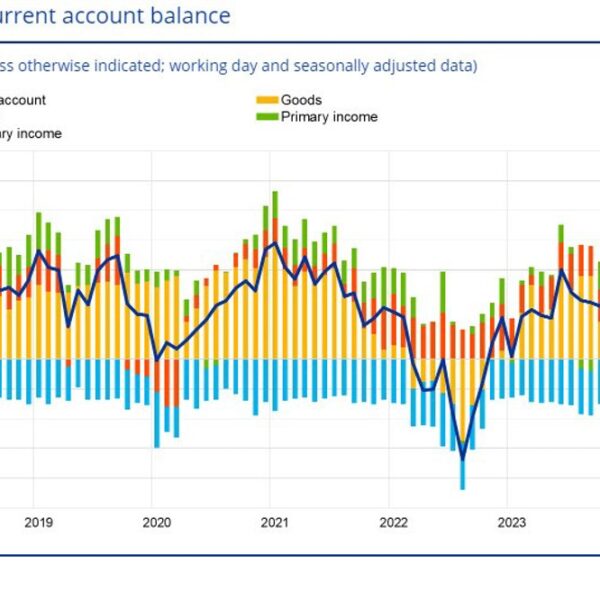

Bitcoin is beginning to show signs of a potential upward trend as several on-chain metrics are turning positive. These metrics, which often serve as indicators of future price movements, paint a picture of growing optimism in the market. One of the key indicators supporting this positive outlook is the exchange inflow/outflow data, which reveals a shift in sentiment toward Bitcoin.

Despite some notable large-scale Bitcoin transfers by the defunct exchange Mt. Gox and significant movements by miners to over-the-counter (OTC) desks, the overall inflow of Bitcoin into crypto exchanges has sharply declined in the past few days.

Bitcoin Exchange Inflows See Sharp Drop

According to a recent report by newsBTC, which analyzed data from Glassnode, Bitcoin’s sharp decline below $50,000 in early August was largely driven by an overreaction from short-term holders. This panic led to a significant influx of Bitcoin into exchanges, increasing the selling pressure and contributing to the price drop.

Supporting this, data from CryptoQuant reveals that on August 5, BTC inflows to exchanges surged dramatically to 94,000 BTC. The trend continued with 49,000 BTC on August 6 and another 51,370 BTC on August 7, further amplifying the selling momentum.

Interestingly, the inflows into exchanges have decreased substantially since then, signaling that the initial wave of selling may be losing steam. CryptoQuant’s data from August 22 shows a marked reduction, with only 32,338 BTC entering exchanges, compared to 32,723 BTC withdrawn, indicating a shift in market sentiment.

Further corroborating this shift, data from IntoTheBlock indicates that the total Bitcoin netflow across aggregated exchanges has turned negative, with a net outflow of 3,560 BTC in the past 24 hours and a negative 2,000 BTC over the past seven days. Although the difference between outflows and inflows is relatively small, it represents the first significant change in buying and selling dynamics since the beginning of August.

What’s Next For BTC?

Historically, when more Bitcoin is withdrawn from exchanges than deposited, it suggests that investors are choosing to hold onto their assets rather than sell them, which is typically a bullish signal.

At the time of writing, Bitcoin is trading at $61,000 and is up by 4.5% in seven days. Other on-chain metrics are providing a cautiously optimistic outlook for BTC, hinting at the possibility of upcoming positive price action. One such metric is IntoTheBlock’s “Bid-Ask Volume,” which currently shows a 3.93% shift towards the bid side.

This shift indicates a higher volume of buy orders compared to sell orders, revealing that there are more buyers than sellers in the market. The increase in buying activity suggests that a growing number of investors are anticipating a rise in the price of Bitcoin.

The futures market derivatives momentum has also flipped to a positive 0.75. This is particularly a bullish signal, especially considering the Bitcoin price now finds itself at a short squeeze.

Featured image created with Dall.E, chart from Tradingview.com