alexsl

Market Review

Emerging markets (EMs) outpaced developed markets with a 5% gain in the second quarter, led by a 15% rally in Taiwan, again driven by strength in the artificial intelligence supply chain, and supported by a 7% return in mainland China. Meanwhile, a bevy of elections prompted mixed reactions in South Korea, Mexico, India, and South Africa, while stocks in Brazil and Indonesia fell as interest rates seemed poised to remain higher for longer.

In Taiwan, strong orders for Nvidia’s (NVDA) AI-enabling chips boosted businesses along the supply chain, including TSMC (TSM), Hon Hai Precision (OTCPK:HNHAF), and other companies in the Information Technology sector, concentrated in semiconductors and related hardware. In China, amid the ailing real-estate market and its continuing drag on consumer and business confidence, the government introduced a new policy, encouraging public purchases of excess housing inventory.

MSCI EM Index Performance (USD %)

|

Sector |

2Q 2024 |

Trailing 12 Months |

|

Communication Services |

8.3 |

2.8 |

|

Consumer Discretionary |

5.2 |

6.5 |

|

Consumer Staples |

-2.9 |

-5.5 |

|

Energy |

3.6 |

25.9 |

|

Financials |

3.6 |

13.2 |

|

Health Care |

-4.3 |

-2.7 |

|

Industrials |

4.1 |

5.6 |

|

Information Technology |

11.4 |

34.9 |

|

Materials |

-1.7 |

-1.5 |

|

Real Estate |

2.9 |

-3.8 |

|

Utilities |

6.4 |

21.0 |

|

Geography |

2Q 2024 |

Trailing 12 Months |

|

Africa |

12.1 |

12.6 |

|

South Africa |

12.5 |

13.1 |

|

Asia |

7.5 |

15.5 |

|

China |

7.1 |

-1.5 |

|

India |

10.4 |

34.9 |

|

South Korea |

-1.1 |

8.6 |

|

Taiwan |

15.2 |

41.4 |

|

Europe |

9.4 |

33.4 |

|

Latin America |

-12.0 |

-5.1 |

|

Brazil |

-12.1 |

-7.2 |

|

Mexico |

-15.9 |

-6.1 |

|

Middle East |

-5.2 |

1.0 |

|

Saudi Arabia |

-7.3 |

1.1 |

|

MSCI EM Index |

5.1 |

13.0 |

|

Companies held in the portfolio at the end of the quarter appear in bold type; only the first reference to a particular holding appears in bold. The portfolio is actively managed therefore holdings shown may not be current. Portfolio holdings should not be considered recommendations to buy or sell any security. It should not be assumed that investment in the security identified has been or will be profitable. To request a complete list of holdings for the past year, please contact Harding Loevner. A complete list of holdings at June 30, 2024 is available on page 9 of this report. |

The effort was reminiscent of the Troubled Asset Relief Program (TARP) in the US in 2008, another government effort to stanch a housing crisis. Policymakers also announced details of trade-in subsidies for cars as part of another program similar to the US “cash for clunkers” program in 2009, followed by subsidizing lending rates to encourage industrial-equipment upgrades. The rally faded, however, as these efforts got off to a slow start and economic releases affirmed weak domestic activity. Leading internet company Tencent (OTCPK:TCEHY), though, outperformed in the Communication Services sector. The stock rose 24% during the quarter on the back of the successful launch of a mobile version of a leading game.

Elsewhere, investors expressed concerns about potential changes to government policies after elections in major EMs. In South Korea, India, and South Africa, markets showed divergent reactions to stronger-than-expected showings by opposition parties. In Korea investors questioned the prospects of the current administration’s “value-up” program to improve corporate governance, assuming the emboldened left-leaning opposition would disagree with planned tax cuts that would enable deeper reforms to holding company structures and cross-shareholdings, albeit the market fell only 1%. In India, markets fell initially on fears of an indecisive coalition government that will try to balance infrastructure and social spending. However, the markets quickly recovered and rose 10% for the quarter once it became apparent that Prime Minister Narendra Modi’s third term in a coalition government would pursue similar economic policies as it had done in its previous two terms even though social spending is expected to increase modestly. Similarly, South Africa rose 13% on hopes for a revival in economic growth; after the ruling African National Congress’s weak showing, it invited the opposition Democratic Alliance to join a coalition government, which is expected to result in more business-friendly policies.

Meanwhile, stocks in Mexico dropped 16% after the ruling party achieved a landslide victory, which led to concerns about potential erosion of institutional checks and balances and a more active approach to fiscal and regulatory policy, including higher taxes on banks. Brazil and Indonesia both fell 12% as their central banks indicated they may have to keep policy rates higher for longer, mirroring the US Federal Reserve. In Brazil, investors also did not appreciate both the signaled intent of the central bank to pause rate cutting and of the government to spend more of its fiscal surplus, delaying its paydown of public debt and weakening its currency.

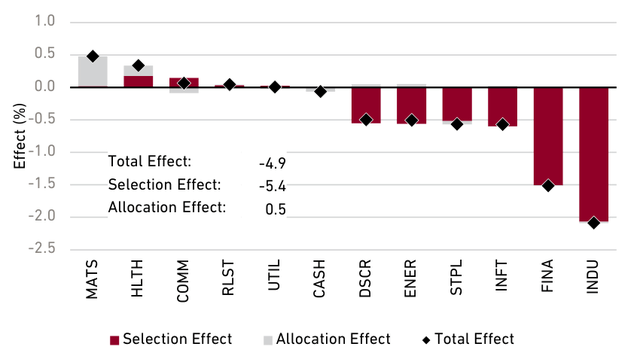

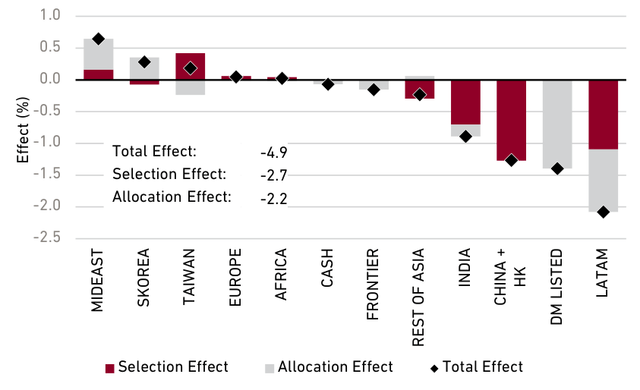

Performance and Attribution

The Emerging Markets Equity composite rose 0.1% gross of fees in the second quarter, well behind the MSCI Emerging Markets Index, which gained 5.1%.

The underperformance was primarily due to poor-returning stocks in the Industrials, Financials, and IT sectors. The portfolio’s large underweight to Materials was helpful. A broader discussion of our recent underperformance follows in the next section.

In Industrials, leading Brazilian rental-car company Localiza (OTCQX:LZRFY) reported solid growth in sales and earnings, but falling prices for the used cars the company sells to fund its fleet renewal pressured the stock. Shares of AirTAC (ATCXF), a pneumatic-equipment manufacturer listed in Taiwan, fell due to concerns about declining sales in its battery segment as well as slower-than-anticipated revenue growth from the company’s new linear-guide business.

In Financials, our Latin America stocks all detracted this quarter. Shares of Mexican banks including GF Banorte (OTCQX:GBOOY) fell on news that the government is considering increasing their tax burden. In Brazil, the threat of higher-for-longer interest rates and the government’s expansive spending plans led to weakness in Brazil’s currency and overall market, including XP, an investment manager and broker, and Itaú Unibanco (ITUB), the leading private sector bank.

Lagging returns in IT were broadly caused by our underweight to the outperforming semiconductor industry, notably our underweight position in TSMC, and our overweight to the less-popular software and services industry. However, this was somewhat offset by a positive contribution from our substantial holding in Aspeed, an electronic-chip designer, which we increased during the quarter. Aspeed’s growth appears to be accelerating due to re-stocking orders from tech giants like Amazon (AMZN) and other so-called hyperscalers and rising demand for the company’s chips both for traditional and AI servers. In IT Services, shares of EPAM and Globant (GLOB) were down significantly on concerns about slowing demand from customers for IT projects.

By geography, the largest detractors included holdings in EM companies listed in developed markets. This cohort includes EPAM and Globant (both listed in the US but with operations in an increasingly diverse mix of EM countries) as well as Tenaris (TS), the leading manufacturer of specialty steel pipes used in the energy industry. Tenaris recently guided for lower growth caused by weaker pricing in North America.

In Asia, we lagged the index in China and India. Shares of Sanhua Intelligent Controls, a Chinese manufacturer of thermal-management components, declined due to concerns about increased competition in its products for electric vehicles, an area where the company has dominated for certain key components globally. In India, relative returns were dampened through the omission of low-quality companies whose stocks were the market’s top performers this period, such as Reliance Industries. However, HDFC Bank (HDB), the country’s largest private-sector bank, was a large positive contributor. The most recent quarter’s results, which ended in March, showed higher-than-expected fee income and strong deposit growth. Returns in Latin America were hurt by Localiza and our Financials holdings.

The portfolio’s underweight to the Middle East was helpful this quarter. Moreover, Emaar Properties, a leading real-estate developer based in the United Arab Emirates, boosted returns amid continued strong property demand in the country.

Second Quarter 2024 Performance Attribution

Sector: Emerging Markets Equity Composite vs. MSCI EM Index

Geography: Emerging Markets Equity Composite vs. MSCI EM Index

|

“DM LISTED”: Emerging markets or frontier markets companies listed in developed markets, excluding Hong Kong. “FRONTIER”: Includes countries with less-developed markets outside the index. Source: Harding Loevner Emerging Markets Equity composite, FactSet, MSCI Inc. Data as of June 30, 2024. The total effect shown here may differ from the variance of the composite performance and benchmark performance shown on the first page of this report due to the way in which FactSet calculates performance attribution. This information is supplemental to the composite GIPS Presentation. |

Perspective and Outlook

The portfolio’s poor performance this quarter does not, regrettably, stand in isolation. Rather, it represents a continuation of a weak period for relative returns stretching back the past four quarters. We want to address the reasons for those results, as we see them. Sharing a comprehensive view of recent poor performance does not mitigate the bad outcome for clients, but we want to explain our thinking to reassure you that we continue to resolutely follow our quality-growth investment approach in a thoughtful and disciplined manner.

The market today is shaped by a dual optimism. Investors are willing to extrapolate the growth trends of the day—notably the roaring investment into AI and the government-led investment growth in India—and tolerate grossly elevated valuations. At the same time cheap stocks continue to outperform across most large EMs, buoyed by expectations of improved fundamental performance of lower-quality businesses. Our investment approach, which demands both high quality and durable growth combined with a disciplined assessment of stock valuations, has been out of step with the behavior of markets recently. Saying that, we have also made mistakes that have exacerbated the structural headwinds we have faced.

The four primary reasons for the portfolio’s weak results have been:

- The high concentration of market returns from the IT sector, notably TSMC, which now stands at nearly 10% of the index, and our decision to preserve portfolio diversification and maintain high active weights to specific IT Services stocks.

- The strong relative performance of cheap stocks in large EMs, including China, India, and South Korea.

- An underweight to India, a market that has been a strong contributor to index returns despite extremely high stock valuations.

- An overweight to Latin America, where there are durable-growth companies whose stocks are trading at attractive valuations. Global macro factors and domestic political risks have weighed heavily on the region’s markets recently.

Analyzing year-to-date factor returns shows that quality and growth stocks have actually outperformed overall. Indeed, the returns on stocks that score in the top tercile of both quality and growth (representing an average of 18.2% of the index over the past six months) have been more than three times that of the broad index (28.4% compared to 7.7%). Surely for Harding Loevner’s EM strategy this should represent a sizeable tailwind? Actually, the answer is “not really.” The composition and return contribution of this attractive group is heavily concentrated in semiconductors, primarily TSMC, which represents about half of this cohort by weight and continues to benefit from the huge demand for chips that power Generative AI. In fact, the return contribution from TSMC alone represents more than 80% of this group and almost half the total index.

TSMC is our largest holding, but it is still less than the index weight, in accordance with our strategy guidelines that limit the weight in any single security to 6% of the portfolio. This lower weight has been a drag on relative performance. The performance shortfall within IT this year is also related to the significant overweight in IT Services and active positions in Globant and EPAM, which have both suffered sharp reversals as management has conveyed a weaker demand environment for their services.

Another powerful trend in recent market returns is the strong performance of cheap companies in large EMs, including superior returns for state-owned enterprises (SOEs) in China and India. In the first half of the year, the top quintile of cheapest stocks in China delivered a sizeable return of 20%, while the most expensive stocks are down 12%. Similar outperformance of cheap stocks can be observed in South Korea, Brazil, and India. Chinese SOEs returned 19% this year, compared with 5% for non-SOEs, while in India SOEs returned 33%, compared with 17% for non-SOEs. SOE share prices in China have responded to efforts by policymakers to institute higher standards of governance and higher returns on capital, but there are few SOEs that meet our investment criteria. Despite these policies, many SOEs still face weak industry structures and a lack of competitive advantages. In India, SOEs have been buoyed by narratives that align these companies with Prime Minister Modi’s investment programs to invest in power generation and related infrastructure, logistics, and real estate. The portfolio’s high-quality, privately owned companies have lagged in comparison, but as the fundamental weakness of SOEs become apparent over time, we expect the value of our businesses’ superior strength will be reflected in their stock prices.

The portfolio’s persistent underweight to India reflects the high valuations of high-quality, durable-growth companies. One outside view of valuations that we refer to is UBS’ HOLT valuation framework, which backs out the implied required rate of return investors are demanding from securities in the market. At a country level, India’s median market-implied yield of 1.4% is at an all-time low and highest (by far) premium to EMs. We have recently added two new Indian holdings in the financial sector, HDFC Life and ICICI Bank (IBN), and it is no coincidence that the valuation of Indian financials is closer to the long-term average market-implied yield of 5%.

Then there is the significant overweight to Latin America. This quarter, the prospect for “higher for longer” interest rates in Brazil dragged stocks lower, particularly growth stocks and companies that are tied to the country’s capital markets, including portfolio holding B3, Brazil’s stock exchange. In Mexico, the specter of rising political risk with the landslide victory for President-elect Claudia Scheinbaum’s Morena party took a toll on the broad equity market as well as the peso. We view the market’s instinct to shun long-duration growth stocks in such an environment as an opportunity to reap stronger returns in the future from more depressed valuations. We maintain our overweight exposure and during the quarter actually added a new holding, Brazilian drugstore chain and retailer Raia Drogasil. (OTCPK:RADLY)

We’re bottom-up investors, but that doesn’t mean we don’t see the big picture and assess where the opportunities lie in today’s market. Beyond TSMC, we are invested in a number of companies set to benefit from the phenomenon of Generative AI, for example. India remains on a solid growth trajectory, but we will not compromise our demand for quality nor accept stocks sporting unfathomable valuations.

High-quality companies will over time prove their worth. We believe in our process, we believe in our long-term, quality-growth focus, we believe in the companies in which we’ve invested your money. Clearly our short-term performance is disappointing, but our process has a solid record in the long term. Our strategy has outperformed the benchmark in 80% of monthly rolling 10-year periods over the past two decades. When economic headwinds hit, as they eventually do, companies with dominant competitive positions, strong balance sheets, and quality management will be the ones that ride out that storm.

Portfolio Highlights

As we mentioned above, we view conditions in Latin America as a buying opportunity. The sharp sell-off in Brazilian equities this year provided us the chance to purchase Brazil’s largest pharmacy chain, Raia Drogasil, at attractive valuations. The retailer’s key competitive advantage is its scale of operations, allowing the company to negotiate better purchasing terms with its suppliers and operate its business with lower cost structures. Industry dynamics in Brazil are also favorable as medicines can be sold only through pharmacies, and license requirements for new entrants further limit competition. The earnings growth outlook for the company is attractive, as Brazil’s rapidly aging population is fueling demand for medicines. We also think Raia Drogasil should continue taking market share from its smaller and financially weaker competitors in Brazil, potentially increasing its 16% current market share to more than 25% as this fragmented market consolidates over the next decade.

The potential risk for this business is the threat of disruption from online retail. However, Raia Drogasil has been investing in its own online retail business to get ahead of the curve. It is working on speeding up deliveries to online customers, leveraging the advantage of its 3,000 pharmacy stores spread across a country where logistics is challenging. As of last quarter, close to 61% of the delivery mix for its online orders were through Click & Collect from physical stores and 92% of orders were delivered or collected within one hour of order. Its online business grew 46% in the first quarter from a year ago, now contributing close to 17% of overall revenue.

We also talked earlier about how our focus on valuation has contributed to our underweight to India. We want to own high-quality companies, but will buy only when the valuation is attractive. That combination presented itself to us twice this quarter: We bought a new position in ICICI Bank and added to our existing position in HDFC Life. The two purchases reduced our India underweight, even as we separately sold Kotak Mahindra Bank.

ICICI Bank is India’s second-largest private sector bank by assets and is one of the leaders in lending to retail and corporate clients in the country. It is a high-quality bank and one of the best positioned to gain from India’s structural growth in financial services due to its strong brand and its technological capabilities that complement its wide network of more than 6,500 branches.

The firm has also gone through a major cultural transformation over the last five years, reducing the hierarchy within its top management, and implementing new parameters for bonus payouts that focus on better asset quality and profitability for the bank. In addition, the bank has made changes in the last few years to improve risk management, such as reducing client concentration in its corporate banking business, reducing asset exposure to riskier corporates, and limiting exposure to its riskier overseas businesses.

HDFC Life is one of India’s leading life-insurance companies, whose stock valuation has become more attractive after the company reported slower-than-expected growth recently. Its long-term growth outlook remains robust as it continues to benefit from

a higher share of life insurance products sold in HDFC Bank branches since the merger of its parent company HDFC Ltd. with HDFC Bank a year ago aligned interests between the companies. Its share within HDFC Bank, now its largest shareholder, has increased from 55% a year ago to 62% now and could go up to 70% over the medium term. Growth should also be helped by increasing penetration of insurance products in the country. Meanwhile, management has made clear that it does not expect a major impact from new regulations intended to protect purchasers of life insurance products from losses from early policy terminations, given its high policy persistency rate.

Lastly, we exited Kotak Mahindra Bank based on an unforeseen regulatory action by India’s banking regulator, the Reserve Bank of India (RBI). In April, the RBI voiced concerns related to Kotak’s IT systems and data security and issued an order preventing Kotak from onboarding new customers through its digital channels as well as barring it from issuing new credit cards. These restrictions, which may last for some time until the regulator is satisfied with remedial actions taken by Kotak, could be a material impediment to Kotak’s growth outlook due to its limited physical infrastructure compared to peers and its digital-led growth strategy. We did not see the valuation as attractive in the face of such growth headwinds.

|

Harding Loevner’s Quality, Growth, and Value rankings are proprietary measures determined using objective data. Quality rankings are based on the stability, trend, and level of profitability, as well as balance sheet strength. Growth rankings are based on historical growth of earnings, sales, and assets, as well as expected changes in earnings and profitability. Value rankings are based on several valuation measures, including price ratios. |