Monty Rakusen

Nucor Corporation (NYSE:NUE) established an expansionary strategy based on new acquisitions and advancement of Nucor’s capabilities. Recently, NUE announced new capital expenditures plans, which could bring new capacity and free cash flow expectations. The recent outlook given for the year 2024 was not that beneficial, and the recent decline in the average sales price per ton sold is also not helping. However, given previous free cash flow growth trajectory and the company’s ongoing stock repurchase program, in my opinion, the company trades significantly undervalued. From here, I see significant upside potential in the stock price.

Nucor, And The Recent Deterioration Of The Outlook

Incorporated in Delaware in 1958, Nucor Corporation manufactures steel and steel products, and produces ferrous and non-ferrous materials. The company also presents itself as North America’s largest recycler. In 2023, the company recycled close to 18.4 million gross tons of scrap steel.

With the presentations being done, I think that it is a great time to talk about NUE because of its most recent valuation. I think that the company is quite undervalued after the company noted somewhat bearish outlook, and investors saw a deterioration of the gross margin and the average price of steel. In this regard, investors may want to have a look at the following words from the most recent quarterly report.

While the U.S. economy has continued to avert a more pronounced downturn, we believe that it is becoming more evident that activity has softened as the year has progressed. We have also seen an increase in imports in 2024 as compared to 2023 and a “higher for longer” interest rate environment that we believe may have tempered or delayed some marginal demand. We believe the confluence of these factors is driving margin pressure on several of our products in the near term. Source: 10-Q

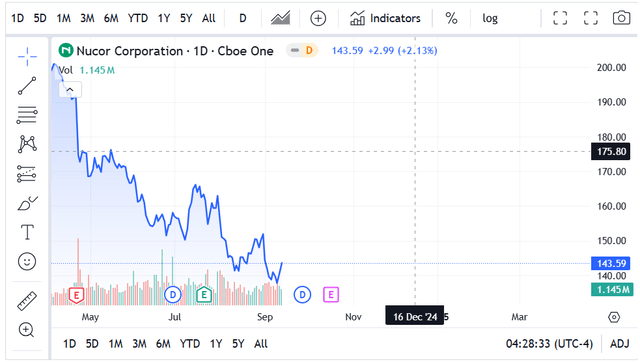

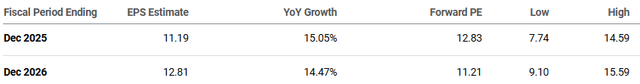

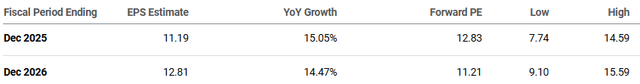

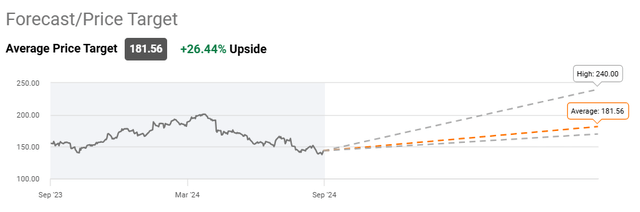

There are a number of reasons to buy NUE at the current price mark. Note that the stock price may trend further down, but I think that NUE could bring stock price gains to shareholders in the long term. The EPS figures expected for 2025, and 2026 seem beneficial. Besides, many analysts see further upside in the stock price. The average price target is close to $181 per share.

Source: Seeking Alpha Source: Seeking Alpha

Nucor Reports A Diversified List Of Customers

In my view, the most valuable about NUE is the fact that the number of clients is quite significant. In 2023, the largest client represented close to 5% of the total amount of sales. It means that problems with one sole client or several clients may not have a detrimental impact on future net income growth.

Besides, I think that NUE will most likely be able to change prices without large pressures from clients. In my view, other competitors with a limited number of clients may not have this level of negotiation power.

The Company’s Large Backlog Will Most Likely Bring Future FCF

I think that the total level of backlog and recent backlog increases are a good indication of future free cash flow growth. In the steel mills segment, NUE’s backlog was close to $3.2 billion in 2023, which was a significant increase as compared to the same time period in 2022. The total backlog in the steel products segment stood at close to $4.9 billion in December 2023. I did not find information about the total backlog in the last quarterly report, but there was plenty of information in the last annual report.

In the steel mills segment, Nucor’s backlog of orders was approximately $3.27 billion and $2.33 billion at December 31, 2023 and 2022, respectively. Order backlog for the steel mills segment includes only orders from external customers and excludes orders from other Nucor businesses. Nucor’s backlog of orders in the steel products segment was approximately $4.97 billion and $6.65 billion at December 31, 2023. The majority of these orders are expected to be filled within one year. Source: 10-k

Acquisitions Could Bring New Know-How, And Enhance Total Capacity

The list of acquisitions executed in the past appears quite significant. In the most recent history, the company bought assets of C.H.I., an ownership position in CSI, a business from Cornerstone Building Brands, Inc., and Hannibal. In my view, the recent acquisitions will bring additional capacity and free cash flow potential. NUE obtained new know-how from these competitors, which will most likely have a beneficial impact on the operations of the whole organization. In addition, I think that acquisitions indicate that directors inside the company are confident about the long-term future environment of the company’s industry. In my financial model, I assumed that these acquisitions will most likely bring additional FCF. Besides, I assumed that the expertise accumulated in the M&A market will most likely help to pursue new inorganic growth in the future.

Nucor used cash on hand to acquire the assets of C.H.I. for a purchase price, net of cash acquired, of approximately $3.00 billion. Source: 10-k

Nucor used cash on hand to acquire the assets of the insulated metal panels, or, IMP, business of Cornerstone Building Brands, Inc. for a purchase price of $1.00 billion. Source: 10-k

Nucor used cash on hand to acquire Hannibal for a purchase price of $370.0 million. Source: 10-k

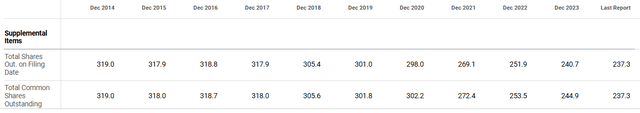

Share Repurchases, And Decline In The Share Count

In 2023, the company approved a $4 billion stock repurchase program, which may accelerate the demand for the stock in the coming years. In the last quarterly report, the company noted that it paid an average of $177 per share, which is significantly lower than the stock price today.

In sum, if we buy shares today, we are buying at a significant discount as compared to the price mark at which NUE bought its own shares. I think that companies usually buy their own shares when they assume that they are cheap. In sum, the fact that the company acquired shares at close to $177 means that they seem cheap at lower price marks. The recent decline in the share count, in my view, is quite beneficial. Further decline in the share count could lead to increases in the fair price.

Capital Expenditures Plans Could Bring New Investors

I think that the company could receive significant demand for the stock as a result of the recent capital projects announced. New capital expenditures are expected to be financed with a combination of unsecured revolving credit facility, debt securities, and other instruments. In my opinion, new capital expenditures will most likely increase future capacity, and accelerate the potential for future free cash flow. In this regard, we may want to read the following lines from the last annual report.

Although we expect requirements for our business needs, including the funding of capital expenditures, debt service for financings and any contingencies, will be financed by internally generated funds, short-term commercial paper issuances, offerings of our debt securities or from borrowings under our $1.75 billion unsecured revolving credit facility, we cannot guarantee that this will be the case. Source: 10-k

Debt Review, WACC, And Price Target Obtained

I studied a bit the company’s notes and debt agreements to understand what could be a conservative WACC. The company reports notes including interest rate between 2% and 6%. My financial model includes forecasts from 2025 to 2031, so I think that the interest rates may change quite a bit in the coming years. Putting everything together, in my view, assuming a WACC close to 6% would make sense. The following is a list of some of the notes reported by Nucor in the most recent annual report.

– Notes, 2.000%, due 2025- Notes, 3.950%, due 2025- Notes, 4.300%, due 2027- Term notes, 2.950%, due 2027- Notes, 6.400%, due 2037- Notes, 5.200%, due 2043- Notes, 4.400%, due 2048- Notes, 3.850%, due 2052- Notes, 2.979%, due 2055Source: 10-k

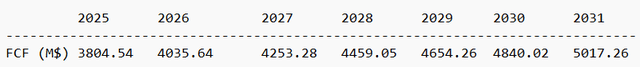

For the design of my free cash flow model, I assumed that further backlog growth and capacity expansion will successfully accelerate the demand for the stock and potential for future free cash flow. I also assumed that the company’s recent acquisitions and the recent expansionary strategy will be successful. In this regard, it is worth reviewing the statement reported by Nucor in the most recent annual report:

In recent years we have embarked on a strategy to advance Nucor’s capabilities and further its value creation, as summarized in our Mission Statement: Grow the Core, Expand Beyond and Live Our Culture. Source: 10-k

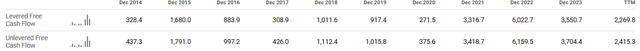

My free cash flow figures included small free cash flow growth from 2025 to 2031, including 2025 FCF of $3.8 billion and $5.017 billion in 2031. My numbers are in line with previous FCFs reported by NUE.

With a WACC of 6%, terminal EV/2031 FCF of 8x, and free cash flow forecasts from 2025 to 2031, I obtained a total enterprise value of $51 billion, equity valuation of $49 billion, and a fair price of around $209 per share. The company reached $200 per share a few months ago, so I am not really thinking out the box here in terms of corporate valuation.

- NPV of FCF: $24,510.76 million

- NPV of TV: $26,694.15 million

- Total EV: $51,204.91 million

- Net Debt: $1,606.20 million

- Equity: $49,598.71 million

- Shares Outstanding: 237.3 million

- Target Price: $209.01

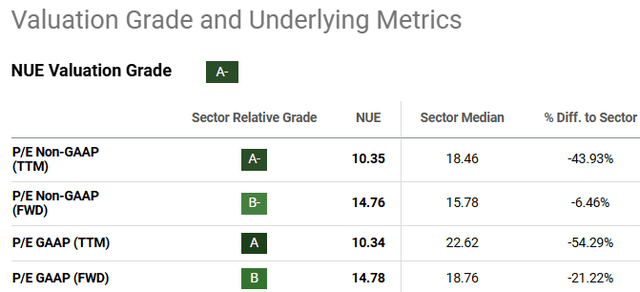

The company’s PE ratio appears significantly undervalued as compared to that of other competitors. The company reported PE FWD GAAP of 14x. The sector median PE FWD GAAP is close to 14x.

The company’s EV/ FWD EBITDA is also quite undervalued as compared to that reported by peers. The following information was obtained from Seeking Alpha.

Risks: Declines In The Average Sales Price Per Ton Sold, And Decrease In Gross Margins

In the last quarter, the company noted a decrease in the average sales per ton, and the total tons shipped also decreased substantially. Net sales for the steel mills segment also decreased. There is clearly a deterioration of revenue and gross margin in 2024. I cannot really tell for how long shareholders could suffer further declines in revenue. With this in mind, in my opinion, we have to think about Nucor as a long-term investment. It is worth keeping in mind that further declines in revenue and margins could lead to significant declines in the stock price.

Net sales for the second quarter of 2024 decreased 15% from the second quarter of 2023. Average sales price per ton decreased 11% from $1,446 in the second quarter of 2023 to $1,284 in the second quarter of 2024. Total tons shipped to external customers in the second quarter of 2024 were approximately 6,289,000 tons, a 5% decrease from the second quarter of 2023. Source: 10-Q

Risks From Purchasing Raw Materials From International Markets

The company invests in the United States, Canada, Mexico, and emerging markets. There are obvious risks coming from the fact that the company obtains raw materials from foreign jurisdictions. In my view, local labor changes, a deterioration of the regulatory requirements, changes in foreign laws, and issues related to the Foreign Corrupt Practices Act of 1977 could affect the company’s business abroad. As a result, the company could report lower than expected revenue growth or profit margins. The stock price could fall.

Changes In The Price Of Natural Gas

The company’s steel mills use a significant amount of electricity and natural gas, which may bring different problems. First, an increase in the price of natural gas or electricity could have significant disadvantages for the company’s net income growth. Future free cash flow growth could also be lower than expected. Besides, availability of natural gas and electricity could also be a problem. Lack of supply or disruptions could lower the company’s production levels, which may bring declines in free cash flow growth.

Our steel mills are large consumers of electricity and natural gas. In addition, our DRI facilities are also large consumers of natural gas. We rely upon third parties for our supply of energy resources consumed in the manufacture of our products. The prices for and availability of electricity and natural gas can be volatile. Source: 10-k

Goodwill Impairments Risks

The company made a number of acquisitions in the past, which means that the goodwill included in the balance sheet is not small. In the future, accountants may lower their expectations about the companies acquired. Synergies expected may be lower than forecasted. Besides, management may realize that the assets acquired are not worth what they initially expected. Under these circumstances, the company could deliver goodwill impairments, which may lower the book value per share. Investors out there may also lower their revenue or FCF expectations. As a result, demand for the stock could lower, and the stock price may fall.

Conclusion

In my view, the long-term expansionary strategy and recent acquisitions executed by Nucor will most likely accelerate future free cash flow expectations, and increase total capacity. In addition, the new capital expenditures plans that were announced recently and the ongoing stock repurchases could enhance expectations about the future. Nucor recently saw a decline in its share price as a result of a deterioration of the gross margins and the average sales price per ton sold. In addition, the outlook for the year 2024 did also not seem to convince investors. With all that being said, I think that many investors would feel comfortable buying shares at the current price mark. Previous free cash flow generation and my conservative free cash flow forecasts indicate that NUE is clearly cheap at the current price mark.