Luis Alvarez/DigitalVision via Getty Images

One company that has been underperforming my expectations as of late is ACCO Brands (NYSE:ACCO). For those not familiar with the company, it operates as a producer and provider of consumer, technology, and branded business products. It’s very well known for its Five Star branded notebooks. But it also produces storage products, laminating tools, stapling products, video game and computer accessories, calendars, and more. You might think that such a diverse business would be immune, or at least resistant, to declines. After all, when one or two product lines suffer, the others have the potential to make up for that. Unfortunately, that has not been the case.

Recently, financial performance for the business has been on the decline. Revenue, profits, and cash flows, have largely taken a hit. The good news is that when you dig deeper, things aren’t all that bad. This is refreshing because, when I last wrote about the company back in March of this year, I rated it a ‘buy’ based on how cheap shares were. The stock still remains attractively priced, not only on an absolute basis, but also relative to similar enterprises. I do think investors would be wise to be wary of further revenue drops. And if this trend does continue for much longer, a downgrade might be on the table. But as things stand, it’s difficult to imagine shares not appreciating at some point in the not-too-distant future.

Tough times

When I last wrote about ACCO Brands earlier this year, I called the company a deep value play. But one of the unfortunate facts of investing is that, in many cases, firms trade at deep value levels for legitimate reasons. The hope from value investors is that, even after factoring in the pain, shares should be worth more than they are trading for. But if that pain worsens, the picture can become problematic. Unfortunately, at least from a revenue perspective, things have been pretty painful for ACCO Brands.

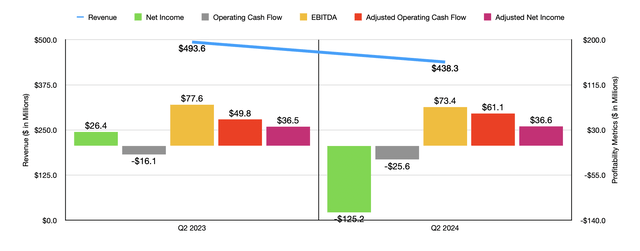

During its most recent quarter, which would be the second quarter of the 2024 fiscal year, ACCO Brands generated revenue of $438.3 million. This represents a decline of 11.2% compared to the $493.6 million reported one year earlier. $4.7 million of the $55.3 million decline was driven by foreign currency fluctuations. Without this, revenue would have fallen by 10.2%. Softer business and consumer demand across the globe, or at least across the regions in which the company operates, pushed volumes down by 9.2%. This weakness was present across its office products and gaming accessories product lines. Although it is worth mentioning that some of this drop was intentional. Management decided to exit certain low margin businesses. And that choice was responsible for 4% of the decline in revenue. To that extent, the company should not be punished.

With revenue falling, profits for the company took a hit. Net income went from $26.4 million to negative $125.2 million. But the largest contributor to this decline was a massive $165.2 million impairment charge for goodwill and other intangible assets. Adjusted net income actually inched up slightly from $36.5 million to $36.6 million. A $10 million reduction in selling, general, and administrative costs, driven by cost-cutting actions and lower incentive compensation costs, aided on this front. The company also enjoyed an improvement in its gross profit margin from 33.3% to 34.8%. This, management stated, was driven not only by moderating product costs, but also by the aforementioned cost-cutting plans that were put into place. Other profitability metrics were mixed. Operating cash flow saw a drop from negative $16.1 million to negative $25.6 million. If we adjust for changes in working capital, however, we get a nice leap from $49.8 million to $61.1 million. Although, unfortunately, EBITDA for the company worsened slightly from $77.6 million to $73.4 million.

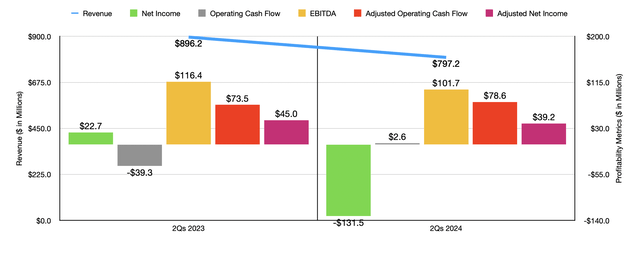

In the chart above, you can see financial results for the first half of 2024 compared to the first half of 2023. The revenue decline was very similar to what we saw in the second quarter alone, with sales dropping by 11 percent on a year-over-year basis. The large impairment charges experienced in the second quarter were instrumental in pushing profits down. And even though adjusting net income improved in the second quarter, for the first half of the year as a whole, it is still down. In fact, with the exception of operating cash flow and adjusted operating cash flow, all of the firm’s profitability metrics have worsened on a year-over-year basis.

Management expects this trend to continue for the rest of this year. However, it does look as though the second-half of the year should be better than the first half was. I say this because management is currently forecasting a decline in revenue for this year in its entirety of between 8% and 9%. They also anticipate earnings per share on an adjusted basis of between $1.04 and $1.09. At the midpoint, this would imply adjusted net income of $103.1 million. This would be down from the $105.6 million reported one year earlier. If we annualize the other profitability metrics that the company has seen for the first half of this year, we would get adjusted operating cash flow of $151 million and EBITDA totaling $218.9 million.

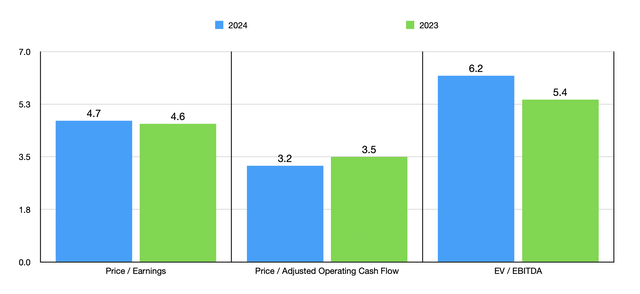

Using these estimates, as well as using historical results for the 2023, we can see how shares of the company are valued in the chart above. On a price to adjusted net income basis, and on an EV to EBITDA basis, shares do like a bit more expensive using the 2024 estimates than if we use the 2023 figures. But on a price to adjusted operating cash flow basis, they are a bit cheaper. In the table below, I then compared ACCO Brands to five similar firms. On both a price to earnings basis and on a price to operating cash flow basis, our candidate was the cheapest of the group. And when using the EV to EBITDA approach, only one of the five companies ended up being cheaper than it is.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| ACCO Brands | 4.7 | 3.2 | 6.2 |

| NL Industries (NL) | 15.7 | 8.9 | 6.1 |

| MSA Safety (MSA) | 25.7 | 18.1 | 16.0 |

| HNI Corporation (HNI) | 21.3 | 8.9 | 10.3 |

| Interface (TILE) | 15.6 | 8.0 | 7.9 |

| Steelcase (SCS) | 17.2 | 6.4 | 7.6 |

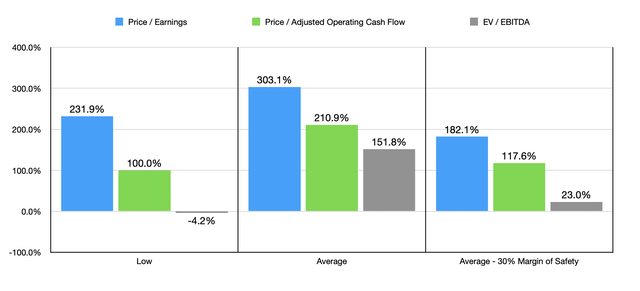

As part of a mental exercise, I wanted to see what shares would be worth if the firm were to trade at the average of these five firms. In the chart below, I looked at three different scenarios for each of the valuation metrics. The first one looks at the upside or downside that would be possible if ACCO Brands were to trade at the multiple of the lowest of the five comparable businesses. The second looks at what happens if the firm were to trade at the average of the five. And the final one looks at the average, but then applies a 30% margin of safety to the overall value of the business. Other than the absolute worst case of the low multiple for the EV to EBITDA approach, in which case shares would warrant downside with only 4.2%, the worst case for the business would be upside of 23%. And in all other cases, we are looking at a doubling, at least, of the stock price, and in some cases more than a tripling. I don’t actually believe that ACCO Brands deserves to trade anywhere near those levels. But this does indicate that some attractive upside could be on the table.

Takeaway

At this point in time, ACCO Brands is not a great company. I certainly don’t think it’s a home run. But shares are very cheap, both on an absolute basis and relative to similar firms. The decline in revenue has been disappointing, though some of it has been intentional, and the company should not be punished for it. From a cash flow perspective, things are mixed, but not awful. Add all of this together, and I do believe that the company warrants a soft ‘buy’ rating at this moment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.