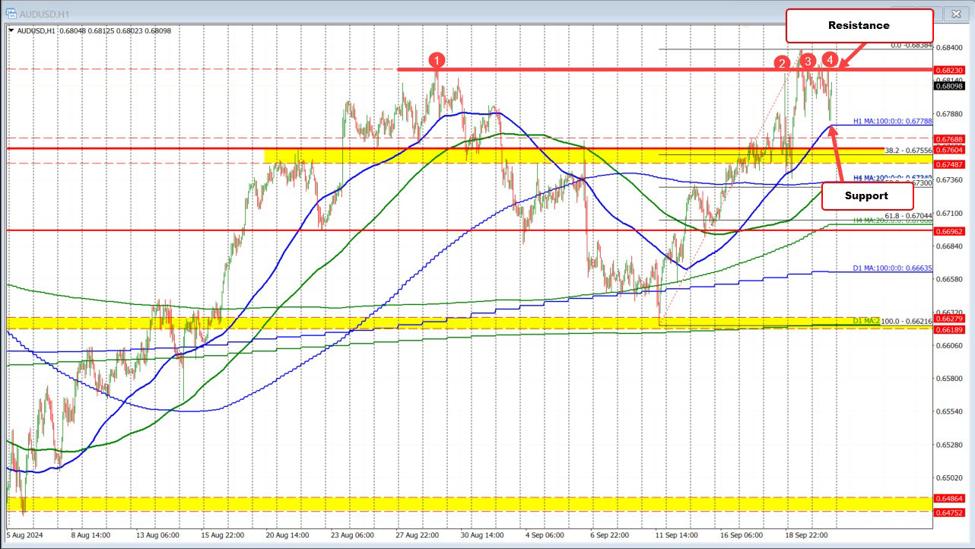

The AUDUSD moved up and tested a swing level near 0.6823 in the Asian and European session. The price then moved lower as stocks fell in the early US trading. However, as a price of the AUDUSD approached its rising 100 hour moving average at 0.6778, the buyers have returned, and stalled the fall. Why is that important?

Recall (and see on the chart below) that on Wednesday, the session low after the FOMC rate decision, stalled at the 100-hour moving average. On Thursday, the low price broke below that moving average, but quickly reversed back to the upside. So there has been buying against that MA level.

Today’s fall has stalled just ahead of that moving average (so far).

Going forward the 100-hour moving average will be a support level that needs to be broken to increase the bearish bias. On the topside moving about 0.6823 and then the high price from yesterday’s spike at 0.68384, increases the bullish bias.