sfe-co2

Bridgestone Corporation (OTCPK:BRDCF)(OTCPK:BRDCY) saw a bit of pressure on some of its more profitable products due to low-priced Thai imports taking the market by storm, with a destocking trend ahead of possible higher tariffs. While Bridgestone is looking more discounted now compared to peers unlike in our previous coverage, and is doing a bit better than some peers in specialty segments, they are still exposed to this Thai import situation and may see another pressured quarter before things more obviously improve. There is also the industrywide pressure emerging on new vehicle demand that looks recessionary.

Latest Earnings

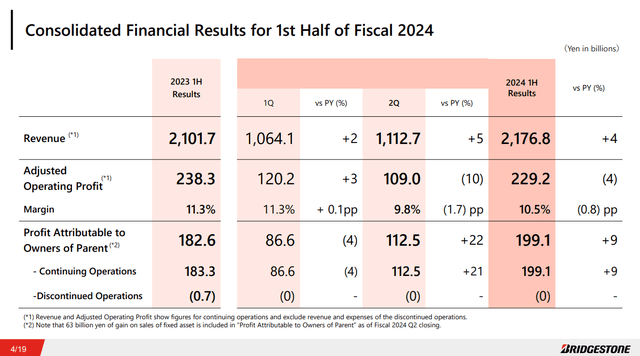

The latest earnings are interesting and we’ll be drawing comparisons to Michelin (OTCPK:MGDDF). Firstly, the H1 looks alright but pressures mounted in the Q2 for Bridgestone.

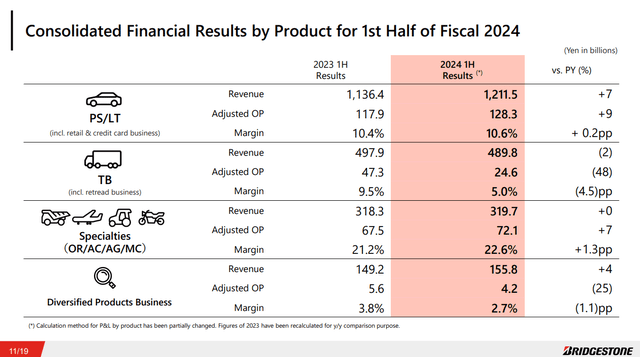

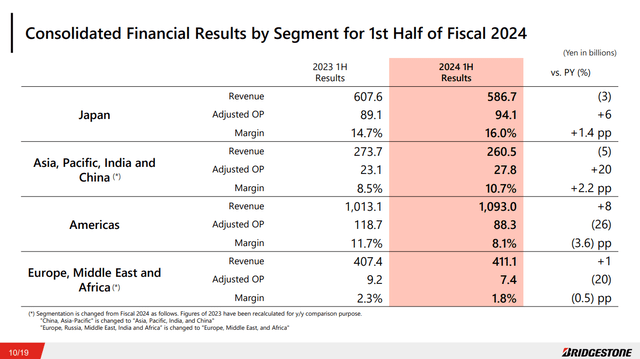

Volumes were under pressure, but comparatively in a decent position compared to peers, but negative mix effects and general competitive pressures in the truck business saw margins in that business suffer meaningfully. Industrial leverage and unit decreases worsened the situation on the operating profits. The Firestone brand for trucks and buses performed relatively weakly because there was a lot of buying in the US market in particular, to which Bridgestone is more exposed than other non-US tyre listings, of low-end imports from Thailand, where a lot of low-cost rubber products are manufactured due to the easy sourcing of raw materials. Furthermore, anticipation of tariffs on these imports, which has already begun with anti-dumping duties in the US but could extend more permanently from October this year, made the buying of substitute products even more extreme in the current quarters as distributors stocked up before it would become more expensive.

Specialty businesses performed quite stably, with stable performance even in mining where Michelin had been seeing some declines on destocking.

The general trends have been increasing natural rubber prices, which are an unavoidable input, as well as generally falling demand for tyres in new vehicles. It’s been particularly bad in Asia which drove the trend for that region’s business.

The Latin American businesses also suffered. While Argentina is dealing with austerity, Brazil, which is an otherwise strong end market, is also highly competitive and has become affected by the low cost importing from Thailand.

Bottom Line

The company is going to generally address the profit pressures with more initiatives to reduce cost and push for their higher margin and price products. Also, the pressure from the low-cost imports should start to subside, probably starting in the coming quarter, but latest after that once the hoarding stops. The issue is that it could create another wave of destocking pressure even after the tariffs on these low cost imports are in in key Bridgestone markets. Also, the continued macroeconomic pressures are a concern, particularly as automotive was for a long time in a suspended state thanks to the pent-up demand in automotive markets still being consumed with production rates having only slowly risen since the semiconductor shortages.

In other words, we aren’t overweight the sector as the macro pressures are becoming evident, and high margin segments in some cases are beginning to see YoY pressure, including mining tyres. For Bridgestone in particular, we note that while there is now a bit of a TTM PE discount to peers like Michelin, of less than 10%, the substantial US and LatAm revenues, where in LatAm the Thai import pressure could continue as these markets tend to be more liberalised for competition from imports, remains an ongoing disadvantage even if some LatAm markets have better prospects than the more developed markets. The possible destocking overhang that could follow the introduction of tariffs also mutes the picture, in addition to issues with the end markets. In all, not especially compelling.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration.