Galeanu Mihai

My initial piece on Crescent Capital (NASDAQ:CCAP) was delivered back in late December last year, where the conclusion was relatively bearish – i.e., the right business focus and healthy cash generation were offset by increasing concentration in below well-performing investment category and slightly elevated leverage.

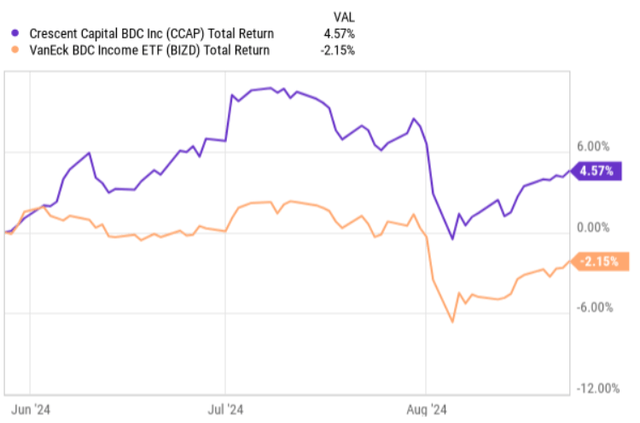

However, after seeing the Q4, 2023 and Q1, 2024 data points my view on CCAP changed. CCAP had managed to deliver robust results, while improving the portfolio quality and getting the leverage down to a level that is somewhat in line with the sector average. After my latest follow-up article on CCAP in which I plotted a more bullish case, the total return performance has been great. In the chart below, we can nicely see how CCAP has kept it performance in the positive territory despite the overall BDC market going down.

There are multiple reasons behind this, but the main ones are related to the combination of conservative underwriting standards and strategy that is tilted towards lower middle market businesses.

Recently, CCAP circulated its Q2, 2024 earnings deck, which a couple of important messages that are worth contextualizing against the current investment case. Let’s now review the earnings report and see how it fits into my bullish case for CCAP.

Thesis review

Q2, 2024 earnings results came in strong, which is in line with what we could notice in the total return performance chart above. While the results were not very robust, all of the core metrics remained healthy, indicating an inherent resiliency of CCAP’s business. This was sufficient to deliver positive return and outperform the index.

The net investment income per share landed at $0.59, which marks a decrease by $0.04 compared to the result achieved in the prior quarter. Compared to the same period last year, however, the result translates to an increase of $0.03 per share.

The main reason why the net investment income fell is associated with reduced top-line. Here we have to really put things into perspective, especially when it comes to Q1, 2024 comp. During this quarter, the primary driver of the drop in top-line was almost purely related to the normalization of non-recurring income component, which in the previous quarter was unusually high. Namely, in this quarter we saw a decreased income from accelerated amortization, advisory fees and common stock dividends – all of which are deemed as non-recurring sources of revenues. Yet, this was fully expected by the market given that the Management sent pre-emptive signals on the decreasing non-recurring revenues already during Q1 conference call.

Furthermore, speaking of the earnings, I would like to highlight that CCAP continues to generate truly high quality cash flows as the PIK income accounted for ~ 4% of the total investment income. This is quite low relative to what we can see within the BDC space.

Even with the drop in non-recurring category and net investment income per share converging back to $0.59, CCAP was still able to grow its net asset base to $20.30 per share, marking the highest level since Q2, 2022. On top of this, CCAP paid not only a based dividend of $0.42 per share, but also added a supplemental one of $0.09 per share, which leads to an annualized yield of 11.1%. The base dividend coverage remains very strong at 140%.

Having said that, I think what it even more important to appreciate is the portfolio quality dynamics. For example, during the quarter, the weighted average portfolio grade (of underlying investment companies) remained 2.1, where the percentage of risk rated one and two investments is at 89%, which is almost perfectly in line with the statistics in the prior quarter.

As opposed to many other BDC peers, CCAP managed to avoid incremental non-accrual positions, keeping this portion at 0.9% of the portfolio fair value. This could be safely deemed as a very solid metric, and as good as it gets in the BDC segment.

Part of this is explained by the fact that CCAP holds about 90% of its portfolio investments in first lien loans that are spread across 20 non-cyclical sectors, where the businesses have already achieved a stable cash generation phase. Plus, almost the entire base of CCAP’s investments are supported by well-capitalized private equity sponsors, which provides an extra layer of (implicit) safety.

Going forward, in my opinion, CCAP is well-position. Apart from embodying the necessary characteristics of defense and quality, we could expect CCAP to grow its portfolio from here, which should, in turn, accommodate stable or slight growing net investment income results.

As stated above, given that CCAP focuses on middle mark loans (including the lower segment), it can avoid the headwinds that are prevalent in the upper market space that is increasingly characterized by growing competition and spread compression.

Henry Chung – President – provided a nice color in the recent earnings call on how he sees the prospects of CCAP’s transaction activity:

Middle market loan volume for the first half of the year increased nearly 20% as compared to the second half of 2023, with most of the pickup in volume driven by refinancing activity. LBO activity, which represented approximately 1/3 of middle-market loan volume in the first half of 2024, continues to increase, albeit modestly, driven by continued strong business fundamentals better clarity on rates, declining spreads and strong demand from the private credit market. Coupled with the margin pressure from LPs to return capital, we believe that conditions are in place for LBO volumes to continue to accelerate in the second half of the year.

In Q2 figures we could already see some first signs of recovering activity levels. Namely, CCAP deployed $119 million, which was sufficient to offset $73 million in aggregate exits, sales and repayments. Importantly, while sourcing the necessary deal flow, CCAP did not sacrifice its quality standards as the investments were made with significant equity cushions and the weighted average loan to value of impressive was 31%.

Finally, it is also important to keep in mind that CCAP continues to enjoy a rather back-end loaded debt maturity profile (from which a notable part is based on favorable fixed rate financing) with no debt maturities coming due until 2026. This should help CCAP pocket accretive spreads and remain competitive when pricing its loans.

The bottom line

CCAP has delivered yet another strong quarter. The portfolio quality has remained very healthy, the new investments have been sufficient to grow the portfolio without relaxing the investment underwriting standards, and, importantly, the net investment income generation stayed well-above the based dividend.

Theoretically, one could argue that Q2, 2024 was bad as the net investment income per share decline from the prior quarter. Yet, it would be an incorrect way of interpreting this since the Q1, 2024 was characterized with elevated non-recurring revenue items that lead to an artificially inflated result. In fact, the Management had also indicated this in the Q1 conference call, which was also a reason why CCAP’s share price has remained stable.

All in all, given the improved transaction outlook, strong cash generation and well-covered dividend, I am remaining bullish on Crescent Capital.