Fundamental

Overview

The NFP report on Friday gave the USD a boost as

the data under the hood was better than feared. The probabilities for a 50 bps

cut decreased as a result and they are now standing around 27%.

A soft US CPI report

tomorrow might increase those probabilities a little bit, but we will still

head into the FOMC decision with a 25 bps cut as the most probable scenario.

Nevertheless, the trend in

the labour market remains skewed to the downside and time will tell if the

Fed’s cuts will be enough to stop this trend.

For the Fed, the market

sees a 73% probability of a 25 bps cut at the upcoming meeting and a total of

110 bps of easing by year-end. For the RBA, there’s a 93% chance of no change

at the upcoming meeting with a total of 20 bps of easing expected by year-end.

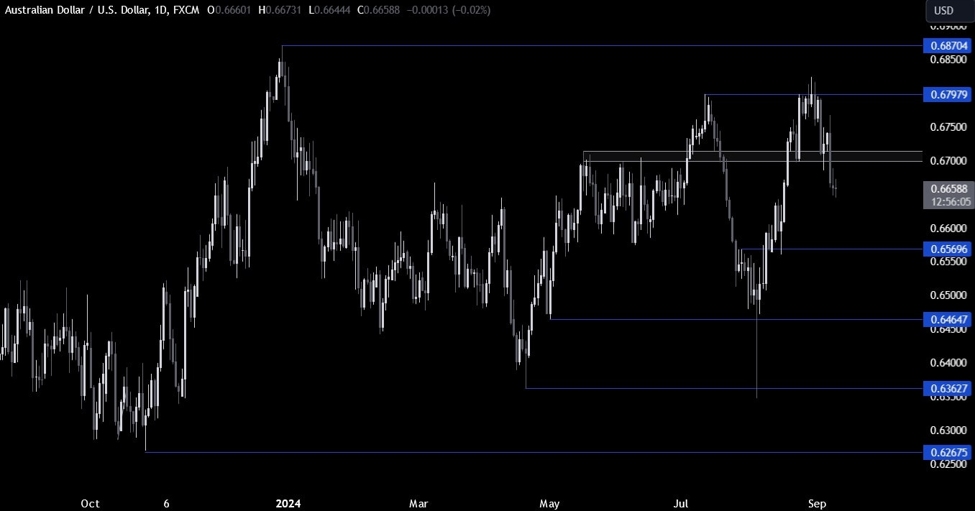

AUDUSD

Technical Analysis – Daily Timeframe

AUDUSD Daily

On the daily chart, we can

see that AUDUSD broke below the key 0.67 support

and extended the drop into the 0.6650 level. The price is now right in the

middle of two key levels. The sellers will want to see a pullback into the 0.67

resistance to position for a drop into the 0.6570 level next with a better risk

to reward setup. The buyers, on the other hand, will want to see the price

breaking higher to position for a rally into the 0.68 handle.

AUDUSD Technical

Analysis – 4 hour Timeframe

AUDUSD 4 hour

On the 4 hour chart, we can

see that the bearish momentum has lost some momentum near the swing level

around the 0.6643 level. This is where we can expect the buyers to step in with

a defined risk below the level to position for a rally into the 0.67 resistance.

The sellers, on the other hand, will want to see the price breaking lower to

increase the bearish bets into the 0.6570 level.

AUDUSD Technical

Analysis – 1 hour Timeframe

AUDUSD 1 hour

On the 1 hour chart, we can

see that we have a minor resistance around the 0.6673 level which created a

tight range with the 0.6643 support. The buyers will want to see the price

breaking higher to increase the bullish bets into the 0.67 resistance, while

the sellers will look for a break lower to position for a drop into the 0.6570

level. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we have the US Small Business Optimism Index. Tomorrow, we get the US

CPI report. On Thursday, we have the latest US Jobless Claims figures and the

US PPI data. On Friday, we conclude the week with the University of Michigan

Consumer Sentiment report.