Abstract Aerial Art

Despegar.com, Corp. (NYSE:DESP), similar to Booking Holdings (BKNG) but mainly in Latin America, has a business model of intermediating the sale of tourism services, earning commissions for doing so. The company has succeeded in gaining a significant share in countries such as Brazil and Mexico, which can be considered one of its differentials.

Despite this, this market is clearly still very competitive, not only between the different players trying to consolidate themselves and fighting and trying to differentiate themselves on who can offer the best platform for travelers, but also fighting over prices and variety of hotels and destinations, but also between the airline or hotel websites themselves, which can increase their margin by offering their service directly to the consumer.

This makes Despegar a solid company in Latin America, but one that certainly has limited competitive advantages, even when compared to others in its sector, such as Booking itself or Airbnb (ABNB), which offers a relatively different service.

Although it’s a company mainly exposed to Latin American countries, its valuation is fine but isn’t that undervalued, which, coupled with high external risks, justifies my discouragement with Despegar Stocks.

Despegar Delivers Some Solid Results

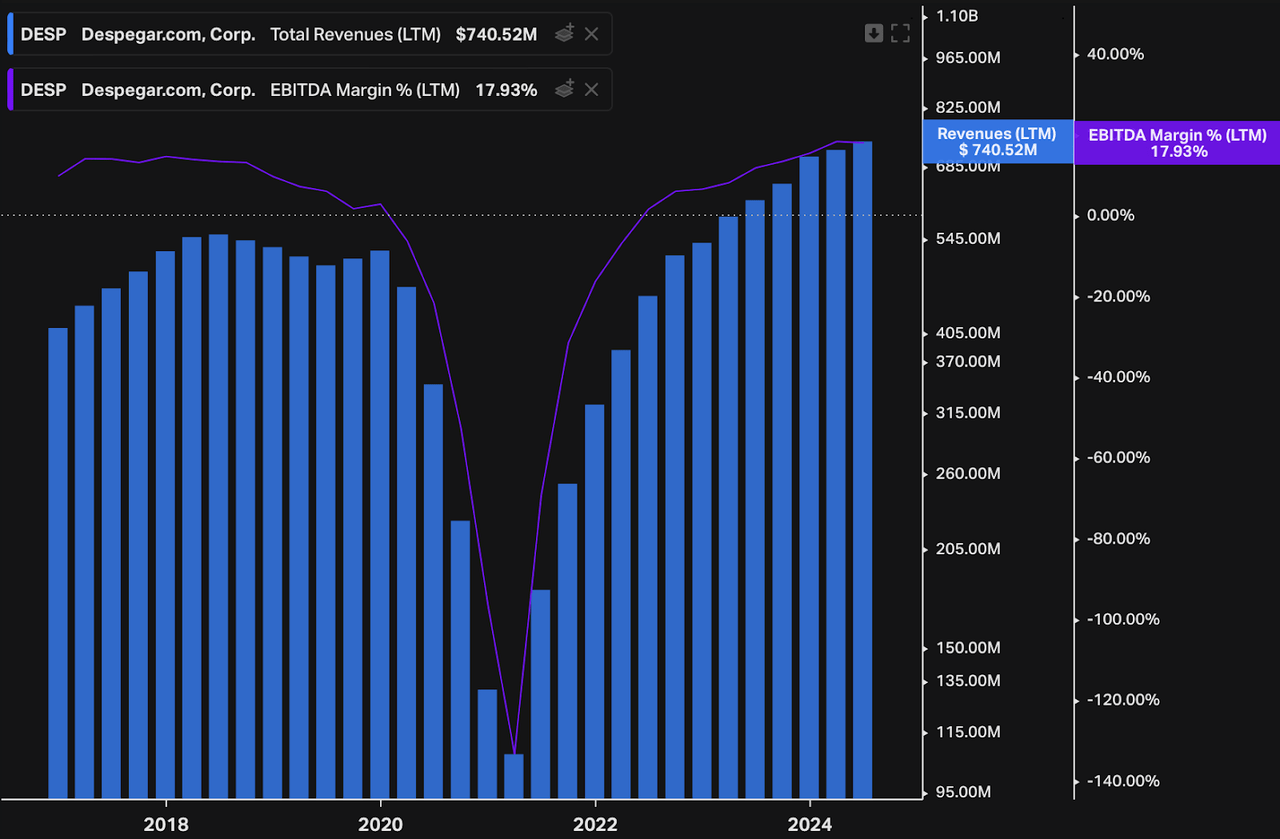

Trying to analyze it in isolation (without considering its sector too much), Despegar is an interesting company that has managed to achieve some success. After the harsh impacts of the pandemic, the company’s net revenue has resumed its growth and even after that, it looks like it will maintain an interesting pace of growth (given its guidance of at least 8% revenue growth for 2024). This came together with a good improvement in EBITDA margin, which reached ˜20% in Q2 2024 against something close to 12% in Q2 2023 even after higher investment and marketing expenses.

Despegar or “Decolar,” which is the name of the brand operating in Brazil, sells mainly in B2C, which represents 83% of its revenue (and more than 60% of that comes from Brazil and Mexico). As the company itself mentions, its main market (B2C in LatAm) is highly fragmented but still allows for growth close to low double digits. In addition, the company operates in B2B through 15,000 offline agencies, representing 9% of revenue, and the remaining 8% is for B2B2C, through white-label partnerships with banking applications and the like.

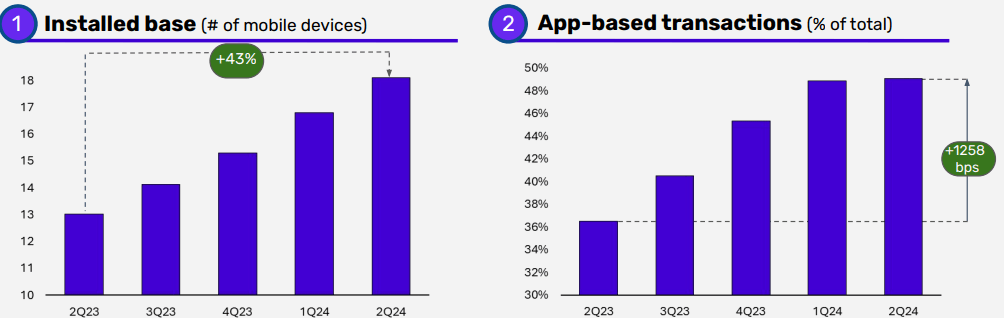

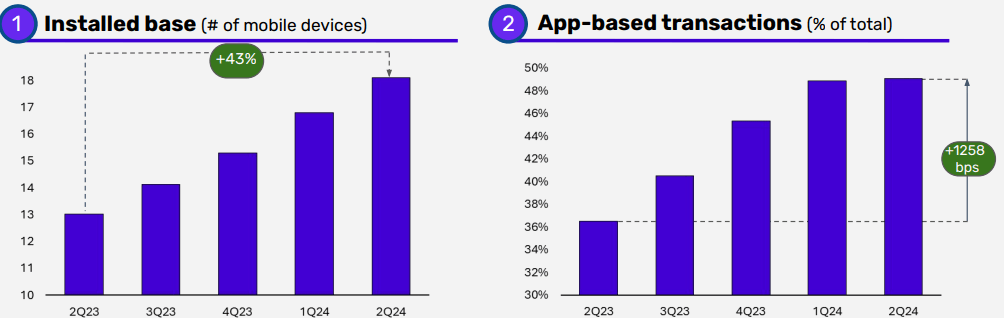

In recent quarters, the company has done a good job of increasing its app users and in-app transactions, currently holding the top position in LatAm among the most popular travel apps. In Q2, the company grew its installed base by 43% YoY, reaching 18 million mobile devices, with app-based transactions reaching ATH of 49%.

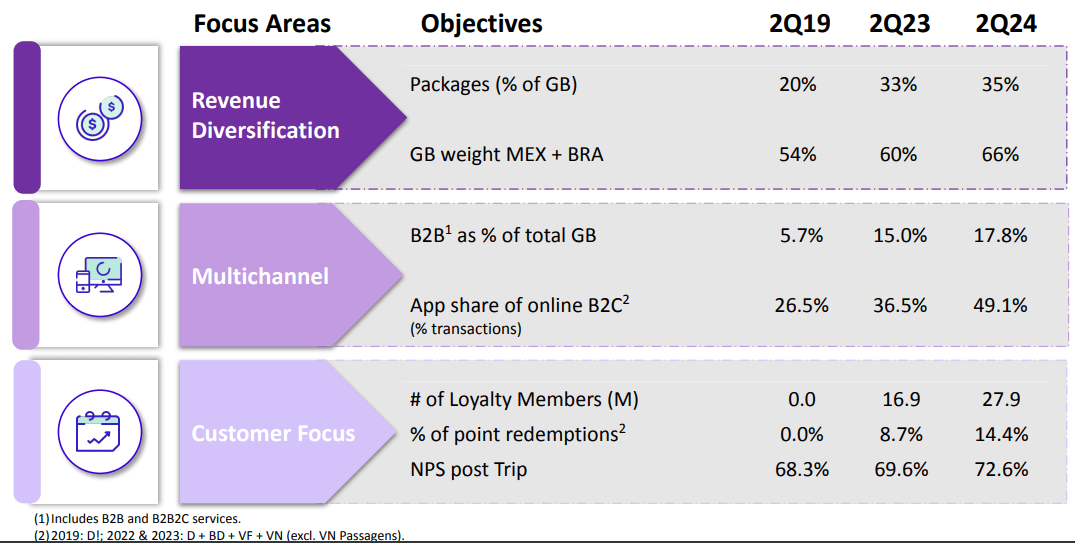

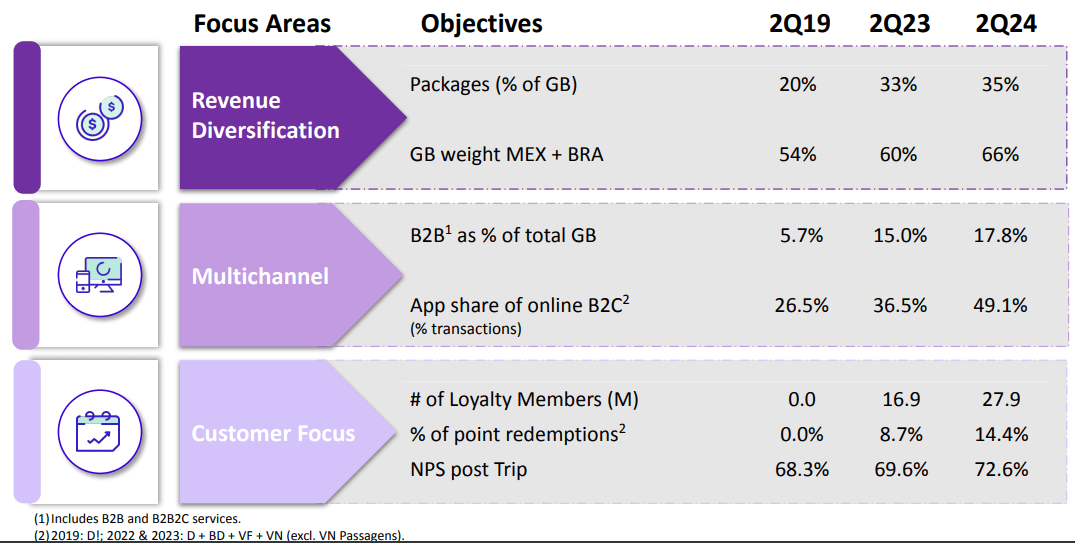

Despegar 2Q24 Presentation

Although a significant portion of users still use websites and other ways to buy their travel, having a high installed base is very important and can help build or solidify your competitive advantages, by increasing recurrence, triggering notifications or just being more convenient for the user to open the app and buy from anywhere.

Other operational metrics have also proved quite interesting over the last few years. The company has managed to increase the number of packages sold, from 20% in 2019 to 35% in 2024. B2B (including B2B2C) has also gained a lot of representation and is now almost 18%. The number of Loyalty Members has also exceeded 27 million, which is good for the vision of resilience and recurrence.

Despegar 2Q24 Presentation

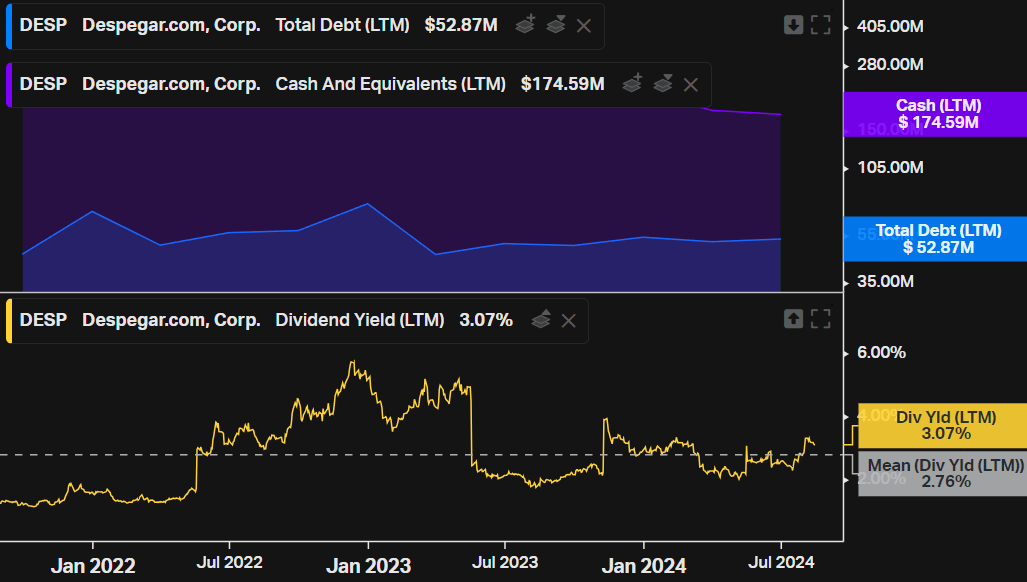

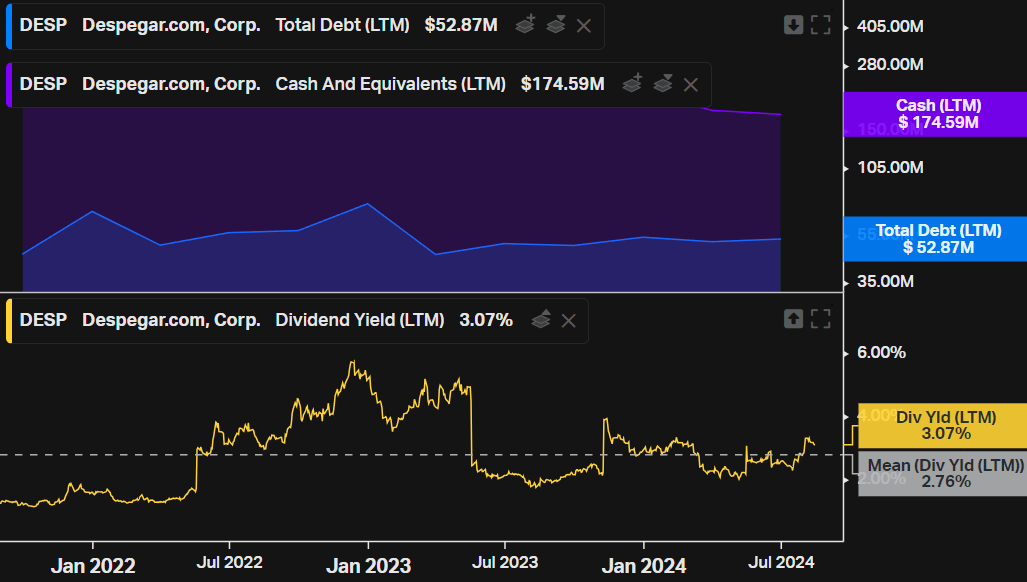

Despegar’s capital structure is also comfortable, with cash and equivalents exceeding $170 million while total debt is $52.8 million, allowing the company to distribute part of its cash in the form of interesting dividends even though it is a growth-focused company.

Koyfin

Dynamic Market Adds Uncertainty to Despegar’s Future

So Despegar is a good company with solid fundamentals and interesting prospects. The problem is that its market generates a lot of uncertainty about the sustainability of these prospects over the coming decades.

I don’t believe that the tourism intermediation market is completely Winner-Takes-All, but it does have Winner-Takes-Most characteristics. On the one hand, there is a very fragmented supply of tourism services, with hundreds of destination options, and in these, a high number of similar hotel and accommodation options, which in turn are able to negotiate with several intermediaries at the same time, meaning that there is supply for more than one player. But there is a strong network effect (and Booking is the best example of this), and once you’ve built up awareness of your brand and hotels, it’s easier to attract new customers and also new accommodation. This goes hand in hand with gains in scale and bargaining power, not to mention other factors that are just as relevant today, such as the data collected from users that allow for a high degree of personalization. This all benefits the biggest player in the segment and makes it more likely that it will continue to gain market share on top of this.

On the positive side, since Despegar is among the leaders in LatAm, it can continue to benefit from the dynamics of the sector to further consolidate itself in this region. For example, after the bust of 123milhas – a company that some said was a Ponzi scheme – Despegar managed to capture market share gains in the Brazilian Market. The fragility of CVC, a Brazilian company in the sector that made a net loss of R$22 million in 2Q24 and has a net debt of R$836,3 million considering the anticipation of receivables, may also have helped/continue to help Despegar strengthen in Brazil.

According to the January 2024 information provided by Conversion, LATAM (airline) was the company with the highest Share of Search in the Tourism sector in Brazil, with 14.5%, and Despegar was in second place with 12.7%, followed by Booking and fourth place was CVC. In terms of consolidated Share of Traffic, Booking leads with 15.8% and Decolar is in 7th place with 6.1%.

This shows that although Decolar is very present in the Brazilian market and in Latin America in general (especially Mexico), the market is still quite fragmented, with other companies offering very similar services.

In other words, while Despegar is indeed a dominant player in LatAm, it also faces competition from local players, apps/sites from first parties, and (even more threatening) global players like Booking. All this makes the outlook for the next few years rather murky, so even if the company has interesting guidance and robust results, the thesis ends up being intrinsically riskier, and one of the premises for investing is to believe that it will not only be able to remain relevant in this market in the short and medium term but also that it will be able to increase its market share in this dynamic market.

Despegar Offers Value but Faces Risks

In view of this greater risk, the consequence is to demand a greater discount on the shares in order to invest with the greatest possible margin of safety.

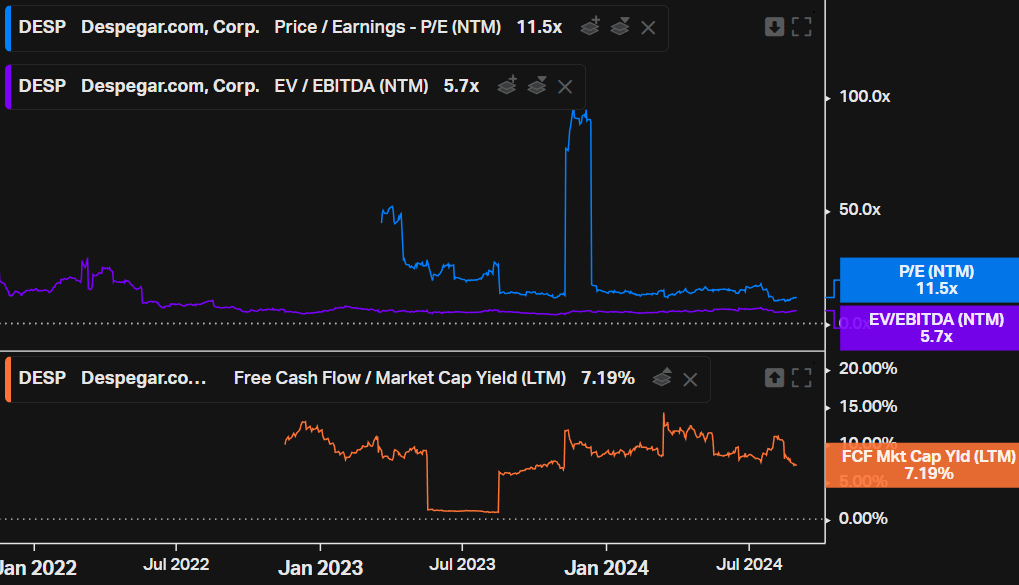

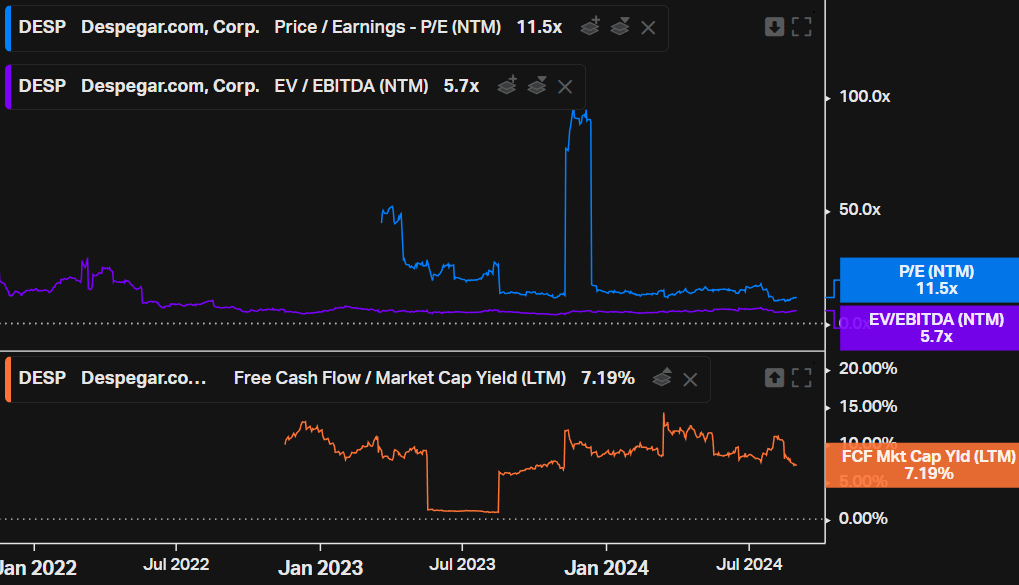

For a growth company that has interesting growth avenues, with the market projecting EBIT growth of ~30% for 2024, and possibilities of maintaining low double-digit growth in the top line and bottom line in the coming years, Despegar is an undervalued company. Its forward price-to-earnings is 11.5x, while its forward EV-to-EBITDA is 5.7x. Its free cash flow yield is also high, close to 7%.

Koyfin

But we must take into account not only the risk of its market but also the macroeconomic risk since the company is mainly exposed to the Brazilian and Mexican currencies. However, compared to other Brazilian alternatives, Despegar doesn’t seem so undervalued. Trying to pick an option focused on tech and growth, Inter (INTR), which is a complete Brazilian digital bank with very promising prospects for net profit, is trading at 14.8x its earnings for the next 12 months. As for the market indices, the Brazilian index, EWZ, is trading at ~8.8x, and the Mexican index, EWW, at ~7.7x.

In other words, the Despegar Stocks at today’s prices can be considered attractive, since with this growth, it will be possible to remunerate the shareholder well. Even so, I don’t think that at these multiples the stocks can be considered a bargain, since the macroeconomic and sectoral risks are great and uncertain, requiring a higher premium while there is no moat or greater consolidation in the thesis.

Final Thoughts

As I mentioned, Despegar is not a bad company and has some potential through the consolidation of markets in Latin America and the dilution of costs and SG&A through greater gains in scale. And all this at a very reasonable valuation (although not that attractive), which should allow for a good return for shareholders if everything goes according to plan in the long term.

The problem with the thesis is something structural. This sector is a bad one (with rare exceptions for the leaders and/or players who are already well established and who manage to get better conditions, such as Booking Holdings), not only because of its cyclicality and low margins, but also because of the uncertainty as to whether Despegar will still be a relevant player in the coming decades, and even though this risk of complete disruption is not so likely, it seems to be too high a risk to take (at least at current prices and conditions).