Andyworks

I’ve been in this business a long time, and come across many interesting investment strategies which are designed to do something different than just track US large-cap stocks. Sure – one could argue US large-cap investing has really been the only game in town for well over a decade. But the reality is the longer the S&P 500 does this, the more likely an extreme decline occurs as history would suggest. If you’re bullish on stocks but want to (hopefully) protect your portfolio with a product that can potentially hedge against your core equity allocation, then you may want to consider Amplify BlackSwan Growth & Treasury Core ETF (NYSEARCA:SWAN). This fund tries to shield investors from those uncommon disastrous events that can throw markets into chaos.

SWAN uses a unique approach to give investors a chance to profit from the S&P 500 while trying to protect against big market drops, which people (usually erroneously) call “black swan” events. This fund follows the S-Network BlackSwan Core Index, which puts 90% of its money into U.S. Treasury securities and 10% into S&P 500 LEAP call options to have a shot at making more money.

This clever mix makes the most of the low or opposite relationship between Treasuries and the S&P 500 when markets tumble (with the notable exception of 2022) as people rush to put their money in safer government bonds during those risk-off periods. The Treasury part serves as a cushion to soften losses, while the LEAP options open the door to unlimited gains if stocks go up.

It’s worth pointing out that SWAN isn’t your run-of-the-mill “tail risk” fund that makes money from market crashes at the cost of positive returns. Rather, it has a chance to do better on a risk-adjusted basis in different market situations. As the S&P 500 goes up, the fund’s call options become more valuable, which leads to a bigger share of equity. On the flip side when markets fall, the Treasury position grows to give more protection. This shifting allocation allows SWAN to adjust to changing conditions while sticking to its main 90/10 target mix through twice-yearly rebalancing.

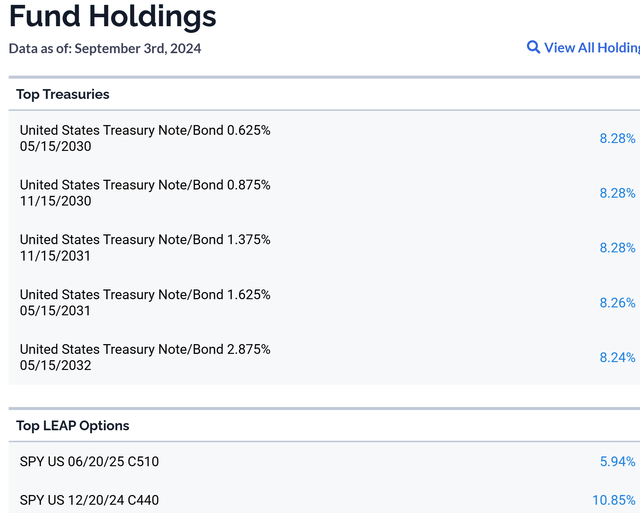

A Look At The Holdings

As noted earlier, the SWAN ETF holds U.S. Treasury securities, which account for about 90% of its assets. These Treasury holdings give stability and help protect against big market drops. The other 10% goes into LEAP call options on the S&P 500 index, which allows for unlimited gains if the stock market rises.

The Treasury part of the portfolio invests in securities with a medium-term duration trying to match the 10-Year U.S. Treasury Note’s duration. This choice takes advantage of the fact that Treasuries and the S&P 500 have moved in opposite directions or at least been non-correlated on average when stocks fall as the flight to safety trade into government bonds occurs for a moment in time.

The LEAP call options SWAN owns expire after a year or more. These options let the fund profit from S&P 500 gains without buying stocks. When the S&P 500 goes up, these call options become more valuable, which increases the fund’s equity exposure.

Keep in mind that while the asset allocation stays fixed at 90% Treasuries and 10% call options, the fund’s actual exposure to the S&P 500 can change. As call options gain value in rising markets, the fund’s equity exposure increases, which can lead to a bigger allocation to stocks in the portfolio (essentially playing momentum as a nature part of the process).

Peer Comparison

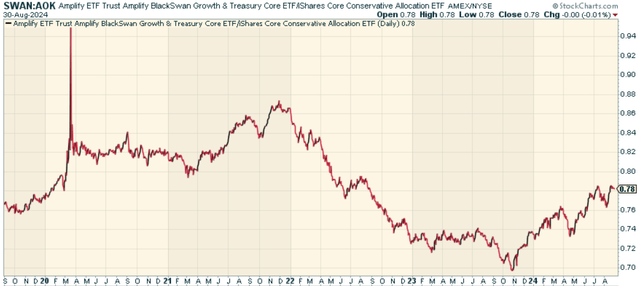

To evaluate the SWAN ETF, you need to compare it with similar funds in the market. The problem is there aren’t any funds out there that explicitly have a makeup like this. Having said that, it’s worth comparing the fund to a more traditional asset allocation mix which also has a mix of stocks and bonds (though in different allocations). For this purpose, the iShares Core Conservative Allocation ETF (AOK) is worth comparing it against. AOK sticks to a more old-school mix of bonds and stocks from a lower volatility asset allocation perspective. When we take a look at SWAN relative to AOK, we find that the two funds have roughly the same performance since late 2019. Notice by the way the big spike during the Covid crash. Yes it worked well during then, but it clearly didn’t hold on to that alpha.

If you believe the flight to safety trade is back in Treasuries, then I suspect SWAN would outperform AOK. But the decision for which to invest in largely hinges on that dynamic more so than anything else.

Pros and Cons

On the plus side, the fund splits its holdings putting 90% in U.S. Treasuries and 10% in S&P 500 LEAP options. This mix helps protect against big losses when markets tank as the flight to safety trade re-asserts. It lets the fund grab some stock market gains while using government bonds to cushion any falls. Also, the fund shifts its stock market exposure based on how the market’s doing. It ups the value of call options when stocks are booming and leans more on Treasuries when the market’s heading south given the natural way the allocations shift.

Note however that in 2022, the approach failed miserably as the once-in-a-generation bear market in Treasuries played out during the Fed’s fasted rate hike cycle in history. The bad news? It was painful. The good news? This likely will not happen again in our lifetimes.

But we need to think about some possible drawbacks too. The fund’s expense ratio of 0.49% is steeper than many regular index funds, which could eat into long-term gains. Also, while the fund tries to shield against big market drops, it might not do as well as a pure stock portfolio during long bull markets. Investors should keep in mind that how well the fund’s hedging plan works can change based on what’s happening in the market, and the fund can still lose money at times.

Conclusion

The Black Swan ETF takes a different approach to investing. It mixes U.S. Treasury securities with S&P 500 LEAP options. This ETF tries to protect investors when markets fall while still letting them benefit from stock market gains. SWAN offers an interesting choice for investors who want to protect against market drops without giving up all possibility for capital appreciation in the S&P 500. But keep in mind its higher fees and the fact it might not do as well during long periods when the market is going up. I do like the fund here, and think it’s worth considering. At some point, the extreme in markets will hit. Time favors it.