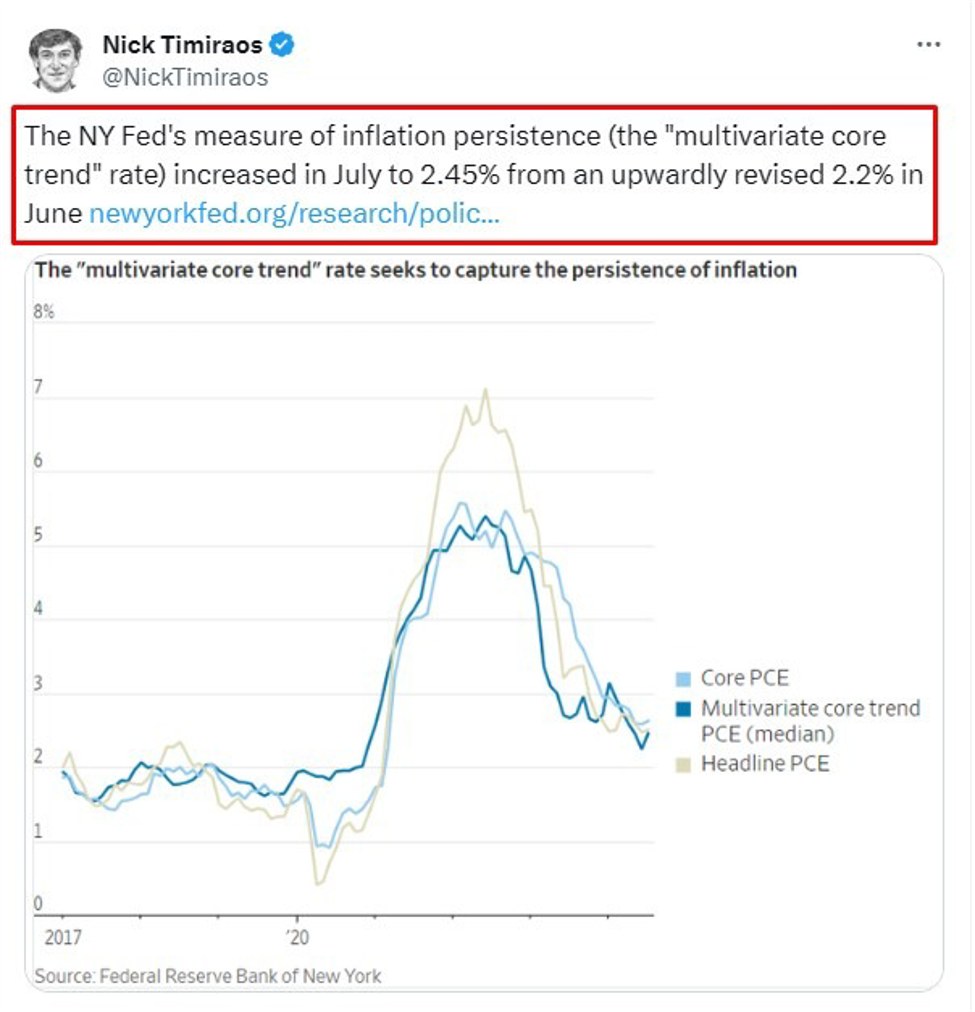

This tweet from the Wall Street Journal’s Fed-watcher Nick Timiraos:

While the data is for July (with an upwardly revised June result thrown in) it was published by the Fed on September 3.

If you are familiar with this inflation measure, this rise offers another reason that the speculation of a 50bp rate cut from the Federal Open Market Committee (FOMC) on September 18 is misplaced and that a 25bp rate cut is more on the money.

—

If you are unfamiliar with the data …. buckle up, here we go:

The Multivariate Core Trend (MCT) Inflation is a metric developed by the New York Federal Reserve to provide a more accurate and reliable estimate of the underlying inflation trend in the US economy. It seeks to address some of the shortcomings of traditional inflation measures, such as the Consumer Price Index (CPI) or the Personal Consumption Expenditures (PCE) index, by focusing on long-term inflation trends rather than short-term fluctuations caused by volatile price changes.

Here’s a summary of key points about the MCT inflation measure:

1. Purpose and Background:

- Traditional inflation measures (like CPI or PCE) can be affected by temporary factors like energy or food price shocks, which may not reflect the true underlying inflation trend.

- The Multivariate Core Trend (MCT) inflation measure was developed to extract the persistent component of inflation by filtering out transitory noise.

- MCT uses multiple data sources, models, and statistical methods to provide a more stable reading of inflation trends.

2. How It Works:

- MCT inflation is based on a multivariate statistical model, which means it considers various variables or components of the economy that affect inflation, such as core prices (which exclude food and energy), economic activity, and financial conditions.

- The model separates short-term noise (temporary price changes) from the underlying, longer-term trend of inflation.

3. Why It’s Important:

- Provides policymakers, economists, and investors with a clearer signal of where inflation is headed in the long term, free from temporary disturbances.

- It is particularly useful for central banks, like the Federal Reserve, as it offers a tool to gauge inflation pressures that may influence monetary policy decisions (e.g., interest rate changes).

4. Comparison with Other Inflation Measures:

- CPI (Consumer Price Index) and PCE (Personal Consumption Expenditures) include all items, including volatile categories like food and energy, which can lead to larger month-to-month swings.

- Core CPI or Core PCE excludes food and energy prices but still may be influenced by short-term price movements in other areas.

- MCT goes beyond these exclusions and provides an inflation measure that looks at multiple economic factors and isolates the persistent inflation trend.

5. Application in Economic Policy:

- The Federal Reserve and financial markets use the MCT as one of the tools to assess inflationary pressures and guide decisions on interest rates and other monetary policies.

- It helps policymakers focus on medium- to long-term inflation outlooks, reducing overreaction to short-term volatility in prices.

6. Challenges and Considerations:

- Like any model, the MCT has limitations, as it depends on the assumptions and variables included. There is always a degree of uncertainty in predicting future inflation trends.

- However, by using a multivariate approach, it attempts to provide a more holistic view of inflation dynamics than single-measure indices like the CPI or PCE.

In summary, the New York Fed’s Multivariate Core Trend Inflation aims to offer a more stable, long-term view of inflation by using multiple economic variables to filter out short-term price volatility.