1 million for the Seaport and Las Vegas assets.

- Add $198 million in cash ($175 million from the rights offering, plus $23 million in cash on hand at time of spin-off).

- Subtract the $113 million in outstanding debt and preferred equity.

Estimated Net Value: $793.1 million. There are currently 5.52 million shares outstanding, but after the rights offering, the share count stands to increase by 7 million shares, to 12.52 million.

Divide $793.1 million by 12.52 million, and we come to a valuation of around $63 per share, a little more than double the current trading price.

Similar Situations Suggest What’s Great on Paper Could Fail to Play Out

Given the availability of valuation comps, it’s not overly complicated to lay out a bull case for a real estate-focused deep value opportunity. However, as seen with similar situations in the past, what looks great on paper can easily fail to translate into real-life outsized returns.

A good example is with Seritage Growth Properties (SRG). Back in the late 2010s, there was a lot of excitement among value investors about Seritage, a real estate holding company spun-off from the now-defunct Sears Holdings.

At that time, the bull case was that Seritage would generate big gains from redeveloping parcels formerly housing Sears department stores. This failed to play out as expected, and SRG stock has fallen by more than 90%.

Yes, comparing Seaport, which owns prime real estate in New York and Las Vegas, to Seritage, which owns vacant retail space scattered around the U.S., is an apples-to-oranges comparison.

However, here’s another example of a “glamorous” real estate development play: Trinity Place Holdings (OTC:TPHS). Similar to Seritage, it was the product of the retail apocalypse financial engineering. The post-bankruptcy successor to defunct retailer Syms, Trinity Place set out to profit from the redevelopment of former Syms locations. Primarily, its former location in Lower Manhattan, which became condo development 77 Greenwich Street.

Between construction delays, slow sales, and a steady need to re-negotiate terms with lenders, 77 Greenwich has been anything but successful for Trinity Place. Trading for between $5 and $10 per share during the late 2010s, TPHS now trades for just a few cents per share.

I’m not saying that Seaport is guaranteed to end up like Seritage, or worse, like Trinity Place. However, as seen with these C-corp real estate plays, execution can be easier said-than-done.

To realize full value, be it $60 per share or even more than $100 per share, execution is going to be key. Namely, execution in revamping the South Street Seaport assets, bringing them to profitability.

Bottom Line

Between the rights offering proceeds, plus the likely additional proceeds Seaport could generate from selling its Las Vegas area assets, it’s very possible that the company has the war chest in place to implement a turnaround.

With an experienced hospitality executive (Anton Nikodemus) at the helm, those bullish on the stock are confident in better times down the road. However, given the lack of success with Seaport development efforts so far, and the fact that there are plenty of strong reasons why this area of Manhattan waned in popularity in the first place, you may want to wait for the first few signs of success with these plans.

Or, at the very least, wait for the latest wave of excitement surrounding SEG to simmer down once again. In the near-term, net losses are likely to persist. It’s going to take years to unlock SEG’s underlying value.

With this, there’s a strong chance you’ll be able to lock down a position at $25 per share, or even less, between now and when the turnaround really starts to take shape. Hence, keep an eye on SEG stock, but sit tight for a pullback.