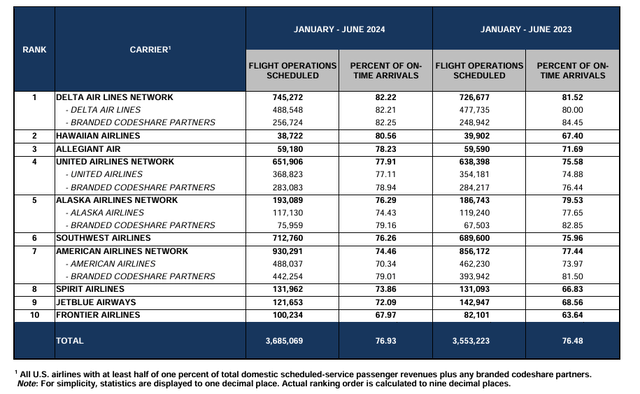

Alvin Man/iStock Editorial via Getty Images

JetBlue Airways (NASDAQ:JBLU) is in the midst of a difficult transformation that came about as a result of a number of strategic challenges with resultant leadership changes that were necessary because of a years-long decline in the company’s financial performance. JBLU stockholders received good news on Thursday, September 5 with improved third quarter 2024 guidance. There is very likely even more good news not just in that guidance but coming in the weeks ahead that should propel the stock forward. It is worth taking a quick trip down memory lane to identify the challenges JBLU has faced, its plan to correct them, its latest news, and identify additional factors that should help the stock.

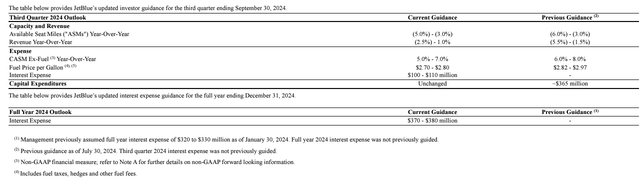

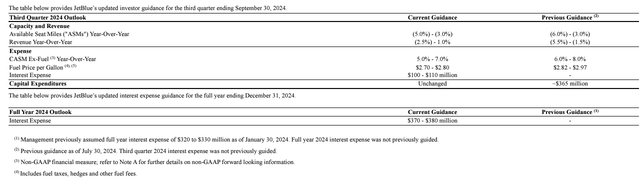

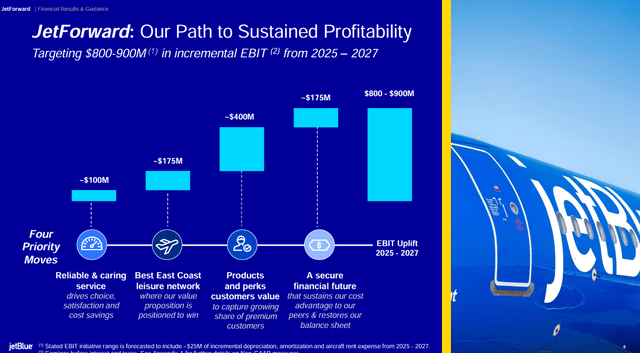

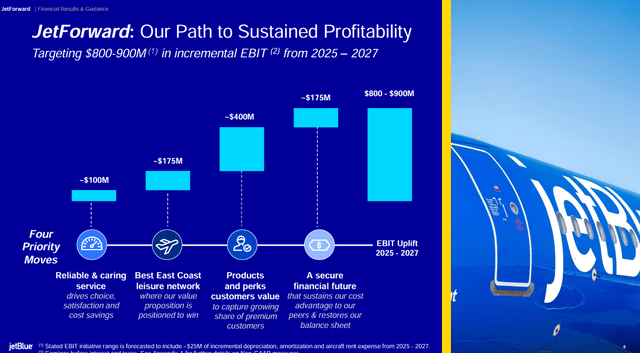

JBLU guidance as of 5 Sep 2024 (JetBlue)

A Great Idea that Hasn’t Worked as Planned

JetBlue was created just a quarter-century ago to replicate at New York City’s JFK airport what People Express Airlines had accomplished at Newark, New Jersey airport – bring low fares to dozens of destinations in the U.S. and across the Atlantic from the largest travel market in the United States – NYC – which had largely been passed over in the growth of low-cost air travel in the U.S. after domestic airlines were deregulated in 1978. While People Express ultimately merged into other entities, its Newark hub was transformed into a large hub, which has been passed to United Airlines (UAL). New York state legislators wanted something similar at JFK airport; JFK airport had and still has more runway capacity than Newark. JFK airport has long been the primary international airport for New York City and is used by scores of foreign airlines, but it was lacking low fare competition in the late 1990s. JBLU was granted slot pairs at JFK airport roughly equal to the size of American Airlines (AAL) at that airport, where American was the largest airline.

JetBlue differentiated itself by offering an amenity-rich product, unique among low-cost carriers. JBLU has offered key initiatives like seatback audio/visual systems on narrowbody (domestic) aircraft as well as free WiFi. While it originally had only coach/economy seats, it has added extra legroom economy seats and its business class Mint product on some longer haul aircraft. JBLU quickly gained share esp. from NYC to the Caribbean and S. Florida where American had traditionally been strong and then grew further as it expanded to the West Coast. In the wake of 9/11, JBLU expanded in Boston as Delta Air Lines (DAL) and US Airways contracted there.

JBLU JetForward pillars (JetBlue)

As the big 6 legacy airlines at the time took turns going through chapter 11 reorganizations, JBLU’s industry leadership was challenged. Delta shifted assets, including from its hub at DFW airport to NYC where it aggressively grew and expanded at JFK, possibly because the FAA removed slot controls at JFK and LaGuardia airports for a period of time in the wake of 9/11 amid depressed travel demand. Several carriers started copying JBLU’s success in S. Florida and gained access to slots from NYC airports as part of legacy carrier asset acquisitions and required divestitures. JBLU’s profits began to decline as the decade of the 2010s progressed due to increased competitive pressure and higher costs as the airline matured. While JBLU was a star during the post 9/11 period, it has struggled to keep up with the recovery of other airlines in the post-covid period.

The airline, under previous leadership, embarked on a number of initiatives, including adding flights in areas of the country outside of the East Coast where JBLU is known. Its operational reliability deteriorated as it pushed its fleet and employees much more than other airlines while operating in some of the nation’s most congested airspace. It expanded to Europe believing that it would be able to provide low premium cabin fares on longer-range versions of the A321 similar to what it had done in U.S. transcontinental markets. Amidst a falling stock and deteriorating financial results that did not show signs of improving, JBLU’s CEO left the airline earlier this year.

JBLU’s strategic misfires over the past ten years have intersected with at least three other U.S. airlines. In 2016, JBLU and Alaska Airlines (ALK) fought to acquire Virgin America, a high amenity startup airline inspired by Richard Branson’s Virgin Group, which focused on a premium transcontinental product. JBLU lost the bidding war, which would have given the New York City-based airline a greater presence on the West Coast. Although ALK dismantled large portions of Virgin America’s transcontinental U.S. network and decided against retaining the special fleet that was required for premium transcon flights, JBLU lost its ability to grow through a merger with a carrier that was strong in another part of the country, in this case on the West Coast. JBLU Mint grew out of the recognition that it could build a better product in-house.

Although JetBlue’s early success heavily came at American’s cost, the two entered into their second marketing arrangement in 2019 when American was struggling under U.S. Dept. of Transportation pressure to fully use its takeoff and landing slots at New York’s LaGuardia and Kennedy airports after years of shrinking its presence in the NYC market. American and JetBlue launched The Northeast Alliance, which sought to share revenue, jointly plan schedules and swap slots at LGA and JFK airports as well as collaborate in other airports. The DOJ filed suit against the arrangement, and a New England federal court sided with the DOJ, ordering that the Northeast Alliance be terminated. Even before the Northeast Alliance case was settled, JetBlue began the process to outbid Frontier (ULCC) and Spirit (SAVE) airlines in a merger the two had planned. JBLU succeeded at outbidding ULCC but the DOJ once again objected to JBLU’s proposal which involved eliminating SAVE, an ultra-low cost carrier that the DOJ believed served as necessary price competition to higher cost airlines including JBLU.

JBLU’s history is full of a fear of being stuck as a mid-sized carrier in the midst of much larger airlines and without the network size or very low prices to attract price-sensitive fliers or higher level of amenities that the big legacy carriers have. Its strategic future remains unclear. Corporate raider Carl Icahn, who has a history in the airline industry, took an interest in JetBlue and appears to be putting pressure on management to turn the company around, although apparently with a lighter touch than Elliott is doing with Southwest Airlines (LUV).

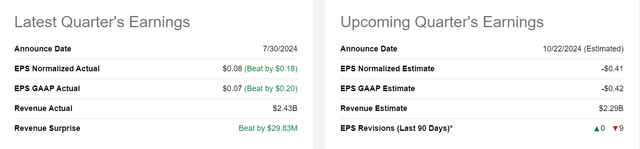

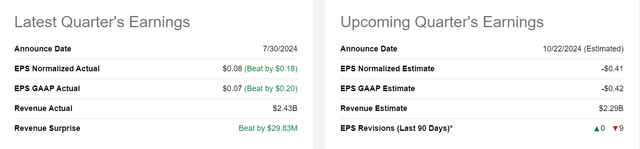

JBLU earnings 5 Sep 2024 (Seeking Alpha)

A Turnaround is Underway

JetBlue’s new executive team has laid out their priorities and the first is to appeal to the core premium leisure passenger which is traditionally what built JBLU; they also will further develop the JetBlue brand, including with their loyalty program. In addition, they are focused on reducing capital spending while their turnaround plan takes effect. Dissecting their priorities, particularly in light of recent actions, shows that they want to try less to pursue business passengers, which they have struggled to win over from the legacy carriers. In addition, they are trying to reduce the amount of direct competition with those legacy carriers, even if it means reducing JBLU’s size in other airline hubs – or leaving some cities altogether. They recognize that their brand does have strong attributes and want to continue to develop it.

JBLU also recognizes that one of the greatest hindrances to its success has been its poor operational reliability; the airline frequently ranks in 9th out of 10 places among U.S. airline networks. Because of the number of late-night flights, it is very difficult for JBLU to reset its operation when bad weather and lengthy air traffic control delays strike the Northeast. Even though the NE has some of the most delay-prone airspace in the U.S., other airlines outperform JBLU’s on-time performance at the same airports indicating that having sufficient backup capacity and margin for overcoming operational challenges is necessary, something in which JBLU’s previous management was not willing to invest.

JetBlue’s outlook was dark going into the third quarter after managing a small profit for the 2nd quarter but expecting that could be its last for 2024. Thursday’s announcement of improved guidance was a breath of fresh air for investors; the stock jumped 7% on the day. The Seeking Alpha quant system and Wall Street investors remain on the sidelines, believing a better day will come while SA analysts are more bullish.

JBLU’s announcement of improved guidance notes that it expects to carry more traffic than it expected, due in part to better near-term bookings and also the CrowdStrike (CRWD) IT failure that hurt several airlines, with Delta (JBLU’s most direct competitor) the hardest hit. United was the second most impacted airline and is also large in NYC, where JBLU had the opportunity to capture some of the lost revenue from those two airlines. While UAL has not given an estimate of the impact of the CRWD failure on its revenue, DAL has said that it did not carry hundreds of millions of dollars of revenue that it expected to carry, and it is certain that good portions of that revenue flew on JBLU. Assuming that the improvement in near-term booking extends beyond the CRWD recovery period for the industry, the improvement in near-term bookings indicates that business and higher-end leisure passengers might be giving JBLU a chance once again.

Part of JBLU’s guidance indicates that they dramatically improved their on-time performance during the 3rd quarter. From an industry perspective, the summer has been challenging from an air traffic control (ATC) standpoint, with Newark airport particularly hard hit as part of the FAA’s rearrangement of ATC responsibilities for the NYC area. JBLU had previously begun to exit lower-performing flying, so they were in a better position to recover from operational challenges than they had been in the past. While the fall is typically a strong operational period for airlines, JBLU could be in a good position to strengthen its operational improvements ahead of the winter travel period. Six months or more of solid improvements will be seen in DOT data and will become known to the seasoned, repeat travelers that JBLU wants to carry.

JetBlue has also committed to improvements in its finances. Historically, the airline has been fairly conservatively run from a financial perspective, but very low profits have taken a toll on the balance sheet. Fearing a lengthy turnaround, management is tapping the debt market by using its loyalty program as collateral in a move that mirrors what the big 3 legacy airlines did during the Covid period. Adding $2 billion in cash will boost the airline’s cash but will come at interest rates approaching 10%. The announcement of the debt offering triggered downgrades from all three of the major credit reporting agencies. All three noted that the turnaround will take time, a reality of which management appears to be keenly aware.

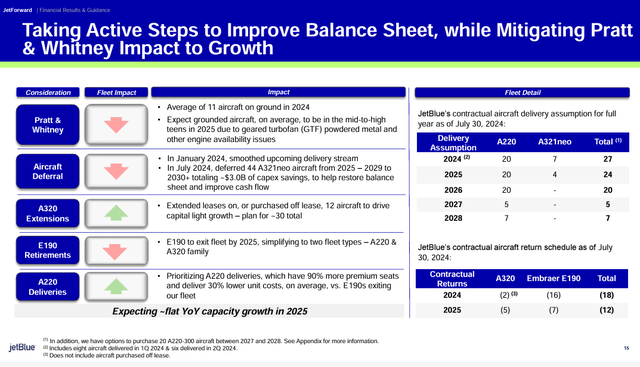

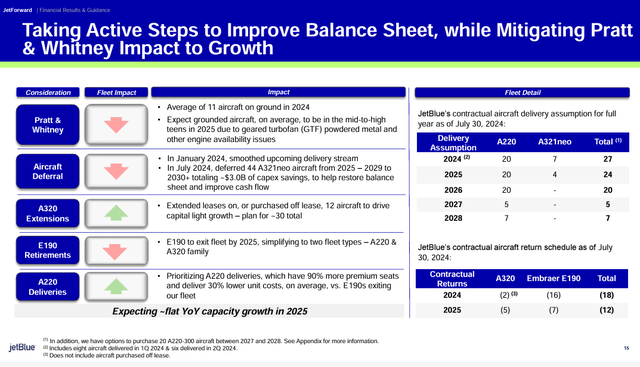

JBLU’s financial focus includes reducing capex by deferring dozens of new aircraft deliveries while also extending the leases or acquiring a number of in-service A320 aircraft that were planned for retirement. JBLU will take delivery of 11 A321NEOs in 2024 and 2025 and then take none for the next three years. It will continue to take delivery of the A220, the 140-seat all-new narrowbody aircraft that has coast-to-coast range at per seat economics that not only rival the A321NEO but also provide much better economics than the E190 large regional jets which JBLU will be retiring.

JBLU fleet actions July 2024 (JetBlue)

JBLU’s decision regarding its A321NEO deferrals is tied to the resolution of the Pratt & Whitney (RTX) Geared Turbofan engine issues which have affected hundreds of aircraft around the world; JBLU says that it expects to have approximately a dozen aircraft out of service (a low single percentage of its fleet) in 2024 with that percentage growing by up to 50% in 2025. A number of airlines are expecting the GTF engine situation to improve in 2026 and beyond, meaning that JBLU and other airlines will be able to put aircraft back in service that have remained grounded (or portions of its GTF-powered fleet) for up to 3 years, proving growth capacity that the airlines already have in their fleets. In addition, extending leases on the smaller A320 aircraft while taking delivery of new very efficient A220 aircraft will limit the amount of capacity JBLU has to put into the market.

Macroeconomic Factors are on JBLU’s Side

Beyond JBLU’s own actions, which seem to be gaining favor with investors, JBLU is likely to receive benefits from two key macroeconomic factors: lower fuel prices and an expected reduction in interest rates.

JBLU notes in its updated guidance that the midpoint of fuel prices is likely to fall by 15 cents/gallon or about 5%. Crude oil prices have sunk based on weakening demand including from China and expectations of increased global supply. While all airlines and transportation companies will benefit from lower fuel prices, cutting tens of millions of dollars in expenses potentially over the remainder of the year will provide a healthy boost for an airline that reported just $25 million in net income in the second quarter.

Crude Oil futures 5 Sep 2024 (Seeking Alpha)

All eyes remain on the Federal Reserve and expectations that it will lower interest rates, which increased fairly quickly to address post-covid inflation. Abundant data indicates that lower-end consumers esp. in the domestic market have been harder hit than more affluent consumers. While JetBlue has tried to focus its sales efforts on the premium travel segment, its global airline competitors have done a better job of satisfying the demands of consumers that are seeking more premium travel experiences, esp. in the international marketplace. As JBLU moves to a more premium experience, mirroring moves by other low-cost carriers, it will certainly benefit from lower interest rates, particularly as temperatures fall in the Northeast and consumers start thinking about and booking winter vacations.

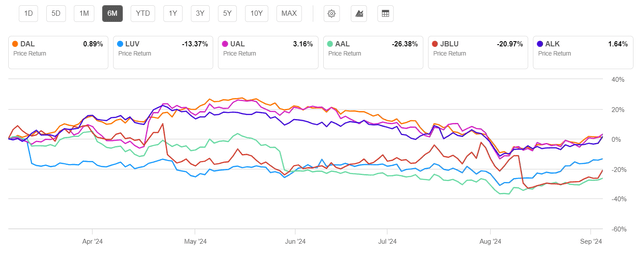

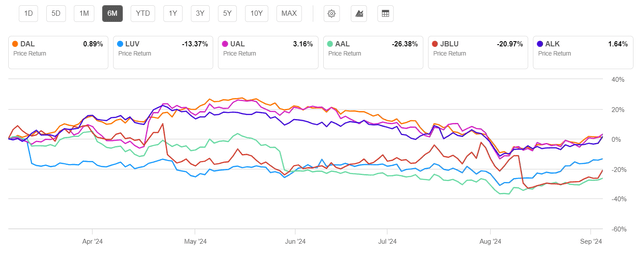

Big 6 US airlines (Seeking Alpha)

The Future Looks Brighter Than the Recent Past

JetBlue remains strategically in a very difficult place. It is a niche airline trying to carve out a segment of the market both geographically and from a product standpoint that other airlines can and have duplicated. Larger airlines have taken back share that JBLU gained from them in JBLU’s early days, and the competitive pressure is not likely to decrease. JBLU management does appear to be accepting their current strategic position and pulling back from the plethora of market expansion strategies and involvement with other airlines that has cost JBLU enormous amounts of money and distracted it from its core market focus.

The U.S. airline industry remains fragile. Costs have risen esp. driven by labor, even as the industry has struggled to find the right levels of capacity esp. in the competitive domestic leisure segment of the industry. At least half of the big 6 airlines are struggling either with margins well below the industry average or with major strategic challenges. JetBlue’s opportunity is to break away from being in the “challenged” tier in order to move to the more stable financially higher tier of airlines where JBLU existed for many years. JBLU’s recognition of its challenges, its strategies to fix its mistakes, and assistance from some macroeconomic factors that will benefit many parties should help propel the stock even further forward.