US stock markets closed on the highs on Friday, led by a surge in small caps.

Last week:

- S&P 500 +1.4%

- Nasdaq Comp +1.4%

- DJIA +1.3%

- Russell 2000 +3.4%

- Toronto TSX Comp +4.1%

Today, futures are tepidly higher with spoos up 8 pints, or 0.15%. Nasdaq futures are slightly lower. The S&P 500 is about 35 points from the July record high.

Energy is in focus with crude up 3% on Libya closing down production and exports so energy stocks will be a driver. So far the bond market isn’t paying attention to any inflationary forces from crude, with yields down 2-3 bps across the curve.

The main event this week comes Wednesday with Nvidia earnings. The options market is pricing in a 10% swing while implying a 1.2% move in the S&P 500.

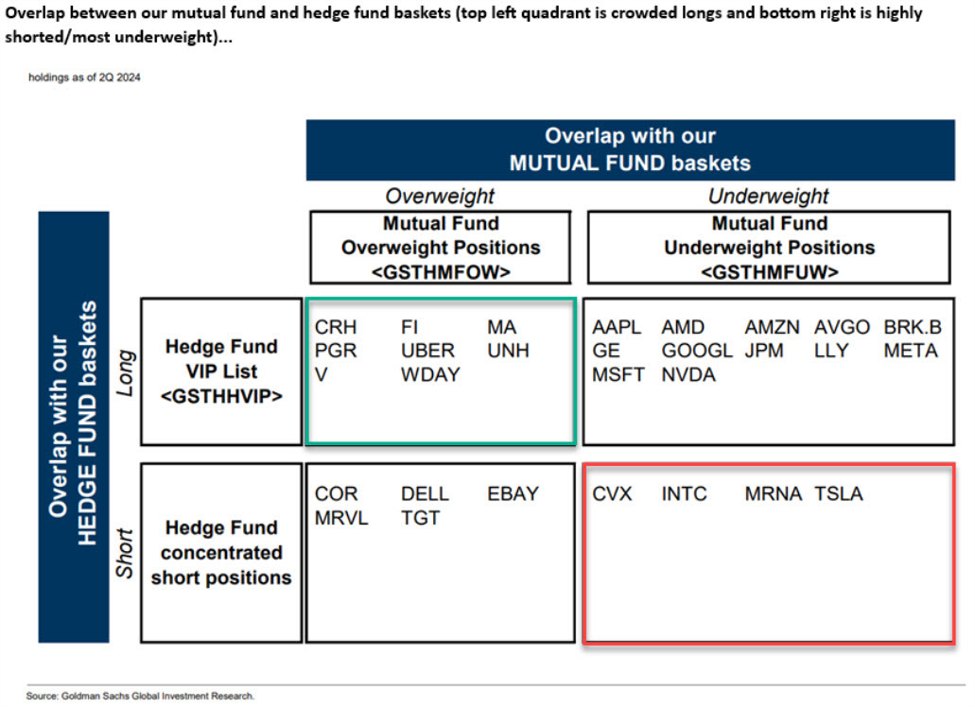

Goldman Sachs has a useful list of which stocks hedge funds and mutual funds are most-long and short:

For what it’s worth, hedge funds have been heavily long Visa and MasterCard for years and they’ve absolutely cleaned up. As for Intel, CNBC reports that they’ve hired advisors for an activist defense (shares +0.2% premarket).

h/t @zerohedge.