- 92 of 101 economists expect a 25 bps rate cut next week

- 65 of 95 economists expect three 25 bps rate cuts for the remainder of the year

- 54 of 71 economists believe that the Fed cutting by 50 bps at any of the meetings as ‘unlikely’

On the final point, five other economists believe that a 50 bps rate cut for this year is ‘very unlikely’. Meanwhile, there were thirteen economists who thought that it was ‘likely’ with four saying that it is ‘very likely’ for the Fed to go big.

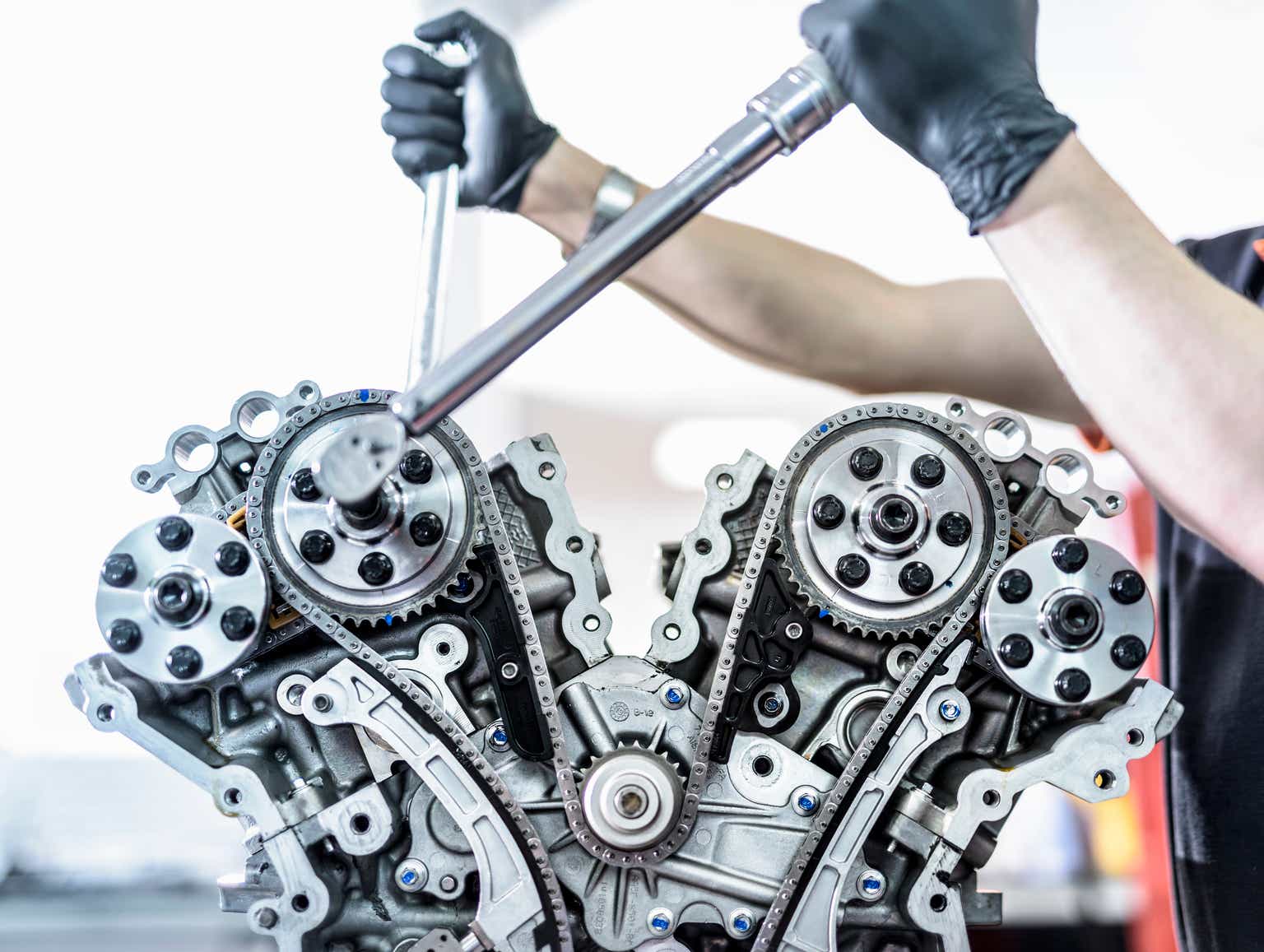

Anyway, the poll points to a clear expectation for the Fed to cut by just 25 bps at its meeting next week. And for the year itself, there is stronger conviction for three rate cuts after taking on that narrative back in August (as seen with the image above).

Some comments:

“The employment report was soft but not disastrous. On Friday, both Williams and Waller failed to offer explicit guidance on the pressing question of 25 bps vs 50 bps for September, but both offered a relatively benign assessment of the economy, which points strongly, in my view, to a 25 bps cut.” – Stephen Stanley, chief US economist at Santander

“If the Fed were to cut by 50 bps in September, we think markets would take that as an admission it is behind the curve and needs to move to an accommodative stance, not just get back to neutral.” – Aditya Bhave, senior US economist at BofA