PM Images

VIOO

Per Vanguard’s website, “Vanguard S&P Small-Cap 600 ETF (NYSEARCA:VIOO) seeks to track the investment performance of the S&P SmallCap 600 Index, an unmanaged benchmark representing small U.S. companies. Using full replication, the portfolio holds all stocks in the same capitalization weighting as the index.”

I think VIOO is a solid choice for those looking to add a small-cap tilt to their portfolio. In an environment surrounding big tech and overvalued markets, this ETF could be flying under the radar. VIOO is extremely diversified, has a historically good risk-adjusted return, a low expense ratio, and a growing dividend yield to top it off. Historically, the dividend yield is on the higher end along with top holdings representing lower PE ratios, which could mean one is buying VIOO at a value premium. I would think these are all great reasons to hold in a well-diversified account.

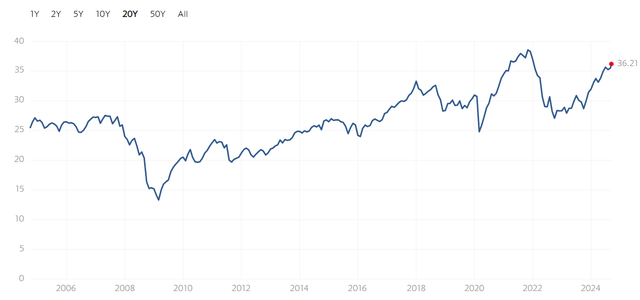

Shiller PE

One thing that is concerning with the current state of the market is the total index is flooded by large cap tech, resulting in an inflated “Price-to-Earnings” multiple. This can be viewed by looking at the current Shiller PE Ratio Chart.

Shiller PE Multiple (Multpl)

It currently sits at 36.21 which is about 30-40% above the average of around 27. Although this could mean the market expecting affiliated growth, the expected earnings are lower during markets with higher PE ratios. Thankfully, VIOO holds many small caps that help bring the total composite payment for earnings a bit lower.

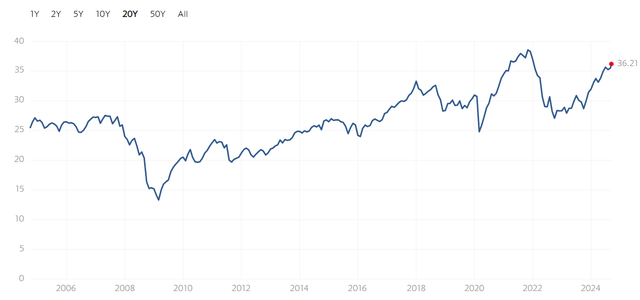

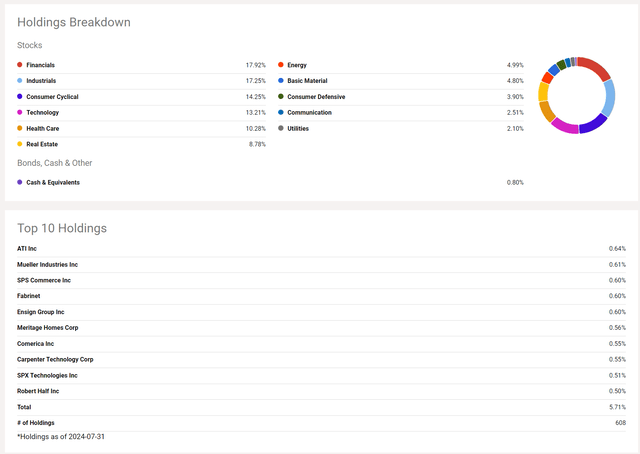

Holdings

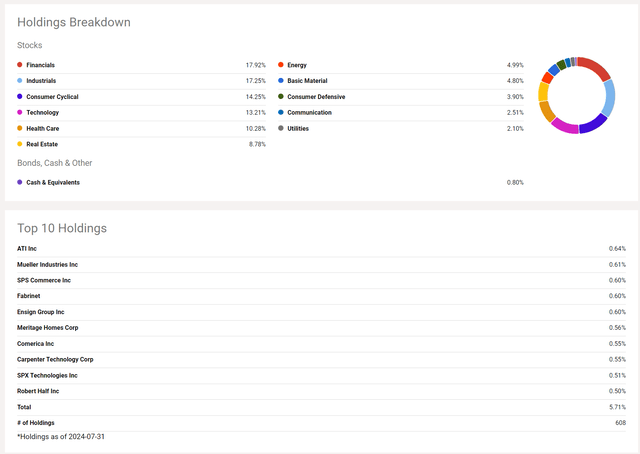

VIOO is extremely diversified. According to Seeking Alpha’s holdings breakdown, they are spread across eleven different sectors, not including a small position in cash & equivalents. Their top 10 holdings don’t make up more than 6% of the total portfolio. This means they are not top-heavy like many market-cap weighted indexes, adding another level to diversification.

VIOO Holdings (Seeking Alpha)

Regarding earnings payment for these companies, some of the top holdings TTM PE are lower than the total index. For example, (MLI) sits at 14-15 PE and (ATI) sits around 23. A culmination of lower PE holdings means VIOO dividend yield sits at a reasonable level compared to historical values.

VIOO Dividend Yield (Seeking Alpha)

Obviously, 1.38% isn’t the highest it’s experienced (which would indicate value purchase), it is on the higher end historically. This could mean VIOO is not only a great index play, but also a value play at its current level.

Analysis

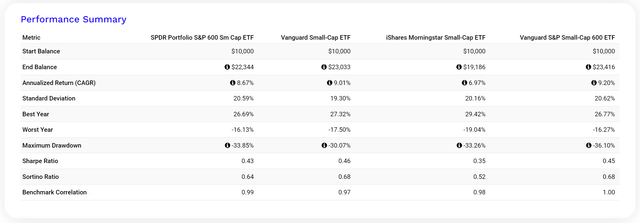

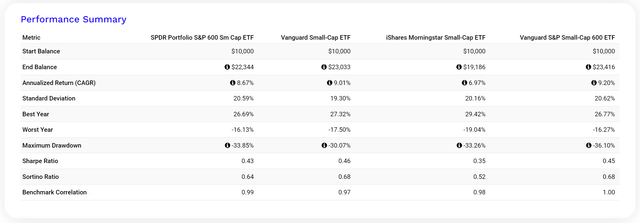

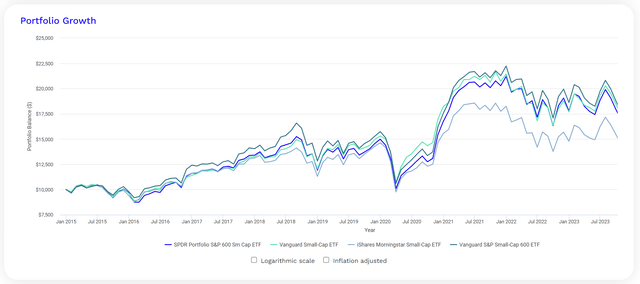

To analyze VSS, I compared backtesting results of various other small cap focused ETFs. These were the SPDR® Portfolio S&P 600™ Small Cap ETF (SPSM), Vanguard Small-Cap Index Fund ETF Shares (VB), iShares Morningstar Small-Cap ETF (ISCB).

VIOO Performance (Portfolio Visualizer Using Author Inputs)

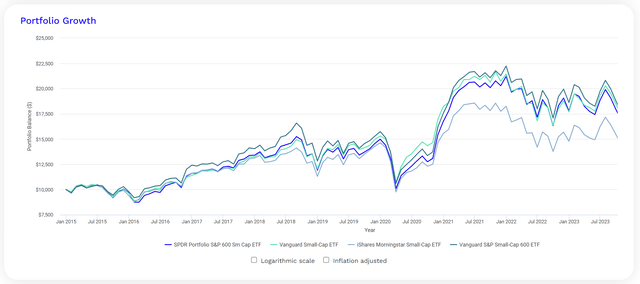

Since 2015, The results indicate VIOO had a CAGR 9.20% which is the highest in the group. However, this came with a standard deviation of 20.62% which is also the highest. So it’s clear VIOO did return more, but came with slightly more volatility. The risk reward is measured by the Sharpe Ratio, which stands at 0.45. This happens to be the second best, just behind VB, with a Sharpe of 0.46. The downside to this ETF is it had the worst Maximum Drawdown measurement of 36.10%. This is around 3% lower than the next ETF in line.

VIOO Performance Graph ( Portfolio Visualizer Using Author Inputs)

VIOO resulted in the highest end value of $23,416 on a $10k investment since 2015. It’s pretty clear from the backtesting, VIOO is the high-risk high reward version of the small-cap ETF comparable.

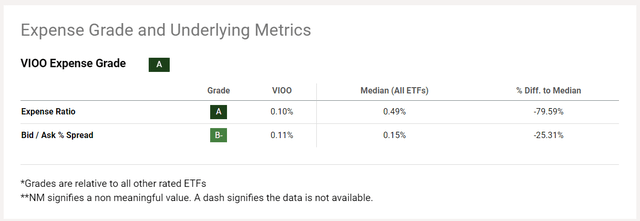

Expense Ratio

The expense ratio is low for VIOO. It has a 0.10% and receives an “A” Grading from Seeking Alpha. This is of course relative to other similar ETFs. This is slightly high compared to the major index tracking ETFs, but nonetheless a reasonable expense ratio.

VIOO Expense Ratio (Seeking Alpha)

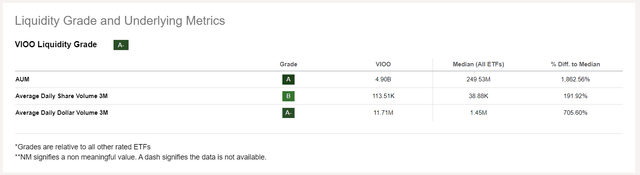

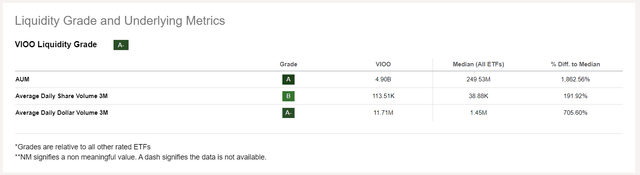

Liquidity

I think liquidity is often looked over regarding ETFs. Being able to move assets does have a value premium to some extent, and VIOO receives a good grade for this according to Seeking Alpha’s dividend scorecard. Nearly $5bn in assets under management (“AUM”) makes this one of the largest and more liquid ETFs in this category.

VIOO Liquidity (Seeking Alpha)

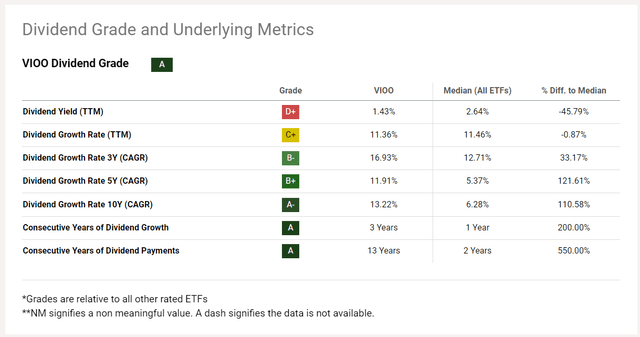

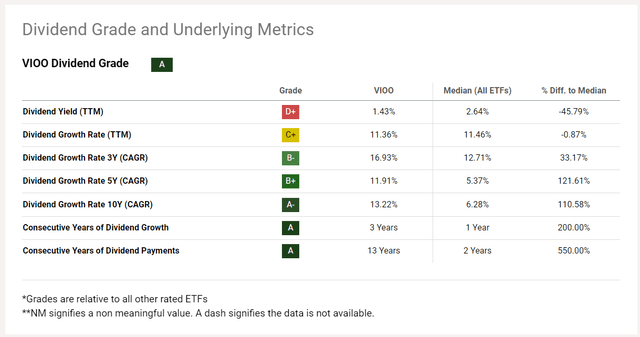

Dividends

While having a good risk-adjusted return, expense ratio, and liquidity, VIOO pays an annual dividend yielding 1.43% with a 10-year compound annual growth rate (“CAGR”) of 13.22%. This is good enough to receive a “A” dividend grading from Seeking Alpha’s scorecard.

VIOO Dividend Scorecard (Seeking Alpha)

Conclusion

Overall, VIOO is one of the more “high risk/reward” small-cap ETFs, but only by a small margin. I believe historically good risk-adjusted return, low expense ratio, and a growing dividend yield are reasons to own this ETF in a well-diversified basket. The holding’s PE and dividend yield may also indicate the investor is buying at a value premium.