vchal

Prime Medicine, Inc. (NASDAQ:PRME) is a gene-editing biotech. Its main platform is Prime Editing, a next-generation technology that can deliver accurate, adaptable, and safer one-time treatments for genetic diseases. This approach can potentially correct specific mutations without the disruptive double-stranded breaks produced by other systems. The company has a diverse early-stage pipeline. PRME’s lead product candidate is PM359. PM359 is indicated for Chronic Granulomatous Disease [CGD] and was recently cleared for clinical trials. I believe PRME has a promising IP for one-time curative treatments across several genetic disorders, but it’s still too early to have a high conviction for their potential. Thus, I consider the stock a “Hold” for now. However, it can be a worthwhile addition to your watchlist to monitor its research progress over time.

PM359: Business Overview

Prime Medicine is a biotechnology company based in Cambridge, Massachusetts. It was founded in 2019 to develop next-generation gene-editing therapies. Interestingly, PRME is working at the cutting edge of gene editing. The company claims that, unlike other gene editing technologies that rely on double-stranded breaks, PRME’s IP corrects mutations precisely. Naturally, this is key because it avoids potential off-target effects. This is why I consider their main IP to be Prime Editing. This platform is designed for accurate, adaptable, and safer treatments for genetic diseases.

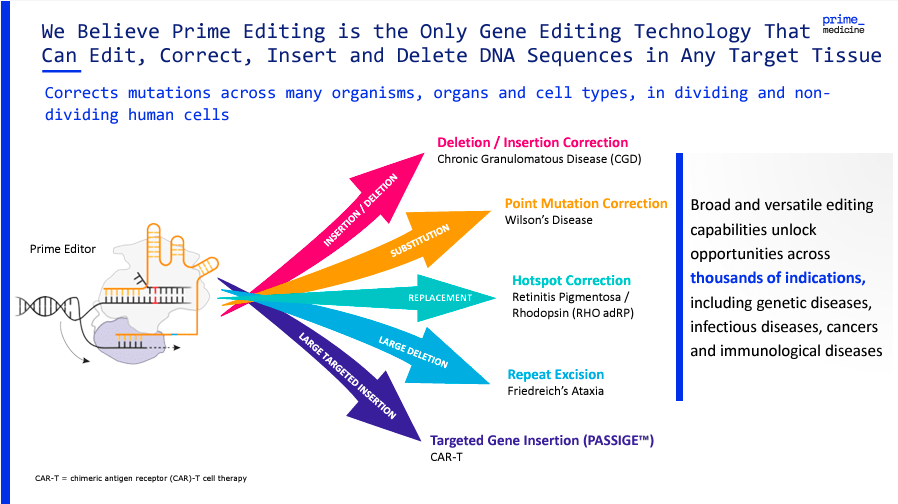

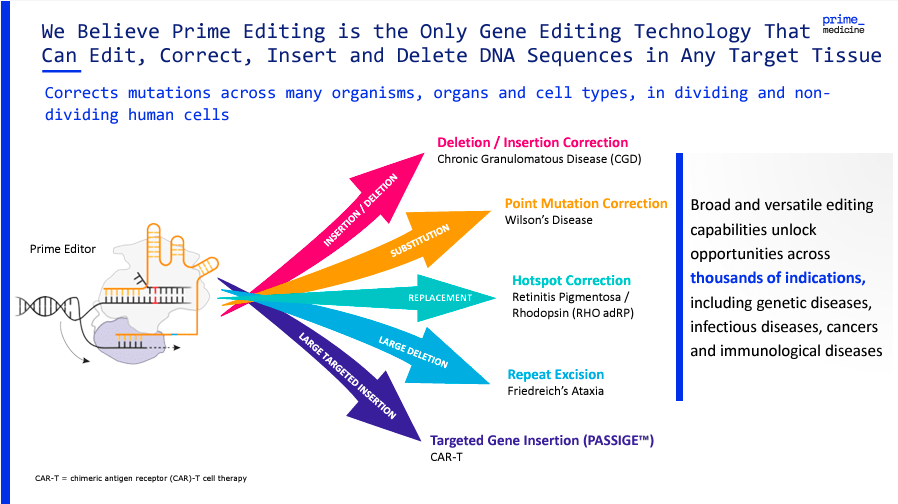

Source: Corporate Presentation. August 2024.

First, PRME begins with its Prime Editor, which locates the target DNA sequence that contains mutations. For this, PRME uses a Cas protein, often Cas9, and a Prime Editing guide RNA (pegRNA). PRME’s pegRNA is crucial, as it guides the Cas protein to the correct location and carries the corrected genetic information. Once the DNA target is identified, their Prime Editor reverse transcriptase (RT) domain synthesizes the corrected DNA sequence directly at the mutation site. This enzyme ensures precise genetic correction without altering other parts of the DNA.

It’s worth mentioning that another key feature of Prime Editing is that it can also remove unwanted DNA segments, assuring that only the desired sequence remains. In theory, this can be a highly precise technology, which I consider one of PRME’s main differentiating factors. Moreover, PRME’s platform includes Prime-Assisted Site-Specific Integrase Gene Editing (PASSIGE). PASSIGE is designed to repair various mutations by substituting, inserting, or deleting base pairs in the DNA sequence. This modular approach to gene editing could also make it highly adaptable and applicable across a wide range of genetic use cases.

Source: Corporate Presentation. August 2024.

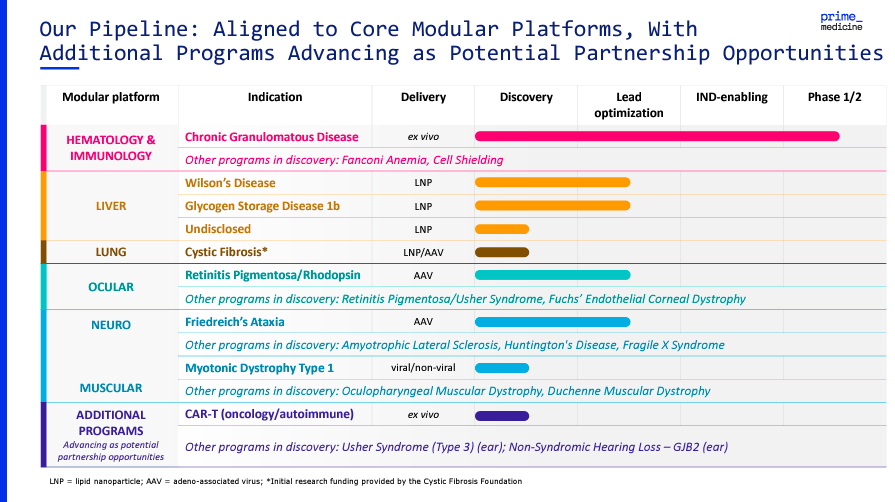

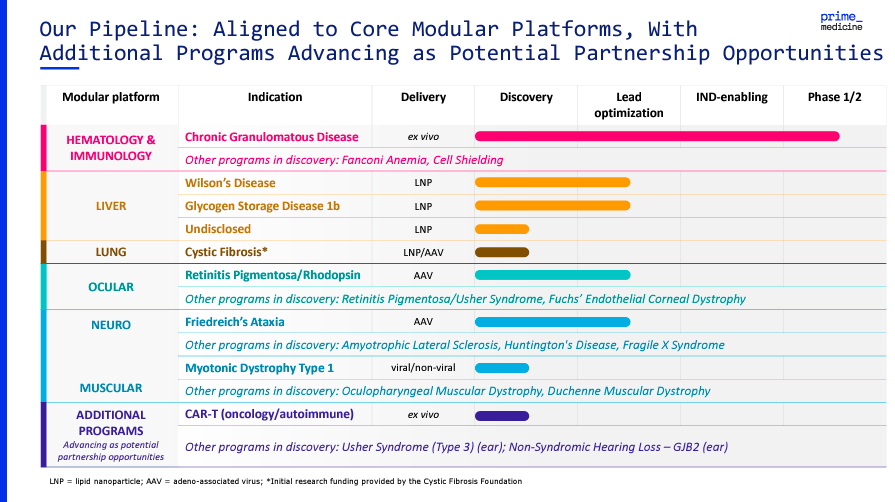

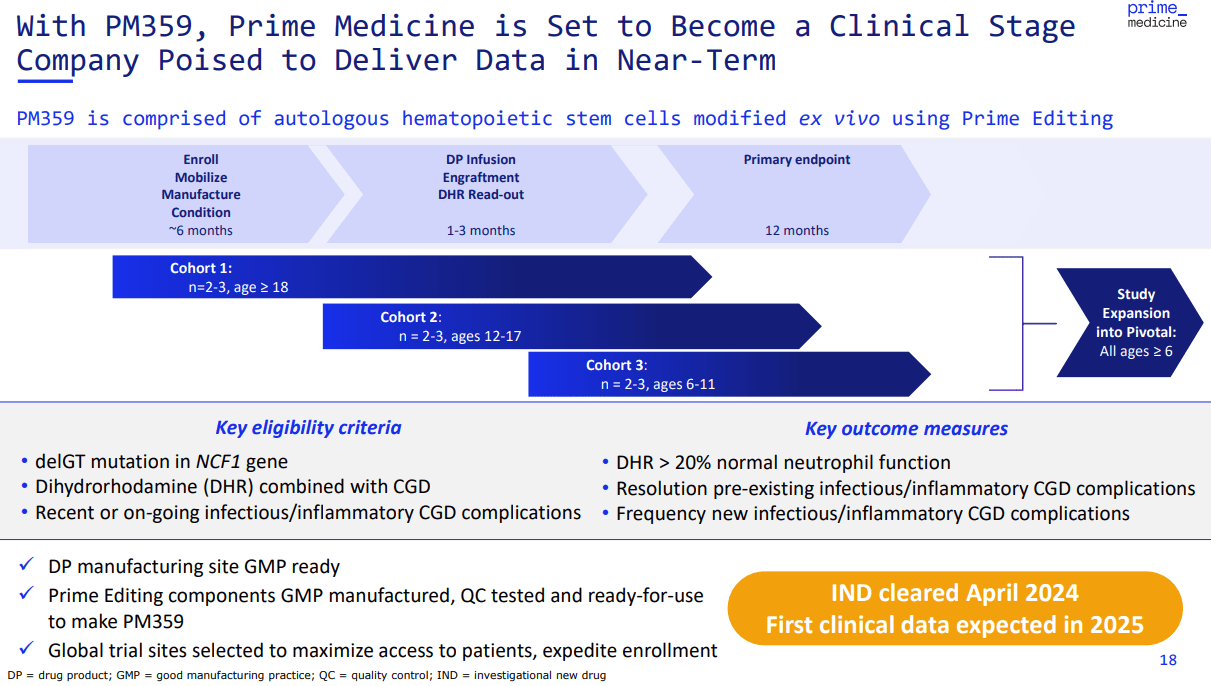

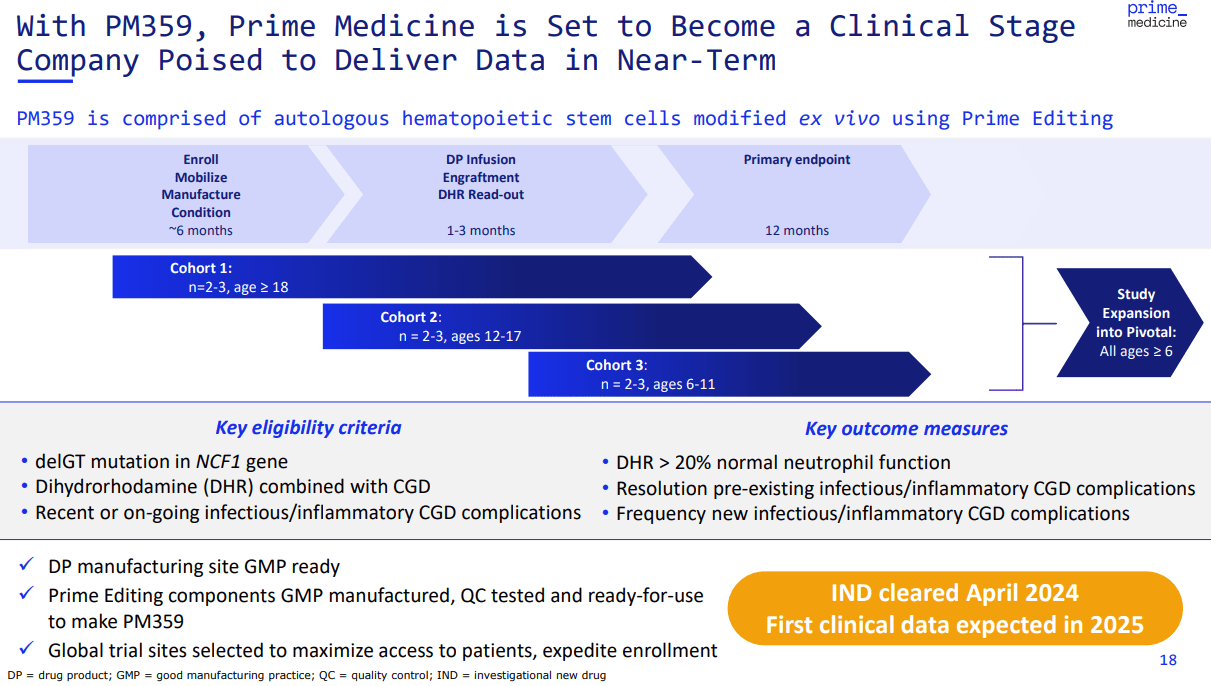

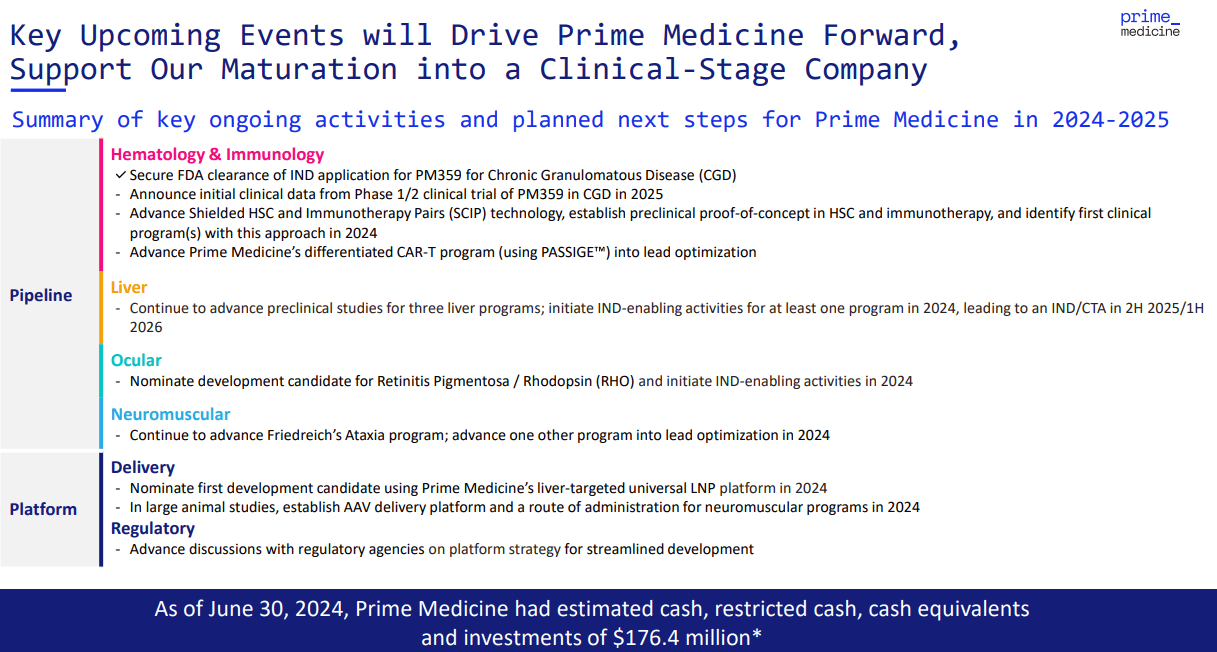

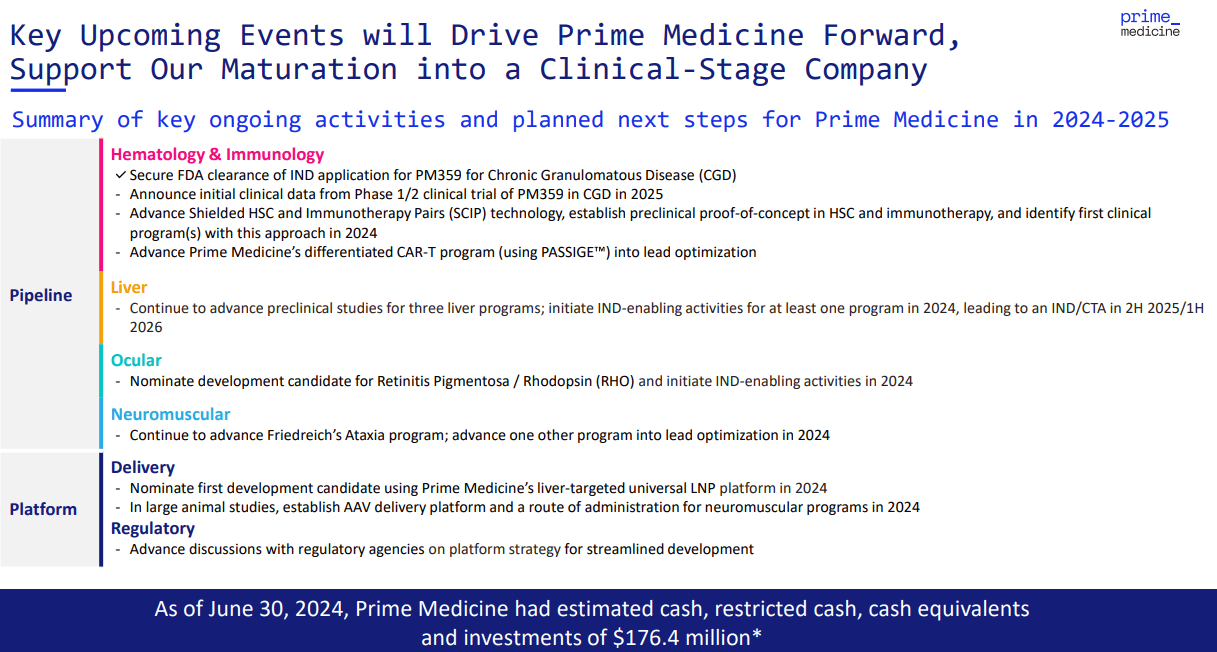

Currently, PRME’s pipeline tries to apply the versatility of its Prime Editing platform across multiple targets. However, it’s important to note that PRME’s candidates are still in early development stages. So, most of the company’s IP remains relatively speculative at this juncture. Nevertheless, their most advanced candidate is PM359. This is a Phase 1/2 hematology and immunology drug candidate. Specifically, the company is testing PM359 for chronic granulomatous disease [CGD]. The idea is to use an ex vivo delivery method to harvest a patient’s cells. Then, PRME genetically modifies and tests them. Once validated, the company reintroduces these edited cells into the patient’s bloodstream. In theory, this process causes patients to start producing more healthy white blood cells. Therefore, PM359 essentially repairs the root cause of CGD. This could make it a long-term cure because it equips the immune system to combat bacterial and fungal infections more effectively.

Beyond PM359: Progress and Updates

Beyond PM359, PRME’s pipeline has modular platforms targeting a wide range of genetic conditions. Most of these other programs are still in their preclinical Phases. For instance, the company works on Fanconi Anemia and Cell Shielding treatments. Also, their liver program targets diseases such as Wilson’s Disease and Glycogen Storage Disease 1b. As for PRME’s lung program, Cystic Fibrosis is their primary focus. Likewise, the company’s ocular program investigates treatments for Retinitis Pigmentosa, Usher Syndrome, and Fuchs’ Endothelial Dystrophy.

Furthermore, PRME’s IP includes neurological conditions such as Friedreich’s Ataxia. They are in the discovery stage for diseases like ALS, Huntington’s Disease, and Fragile X Syndrome. Their muscular program focuses on Myotonic Dystrophy Type 1, with potential expansions into other muscular dystrophies. Lastly, PRME applies its PASSIGE technology to CAR-T cell therapies for oncology and autoimmune conditions.

Source: Corporate Presentation. August 2024.

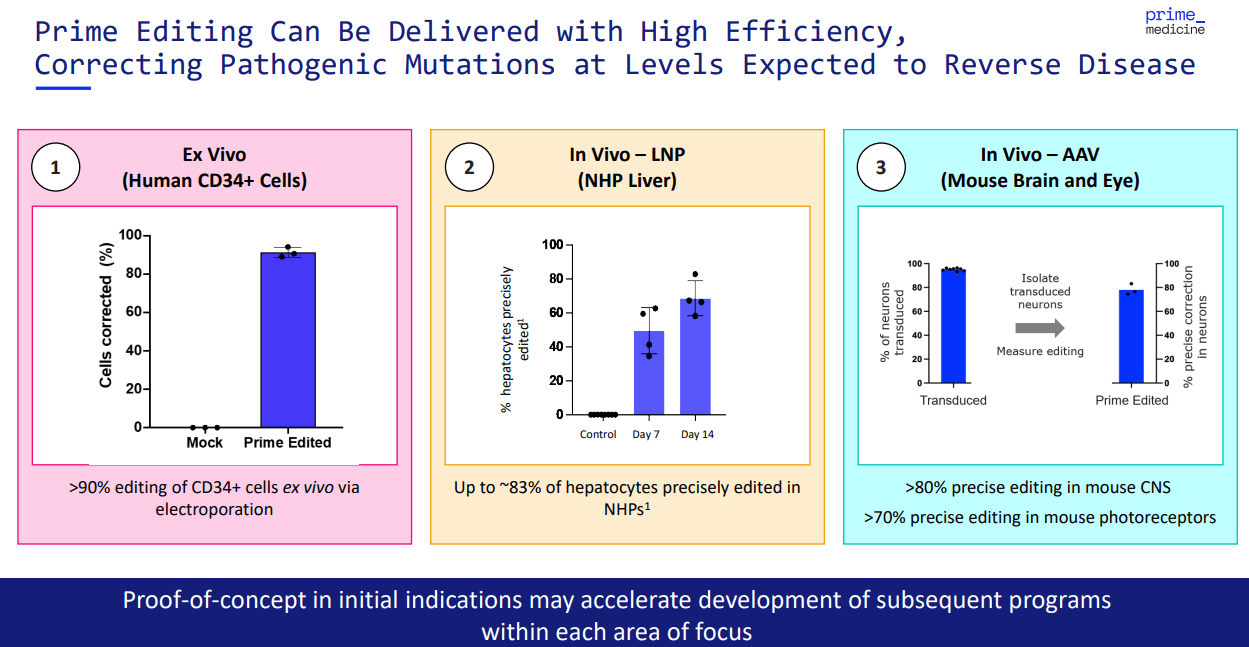

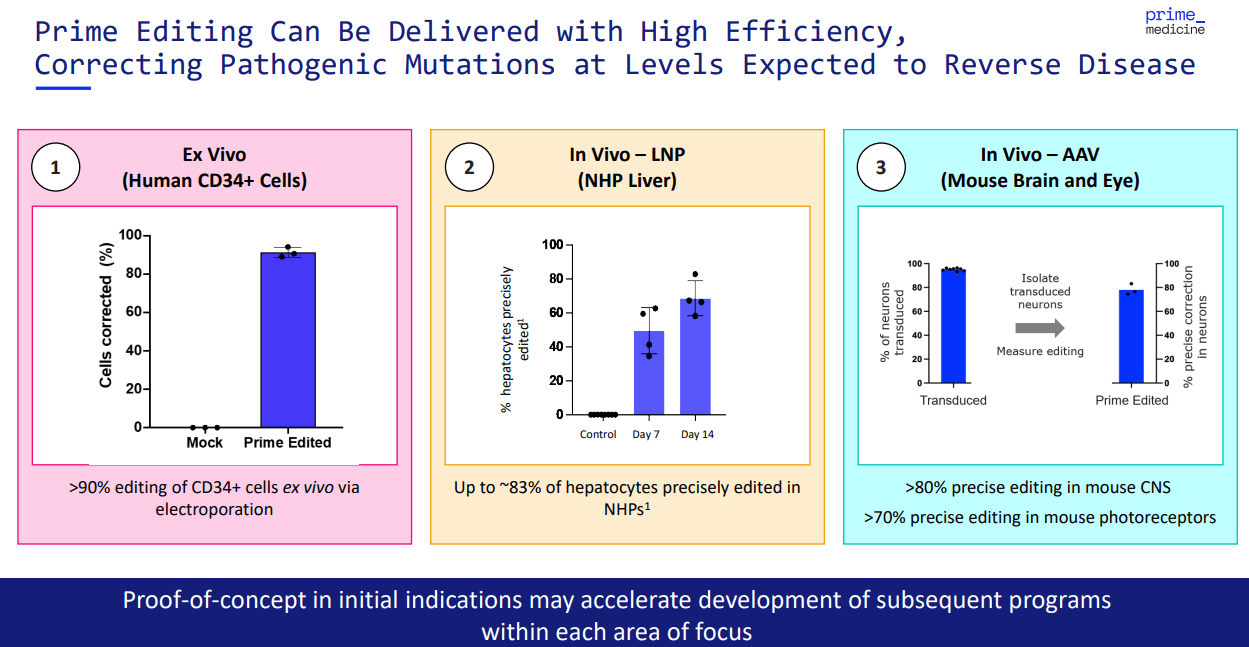

However, overall, the company’s delivery methods are tailored to the specific needs of each genetic condition. These include ex vivo techniques, where cells are edited outside the body and reintroduced to the patient. Alternatively, the company can use lipid nanoparticles (LNPs) to encapsulate gene-editing components inside cells. Also, PRME can use Adeno-Associated Virus (AAV) vectors to introduce the editing tools into target cells. So overall, it’s clearly a highly versatile set of technologies, which is why the company is exploring its application across many potential indications. Yet, I suspect this is why the company’s cash burn is also particularly high (more on this later).

Nevertheless, in January 2024, the Cystic Fibrosis Foundation provided up to $15 million to develop gene editing for a definitive cure for the disease. This funding includes $6 million upfront, an additional $6 million based on pre-clinical results, and $3 million if necessary. I think it’s a promising update that somewhat corroborates PRME’s potential. After all, this investment could accelerate their gene editing and explore cystic fibrosis applications.

Source: Seeking Alpha.

More recently, on April 29, 2024, the FDA approved initiating the first clinical trial for PRME after positive preclinical studies. The company’s early data seemed to confirm a mutation correction of over 75% of the edited stem cells in their mouse studies. However, while I consider these results impressive, they’re not guaranteed to translate into humans.

Source: Corporate Presentation. August 2024.

Nevertheless, that early data was enough to get the FDA clearance on PM359 for CGD trials. If successfully researched and commercialized, PM359 could become a one-time genetic therapy for CGD, so it’s a meaningful development in its sector. Management disclosed that their PM359 Phase 1/2 study will present early data by 2025.

In-Line: Valuation Analysis

From a valuation perspective, PRME trades at a market cap of $497.8 million, making it a microcap within its sector. However, the company’s balance sheet seems somewhat low on cash. As of Q2 2024, it holds $55.6 million in cash and equivalents, along with $107.3 million in short-term investments. This brings their total short-term liquidity to $162.9 million against no financial debts beyond regular operating liabilities. The book value stands at $196.6 million, which results in a P/B multiple of 2.5. This also aligns with the sector’s median P/B of 2.5, implying a relatively reasonable valuation.

Source: Corporate Presentation. August 2024.

However, despite this valuation, PRME is still in the early stages of development, with no product sales and minimal revenue from collaborations. I estimate the latest quarterly cash burn at $47.4 million by adding its CFOs and Net CAPEX. This implies an annual burn rate of approximately $189.6 million. This translates to a cash runway of about 0.9 years, which raises concerns, especially considering their most advanced drug candidate is only in Phase 1/2 trials. This means PRME is likely years away from securing any regulatory approvals or monetizing its IP.

Given these circumstances, I believe it’s almost inevitable that PRME will need to raise additional liquidity in the near term. Naturally, this would likely lead to some dilution. In my experience, companies often raise enough to cover 2 to 3 years of cash burn, suggesting a potential raise in the range of $379.2 million to $568.8 million. A raise of that magnitude would be a significantly dilutive event. Therefore, I currently rate PRME as a “hold,” but I do believe it’s a good addition to your watchlist. Their unique approach and diverse pipeline make it worthwhile following as their research progresses. But for now, I think it’s prudent to remain neutral on the shares.

Caveats: Risk Analysis

Alternatively, PRME could focus on reducing its substantial cash burn by narrowing its R&D scope to its lead hematology candidate. In my view, the company’s diverse pipeline may be spreading its limited resources too thin. By concentrating on PRME’s most promising candidate, the company could potentially reduce expenses and cash burn. So, if they raised a more moderate amount with a lower cash burn, PRME could transition into a more long-term sustainable operation.

Source: TradingView.

Nevertheless, based on the current financial data, I can’t consider PRME as a viable investment. Their high cash burn, short runway, and early-stage IP are substantial red flags that could cause significant shareholder losses if mismanaged. Even though their IP is promising due to the recent FDA IND clearance for PM359, I ultimately lean neutral based on those concerns. But conversely, the FDA clearance is undeniably an important milestone for PRME as it’s its first open IND. Investors’s optimism may be sustained until we get their initial data from the Phase 1/2 trials. If that occurred and the data is promising, it could help support PRME’s stock price. However, even if their trial update is favorable, I doubt that alone would drive substantial upside potential, particularly given PRME’s substantial dilution risks.

Watchlist for Now: Conclusion

Overall, I think PRME has an intriguing early-stage IP that could blossom over time into something valuable. Their recent FDA clearance for PM359 is a promising sign that their research efforts are heading in the right direction. Nevertheless, it’s still a relatively early-stage program. At the same time, its cash runway is short, and its cash burn appears quite high for a relatively small biotech such as PRME. Also, this adds considerable dilution risks that we can’t ignore, so ultimately, this tapers my optimism on the shares. Thus, I rate PRME a “Hold” for now, but I believe adding it to your watchlist is worthwhile. Its IP is promising on paper, and favorable updates could change my neutral outlook over time.