The September

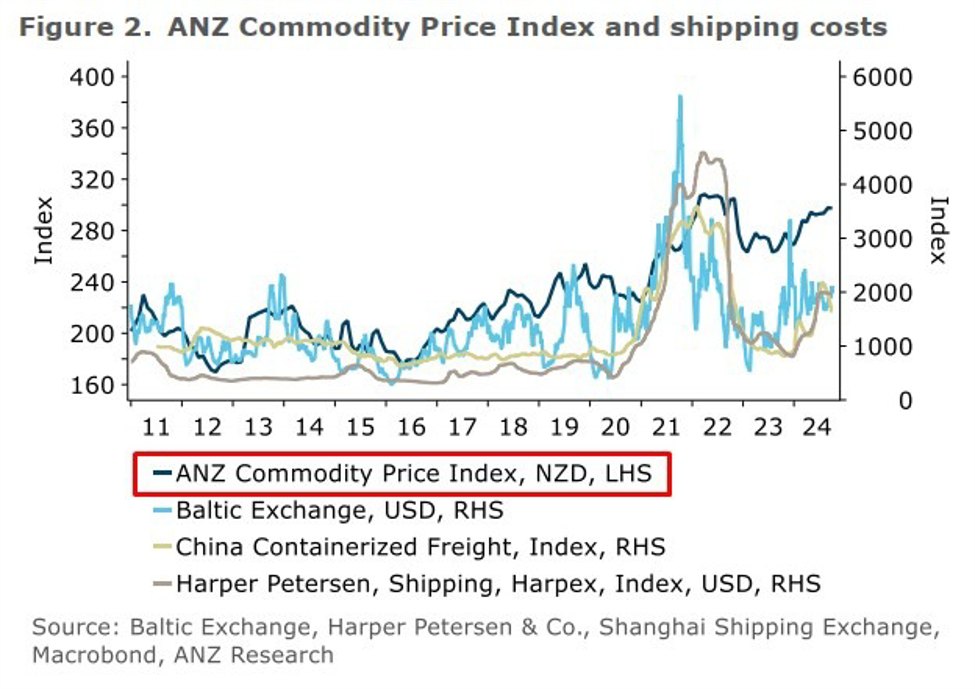

ANZ Commodity Price Index for New Zealand:

- +1.8% m/m in September

In New Zealand dollar terms, the index fell 0.2% m/m as the NZD Trade Weighted Index lifted 1.0%.

The index tracks the prices of 17 of New Zealand’s major commodity exports, including dairy products, meat, wool, forestry products, and seafood.

***

As part of this report ANZ remark on

Global shipping prices:

- continue to bounce around as shipping route disruptions persist.

- Escalated tensions in the Middle East have resulted in the majority of container ships opting for the longer route around Cape Horn rather than risking the more direct passage through the Suez Canal.

- The Baltic Dry Index lifted 12% during September, but other shipping indices softened during the month. This includes the China Containerized Index, which has eased as we are now past the seasonal peak in exports from China.

- Dock workers in the United States are currently striking, which is expected to cause considerable delays at many ports.

***

ANZ have projected a 50bp rate cut from the Reserve Bank of New Zealand next week:

Other previews:

- RBNZ preview – most likely cut the cash rate by 50bps next week, and again in November

- 100bp of rate cuts coming up from the Reserve Bank of New Zealand, beginning next week

- Here is another forecast for a 50bp interest rate cut from the RBNZ next week

- HSBC expect a 50bp interest rate cut from the Reserve Bank of New Zealand next week

This article was written by Eamonn Sheridan at www.forexlive.com.