Supatman/iStock via Getty Images

Investment Thesis

Enterprise cloud software solutions company C3.ai (NYSE:NYSE:AI)is slated to report the first quarter of their FY25 earnings cycle next week on Wednesday, September 4, after markets close.

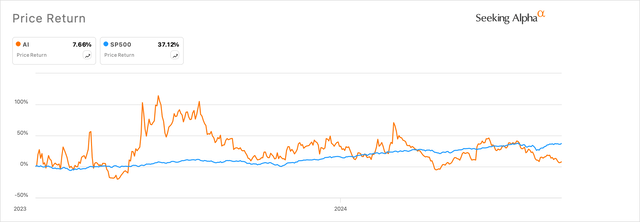

C3 has found it difficult to recover after short sellers, Kerrisdale Capital and Spruce Point Management, published their reports alleging misreporting in the company’s sales numbers.

Exhibit A: C3.ai’s stock fails to recover lost ground after short sellers alleged malpractices early last year (Seeking Alpha)

Complicating matters for the company was also the transition state that C3 found itself in after growth did not take off as expected given the AI tailwinds that management had been touting since ChatGPT’s launch.

The company has been increasingly looking to take a share of the U.S. Federal government’s IT budget, and C3’s Q4 FY24 earnings report in May this year offered some hints of progress.

Unfortunately, C3’s management continues to underwhelm on sustainable growth, leaving me on the sidelines. I do see moderate levels of pessimism in its valuation, and for those reasons I will recommend staying Neutral on C3 before its earnings.

The Bookings Growth Critical For Revenue To Ramp Needs More Clarity

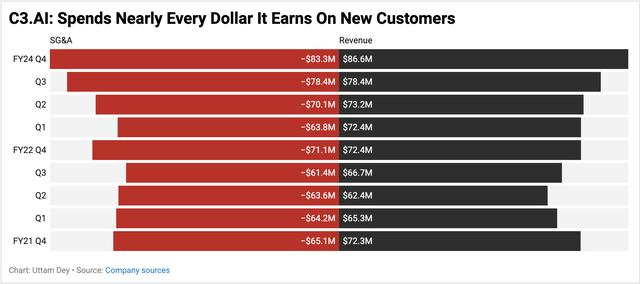

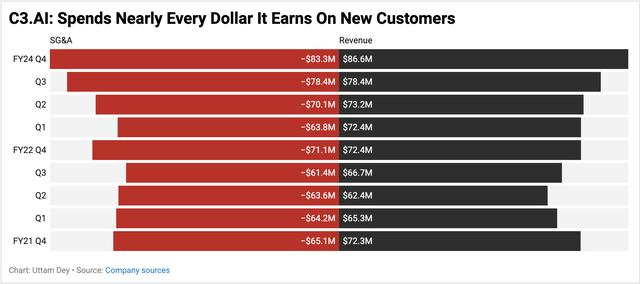

My previous coverage on C3 delved into the company’s stunning customer acquisition costs, which showed that it needed to spend every dollar of revenue earned on SG&A to acquire future customers. I was not impressed by management’s efficiency or the fundamental strength in its business model and had rated the company as a Sell while valuing the company at ~$23 per share. My thesis has played out so far with C3 trading at the per share value I deemed fair.

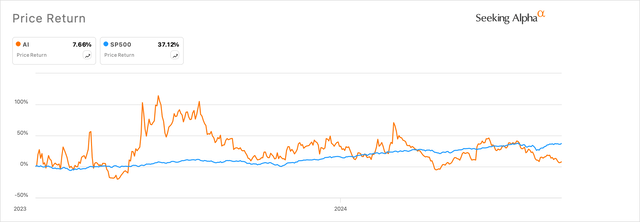

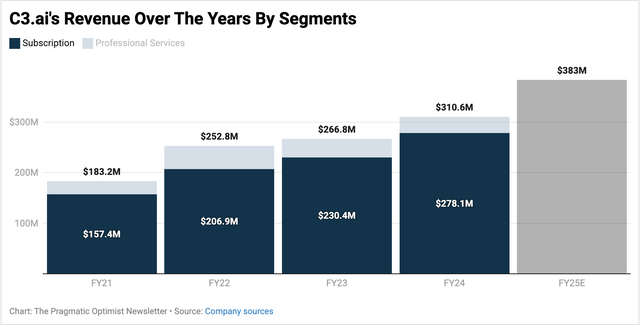

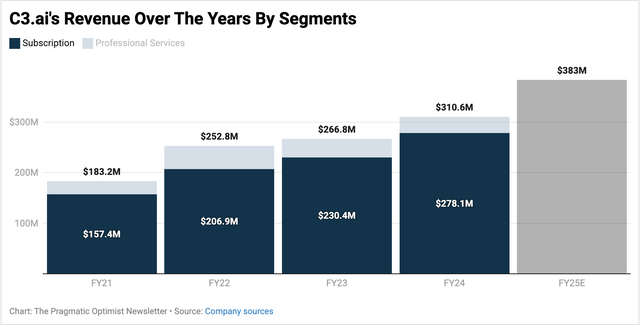

Since then, C3 closed out its FY24 with an earnings report that initially impressed markets, but eventually the momentum faded as C3 drifted closer to the ~$23 price range. Revenue for the full year came in at $310.6 million, $2.2 million above consensus estimates. At the same time, management guided the company to grow FY25 revenues to a target range of $370–$395 million, well above expectations of $368 million. Therefore, with these projections, the company’s FY25 growth rate is expected to surpass their FY24 revenue run rate.

Exhibit B: C3.ai’s revenue trends (Company sources)

Driving the underlying momentum for management’s projections was the performance of the company’s bookings metric, pilots. C3’s pilot metric tracks the number of customers the company was able to sign up for a 6-month paid trial period. During the trial period, the customer gets dev access to the C3 AI platform, its COE services and any one C3 AI Application or C3 Generative AI. After the trial ends, the customer enters into a subscription-style commitment with consumption credits loaded on top of the commitment. Most sell-side analysts on the Street found the company’s volume of customer pilots, C3’s measure for their business bookings, to be encouraging.

If an investor takes the past performance of this pilot metric on face value, one can easily assume strong growth for the company. C3 closed 123 pilots in FY24, up 151% y/y indicating that these customers are “either in their original three- to six-month term or extended for some duration or converted to a subscription or consumption contract, or are currently being negotiated for conversion to a subscription or consumption contract.”

In my opinion, that leaves a lot of room for customers to drop off after the pilot trials end, and if that materializes, management would be forced to suddenly downgrade their outlook.

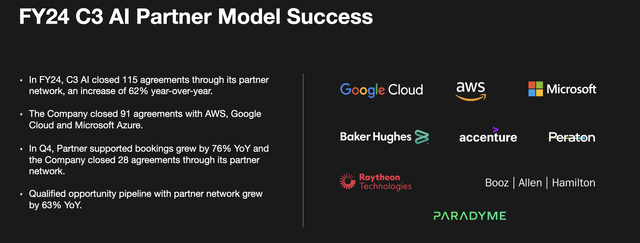

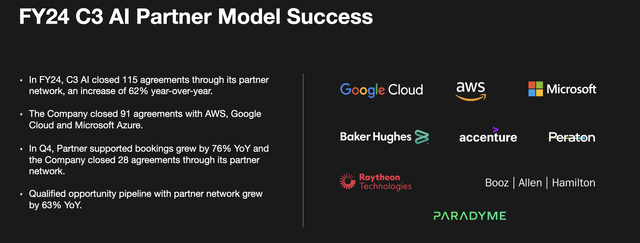

The other part of their business model is driving bookings growth by leveraging their partner’s network. Management has only revealed the count of its booking agreements signed rather than the dollar value of those agreements.

Exhibit C: C3.ai’s partner model is often cited as success factors for its business (Investor Presentation, C3.ai)

In my opinion, this makes revenue projections challenging. As I mentioned in my previous coverage, RPO cannot be used since management expects this metric to decline in the future due to the company’s switch to a consumption-pricing based revenue model. While C3 sells its products via the respective marketplaces of the Big Tech companies it partners with, the sales deals between C3’s other partners aren’t fully clear yet. However, due to the distribution of its partner relationships, C3 has half of its bookings coming from the various U.S. federal departments, while a quarter of the remaining half accounts for bookings from the Oil and Gas industry as well as governments and local bodies in the U.S.

Management has been on just one conference so far, since their previous earnings report, where they talked about the strength of their federal business without divulging specific metrics. I continue to expect management to be clearer about their forward growth metrics, such as many of their peers do.

Well Capitalized Books But Margin Deterioration Expected

I do agree that C3 looks well capitalized with just $59 million worth of debt and obligations while carrying $167 million in cash. C3 trades at 3.4x its book value before next week’s earnings, which makes this look appealing given it is a fast-growing technology company.

But the margin story of the company needs to fundamentally improve for me to be impressed with that book value multiple because management will be forced to tap into its cash reserves if growth suddenly slows, diminishing the appeal of that book value multiple.

On the Q4 earnings call, management revealed that they expect gross margins to be pressured due to a higher mix of pilots that carry greater revenue overhead. C3’s gross margins now stand at 58% and have declined every year since 2021.

In addition, the company also expects its operating margins to deteriorate due to “additional investments” due to be made in their business, “including in our sales force, research and development, and marketing spend.”

I had noted this in my previous coverage as well, where I expressed dismay at the company’s high customer acquisition costs.

Exhibit D: C3.ai still spends nearly all its revenue dollars on acquiring customers (Company filings)

Expect the company to maintain the same margin guidance on the earnings call next week.

However, Mathematical Valuation Points To Some Upside

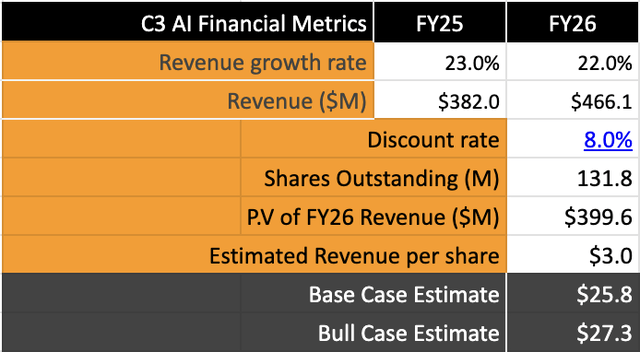

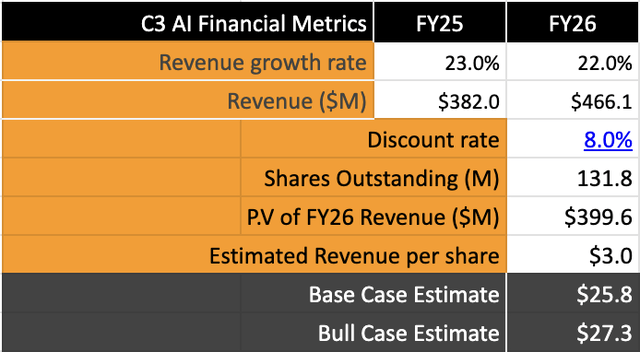

In my previous coverage, I explained how I believed the company could grow revenue in the double digit range closer to the high teens. With management’s upgraded growth outlook, I estimate C3’s growth rate to be 22-23% CAGR over the next two years. I will still be using a sales forecast since there is no scope for margin improvement in the foreseeable future for C3.

Exhibit E: C3.ai’s valuation according to author (Author)

In my base case, I value C3’s forward sales at 8-9x sales, implying ~10% upside if I compare C3’s revenue growth to the long-term revenue growth of the S&P 500. Certain investors may be more bullish and willing to apply a higher sales multiple. I have attached my price targets in the bullish scenario as well, but I am not fully confident of C3 warranting those sales multiples.

My model assumes a discount rate of 8% and a share dilution rate of 5%. I have raised my share dilution rates after I noticed that share dilution surged 8.6% in FY24.

What To Look For In C3’s Q1 Earnings Report

Q1 Estimates: Analysts call for C3 to report losses of 13 cents per share on revenues growing by 20% to ~$87 million at the midpoint of management’s Q1 guidance range of $84-$89 million. I do not expect any surprises here.

Q2 & FY25 Forward Guidance: This is where it will get interesting. Markets expect growth to accelerate sequentially to $91 million, implying ~25% y/y growth, while losses are expected to be at 13 cents per share in Q2 FY25 as well. Expect severe repercussions if management fails to guide above expectations. Full-year FY25 revenue is expected to be at $383 million, within the $370-$395 million target range.

Business Commentary: I strongly believe providing commentary around proven business metrics such as bookings, billings, deferred revenue, and ARR would improve my impression of C3’s management, but I do not expect them to. So, the key in the Q1 earnings call next week as well will be to observe how their pilot’s growth has trended and if growth has slowed.

Takeaway

I am not overly optimistic about C3 with the business transparency that management provides for investors. The operational metrics that management provides do not provide a clear, accurate operating environment for me to evaluate. Investors are left with anecdotal evidence of business metrics that may provide short boosts of growth in the short term, but nothing that points to secular growth for C3. I do not expect any of that to change yet in the upcoming Q1 earnings call.

Still, my sales forecast-based valuation models for C3 suggest there is marginal upside for the company’s stock in a base case evaluation.

Given the risks that still exist heading into the earnings call, I recommend staying neutral on C3 and watching for more formidable signs of business strength.