Adam Yee

Thesis Recap

I first covered Weibo Corporation (NASDAQ:WB) in February 2024, with the thesis that it offered a contrarian buying opportunity to those who can tolerate volatility, claiming its cheapness and strong network effects could protect its earning power and user base. Since my article, the stock has traded roughly flat, down 2% at the time of this writing. Despite the lack of investor interest and enthusiasm for this Chinese name, the stock is still undervalued in my opinion, even without any top-line growth. Therefore, I continue to reiterate my buy rating, with a slightly lower price target of $12.

Value-Added Services Perform Well

Weibo announced Q2 earnings on August 22, 2024, with the following results:

Net revenues were US$437.9 million, a decrease of 1% year-over-year or an increase of 1% year-over-year on a constant currency basis.

Value-added services (“VAS”) revenues were US$62.6 million, an increase of 15% year-over-year or an increase of 18% year-over-year on a constant currency basis.

Net income attributable to Weibo’s shareholders was US$111.9 million and diluted net income per share was US$0.43.

Despite net revenues being roughly flat, VAS revenues performed very well with an increase of 18%, demonstrating that Weibo still offers some unique value to its users in an arguably tough Chinese economy. As a reminder, VAS stands for the revenues Weibo earns through VIP memberships, virtual gifts, and advertising and promotional tools that advertisers purchase. What this means to me is that Weibo is still a critical tool that Chinese companies use to push their products and services. Users still value the social media ecosystem and are keeping their VIP memberships even through economic difficulties.

Going forward, I think this recent quarter shows that growth is no longer probable in today’s Chinese economy. However, margins and profits are still holding up pretty well, and the user base remains active, highlighting Weibo’s societal and economic value to its stakeholders. Thus, “net income attributable to Weibo’s shareholders for the second quarter of 2024 was US$111.9 million, compared to US$81.4 million for the same period last year” an increase of 37% YoY.

Despite this, the stock still refuses to budge despite reasonably resilient results. I think there is still overall pessimism and doubt because of China’s risk, but I will reiterate that most of these risks seem to be priced in at today’s levels. While some may point out that there’s no growth, I would argue that even without any growth, the stock is still undervalued. At a P/E of 4x, assuming earnings stay roughly flat, investors will get back what they pay in about 4 years, an earnings yield of 25%. That’s a high enough return to compensate investors for the China risk, in my opinion.

Monetizing User Engagement

One positive I liked in this quarter’s earnings transcript is management’s focus on monetizing user engagement. I believe there is still untapped potential for revenues and earnings to improve once management deploys smart tactics on the app to help advertisers do more targeted, effective advertising. The old saying, “Half of the money on advertising is wasted, the trouble is which half” I think is no longer true, as Weibo offers hot trend marketing, which “has been recognized by a wider range of industries and advertisers” for its effectiveness.

Furthermore, I like that Weibo is really leaning into User-Generated Content. It looks like Weibo is taking notes from Instagram and Facebook, by offering users the opportunity to post their content. I think UGC is a great idea, it increases the authenticity, realness, and intimacy of the Weibo community and can potentially be monetized well. This should continue to retain user growth, as well as increase the interactions, which then fuels more quality content generation for everyone on Weibo.

Finally, I applaud recent creative partnerships that are both timely and relevant to the primarily younger audience on Weibo. For instance, in the transcript management explains,

During college entrance exam season this year, we cooperated with People’s Daily to boost discussion on university’s major selection and application after the entrance exam and organized the expert and KOLs of over 10 verticals, such as education, healthcare, digital product, automotive and finance, to share with examinees on suggestions of professional learning, application and industry employment.

This is another example of how Weibo has the opportunity to get creative. By partnering with TV shows, newspapers, colleges, and popular celebrities, Weibo still has a lot of monetization opportunities to bring in new users and generate high-quality content. Those two building blocks are in my opinion the core of a successful social media company, and I like how Weibo is trying to be more flexible in bringing in new industries and topics to their platform. As a result, I believe the long-term future of Weibo is still positive for shareholders, as management can still unlock opportunities to monetize its large user base and provide increasing value for their advertisers.

Valuation – $12 Fair Value

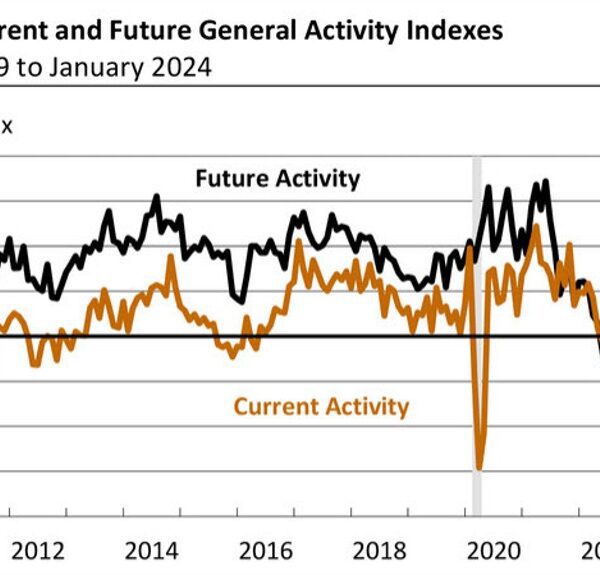

I am lowering my fair value a bit from $15 to $12, to account for a weaker Chinese economy affecting top-line growth. Management appears to be more cautious in their earnings call transcript,

And also in terms of the Q3 outlook and also the second half performance, there are still some of the uncertainties in terms of the macroeconomic development, especially about the consumption. So, we remain very much cautious over the outlook for the rest of 2024.

Therefore, I will assume revenues continue to be flat for the rest of 2024 and beyond. This conservative assumption will demonstrate the stock is still undervalued even without any growth. So, sales should remain above at least $1.7 billion annually. Apply a net profit margin of 15%, which is around the last TTM, gets me earnings of $255 million. Divide by shares outstanding of 243 million gets me an EPS of $1, rounded down.

Apply a sector median forward earnings multiple of 12x, which is around Weibo’s 5Y average, gets me $12 per share (1×12=12). I think that the stock is conservatively undervalued and already prices in China risk for investors. With $2.8 billion in cash, the market cap is 67% of total cash, which is another sign of undervaluation. Thus, if investors like Chinese stocks, then I think Weibo continues to offer solid earnings and a strong network effect to protect its user growth.

Risks

China is still an unliked place to invest, due to political risk and geopolitical tensions between the United States. Investors may already be well aware of the Chinese big-tech crackdown, fines for publishing illegal content deemed by the PRC, and real estate meltdown going on in China. These ugly headlines have scared off most institutional investors, who typically invest large sums into the Chinese stock market. Thus, investors should remind themselves that they are investing in China, and along with that comes a whole set of risks that may cause Weibo shares to flat-line or decline.

Competition from Duoyin, WeChat, and other legacy apps like Momo can compete against Weibo and poach users. Recently, a relatively new app that has been gaining traction in China, from my perspective, is Xiaohongshu, described as China’s answer to Instagram by some. Xiaohongshu translates to Little Red Book in English and has seen rapid user growth to over 200 million MAUs as of June 2024.

Finally, censorship in China has been a common issue as some may question China’s policy on free speech. If Weibo fails to regulate illegal content deemed by the Chinese government, they may face future fines that punish earnings. In addition, Weibo has to continue to protect its users from fraud, scams, and AI-generated deepfakes to protect the authenticity of their content. Failure to create a trustworthy content experience for users can lead to user count decline for Weibo, which could negatively affect sales.

Buy Weibo

I reiterate my bullishness on Weibo Corporation because the Chinese stock market continues to be shunned and ignored by most institutional investors. The company continues to generate good cash flow and earnings and spots high profit margins. Without any top-line growth, the stock is still cheap and investors who like Chinese stocks should consider buying Weibo as the fundamentals remain strong amidst a tough Chinese economy.