Justin Paget

It looks like Atlantica Sustainable Infrastructure’s (NASDAQ:AY) acquisition will be completed in a few months, leaving investors to consider where to redeploy the cash. We are sure some investors would have preferred keeping their shares given the high dividend yield, especially now that interest rates in many countries are being lowered, with the U.S. expected to start reducing them in September. It is likely that this interest rate development would have increased Atlantica’s share price, but now it is more or less anchored to the offered price of $22 per share. With that in mind, let’s look at some potential replacement options to redeploy the cash that will be paid to shareholders once the acquisition is completed.

Farewell Atlantica Yield

Atlantica Yield is one of the few remaining YieldCos left, but not for much longer if the acquisition closes in the next few months as expected. This type of company became very popular in the renewable energy sector some years ago, with many having “sponsors” that would sell the YieldCo new assets. The attraction for many investors was the high dividend yields, as most returned the majority of their earnings or cash available for distribution (CAFD) to shareholders. Unfortunately for investors, sponsors would sometimes get in trouble and the company would end up being acquired at a relatively low price. For example, this happened to Terraform Power when its sponsor SunEdison filed for bankruptcy, and Terraform Power was eventually bought by Brookfield Renewable (BEP)(BEPC). While Atlantica’s sponsor, Algonquin Power & Utilities (AQN), has not gone bankrupt, it has experienced financial difficulties and was a motivated seller of the company. As the majority shareholder, it had a significant sway on whether an offer would be accepted for the company or not.

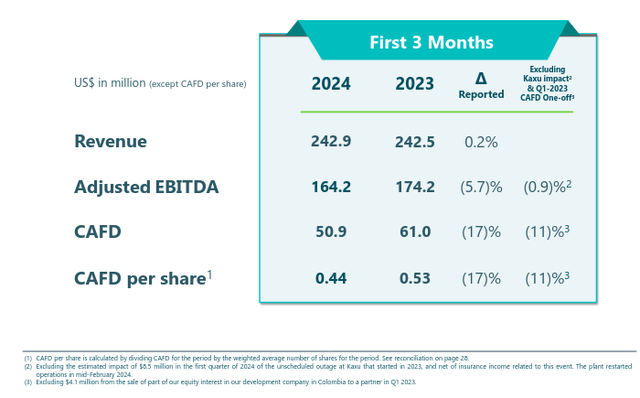

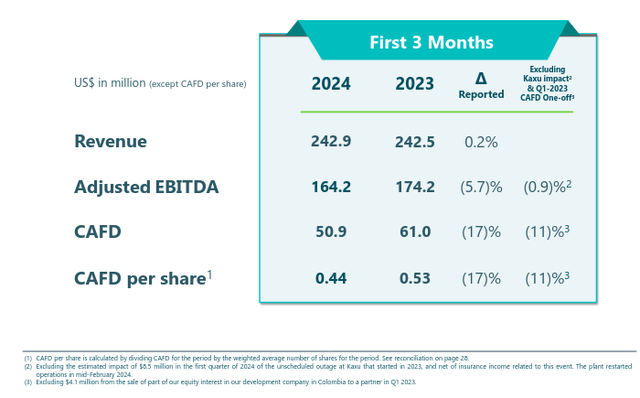

In our last article before rumors of the acquisition surfaced on Bloomberg, we argued that Atlantica was too cheap with a 10%+ CAFD yield. Since then, the company has significantly outperformed the S&P 500 Index (SP500)(SPY). Once it became known that the company was in advanced acquisition negotiations, we wrote another article evaluating what we considered a fair valuation would be, but warning that the company might accept an offer even if it undervalued the company, given that it was well known that Algonquin was a very motivated seller. We still had some hope that if there were multiple bidders, the company might receive a decent buyout offer, but unfortunately the final offer was relatively underwhelming. In any case, it is probably a good time for Atlantica Yield investors to start looking for alternative places where they can redeploy some of the capital returned as a result of the buyout. The last thing we will say about Atlantica Yield is that its most recent quarterly results were relatively disappointing, with CAFD coming in relatively weak and barely approaching the $0.445 per share quarterly dividend.

Atlantica Sustainable Infrastructure Investor Presentation

Northland Power

Even though it is currently paying out most of its free cash flow as dividends, Northland Power (NPI:CA)(OTCPK:NPIFF) is not technically a YieldCo. We see that as a good thing, as it means it develops new projects on its own, instead of relying on a “sponsor” to sell it fully developed projects. We much prefer this type of integrated company, as we believe a lot of the value actually resides in finding, developing, and contracting new projects.

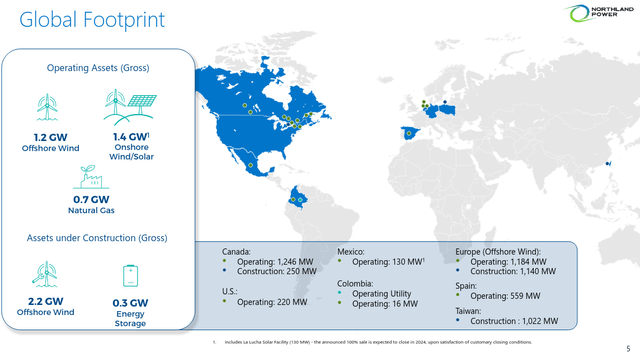

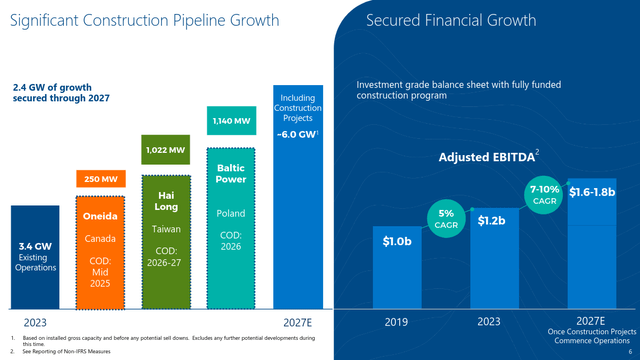

Northland Power Investor Presentation

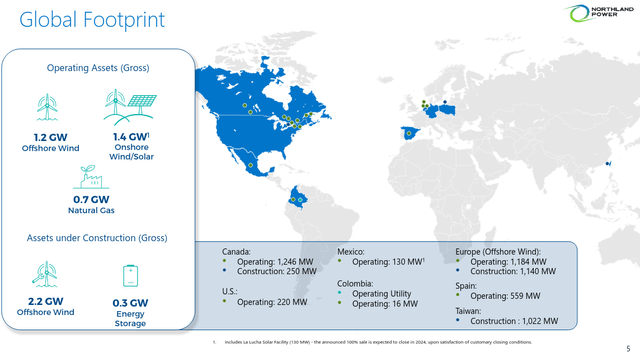

In addition to owning and operating several renewable energy projects, Northland Power is also a developer, with a very substantial project pipeline. These include projects currently under construction, as well as greenfield opportunities to be developed further into the future. The company is mostly focused in offshore wind, but has some onshore wind and solar, as well as a utility company in Colombia. The company pays dividends monthly and currently sports a dividend yield of close to 5.9%. It has three major projects currently in progress that should add significantly to its EBITDA and cash flows once completed. We wrote an article about the company in April, and we believe this is a very attractive opportunity in the renewable energy sector at current prices.

Northland Power Investor Presentation

Innergex Renewable Energy

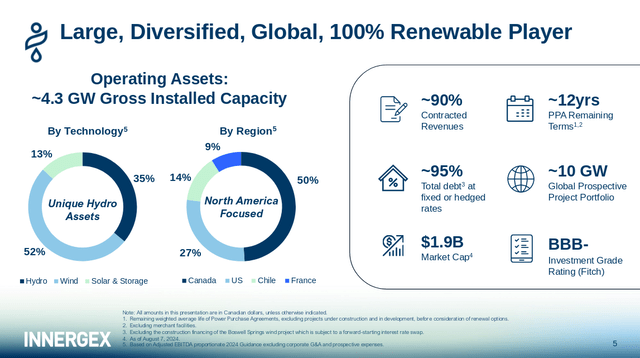

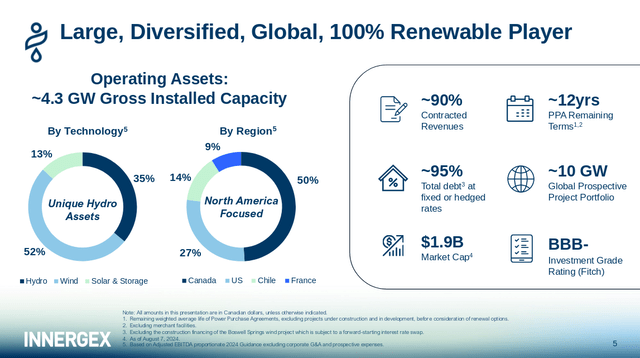

Another Canadian company that develops, owns, and operates renewable energy assets is Innergex Renewable Energy (OTCPK:INGXF). The company is relatively small and recently disappointed investors with a dividend reduction, but we saw this as a positive as it would enable the company to be more aggressive in developing its projects pipeline. We like that the company has good diversification in terms of technologies and geographies, and in particular we appreciate that it owns significant amounts of hydro projects, which, we believe, have the strongest competitive moat and have a very long useful life.

Innergex Investor Presentation

Brookfield Renewable

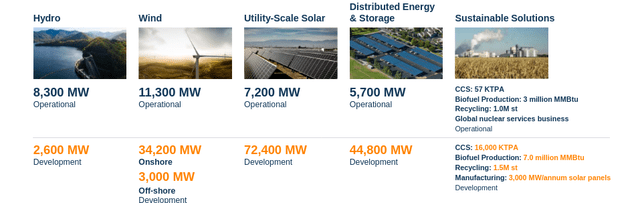

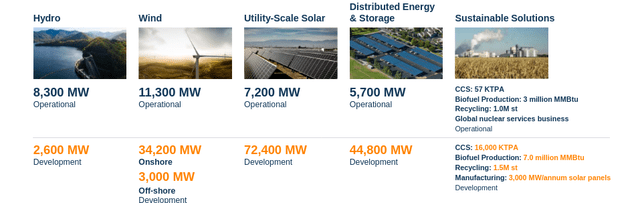

Finally, there is Brookfield Renewable (BEP)(BEPC), probably the biggest player in the industry with a massive global scale. It currently has over 30 GW of operating renewable energy assets, and has the potential to reach 200 GW when its development pipeline is included. The company has the ability to find, develop, build, and contract assets across several different renewable energy technologies. It is important to note that there is some debate as to whether Brookfield Renewable remains a completely renewable energy company after their acquisition of the Westinghouse Electric Company, which provides services to the nuclear energy industry.

Brookfield Renewable Investor Presentation

Brookfield Renewable often recycles capital as well, and it has a strong track record of selling mature assets at attractive prices, which it then recycles into M&A opportunities or into its own development pipeline. The company recently made news with the massive agreement signed with Microsoft (MSFT), to provide them with more than 10.5 GW of renewable energy capacity in the U.S. and Europe starting in 2026.

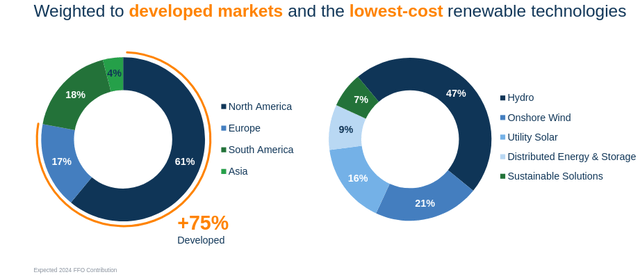

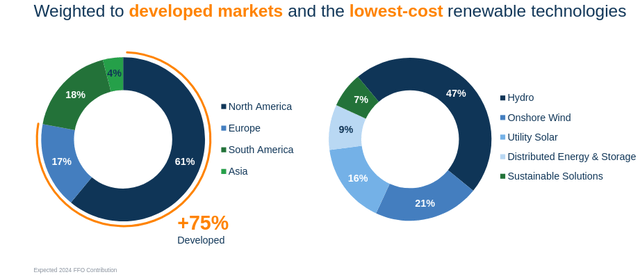

Similar to Innergex, Brookfield Renewable has a good portion of its generating assets in the form of hydropower, and about three quarters are located in developed countries.

Brookfield Renewable Investor Presentation

Other Alternatives

There are other alternatives, with some like NextEra Energy Partners (NEP) having high dividend yields. Still, we believe investors should look at more than just the dividend yield, and we have shared our three best ideas in the sector.

For those looking for a more diversified option, there is the iShares Global Clean Energy ETF (ICLN) and the Global X Renewable Energy Producers ETF (RNRG).

Other interesting options include traditional electricity generation companies that now produce most of their energy from renewable sources, such as Ørsted (OTCPK:DNNGY) and Iberdrola (OTCPK:IBDRY). An important point with Ørsted is that they have paused their dividend for a few years to strengthen their balance sheet, after a series of setbacks with their U.S. offshore wind projects.

Valuations

Most of these companies pay most of their free cash flow as dividends, Innergex currently being the exception, after it reduced its dividend by half to be able to invest more in its development pipeline, and even repurchase some shares now that they are trading at a low valuation.

Brookfield Renewable reports funds from operations (FFO) and its payout is currently very elevated, but it has a history of managing to grow its cash flows despite retaining a small percentage of its free cash flow by recycling mature projects and bringing in partners to help finance new developments. We believe that this track record deserves a premium, compared to companies like Atlantica Sustainable that have a much weaker CAFD growth history. Northland Power is paying most of its free cash flow too, but it is expected that its payout ratio will improve once its three main projects begin producing energy.

| Company | Dividend Yield |

| Innergex | 3.86% |

| Northland Power | 5.78% |

| Brookfield Renewable Partners | 5.70% |

| Brookfield Renewable Corporation | 4.98% |

| Atlantica Sustainable Infrastructure | 8.14% |

Takeaway

Unfortunately, it might be time for investors to start evaluating where they will reallocate the cash they will receive for their Atlantica Sustainable shares. We explored some similar companies, although they all currently have lower dividend yields.

On the positive side, these companies are much more than pure YieldCo’s, capable of developing and contracting assets themselves, meaning they can capture more of the value of new renewable energy projects. Atlantica Sustainable has a very high dividend yield, but usually did not leave much free cash flow for reinvestment purposes. Still, it will be missed by many investors who appreciated its high dividend yield, but it is now time to start looking where to reinvest that capital.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.