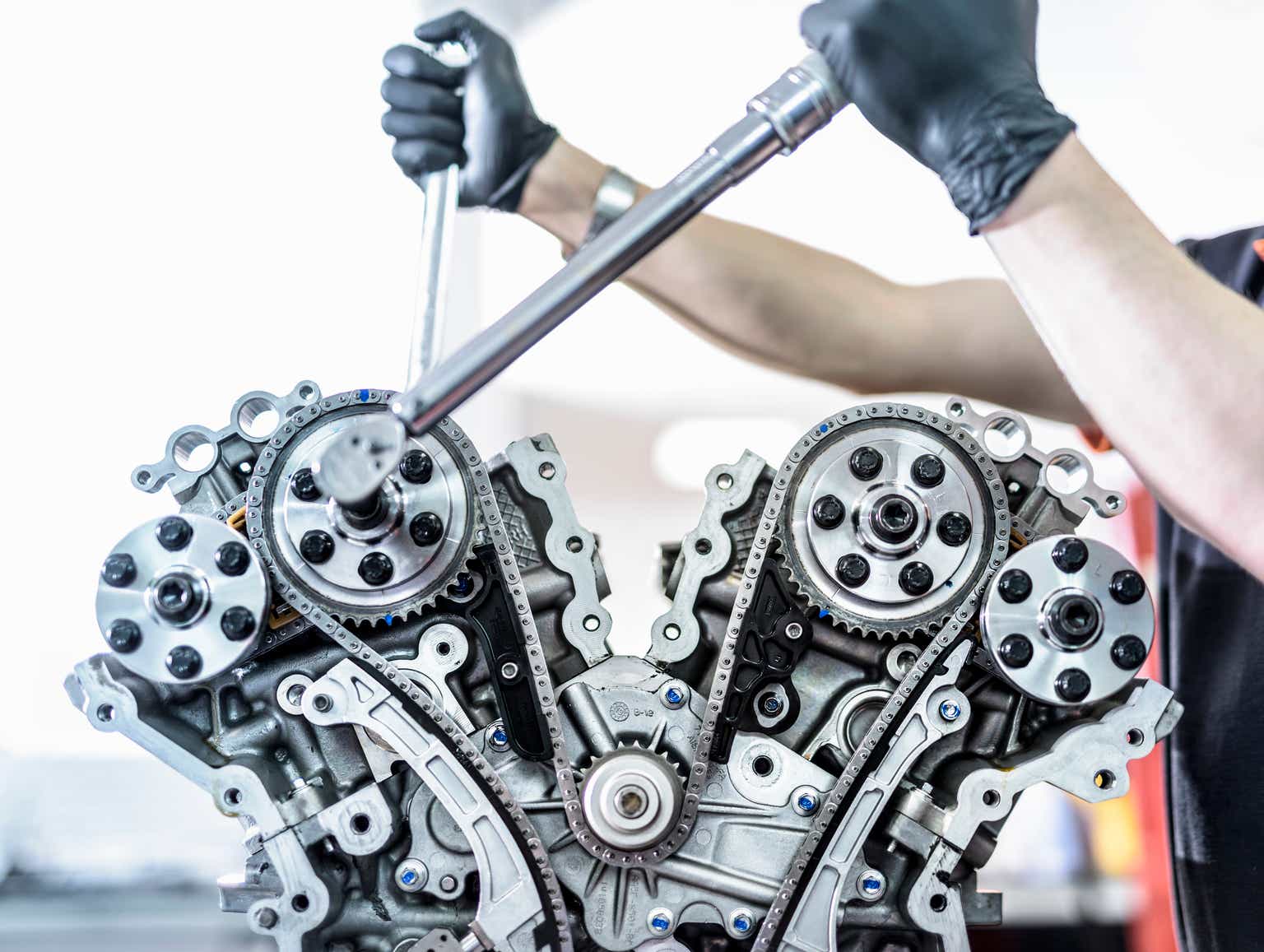

Monty Rakusen/DigitalVision via Getty Images

There are nearly as many types of profitable business as there are stars in the sky. For a lot of companies, growing profits means driving a spike in revenue, or broaching the launch of a new product. Sometimes, however, companies aren’t generally increasing revenue but are still making a growing amount of money based on improved margins.

Today, I want to look at one such company, Power Solutions International (OTCPK: PSIX). They are a relatively small company, but have attracted a lot of interest this year with strongly growing earnings per share.

Understanding Power Solutions International

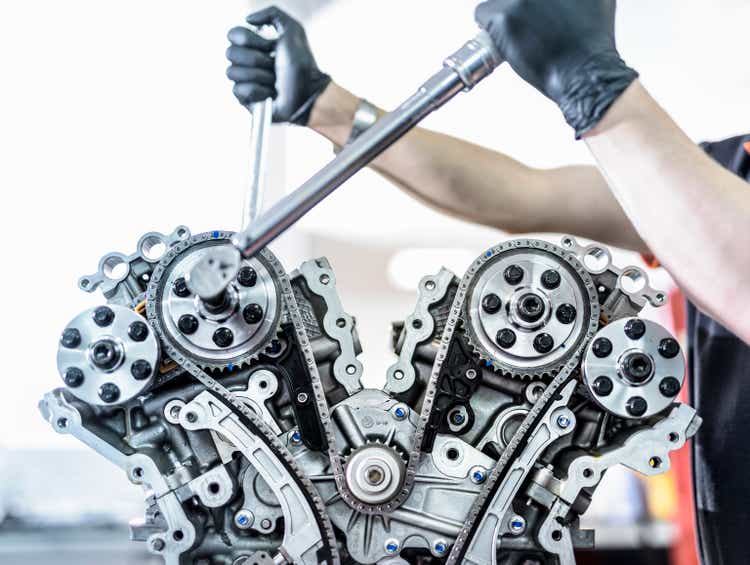

Illinois-based Power Solutions International is a company that designs, markets and sells engines and power systems for various companies. The products are used by global OEMs and end-users, and target a number of different alternative-fuel options.

The company reports that it aims to increase profitability both through strategic price increases and through product redesigns. Early indications are that this is very successful, and is turning Power Solutions International into a strong value-oriented play.

Power Solutions International’s key suppliers include Doosan, Shenyang Aerospace Mitsubishi Motors Engine, and Weichai. The company is aiming to grow its international sales, which in 2023 made up 17% of their net sales.

Consolidated Balance Sheet

|

Cash and Equivalents |

$28.8 million |

|

Total Current Assets |

$231.6 million |

|

Total Assets |

$307.5 million |

|

Total Current Liabilities |

$243.8 million |

|

Total Liabilities |

$282.7 million |

|

Total Shareholder Equity |

$24.7 million |

(source: most recent 10-Q from SEC)

A small company, Power Solutions International, hasn’t got a huge nor particularly powerful-looking balance sheet. The company has a modest amount of cash on hand, and with a current ratio of only 0.95, they would likely have a difficult time adapting to costly changes in their industry in a timely fashion.

At current prices, the company trades at a price/book ratio of over 16. That’s hugely higher than the sector median of 2.72, and definitely raises some concerns about the stock being overpriced. Still, the company lives or dies on its profitability, which has been quite admirable recently.

The company has a fairly high amount of debt, but has reached credit agreements with both Standard Chartered Bank and Weichai. While the company’s debt level is not exactly desirable, the recent agreements suggest that it is not immediately going to be a problem for operations.

The Risks

Beyond managing their debt, Power Solutions International has substantial risks, which any prospective investor needs to be aware of.

Some of their important source products come out of China, and that means they are potentially to be subjected to nasty tariff increases. Those tariffs could do big harm to some of the company’s most important products, and be a drag on the all-important margins.

Power systems that the company designs can have potentially long and variable design cycles. That means developing new products and getting them through enough testing to really market them to take quite some time.

A big part of the company’s future is alternate-fueled power systems, but where the global market develops with respect to those alternative sources is not entirely certain. Moreover, the demand for their products can be impacted strongly by prices for the various fuels, so if prices favor a fuel they don’t make a lot of power systems for, the bottom line could be harmed.

Finally, the power systems market is highly competitive, and there is no guarantee that OEM customers won’t decide to go a different way, or design their own solutions and cut Power Solutions International out of the equation.

Statement of Operations – The All-Important Margins

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Net Sales |

$456 million |

$481 million |

$459 million |

$206 million |

|

Gross Profit |

$41 million |

$88 million |

$106 million |

$61 million |

|

Gross Margin |

9.0% |

18.4% |

23.1% |

29.6% |

|

Operating Income |

($42 million) |

$25 million |

$44 million |

$36 million |

|

Net Income |

($98 million) |

$11 million |

$26 million |

$29 million |

|

Diluted EPS |

($2.12) |

49¢ |

$1.15 |

$1.25 |

(source: 10-K’s from FY2022, FY2023, and most recent 10-Q)

As you can see, Power Solutions International’s earnings have been growing substantially in recent years. It is not, however, a matter of a growth in sales, but a strong increase in gross margins, which is continuing into 2024 and turning the company into quite a profitable endeavor.

Estimates are that the company’s earnings are going to continue to grow, with 2024 estimates that they are going to come in with revenue of $470 million and earnings per share of $2.43. That’s a P/E ratio of 7.57, very neatly in the potential value-stock range. Next year is even better, with estimates of revenue of $507 and earnings of $2.82 per share. That’s a forward P/E of 6.52. By comparison, sector medians for P/E and forward P/E are 22.9 and 21.5, respectively. At least with respect to earnings, that suggests that Power Solutions International is still relatively cheap.

In Q2 earnings last month, the company came in with earnings well above the estimate, 40¢ more earnings per share than was expected. That’s impressive, especially since they came in below revenue estimates. That only underscores just how strong the margin growth has been. Indeed, the company has had noteworthy quarterly beats in recent quarters, and hasn’t had an earnings miss since 2021.

Conclusion

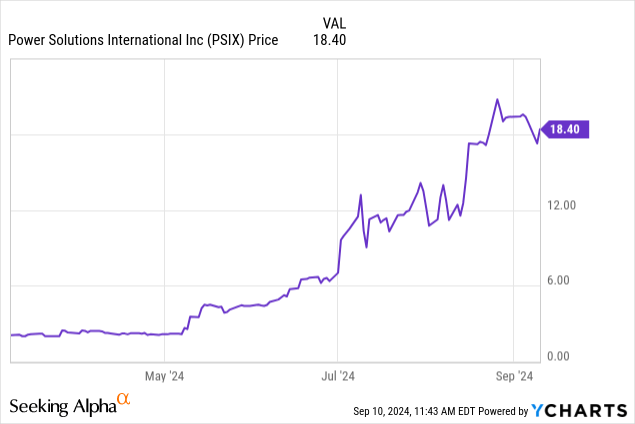

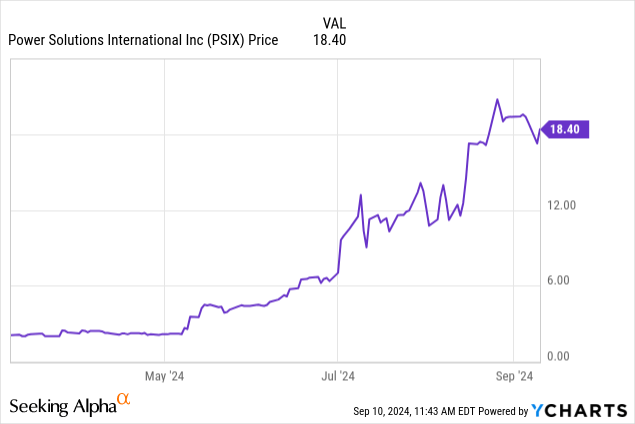

As you can see, Power Solutions International has seen its share price grow enormously in the past few months. Investors should be cautious in this case, in the event that momentum is causing the market to get ahead of itself.

Despite that concern, and the company’s high premium to its book value, I’m still going to rate it a buy, simply on the basis of the company’s earnings and future earnings. The improving margins are really impacting the bottom line, and so long as that continues, this company should continue to perform well.

For investors, I would keep a close eye on margins in the future earnings, as well as whether the company is facing high tariffs on their source products, which would force them to try to pass along difficult price increases to customers, and potentially risk those margins.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.