Volvo EX90, full electric SUV, outside the official dealership. Luca Piccini Basile/iStock Editorial via Getty Images

The latest buzz phrase to mesmerize the global auto industry is the “software defined car,” a descriptor for vehicles that are increasingly electrified, containing features – some once mechanical – that now are controlled by computers and software programs.

Volvo’s new EX90 three-row large SUV exemplifies the trend towards vehicles packed with digital technology, which has been gaining momentum and is proving to be a growing opportunity for all kinds of high-tech suppliers, from the makers of radars and cameras to the creators of code.

NVIDIA Corporation (NASDAQ:NVDA) dabbled in the automotive business more than a decade ago, supplying graphics for automotive displays, a business that soon became commoditized. As self-driving, connectivity, and active safety features such as automatic braking and over-the-air (OTA) updates became more common, cars required massive computing power, opening the door to the designers of chipsets with supercomputing capability.

Tesla, Inc. (TSLA), known mainly for its success with batteries, may be credited with another key automotive innovation: A single central computer that controls all of a vehicle’s electronic functions, with additional chips for redundancy. Prior to Tesla’s single large computer, electronic features on a typical car such as windows, windshield wipers, infotainment and so forth were wired to an electronic control unit – ECU – and all were networked and powered by the battery or generator.

All wired up

The wire harnesses connecting a vehicle’s electrical components and their ECUs were heavy, bulky and carried only a limited amount of data.

Until 2019, Tesla furnished its vehicles with Nvidia’s Drive PX computing platform, which controlled advanced driver assistance systems (ADAS) – a precursor to autonomous driving. Tesla then switched to its in-house designed computing platforms. The automaker continues to purchase Nvidia’s celebrated H100 chips for artificial intelligence training purposes.

Volvo’s decision to install central computers using Nvidia’s Drive Orin system on a chip for the first time in one of its models was driven by the increasing use of cameras and sensors for advanced active safety and other features, which require more capacity and data processing speeds that lately are measured in trillions of operations per second – TOPS. Drive Orin, the company says, is rated at 254 TOPS.

Nvidia Drive Orin (Nvidia)

The battery-powered EX90, starting at about $81,000, will be equipped with radars, lidar and cameras and be able to create a 360-degree view around the car that can detect small objects hundreds of yards ahead, nudge or alert a driver who is distracted or drowsy; Pilot Assist that adjusts speed, steering and braking; adjustment for the shape and intensity of headlights; and bidirectional charging for using power to light a home or transfer power to another Volvo EV.

More data soon

Initially, Volvo’s lidar unit will be able to connect data though it won’t be integrated into the vehicle’s functions until some future date, which will be accomplished by OTA.

Volvo Lidar unit on roof of EX90 (Volvo)

EX90 connectivity tech also facilitates OTA so that software may be repaired, enhanced and maintained without a dealership visit.

With automotive software’s opportunities and improvements can come pitfalls as well. Volvo’s EX30, a smaller battery-powered car imported from China that was introduced in the U.S. earlier this year and has been pulled from the market due to U.S. tariffs, has reportedly suffered a software glitch affecting its speedometer.

As AI replaces crypto as the buzz of the moment for equity markets, Nvidia for the time being occupies a top position among the most watched stocks. The company’s massively powered chips are needed to “train” AI algorithms. The enthusiasm for AI’s potential to increase the productivity of major industries is reflected in the company’s latest financial results, which are quite dazzling.

Q1 revenue on a GAAP basis for fiscal 2025 was up nearly three-fold from a year ago, with net income up nearly five-fold. Gross margins are a hair below 79%, up from about 67% a year ago. The AI and supercomputing industries are literally begging for Nvidia chips and are willing to pay nearly anything to get them.

Impressive numbers

For the moment, automotive revenue and income constitute a sliver of Nvidia’s business. First quarter Automotive revenue was $329 million (of a total revenue of $26 billion), up 17% from the previous quarter and up 11% from a year ago.

Among the large number of automotive companies that buy Nvidia chips are Mercedes-Benz (infotainment), Jaguar Land Rover, SAIC, Rivian, Hyundai, Lucid, Polestar, Zoox, and Cruise. In 2023, Chinese automakers BYD, XPeng, Li Auto and NIO announced that they would be using high-speed Nvidia DRIVE Orin platforms in their vehicles. The global market for light vehicles is rebounding, having reached 88.8 million in 2023 – more and more will be equipped with high-tech features that require advanced computer processing.

The future isn’t completely bright. Since 2022 Nvidia has faced U.S. government export restrictions on its chips to China, primarily for data centers, based on national security concerns. How chip shipments will be affected is unclear based on a variety of factors including how extensive the White House wishes to limit exports and the actions of other countries that may be exporting Nvidia chips to China.

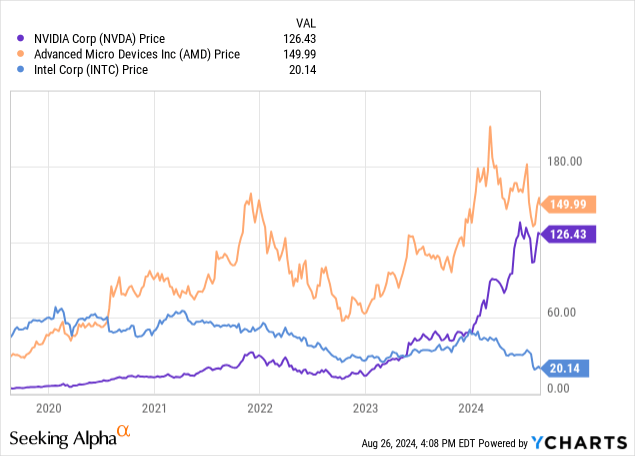

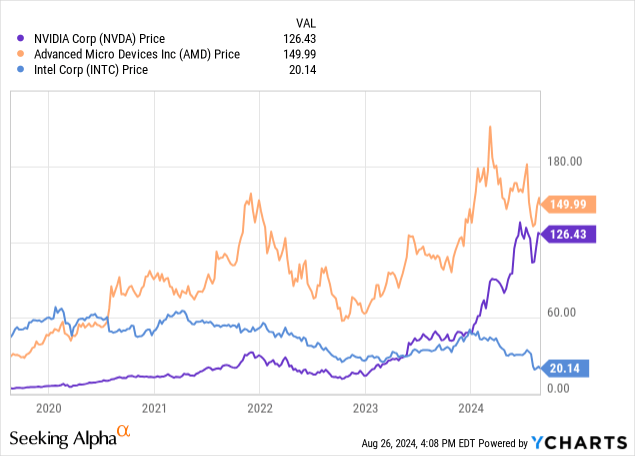

Volvo’s EX90 is one vehicle that appears to be immune to the danger of export controls disrupting its production. The future could be very bright for Nvidia’s automotive business as long as automotive companies continue to switch to electronic architectures – as they appear to be doing – and that Nvidia remains a top competitor among chipmakers, which include Advanced Micro Devices, Inc. (AMD) and Intel Corporation (INTC). Alphabet Inc. (GOOG) (GOOGL), Microsoft Corporation (MSFT), and Amazon.com, Inc. (AMZN) – important Nvidia customers – are designing their own chips for internal use.

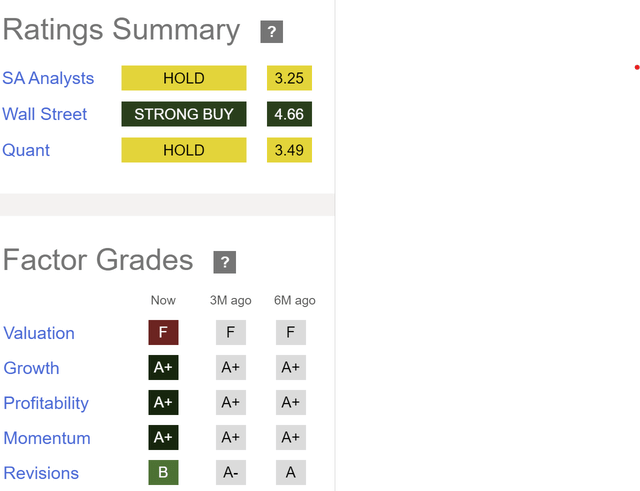

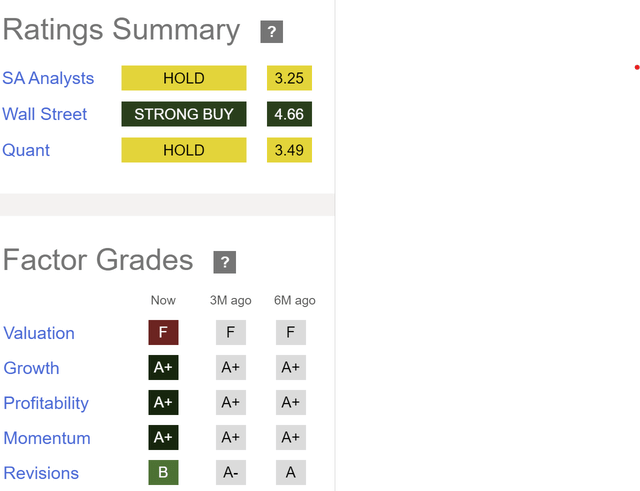

Seeking Alpha’s analysts and its Quant Rating lately have grown more bearish on NVDA shares, likely because of their F grade for valuation. Yet, the Quant’s Growth, Profitability, and Momentum grades remain quite strong. A new Nvidia Blackwell chip has been delayed, leading lately to some hesitation among some analysts.

Seeking Alpha ratings on Nvidia (Seeking Alpha)

Generative AI – machine learning that uses language and other data to create new content such as texts, video, music, audio, and, yes, driving instructions – appears to this analyst like a field whose growth is just beginning and is likely to be exponential.

Nvidia – which dominates its category by dint of early mover advantage and an enormous market capitalization – will experience ups and downs as competitors arise. Nevertheless, the company’s longer-term trend looks quite positive and will benefit those holders with a long-term investment perspective.