South_agency

This article analyzes Quest Resource Holding (NASDAQ:QRHC) 2Q24 results and earnings call. It also revisits the company’s valuation and my rating (a Hold since March 2023).

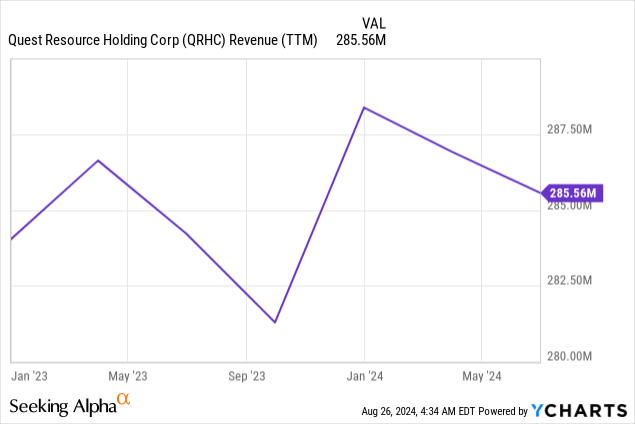

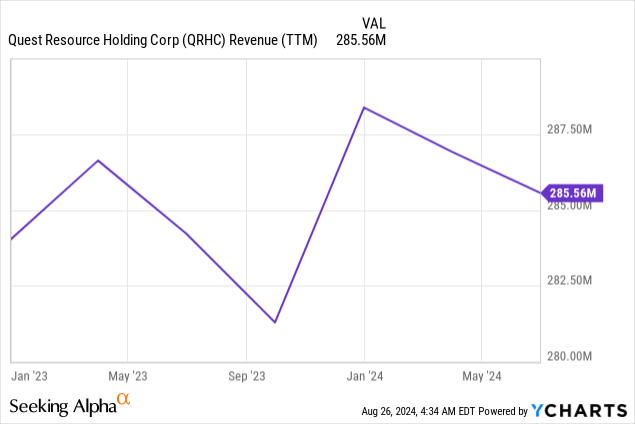

The company’s results were not great. The company had guided for growth as it started to ramp up new contracts but posted revenues shrinking, caused by some clients meaningfully driving down volumes. This did not affect the company’s profits because these clients seemed to be low-margin businesses. Still, the company is still not showing the much expected double-digit growth. During the call, management commented on new business wins and expansion, which should start hitting the top line in 3Q24.

On the valuation level, the company continues to trade at elevated figures of current profitability (25x EV/NOPAT adjusted for amortization of intangibles and even more aggressive figures for P/E adjusted for amortization). This has to do with the expectations of growth, but I believe the valuation already cancels most of the upside from those expectations materializing, leaving little opportunity for investors. For that reason, I believe Quest is still a Hold.

2Q24 results mixed

‘Growing’ with revenues down: Since 2Q23, Quest has announced 9 contract wins, potentially generating close to $40 million in annualized revenues (based on the company mentioning whether the contracts are 7 or 8 figures). In addition, it has commented on expansions for several clients. However, none of that has hit the topline since.

2Q24 was no different in this respect. The company posted revenues down 2.4% YoY. According to management during the call, the decrease was due to a large industrial client and two smaller clients, decreasing the amount of waste volumes they generate for macro reasons. These temporarily lower volumes offset the growth from new customer ramp up.

Customer expansion: The company did not have new customer wins during the quarter, but commented on three customer expansion wins, all of them 7 figure contracts. Management commented that it is onboarding record numbers of customers and that existing customers are extremely happy with the service. For example, the company landed a 5-year extension with a client against a 3-year average contract. The client had never signed a vendor for so long. Another mentioned example is that one recently onboarded client decided to become a positive reference for the company within 7 days of onboarding.

Although these wins are positive, the divide between reality and expectations continues to grow large, as the company has not grown revenues for a year and a half already.

SG&A flattish to up: The company’s SG&A (ex D&A) went up a little, about 2.5% for the quarter. Adjusting for bad debt expense ($300 thousand higher in 2Q23), SG&A was up 5%. Quest is investing in technology and expanding its sales team, so that most of the increase comes from labor.

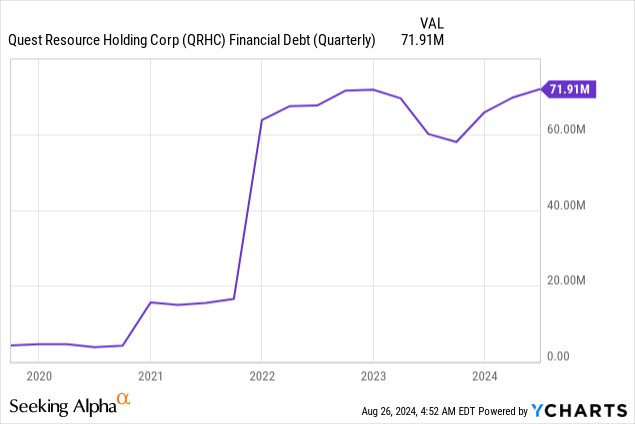

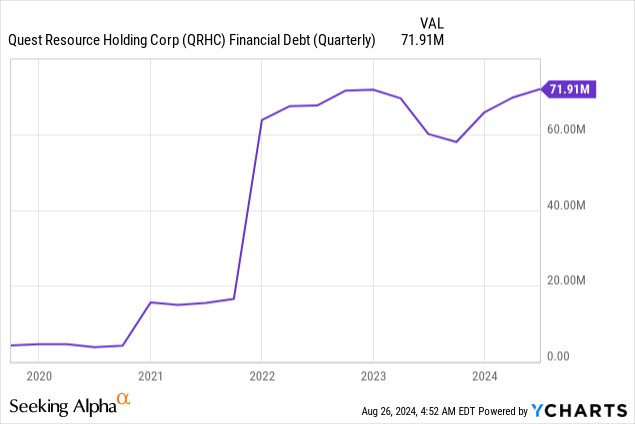

Debt up and extended: The company’s debts increased slightly as it expanded receivables by $5 million YTD. Receivables expansion is a natural dynamic for a B2B business with new clients, but debt is one of Quest’s main risks, especially because the cost is very high (current TTM interest of $9 million or 12.5%). In addition, the debt is variable rate (tied to SOFR plus large spreads) and has short maturity. Relating to these maturities, mostly in April 2025, the company managed to extend them to April 2026. Management commented that they expect to refinance to more attractive figures in the future.

High CAPEX on trucks: Quest also posted much higher CAPEX than expected in 1H24. Although the company guides for normalized CAPEX of less than $1 million per year, it posted $4 million in 1H24. The company used $3 million to purchase compactor trucks at attractive prices. Management mentioned that owning compactor trucks is a high-margin business and provides differentiation opportunities (despite the company’s business model being a broker or asset-light business).

Valuation remains unattractive

I believe there is excitement about Quest’s future growth, and that shows up in its price.

The company has generated $4 million in operating income for the past twelve months. Adding back $9 million in intangibles amortization (mostly from acquisitions, and therefore not a cost of doing business), we arrive at $13 million in adjusted operating income. After taxes, this becomes about $10 million in NOPAT. This compares badly with an EV of $250 million, leading to a high 25x EV/NOPAT multiple.

The valuation on the net income line is even more frothy. After removing $9 million in annualized interest and taxes, we arrive at $3 million in net income, or a 58x P/E multiple on a $175 million market cap.

Even when accounting for mentioned wins, the figures are high. Assuming that the additional $40 million in revenues from new contracts come at similar EBITDA margins of 5%, we could be talking of a forward EV/NOPAT of 21x or a forward P/E of 42x. Assuming that the incremental revenue comes at double those margins, we are talking of forward multiples of 19x and 29x, respectively.

The question of whether the valuation is unjustified, fair, or opportunistic depends on future growth and the reader’s own required rate of return. The problem, in my opinion, is that the current valuation already discounts a lot of growth and, therefore, offers little opportunity. Even in the best scenario (all recent wins ramp as expected, no further revenue losses, and incremental margins double), we are talking of an earnings yield of 3.5%, which requires earnings growth of 10%+ to justify the ownership of a microcap company with significant high-interest debt. Supposing that materializes, then we would only be talking of a fair valuation. If the valuation is fair only with the stock growing 10%+, something that has so far proven elusive besides the named wins, then the stock is not an opportunity.

For that reason, despite interest in QRHC, I still consider the stock a Hold at these prices.