hapabapa

Introduction & Investment Thesis

I last wrote about ServiceNow (NYSE:NOW) (NEOE:NOWS:CA) in June, where I reiterated my “hold” rating based on my belief that its valuation provided little to no upside given the management’s 2026 revenue and earnings projections in their Investor Presentation. Since then, the stock has climbed over 5%, outperforming the S&P 500, although it has been performing at par with the index for the whole year thus far.

The company reported its Q2 FY24 earnings, where revenue and non-GAAP operating margin grew 22% and 32%YoY,Y respectively, as it saw robust growth in Net New ACV over $1M, while its overall customer count with at least $1M in ACV grew 15% YoY to 1988 customers. Particularly, demand for its genAI product Now Assist has doubled quarter over quarter as enterprises look to unlock efficiency and productivity gains across AI use cases. As the company drives strong synergy between its product innovation and go-to-market strategies to grow market share, it has raised its FY24 guidance for revenue and non-GAAP operating margin.

Although it is possible that the company can continue to beat its revenue and earnings estimates over the coming years, given its operational excellence, that is not my base case at the moment. When I take management’s 2026 revenue and earnings growth projections into my valuation model, I believe that the stock is priced to perfection. Therefore, as someone who does not have an existing position in the company, I will not be initiating one at this moment for risk management purposes, thus reiterating my “hold” rating at current levels.

Strong Revenue growth with an accelerating contribution from GenAI.

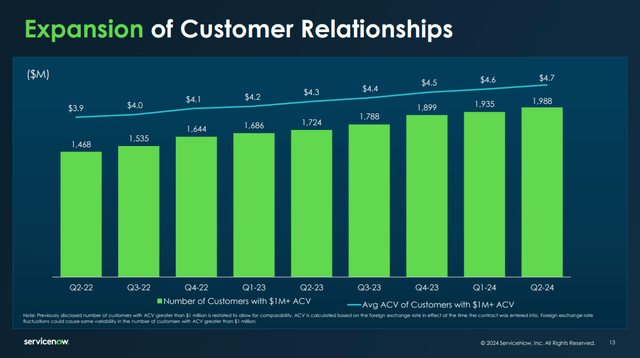

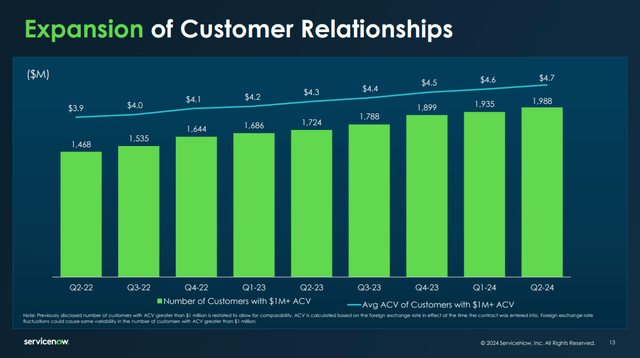

ServiceNow reported its Q2 FY24 earrings, where revenue grew 22% YoY to $2.62B, beating estimates driven by strength in net new ACV over $1M as demand for its genAI product Now Assist doubled quarter over quarter, along with 14 of their top 20 deals that included eight or more products. Meanwhile, Current Remaining Performance Obligations (“cRPO”) grew in line with revenue growth as existing customer cohorts continued to deepen adoption of their solution suite, with the Number of customers with $1M in ACV growing more than 15% YoY to 1988 customers. Plus, the number of customers with $20M in ACV also grew 40% YoY, demonstrating success with enterprise penetration. From an industry perspective, US Federal Manufacturing and Energy & Utilities saw net new ACV grow by 50% YoY.

Q2 FY24 Earnings Slide: Deepening customer adoption

Similar to the previous quarter, AI remained a central theme as ServiceNow positions itself as an AI platform leader for business transformation, with the company signing 11 Now Assist deals with $1M in ACV, two of which were over $5M, across industries such as banking, healthcare, manufacturing, technology, and more, as CEOs are looking for new vectors of growth, simplification, and digitization.

During the earnings call, Bill McDermott, CEO of ServiceNow, outlined the three pillars of why enterprises are rapidly adopting ServiceNow’s genAI solutions, which include: 1) desirability, where their solutions are focused on infusing intelligence across workflows so that employees can level up knowledge work; 2) viability, where they are positioned to deploy cost-effective domain-specific multimodal language models; and 3) feasibility, where they are already leading by example, with their own employees and developers expected to save over 21,000 hours with faster self-service.

Strong synergy between innovation and go-to-market strategies to expand market share

In May, ServiceNow brought together over 20,000 customers and partners in their Knowledge Event where they introduced new AI innovations such as Now Assist for Strategic Portfolio Management, Now Assist for Government Cloud, Creator Studio, and more that are designed to offer greater flexibility and choice to customers. Since the event, their newly created pipeline is up over 50% YoY, which demonstrates the magnitude of enterprise demand for these solutions, especially amidst ongoing platform consolidation. Furthermore, the company is also expanding its total addressable market by launching the RaptorDB lighthouse program, which is built on the RaptorDB database offering, especially as CIOs are looking to get their data house in order, thus enabling them to ingest and analyze data from multiple data sources as they solve for new AI use cases.

Simultaneously, the company also expanded its strategic AI partnerships with Microsoft (NASDAQ:MSFT), IBM (NYSE:IBM), and NVIDIA (NASDAQ:NVDA), where it will seamlessly integrate with their systems to accelerate customer workflow productivity, which I believe creates a win-win for all in the competitive landscape, while they extend co-innovation partnerships with companies like Bell Canada, where they signed a multi-year agreement to accelerate Bell’s transformation to meet the growing customer demand for tech services and digital media.

Finally, the company is also focusing on its international expansion efforts, particularly in Japan, where they had a number of major wins, such as Nomura, Panasonic Information Systems, etc., as well as announcing plans for a UAE Cloud hosted on Microsoft Azure to meet the business transformation requirements of private and public sector entities in the UAE and investing in their partner ecosystem with inMorphis as ServiceNow looks to extend their presence in India and the ASEAN region.

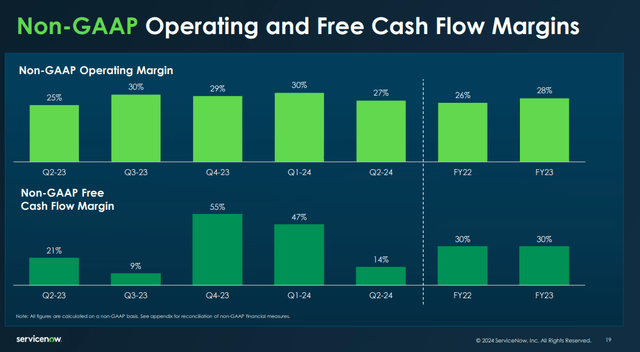

Unlocking operating experience while raising guidance

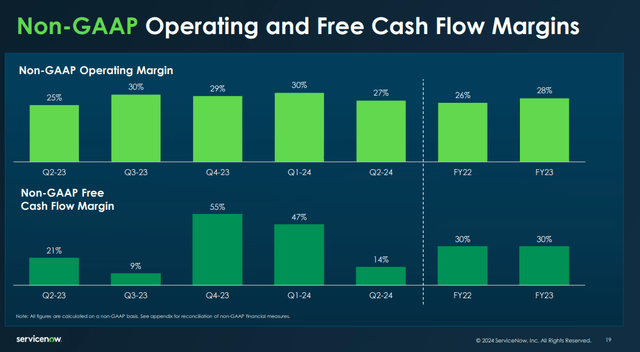

Shifting gears to profitability, ServiceNow generated $720M in non-GAAP operating income, which grew 32% YoY with a margin expansion of 200 basis points to 27% driven by streamlining operating expenses, timing of marketing spend, and success in driving higher adoption among customer cohorts, with the average ACV of customers spending at least $1M growing 9% YoY to $4.7M. Given the strength of unlocking operating leverage, ServiceNow has raised its guidance for non-GAAP operating margin to 29.5% (up from 29%) while also increasing its Subscription revenue guidance to $10.58B, growing 22% YoY vs. prior guidance of $10.56B.

Q2 FY24 Earnings Slides: Growing Profitability

However, based on management’s future expectations, most of the growth is priced in.

There is no doubt that the company is operating with extraordinary resilience as it positions itself as the AI operating system for enterprises, where it is seeing strong customer acquisition and deepening enterprise penetration given its robust genAI product innovation, enabling companies to unlock new AI use cases to drive efficiency and productivity growth. Plus, its strategic partnerships as well as international expansion should enable it to continue to unlock new market opportunities. However, the question is whether the expected future growth rate is already priced into its stock.

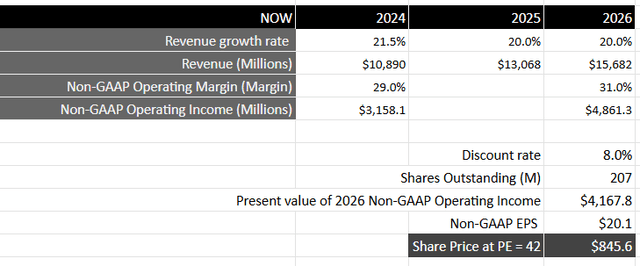

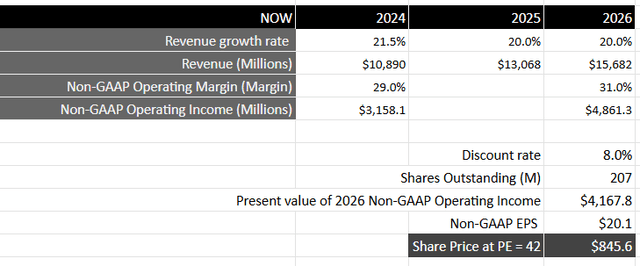

The company has already raised its FY24 revenue and earnings guidance, which is a positive sign of the overall market momentum when it comes to demand for its solutions, especially as Bill McDermott pointed to Gartner’s forecast of IT spending growing 8.9% in 2024 and software-as-a-service growing 17% as per IDC. However, if we take the management’s 2026 projections, where it expects Subscription revenue to grow 20%, with non-GAAP operating margin expanding 100 basis points yearly from FY24 to FY26, we will have an estimated $15.68B in revenue with a non-GAAP operating income of $4.8B, which is equivalent to a present of $4.16B when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15–18, ServiceNow should trade at approximately 2.5 times the multiple, given the growth rate of its earnings during this period of time. This will translate to a PE ratio of 42, or a price target of $845, which represents an upside of 2.13% from its current levels.

Author’s Valuation Model: Base Case

My final verdict: There is an optimistic scenario, but that is not my base case.

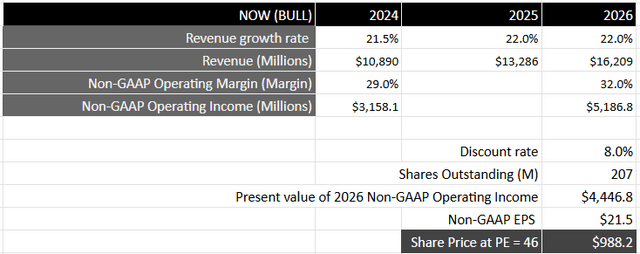

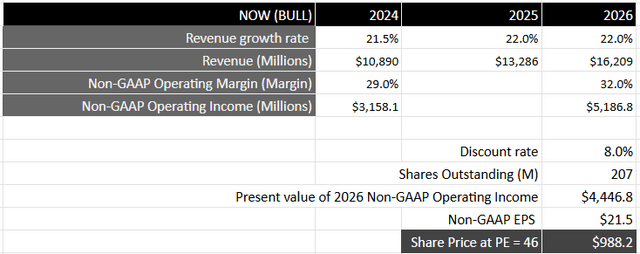

I would like to point out that, in an optimistic scenario, it is possible that ServiceNow can overachieve its 2026 estimates by 1-2 percentage points, given the company’s robust innovation roadmap and the growing contribution of genAI to overall revenue growth along with operational excellence. In that case, it will likely grow its revenue to $16.2B by FY26 with a non-GAAP operating income of $5.18B, which would be equivalent to $4.4B. Applying the same proxy as the S&P 500, this should result in a price target of $988, which represents an upside of 19%.

Author’s Valuation Model: Optimistic Scenario

However, it is important to note that in order for the optimistic scenario to play out, the company has to continue beating its revenue and earnings guidance. Unfortunately, that is not my base case for risk management purposes. Therefore, while the stock can continue to appreciate from its current levels if management continues to outperform its own guidance, there is very little room for upside if future performance meets expectations. Since I don’t own shares in ServiceNow, I don’t believe that its current price is an attractive point to initiate a long-term position and will reiterate my “hold” rating on the stock.