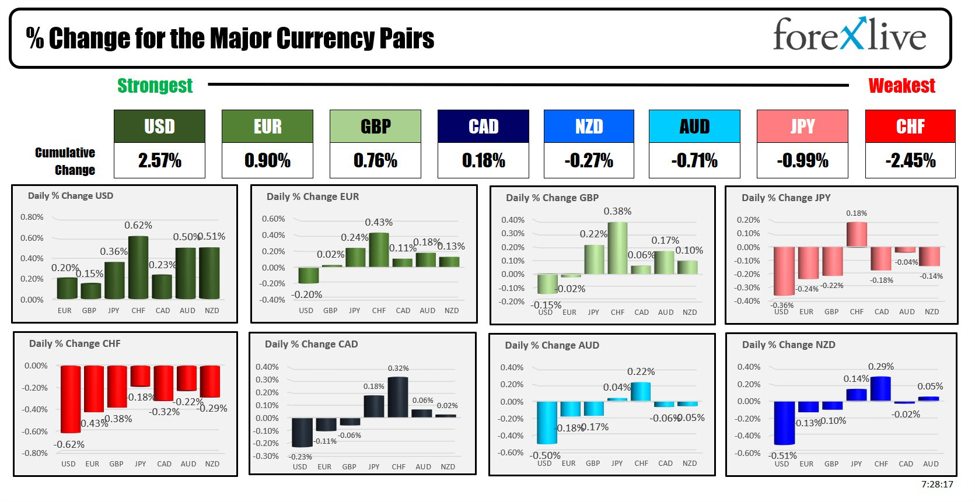

As the North American session begins, the USD is the strongest and the CHF is the weakest. Japan was on holiday today and so is Canada (Thanksgiving). The US has a quasi-holiday but the US stocks are open (Columbus Day). The bond market is closed, however. There are no economic releases today, but Fed Minneapolis Pres. Kashkari is in Buenos Aires speaking at a couple events with one at 9 AM and the other at 5 PM. Sandwiched between is Fed Governor Waller is speaking at 3 PM.

Over the weekend:

- Goldman sees PCE data showing 2% YoY. The core is stil expected to be higher at 2.6% when the data is released near the end of the month. The US CPI and PPI data last week was mixed. https://www.forexlive.com/centralbank/goldman-sachs-says-the-pce-inflation-data-will-show-the-fed-is-at-its-2-target-already-20241013/

- UBS still sees the Fed cutting rates by 25 bps at the next meeting in November. https://www.forexlive.com/centralbank/ubs-says-the-federal-reserve-remains-on-track-to-cut-rates-shrugs-off-higher-cpi-data-20241013/

In China, at a highly anticipated press conference on Saturday, China’s Finance Minister, Lan Fo’an, offered limited details on the country’s fiscal stimulus plans, leaving markets underwhelmed. The event, organized by the State Council Information Office, was expected to shed light on how China would intensify countercyclical fiscal policies, but instead, it was light on specifics.

Here are the key takeaways from the event:

-

Borrowing capacity highlighted: Lan mentioned that China has significant room for issuing debt and increasing the fiscal deficit. This is seen as a tool to support future stimulus measures, though no specific amount or timing was mentioned.

-

Local government debt: Local governments have access to 2.3 trillion yuan in debt funds available to spend in the last quarter of 2024, but these funds come from bonds that have already been issued earlier this year, not new financing.

-

Affordable housing plans: The government is considering purchasing unused housing units and converting them into affordable housing. This is part of a broader strategy to stabilize the housing market, which has been a source of concern due to oversupply and declining demand.

-

Vague timeline for policy announcements: Lan indicated that more countercyclical measures are being studied and that concrete policies will be announced “step-by-step.” The real details, however, may only come after legislative meetings in the coming weeks.

-

Market reaction: With no immediate or new stimulus measures announced, there’s skepticism about whether markets will remain patient as they await the next round of policy announcements. The Shanghai composite index did rise by 2.07%. The Hong Kong Hang Seng fell -0.75%, and the CSI300 rose 1.9%

Overall, while the Chinese government reassured its ability to take action, the lack of immediate, tangible measures disappointed those hoping for clearer guidance on stimulus plans. Markets now await further legislative meetings for more concrete information.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down -$0.50 and $74.08. At this time yesterday, the price was at $75.32

- Gold is trading down -$3.93 or -0.15% and $2653.14. At this time yesterday, the price was $2645.73

- Silver is trading down -$0.32 or -1.05% at $31.19. At this time yesterday, the price is at $31.24

- Bitcoin is trading higher at $64,846. At this time Friday, the price was at $61,156

- Ethereum is trading at $2534.90. At this time Friday, the price was at $2417.80

In the premarket, the snapshot of the major indices trading mixed after Friday’s gains. The Dow industrial average is lower while the S&P and NASDAQ indices are higher:

- Dow Industrial Average futures are implying decline of -97 points. Yesterday, the index rose 409.74 points or 0.97% at 42863.86

- S&P futures are implying a gain of 6.97 points points. Yesterday, the index rose 34.98 points or 0.61% at 5815.03

- Nasdaq futures are implying a gain of 54.03 points. Yesterday, the index rose 60.89 points or 0.33% at 18342.94

Yesterday, the small-cap Russell 2000 rose 45.99 points or 2.10% after 2234.41

Last week the S&P and Dow industrial average closed at record levels. The Dow industrial average rose of .21%, the S&P rose 1.1%, and the NASDAQ index rose 1.13%.

European stock indices are trading modestly higher:

- German DAX, +0.34%

- France CAC, -0.29%

- UK FTSE 100, +0.06%

- Spain’s Ibex, +0.59%

- Italy’s FTSE MIB, +0.48% (delayed by 10 minutes)

Shares in Asian Pacific session shares were mixed:

- Japan’s Nikkei 225, closed for holiday

- China’s Shanghai Composite Index, +2.07%

- Hong Kong’s Hang Seng index, -0.75%

- Australia S&P/ASX index, +0.47%

Looking at the US debt market, the markets will be close for Columbus Day holiday. The closing levels on Friday

- 2-year yield 3.953%. At this time yesterday, the yield was at 3.970%

- 5-year yield 3.898%. At this time yesterday, the yield was at 3.912%

- 10-year yield 4.096%. At this time yesterday, the yield was at four point zero nine 2%

- 30-year yield or .405%. At this time yesterday, the yield was at 4.356%

Looking at the treasury yield curve close steeper on Friday. At the close

- The 2-10 year spread is at 14.4 basis points. At this time Friday morning, the yield spread was +11.6 basis points.

- The 2-30 year spread is at +45.3 basis points. At this time Friday morning, the yield spread was on 41.7 basis points.

In the European debt market, the 10 year yields are trading mostly lower with the exception of the UK 10 year yield: