Diversity Studio/iStock via Getty Images

South Korea’s integrated telecommunication service provider, KT Corporation (NYSE:KT) has risen 22% (YoY) and has gained 32.71% over the last 5 years. It released its financial earnings for Q2 2024 which saw operating revenues remain constant on a year-over-year basis and a slight drop of 1.6% (QoQ). Despite the hit on earnings, I will explain why the transformation of KT Corporation into an artificial intelligence (tele)communication technology (AICT) company and the road to 6G makes it a hold into 2025.

Revenue segregation

KT Corporation has four main revenue segments: ICT, Finance, Satellite TV, and real estate. Out of the total operating revenue of KRW6.548 trillion ($4.93 billion) posted in Q2 2024, the ICT segment accounted for 69.5% of the total revenue at KRW4.548 trillion ($3.43 billion).

KT Corporation Q2 2024 Sec Filing

It represented a 3.12% (QoQ) decline from KRW4,694.8 trillion ($3.54 billion) realized in Q1 2024. There was a small uptrend in business-to-customer (B2C) revenue in Q1 2024 compared to Q2 2024 due to more premium subscribers in the telecommunication segment represented by the Wireless sector, broadband services, and general media.

KT’s revenue has been stable since 2022, but structural change is needed in 2025 to augment the company’s growth and profitability.

The idea of infusing AI into KT’s ICT segment is not only welcome but necessary as the latter is the largest revenue earner of the company.

First of all, the potential of AI in the telecommunication industry is worth considering since it will take innovation to a whole new level. It will help the company to process large amounts of data and clear information flows from sensors in real time. Additionally, it can forecast issues of maintenance, control the flow of data traffic in an intelligent fashion, and optimize the pathways of communication. Overall, it will aim to raise the reliability of communication devices that are connected and lower cases of downtime efficiently. In Q2 2024, KT released its innovative vision, indicating that it would transform itself into an AICT telecommunication company.

The 2024 ESG report stated,

To stimulate innovation as an AICT company, KT has launched an AI transition that spans the entire company. We operate a range of programs to develop the basic IT competence of our employees and increase the accessibility of the AI Certificate for Everyone (AICE), contributing to the stronger AI competence of Korean people and the popularization of AI. In addition, we will prepare to lead the AI era by hiring and nurturing experts in the AI and digital fields.”

There has been a lot of interest among telecommunication companies to adopt Generative AI to increase profitability and expand client bases. In the beginning of 2024, a report by the McKinsey Group released a survey stating the following,

Most telco leaders we surveyed say they are developing gen AI solutions that range from pilots to full-scale deployments, and leading telcos such as AT&T, SK Telecom, and Vodafone have made much-publicized early gen AI commitments and launched trials. Some telcos around the world have started to experience significant double-digit percentage impact from this technology.”

It is about augmenting sales, innovations, improving customer service, and growing automation of repetitive tasks. KT indicated that it already has in place a special AI web portal known as Gen.AIDU aimed at helping employees utilize generative AI in promoting security and work efficiency. There is also Jenny, a knowledge assistance service (KAS) to guide in the response to queries and offering of product information. According to research, large generative AI is set to revolutionize “autonomous wireless networks, allowing multi-modal GenAI models trained over Telecommunication data to smoothen certain downstream tasks eliminating the need for building and training dedicated AI models for each specific task and paving the way for the realization of artificial general intelligence (AGI)- empowered wireless networks.”

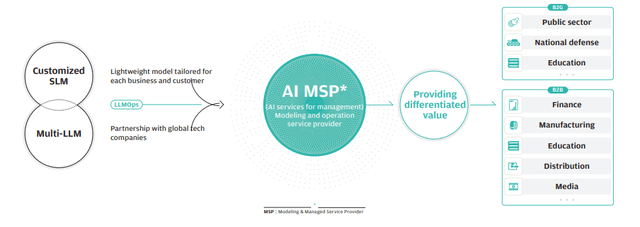

KT’s AICT is set to adopt the following model where SLM is a small language model and LLM is a large language model (affecting the entire corporate DNA).

The road to 6G

The deployment of generative AI in solving challenges within communication networks in the advanced 5G environment is being studied as a possible outcome in the realization of the 6G network. Despite being in the future, the 6G network is expected to have various advantages such as stronger network reliability, higher levels of data rates, reduced latency, robust security, energy efficiency, and easier integration of AI. It is the interplay “between generative AI and the advanced 5G network” that will spearhead the evolution of 6G.

South Korea’s Ministry of Science and ICT has been at the forefront in advocating for the rollout of the 6G network and even invested KRW220 billion for the establishment of related standards by 2025. While the rollout of this network is expected between 2028 to 2030, it may come even sooner depending on other factors such as the establishment of “low orbit satellite communication” that is necessary for 6G.

Dell recently announced its collaboration with SK Telecom (SKM) among other actors using AI to change its internal procedures including revamping customer engagement. On its part, SKM stated, “We will continue to innovate to provide AI services that save our customers’ precious time and enhance convenience and quality of life.”

That being said, KT stated that it was anticipating “AI sales of KRW1 trillion in 2 years with customized AI-centered businesses” after obtaining cumulative orders of more than KRW800 billion in AI logistics and AICC in 2023. By 2027, KT is planning to invest at least KRW7 trillion ($5.2 billion) to strengthen its competitiveness in AI-related sales.

Risks

Local South Korean media outlets implicated KT Corporation in the “deliberate infection of more than 600,000 torrent service users with malware.” KT is yet to offer an official statement and may likely face legal consequences if confirmed. Still, the company has about 25 million mobile subscribers (30% market share) with broadband customers at 9.8 million (40% market share) and 12 million fixed line/ VoIP customers indicating a substantial number of users may be unaffected by the malware.

Further, KT has a market capitalization of $7.57 billion and plans to invest more than 68% of this valuation on AI indicating its willingness to change the company’s corporate DNA by 2027. Failure to proceed with the plan of turning KT into an AICT may affect future earnings.

The company also has a total debt of $8.18 billion against a cash position of $3.63 billion with higher interest payments that may affect the AICT rollout. This technological shift may also mean higher costs that will likely take a toll on earnings. However, a dividend cut may not be necessary if the company manages to stabilize its profits in the long term. KT’s revenues are also recovering after taking a hit in Q4 2023. Net profit was down 2.4% (YoY) to KRW1.65 trillion at the time (despite record annual sales of KRW26.4 trillion). The company has bounced back posting a net profit of $284.7 million and a 55.17% (YoY) growth in cash.

Valuation

The forward price-to-earnings ratio stands at 5.50X against the industry average of 17.63X. It leaves off a difference of -68.79% showing the company is undervalued and we may see an upside into 2025. Also, the forward annual dividend yield of 6.99% is 99.04% higher than the sector average of 3.51%. It is also higher than that of SKM which sits at 6.08%.

Takeaway

KT Corporation is a hold as it seeks to change its corporate structure to infuse AI into its most profitable ICT segment. It expects to invest more than 68% of its market cap into this transformation to establish an AICT company. I believe this strategic shift is essential for the company’s success and I will be watching for further progress before establishing an entry point.