FG Trade/E+ via Getty Images

Introduction

CoreCivic (NYSE:CXW), the owner of correctional facilities, has experienced recent share price volatility. The company’s shares rallied by around 50% in the fifteen months after I wrote a bullish thesis last year. Unfortunately, the company announced termination of the company’s contract with ICE over its Dilley Detention Facility, and that sent shares on a wild ride of volatility. While prospects for CoreCivic’s idle assets may look promising, the upcoming election has me downgrading shares to a hold until the US political outcome is better known.

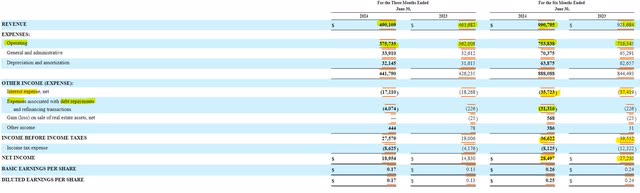

CoreCivic Earnings

Despite the political headwinds facing CoreCivic, the company has been growing sales and profits. During the first half of 2024, CoreCivic’s revenue grew by $70 million, or nearly 8% compared to the same period a year ago. Costs also grew, led by a $37 million increase in operating expenses. CoreCivic was able to control its overall cost growth to $44 million, which was less than sales growth. What hurt the company’s profitability in the first half was its debt repayments, which required it to take a $31 million charge. Despite this one-time charge, net income still increased by $1 million to $28 million for the first half of the year.

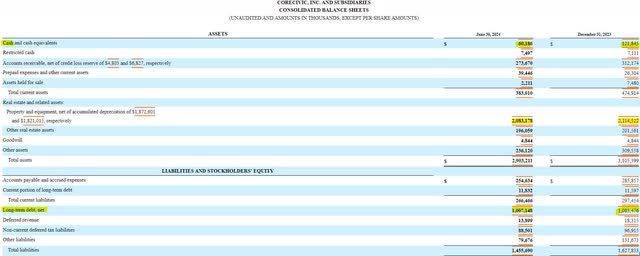

CoreCivic’s balance sheet consists heavily of property assets and accounts receivable on the asset side and long-term debt on the liabilities side. Investors should note that the company is carrying less than 50% of the net value of its assets in debt, which is a manageable amount of leverage. One item of concern is the drop in cash from $121 to $60 million. Shareholder equity edged down to just under $1.45 billion.

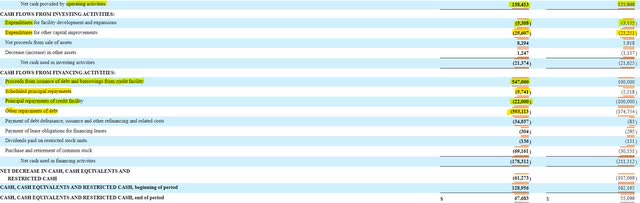

CoreCivic’s cash flow statement can provide some insight as to what led to the drop in cash on the balance sheet. Cash flow from operations, or the company’s ability to generate cash on a day to day grew by $13 million to $138 million during the first half of 2024. After taking capital expenditures into account, free cash flow also rose to $107 million. CoreCivic threw most of its free cash flow into debt reduction during the first half, but also purchased $69 million worth of common stock.

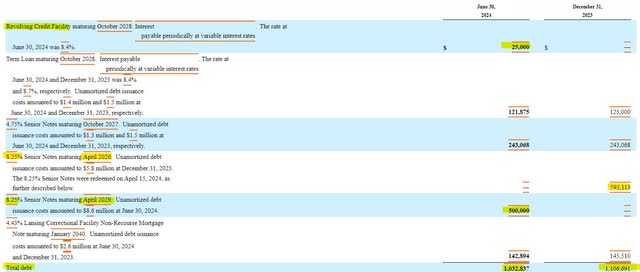

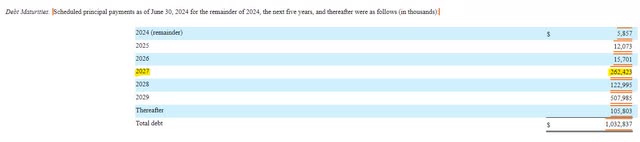

A Look at CoreCivic’s Debt

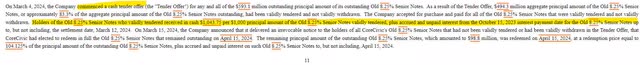

CoreCivic retired $593 million worth of debt maturing in 2026 during the first half of 2024. The company used the proceeds of a $500 million debt offering maturing in April 2029, $25 million from the company’s revolving line of credit, and cash on hand to pay off the notes. Investors should note that the new debt offering was at the same coupon rate as the old debt offering and slightly lower in principal, meaning that the refinancing created a slightly lower future interest expense.

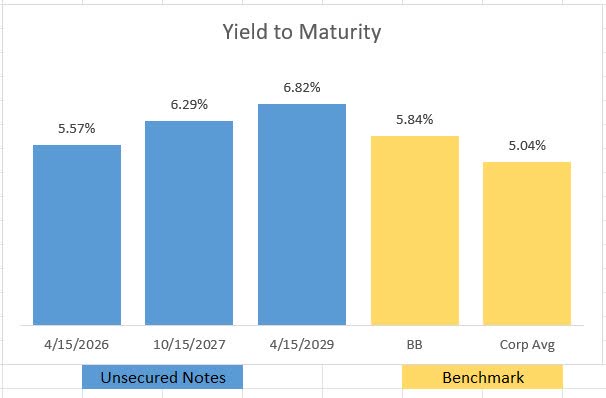

The refinancing of the 2026 notes greatly improved CoreCivic’s debt maturity profile. The company has less than $35 million of debt coming due over the next three years and does not face significant maturity until 2027 when $262 million in debt comes due. In the past, I’ve been a big fan of CoreCivic’s debt and at one point, they were generating good returns. However, like the shares, the debt has rallied, and I do not believe investing in any debt at these levels will provide an attractive return for investors.

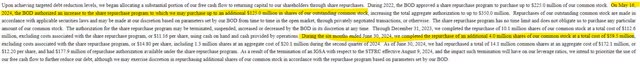

Why The Hold Rating

Based on the share buyback disclosure in the 10-Q, it appears as if CoreCivic management engaged in a share buyback after the plunge to under $12 per share in June. While share buybacks may put a floor on the price of the company’s shares, I’m not a fan of buying the stock at $14 per share. Additionally, the company’s cash balance is lower now than before the buyback and while CoreCivic has nearly $300 million in liquidity, borrowing money to buy shares would not be in the long-term interests of shareholders.

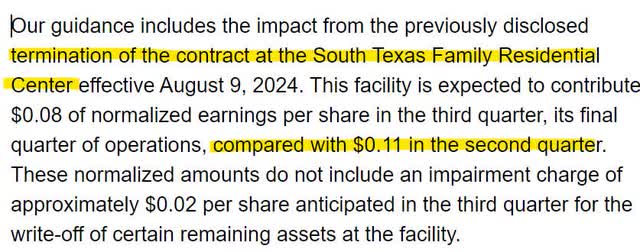

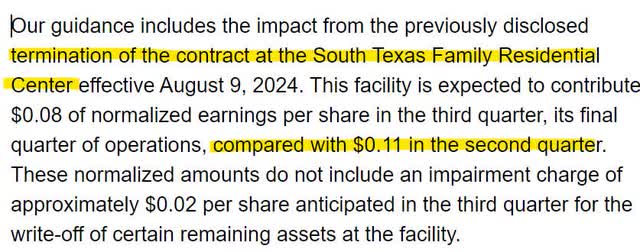

In addition to that, the Dilley contract termination is taking a big bite out of earnings. Per the earnings call, the Dilley contract accounted for 11 cents per share of earnings per quarter, or 44 cents per share per year. Analysts have already revised their 2025 estimates down to reflect the loss of the Dilley contract. Regardless of the outcome of the election, investors are going to be faced with a lame duck government this winter that could terminate more ICE contracts, further impairing CoreCivic’s earnings.

Earnings Call Transcript Yahoo Finance

Risks to Being on the Sidelines

Just as additional contract cancellations can push shares lower; it is possible that investors could miss out on a possible run-up to CoreCivic shares. During the conference call, management made several comments insinuating elevated interest in the leasing of idle facilities. There does seem to be a growing demand for the use of detention facilities near population centers and CoreCivic could benefit from winning new contracts and see its share prices surge.

Earnings Call Transcript Earnings Call Transcript Earnings Call Transcript

Conclusion

CoreCivic’s shares have bounced back from their June plunge, but the political uncertainties are too much to continue a buy rating. The Dilley contract cancellation has removed over 40% of next year’s earnings and there is no indication what the government’s stance will be towards the facilities that CoreCivic owns in the coming months. For now, I am rating CoreCivic a hold until there is more near-term certainty.