I could probably count a dozen instances in the past week or so of economists I respect saying the Fed should cut 50 basis points but probably will only cut 25 bps.

At some point, that chorus grows so loud that it tips the balance. We’re likely at that point now with the Fed funds futures market pricing in a 61% chance of 50 bps.

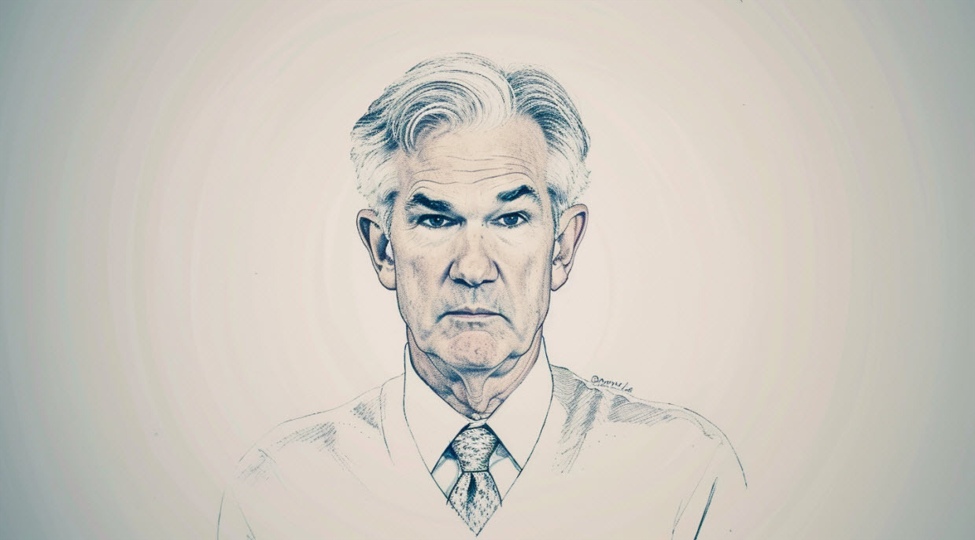

Powell is a practical guy and he has a dovish bent. He wants to nail the soft landing and he knows that rates are unnecessarily restrictive at 5.25-5.50%. Moreover, he appears to have Governor Waller on board with 50 bps, or at least open to it.

If Powell makes the case for 50 bps at the FOMC meeting this week, the rank-and-file will fall in line because the reasoning is compelling. Front-loading rate cuts gives the Fed the chance to be proactive against mounting signs of softening in the employment picture.

In the WSJ this weekend, Greg Ip made the best case for cutting more.

“The gap between 2.7% [current inflation] and the Fed’s 2% target largely reflects the lagged effects of higher housing, auto and other prices from a few years ago,” he writes.

I find that impossible to argue against and with oil at $70, there is more disinflation in the pipeline. Yes, there are some lags around wages and risks of a pickup but China continues to export deflation and that’s a more-powerful force.

It’s going to be an interesting debate this week and I think what is ultimately the bigger driver is what the Fed signals in the dots. The market currently sees 250 bps in cutting over the next year. The dots will point to higher rates than that but that will be no surprise. The question is how much difference can the market tolerate?

I think it will be some comfort that the most-recent dots indicate just 25 bps in cuts this year and that we could get 50 bps Wednesday and are in-line to get at least 75 bps this year. So it should be easy to dismiss hawkish dots as the Fed emphasizes that it will move with incoming data.

Expect Powell to repeat this as well.