Black professionals in the City are noticing a shift. At first it was subtle; fewer Black History Month events or a shrinking number of external speakers.

Then the changes became more apparent. Recruitment campaigns for underrepresented groups were abandoned while diversity, equity and inclusion professionals in their companies seemingly vanished. The pay gap for Black workers has persisted, too.

More than four years since the murder of George Floyd in the US sparked an unprecedented desire for change in the City of London, the financial district for the UK, meaningful action has stalled. Research shows the pace of change has slowed, and it will now take 50 years for the proportion of Black talent in the UK’s financial and professional services to near 4.4% — the percentage of Black employees in the country’s working age population. That figure would be even higher in the capital, where 13.5% identify as Black.

Bloomberg spoke with 20 Black professionals who have worked in the City of London in roles ranging from banking analysts to a global head of DEI, most of whom asked to stay anonymous for fear of reprisals from their employers. While some remain optimistic about their future in financial services, others have left the industry entirely. They all agreed on one thing: the City seems to have largely given up on achieving racial equality.

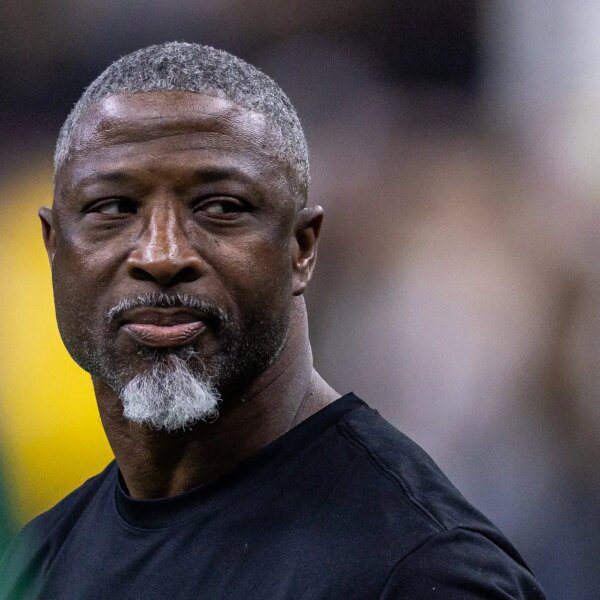

“It almost seems like it was just trending for a moment, but now that trend is moving,” said Junior Garba, CEO and Co-Founder of Equity City, which works with firms across financial and professional services to recruit diverse talent.

In the wake of the Black Lives Matter movement, British companies claimed they wanted to seriously address racial disparities. Some pledged to hire more Black workers and also tackle high attrition rates. Others, such as Lloyd’s of London, apologized for their historic link to the transatlantic slave trade.

Yet employees in the financial industry say those efforts have since been heavily deprioritized. Some expected it, especially after many US companies retrenched on DEI efforts amid pushback from conservative activists. City firms haven’t felt the same pressure. Instead, industry experts blame poor processes, the economic climate and new priorities — as well as the slow pace of change.

Firms are reassessing and saying that “we’re not seeing enough progress; we haven’t fixed the issue in two years,” according to Pauline Miller, who worked in the finance sector for 20 years, including managing diversity at State Street and Barclays Plc., before leaving the industry.

That reflects a view among DEI professionals and specialist recruitment firms that the pledges on racial inclusion in 2020 were made in haste. Although the C-suite was often involved, the promises came with neither comprehensive strategies nor enduring financial commitments.

In some instances, said Miller, DEI recruits without the requisite experience were tasked with changing the culture of a company seemingly overnight. Struggling with the scale of the challenge, they often failed, leading to some companies swiftly pulling back.

Natasha Ferguson, COO of the Taylor Bennett Foundation, which places diverse candidates with companies including Banco Santander SA, said in an interview that after years of surging interest, the organization is feeling the effects. Demand for its paid internship and mentoring programs, for example, have seen a 25% decrease year-on-year since 2022 from financial institutions, agencies and City-based organizations.

The foundation’s clients are also reducing cohort sizes for Black Heritage schemes — which aim to support primarily Black talent into companies or professions — and HR professionals admit to her that they were ill-equipped to support the previous recruits.

A spokesperson for Santander said DEI spend at the bank and headcount have remained the same as previous years. “The Bank is committed to being a truly inclusive organisation reflecting the customers and communities we serve – our DEI strategy is designed to deliver this,” they said.

One former employee who joined a high-profile financial PR firm after taking part in a diversity scheme said the business wasn’t prepared for minority employees. “I felt that sense of tokenism that people always talk about,” they said.

The slow progress to racial equality is reflected in the data. A 2023 report by KPMG found that Black representation in financial services has not “significantly improved” since 2020 and has got worse in some sectors.

Part of the problem is a lack of available data about ethnic minority talent, particularly when it comes to Black employees. Historically, companies in the UK have tended to group together the so-called BAME umbrella, referring to Black, Asian and Minority Ethnic, which can discount the experiences felt by each individual group.

The Financial Conduct Authority, the City’s financial regulator, last year said that “diversity and inclusion are regulatory concerns” and consulted on whether firms should publish DEI strategies. The group paused those plans this year after the House of Commons Treasury Committee said in May that it could result in a costly “tick box” exercise for firms.

In its most recent report, the Change the Race Ratio — whose financial services signatories include HSBC Global Asset Management, Lloyds Banking Group and Schroders Plc — recommended that companies seeking to close Black representation gaps should collate disaggregated data on ethnic minority “representation, progression and tenure” to help it better understand its workforce. But the advocacy group itself didn’t even start collecting data on Black senior management representation, ethnic minority attrition or all-colleague attrition until this year. Most financial firms don’t publish this breakdown either, which makes tracking whether they met their objectives impossible.

Under UK law, employers are allowed to ask staff to self-identify their background, revealing their ethnicity or socioeconomic background. But many didn’t choose to do so until after the BLM movement.

For some DEI professionals, this meant that some employees were caught off guard when asked about their background, and either chose not to participate or actively resist the conversation.

That was the experience of one DEI professional who was the first London-based global diversity and inclusion director at a large asset manager. A lack of active board support for her campaign crippled efforts to get data, with 65% of employees responding. Without data to demonstrate progress, the former employee said their job was made virtually impossible.

The result was a DEI function that was reliant on the cooperation of others for success and limited to performative action, according to the individual. She also said her every move faced multiple layers of legal scrutiny, including statements and press releases, while inclusivity targets were rebranded as a “path forward.” It got to the point where her job became effectively unworkable, she said.

Black employees in the City say the realignment of corporate commitments away from inclusion efforts is impacting them at work. Karen Muperere, an analyst who previously worked in private equity, said that Black History Month events at her previous employer would have increasingly fewer speakers while several DEI staff suddenly left the company. “They were just gone,” she said.

This subtle shift marks a distinction between the rollback in the UK and in the US. While Wall Street firms have actively canceled diversity programs, DEI professionals in London privately say that firms still want to talk about their diversity efforts while offering little support. In some instances, they were told to organize events but weren’t allocated a sufficient budget.

As priorities shift away from diversity, companies who are actively committing fewer resources, time and energy to diversity efforts risk losing out on top talent, according to Garba, the Equity City co-founder. That’s based on questions from candidates, who ask the organization about statistics including a company’s ethnicity pay gap and Black-specific recruitment targets.

While reporting on the ethnicity pay gap is not yet mandatory — the Labour government recently committed to introducing a draft bill this Parliamentary session — many finance firms have already started publishing the data. The numbers reveal almost stagnant progress while Black employees face the biggest pay gap compared to other ethnic minorities overall.

Even as some firms say this is down to increased recruitment in junior lower-paying roles, it suggests that Black workers are facing a ceiling at work — or leaving.

Yet some in the sector remain optimistic. Mark Lomas, current head of culture at Lloyd’s of London, says creating lasting change is “not impossible” but requires “concerted concentrated effort.”

Last year Lloyd’s said it achieved its ambition to ensure one in every three hires to its corporation were from an ethnic minority. Even then, the firm does not publish the number of Black employees included in that figure.