Thomas De Wever/iStock Editorial via Getty Images

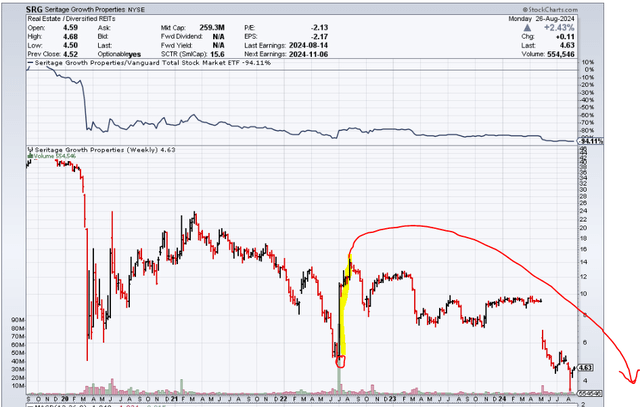

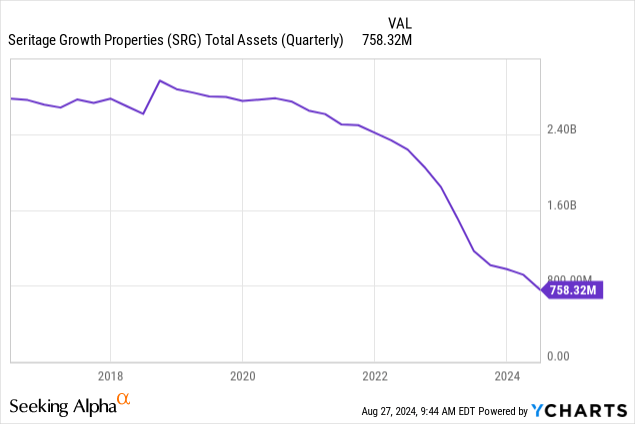

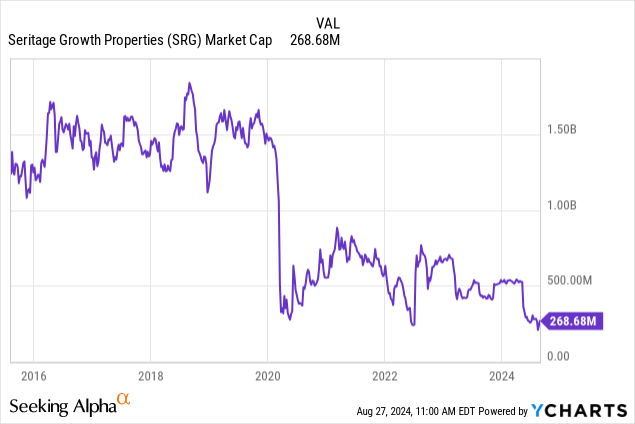

That is not the bullish headline investors were looking for, but it’s the best we can do here. The Seritage Growth Properties (NYSE:SRG) saga is coming to a fitting end after 9 years in the public markets. The initial strategy was to redevelop properties and sell them. After over $1 billion in capex, financed by selling all their star properties, SRG finally realized that burning cash to keep the house warm is not highly cost-effective. So they went in the other direction. Liquidation mode. You can see how the stock went vertical on the news from $5 to over $14 in 2022.

Of course, time, tide, and juiced-up real estate markets wait for no man. They missed the window of unloading these Class B properties and that entire gain and then some, has been wiped out.

Q2-2024

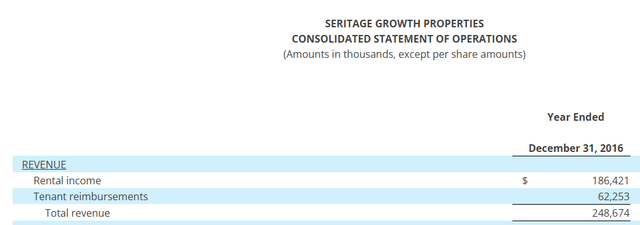

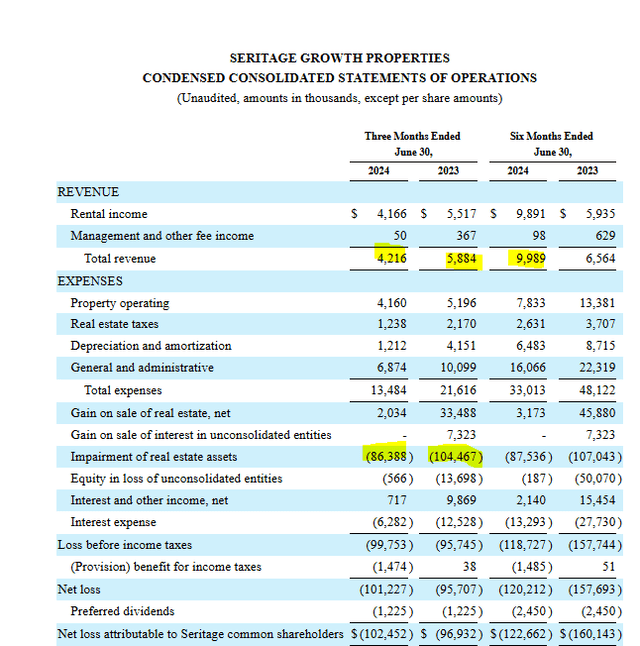

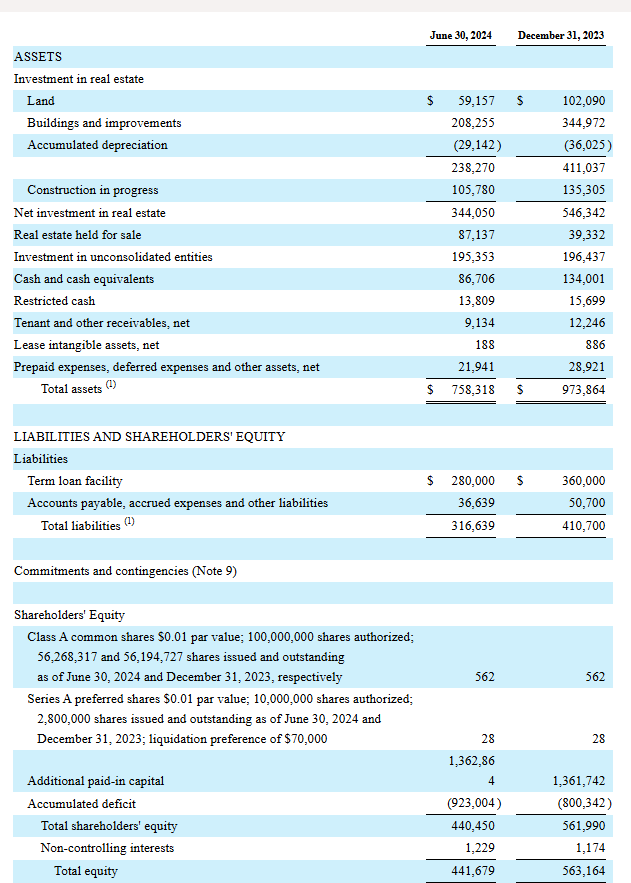

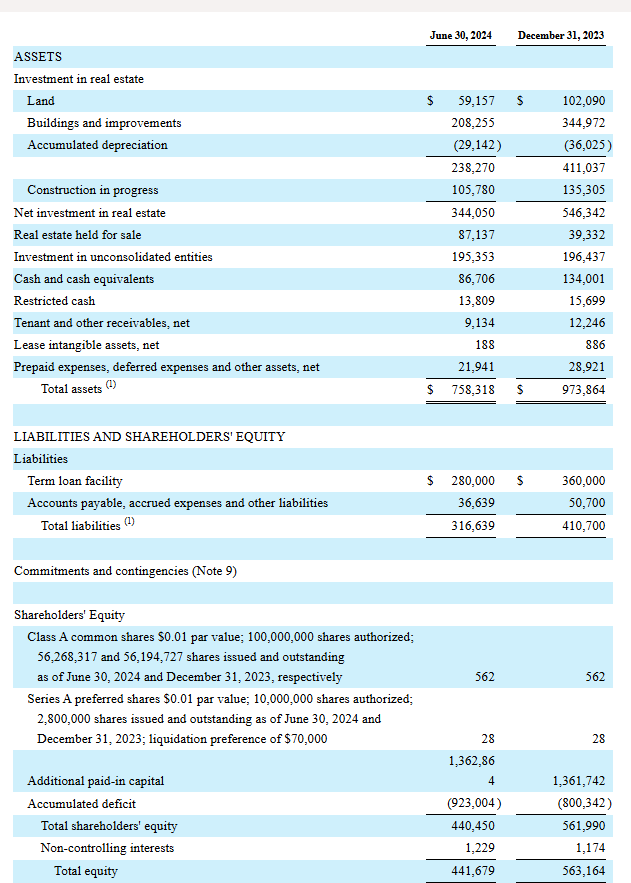

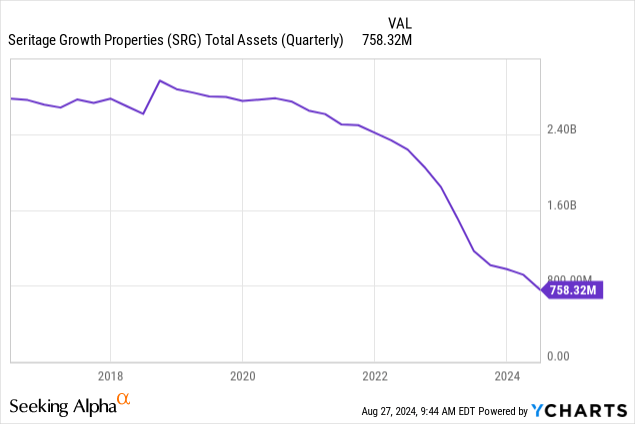

SRG delayed the release of its Q2-2024 financials by a bit as they figured out what their impairment loss would actually be for the quarter. Of course the highlight here was the $4.2 million quarterly revenue run rate. Sure, they have sold assets to get down here, but it is nonetheless a reflection of how awful a play this has been. For comparison, SRG started off near $250 million in annual revenues in 2016.

With perfect hindsight, they probably should have omitted the “growth” in their name. But back to the matter at hand. SRG showed another large impairment and this was fairly significant in light of its residual market cap of close to a quarter billion.

The delay in the release likely stemmed from the fact that the rent relief requests came in the second quarter itself.

During the three months ended June 30, 2024, we agreed to sell one asset that was below book value resulting in the recognition of impairment losses of $0.6 million, which is included in impairment of real estate assets within the consolidated statements of operations. Additionally, during the three months ended June 30, 2024, the Company recognized an impairment charge of $85.8 million on its development property in Aventura, FL due to negotiations for rent relief with existing tenants that began during the second quarter of 2024 which triggered the need for an impairment analysis pursuant to ASC 360, Property, Plant and Equipment. During the six months ended June 30, 2024, we recorded impairment losses of $87.5 million primarily due to changes in discount rates and residual cap rates between June 2023 and June 2024.

Due to increasing development and construction costs, deteriorating market conditions and, in certain circumstances excluding Aventura, agreeing to sell below carrying value, the Company recognized $104.5 million and $107.0 million of impairment losses during the three and six months ended June 30, 2023.

Source: SRG Q2-2024

Outlook

Regardless of how management spins it, impairments in the case of REITs under US GAAP should be a red flag. The rationale is that the net book value is heavily depreciated with GAAP accounting. If that lowered net book value needs to be written down further, that means things have gone awfully bad. One relative exception here is for newly constructed assets like Aventura. There is generally very little depreciation booked. But the fact that tenants are asking for rent relief, cannot possibly be a sign of a “premier property”. SRG’s book of assets is also fairly depleted here. Assuming you take total assets ($758 million) and total equity ($440 million) at face value, one should not expect blowout returns on the current market cap of $260 million.

SRG Q2-2024

Additionally, one must keep in mind that we got here after the liquidation of a lot of assets.

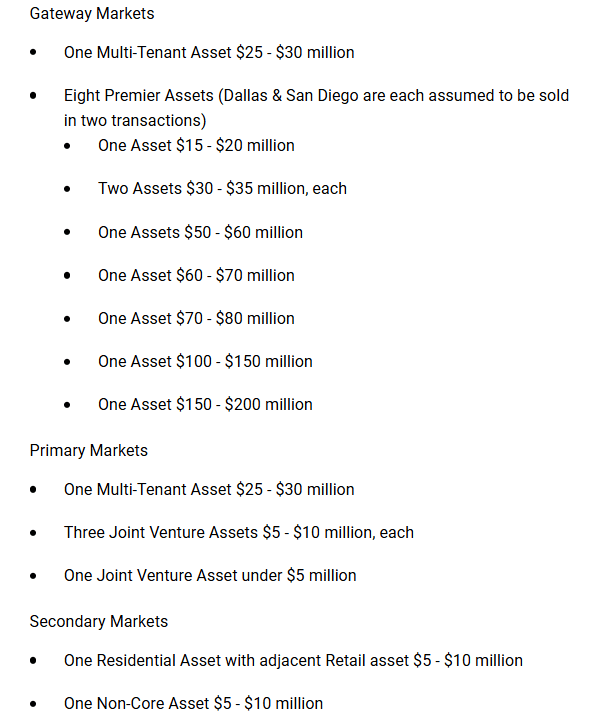

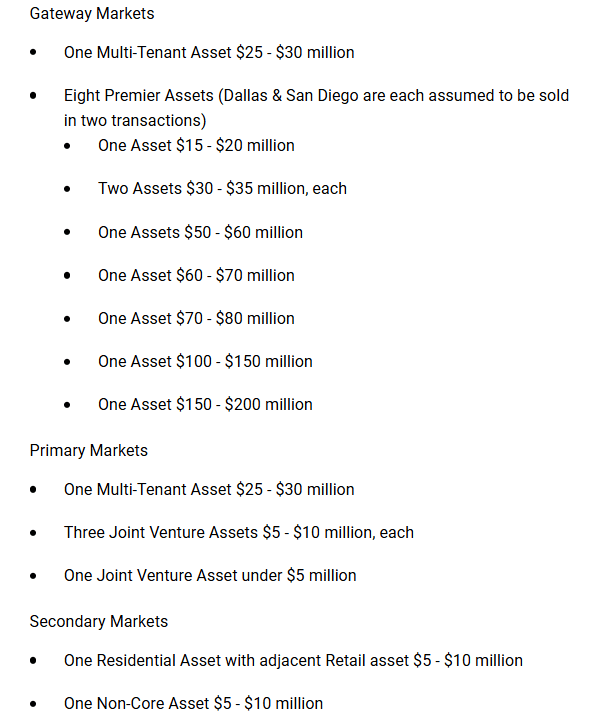

This quarter we saw $40 million more in asset sales and the company confirmed that it has 5 assets advancing through the sales process which should fetch it about $138.6 million. Excluding those assets, we have the following.

SRG Q2-2024

At this point, there should be a fairly high degree of certainty in these values. But for practical purposes, we will assume the low end of each of these numbers. That works out to about $550 million. Adding up the $140 million in expected asset sales which are not included here, your total exit value becomes about $690 million. The company also has about $130 million of current assets which includes about $100 million of cash and restricted cash. So at present, we can assume that a liquidation would fetch at least $820 million. SRG has $316 million in total liabilities. We should also assume that the cash burn rate of about $15 million a quarter for 7 quarters. The burn rate should drop over time as interest expense falls, but to be conservative we can run with $15 million all the way through. Finally, we need to subtract the preferred shares out of the equation. Seritage Growth Properties 7% CUM PFD SR A (NYSE:SRG.PR.A) have a par value of $70 million.

Verdict

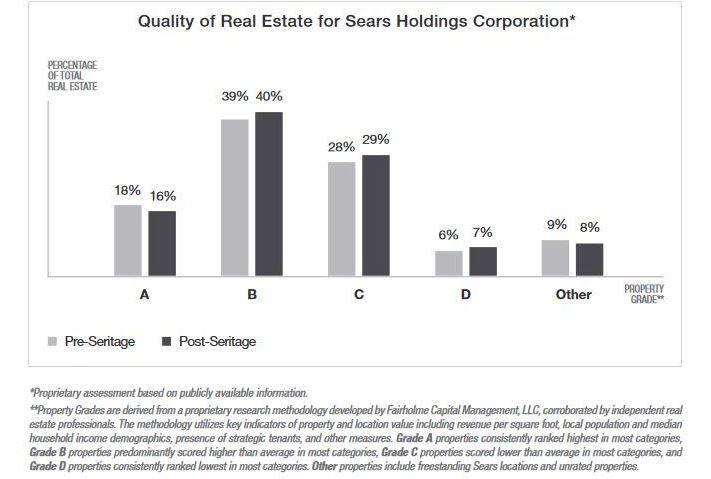

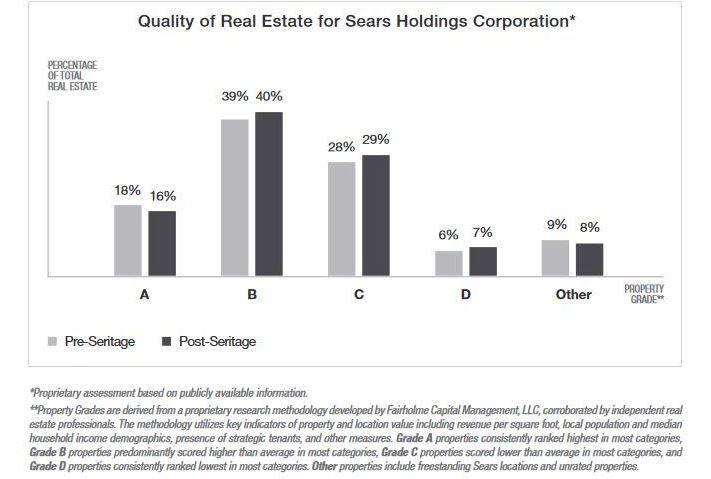

$330 million is what is left after everything is sold off by the end of 2025 and all debts are paid. Who could have predicted that for a company that came into existence with a $3.5 billion enterprise value? Actually, Bruce Berkowitz (the biggest bull on all things Sears) told everyone how poor the asset base was back in 2017 (see here for an interview). He showed the split of assets left inside the now-defunct Sears Holding Corporation and SRG.

Bruce Berkowitz

Funnily, investors insisted on valuing this far above A-rated malls for most of its history. They were too enamored with the fact that Warren Buffett owned some equity so they gave a hard pass to the facts. At this point though, the odds of getting more than the current market capitalization is fairly high.

So this is like buying a dollar for well, 80 cents. That’s like getting to watch four Nickelback concerts for free. The good part is that you can make that return profile with even less risk. The simplest way would be to buy the stock and sell the $5.00 covered call for 60 cents for April 2025. Alternatively, you can sell the $5.00 covered call for $1.00 for January 2026. This reduces your net cash outlay significantly and improves your buffer. We are actually putting a buy here at $4.60, and we might initiate the trade for our portfolio.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.