Luis Alvarez

Covered call funds that push out higher yields thanks to writing out of the money options continue to be all the rage, and no fund exemplifies this trend more than the JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ). The fund has only been out there since May 2022, but it’s raised a whopping $15.94 billion in assets. And you know what? Why not? It launched into the rising rate and a cycle through AI that just caused a moonshot of outperformance in the NASDAQ Composite Index (COMP:IND).

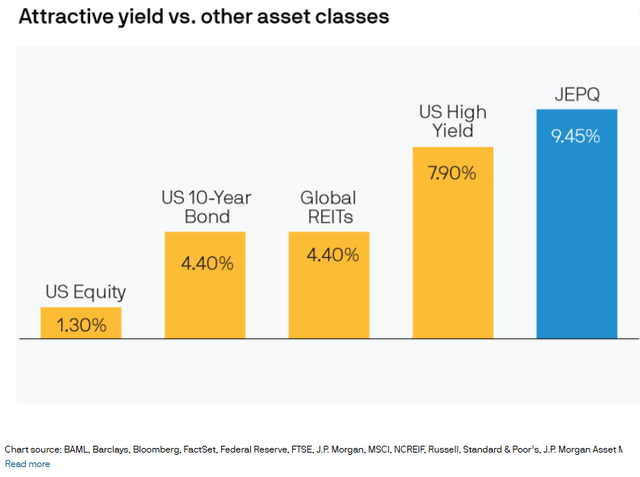

JEPQ has two main goals: to create steady monthly income and to give investors a chance to profit from the growth-focused stocks in the NASDAQ 100-Index (NDX). To reach these goals, the fund uses a strategy based on options to work to help reduce the risk of losses while setting a limit on potential gains. This method allows JEPQ to shoot for an impressive income range of 9% to 11%, which is much higher than what many standard income-focused investments offer.

What makes JEPQ unique is its emphasis on the Nasdaq 100, an index recognized for its higher allocations to sectors of the market that are growth-oriented. This sets it apart from its sister fund, JEPI, which concentrates on the broader S&P 500 (SP500). By zeroing in on Nasdaq 100 companies, JEPQ gives investors a chance to gain exposure to some of the market’s most groundbreaking and fast-growing firms in the tech sector – where all the momentum is centered,

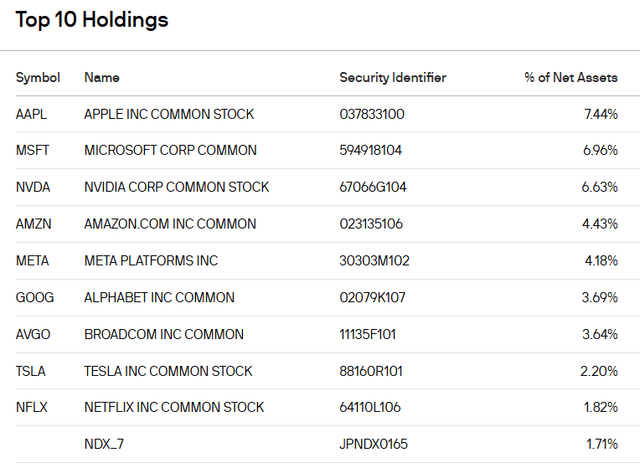

A Look At The Holdings

JEPQ’s portfolio matches the Nasdaq 100 Index. This means people who invest in it will have a lot of exposure to big tech companies like Apple, Microsoft, Amazon, and Alphabet as well as other fast-growing companies in areas like consumer discretionary and communication services.

JEPQ’s strategy with options makes its holdings more complex. It writes call options on its stocks to earn extra income. That means that the fund likely underperforms the Nasdaq 100 in unrelenting bull markets, but can generate outperformance because of the income generated from selling those call options as stocks drop.

Sector and Global Allocation

JEPQ concentrates on the Nasdaq 100, so its sector allocation tilts toward technology and communication services. This differs from broader market ETFs or its counterpart JEPI. JEPQ’s tech-heavy nature can help – and hurt – it, offering higher growth potential but increasing volatility. And while the Nasdaq 100 includes some international firms, U.S.-based companies dominate it. So, investors should see JEPQ as a U.S.-focused investment, though it has significant global revenue exposure through its constituent companies’ multinational operations.

Peer Comparison

When you look at JEPQ next to similar funds, you need to think about regular Nasdaq 100 ETFs and other funds that focus on income. Compare it to something like the Invesco QQQ Trust ETF (QQQ), which just follows the Nasdaq 100. JEPQ gives you almost the same thing, but with a twist that brings in some added income. When we look at the price ratio of JEPQ to QQQ, we find that JEPQ has underperformed. Again – makes sense given the unrelenting bull market, whereby the selling of calls has limited up-capture. Having said that, I do think this outperforms QQQ going forward, given the potential for broader volatility in the Qs ahead.

Pros and Cons

The appeal of JEPQ comes from its capacity to generate substantial monthly distributable income while giving investors access to some of the market’s most energetic companies. The fund’s options strategy adds a safety net, lowering ups and downs compared to investing in stocks on a pure basis. This can attract cautious investors or those close to retirement who want to keep money in stocks but with some protection against market drops.

But remember, this strategy has its downsides. The income-generating and options overlay also limits potential gains. When the market is booming, JEPQ might not perform as well as a straight Nasdaq 100 index fund. Plus, because it’s invested in tech and growth stocks, it’s not as diverse as broader market ETFs. This focus on specific sectors can make it more volatile and risky if these sectors lose popularity.

Conclusion

The JPMorgan Nasdaq Equity Premium Income ETF offers a good choice to investors who want to balance investing in the Nasdaq 100 while having income distributed throughout that journey. If you think tech and other cutting-edge industries will grow over time but want a relatively safer stock approach with high income, JEPQ might suit you. I think it’s worth considering, not for the yield, but just because of the environment I suspect we are heading into.

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a limited time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.